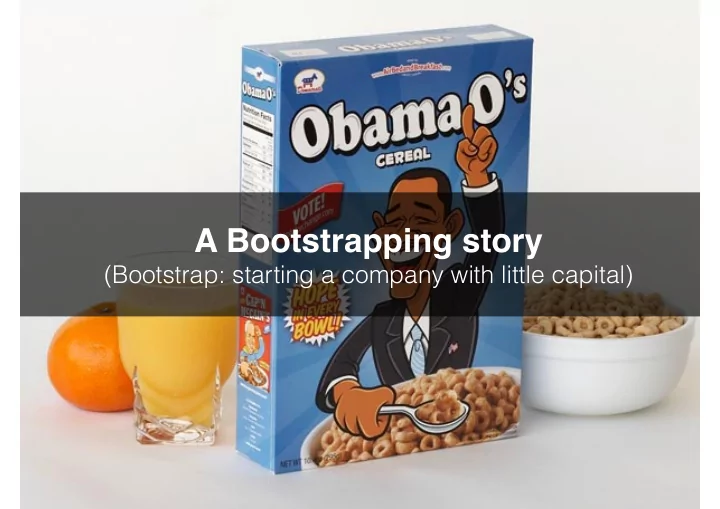

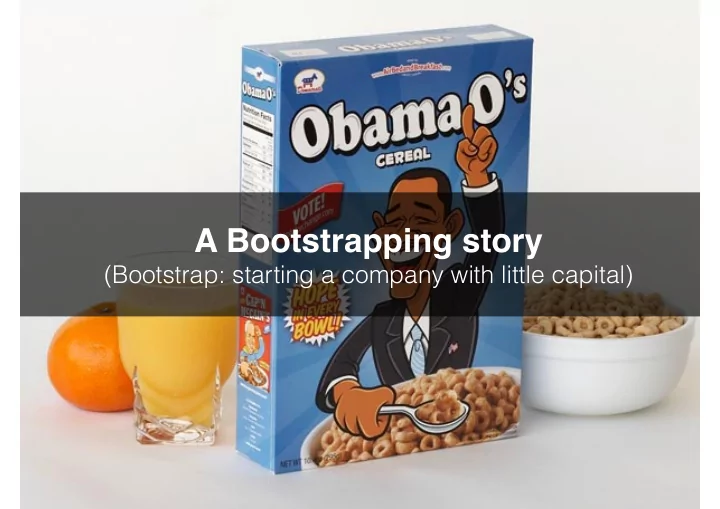

A Bootstrapping story (Bootstrap: starting a company with little capital)

‘We made 500 of each (Obama O's and Cap'n McCains). They were a numbered edition on the top of each box, and sold for $40 each. The Obama O's sold out, netting the funds we needed to keep ??? alive. The Cap'n McCains… they didn't sell quite as well, and we ended up eating them to save money on food.’

‘We couldn't wrap our heads around air mattresses on the living room floors as the next hotel room and did not chase the deal.’ Fred Wilson (Union Square Ventures)

$ 25 billion valuation

Financing your business

4 ways to finance a startup • Grant • Debt • Equity • Crowdfunding

Grant • Definition : A financial award for a particular purpose • Governamental institutions (ALMI, EU etc.) • Pitching Contest (TC, StartUp Weekend, etc.) • FFF (Family, Friends & Fools) • Pros: Free of charge, enables Bootstrapping • Cons: Time consuming (to find, to apply for, to report on) Generally little money Sometimes tied to specific purposes

Crowdfunding • Definition : The use of small amounts of capital from a large number of individuals to finance a new business venture. • Kickstarter, Indiegogo, Fundedbyme, AngelList, etc… • Pros: can do Reward (ideal for products), Equity, Loan Good to test the market Little loss of control (if Equity based) • Cons: Some argues messy captable

Debt • Definition : An amount of money borrowed by one party from another • Banks / Financial institutions; individuals (up to a certain amount depending on legislation) • Pros: Lenders • Cons: Hight interest rate (cost of money), or Need a guarantee (assets, future cash flow)

Equity • Definition : refers to the sale of an ownership interest for business purposes. • Angels, VCs, Banks / Financial Institutions, • Pros: Generally comes with business knowledge, network etc. of the investor(s) • Cons: reduction in ownership / control of the business

Convertible • Definition : a type of loan that can be converted into a predetermined amount of company equity at a certain time during its life. • Angels, VCs, Banks / Financial Institutions, • Pros: Generally simpler and faster than priced rounds; It defers company valuation at subsequent round of financing giving time to determine fair price.

Banks won’t lend money to finance projects with no short term revenue generation So let’s focus on shareholders (equity) (Equity = long-term financing needs in uncertain corporate investment) that’s you

Who are the Shareholders for each step? Series A & B Series C+ Pre-seed Seed 5 00k-5M <100k 100k-1.5M M&A IPO Venture Capitalists Venture Capitalists Savings Venture Capitalists F&F F&F Angel Funds Growth Funds Business Angels Grants Corporate Funds Angel Funds Rule of thumb: each round you give around 20-30% of your remaining capital, except in pre-seed when you give around 5-10%

If you raise funds in tech, it will most likely be sooner or later with venture capitalists

Process

Valuation: the basics

Some say that Startup valuation is more an art than a science but at the end of the day the valuation of a startup is what the market is willing to pay

Loads of di ff erent methods David Berkus model for early stage companies Scorecard Method for early stage Industry multiples Discounted Cashflow P/E Ratio (for Mature Companies) Ratios on EBITDA Asset Based Approach

Investments In At a minimum, your startup should be worth the amount of money+ man-hours* that have been invested in it by the founders during all the time of startup existence. *1 man-hour costs an average salary one would get working elsewhere

Industry comparables Compare your startup to one that has had an exit or is at the similar stage. Mind di ff erent geographical regions! Check: www.angel.co

Should you rise funds? When?

“Avoid investors till you decide to raise money, and then when you do, talk to them all in parallel, prioritised by expected value, and accept o ff ers greedily. That's fundraising in one sentence. Don’t introduce complicated optimisations, and don't let investors introduce complications either. Fundraising is not what will make you successful. It's just a means to an end. Your primary goal should be to get it over with and get back to what will make you successful—making things and talking to users—and the path I've described will for most startups be the surest way to that destination. Be good, take care of yourselves, and don't leave the path.“ - Paul Graham

Net Profit line Product / Market fit Growth Stages Exit

Financial model

Use Excel • Drivers • Revenues • Cost • Net Profit • Projection & KPIs

Drivers • # Users, • Product(s) price - use average price for multiple products • etc. • include growth for each driver • Plot in a graph to adjust

Revenues • Revenues = Price x Quantity • Volume business (low margin) v. price based business • Can do both, but difficult

Cost • List ALL your cost: • CoGS (cost of good sold) or direct cost = anything that can be directly correlated to sales - e.g. services related to the sales, e.g. servers. • Indirect cost = usually fixed: Marketing, R&D, Rent, electricity etc. • Keep salaries and other expenses (lawyers, travel and other expenses) separate

Net Profit Total Revenue - Total Costs = Net profit

Projections • create a spreadsheet by month (but report by quarter) over 3 years • adjust every number that seems incorrect • When is your break-even? • Plot Revenues, and net profit

KPIs • Identify your KPIs (Key Performance Indicator): e.g. financial based, Sales related, cost control, num users etc… • Monitor them over time and adjust your business (or KPIs) accordingly)

PnL (example)

KPIs and Break even (example)

Recommend

More recommend