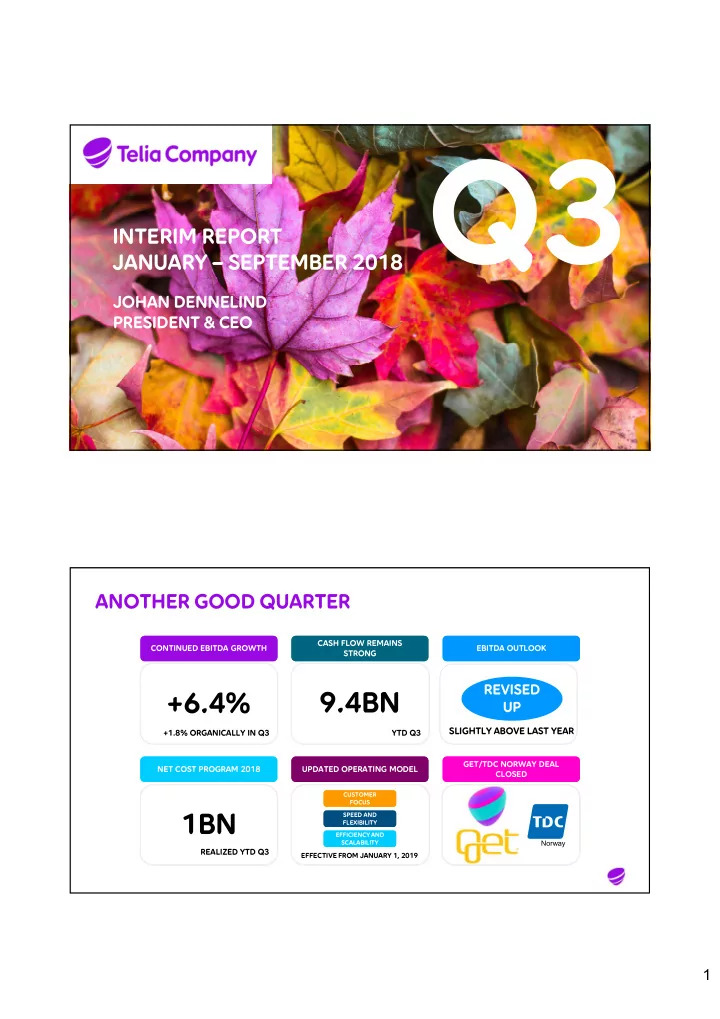

INTERIM REPORT JANUARY – SEPTEMBER 2018 JOHAN DENNELIND PRESIDENT & CEO ANOTHER GOOD QUARTER CASH FLOW REMAINS CASH FLOW REMAINS CONTINUED EBITDA GROWTH CONTINUED EBITDA GROWTH EBITDA OUTLOOK EBITDA OUTLOOK STRONG STRONG REVISED +6.4% 9.4BN UP SLIGHTLY ABOVE LAST YEAR +1.8% ORGANICALLY IN Q3 YTD Q3 GET/TDC NORWAY DEAL GET/TDC NORWAY DEAL NET COST PROGRAM 2018 NET COST PROGRAM 2018 UPDATED OPERATING MODEL UPDATED OPERATING MODEL CLOSED CLOSED CUSTOMER CUSTOMER FOCUS FOCUS 1BN SPEED AND SPEED AND FLEXIBILITY FLEXIBILITY EFFICIENCY AND EFFICIENCY AND SCALABILITY SCALABILITY Norway REALIZED YTD Q3 EFFECTIVE FROM JANUARY 1, 2019 1

KEY HIGHLIGHTS BY COUNTRY 6% ORGANIC EBITDA GROWTH EBITDA ABOVE NOK 1 BILLION TDC NORWAY/GET CLOSED STRONG B2B DUE TO GOOD M&A EXCECUTION • • • PHONERO SYNERGIES REALIZED • LIIGA SUCESSFULLY LAUNCHED STRONG B2C ROADMAP EARLY 5G INTEREST • • Norway 4% ORGANIC EBITDA GROWTH 3% GROWTH IN B2C MOBILE MOST SATISFIED MOBILE CUSTOMERS (SKI*) DOUBLE DIGIT MOBILE GROWTH (LIT) • • • INCREASED MOBILE B2C MARKET SHARE • IMPROVING CUSTOMER NPS (DEN) COST BASE TOO HIGH TELIA ONE (EST & LIT) • • *SKI = Swedish Quality Index (October 2018) CONTINUED EBITDA GROWTH SERVICE REVENUE DEVELOPMENT EBITDA DEVELOPMENT Organic growth, external service revenues Organic growth, excluding adjustment items 1,8% -1.9% -1.9% Q3 17 Q4 17 Q1 18 Q2 18 Q3 18 Q3 17 Q4 17 Q1 18 Q2 18 Q3 18 • Low margin voice revenue decline representing • Organic EBITDA growth in 5 of 7 markets 2/3 of the drop in Q3 and half of the drop in Q2 • Continued cost savings realization • Continued legacy pressure in Sweden • Reported growth of 6.4 percent supported by FX • Mobile growth in 5 of 7 markets 2

SIGNIFICANT STEPS TO SUPPORT SWEDEN TURNAROUND SWEDEN EBITDA DEVELOPMENT UPDATED OPERATING MODEL - JAN 1, 2019 Organic growth, excluding adjustment items CUSTOMER CUSTOMER SPEED AND SPEED AND EFFICIENCY AND EFFICIENCY AND -5.6% FOCUS FOCUS FLEXIBILITY FLEXIBILITY SCALABILITY SCALABILITY • Common Product and Services unit to capture synergies and increased speed • Around 500 employees move to common units • More customer centric and faster go-to-market approach locally • Other countries to follow Q3 17 Revenues Cost Q3 one-time Q3 18 effects* • Significant structural cost savings from transformation • In previous quarters cost savings mitigated expected in 2020 revenue pressure • Short term cost savings in focus to compensate • Tougher cost comparisons • Slower realization of cost savings in Q3 * Includes thunderstorm costs and FX effects DELIVERING ON THE COST PROGRAM COST SAVINGS REALIZATION – 9M 2018 COST SAVINGS BREAKDOWN – 9M 2018 SEK in billions Other SWE 1,1 1,0 BALT DEN FIN 9M 2018 Full year target NOR • Strong cost execution YTD • Despite Sweden being behind target, other units compensate • Continued focus on ensuring that cost awareness is part of the organizational culture 3

MOBILE REVENUES CONTINUE TO GROW MOBILE SERVICE REVENUE GROWTH MOBILE ARPU GROWTH Q3 In local currency, pre & post-paid, y-o-y Organic growth SWEDEN SWEDEN NORWAY NORWAY +1.9% +1.9% +0.3% +0.3% 3% 2% FINLAND FINLAND +0.7% +0.7% +4.1% +4.1% 1% LIT EST DEN +9.9% +0.2% -4.4% 0% Q3 17 Q4 17 Q1 18 Q2 18 Q3 18 • Mobile revenue growth in 5 of 7 markets • ARPU continued to grow in majority of markets • Strong B2B development in Finland • Core ARPU main driver through price increases and customer migration • Lithuania +14 percent on mobile in Q3 LIIGA IN PLAY AND DELIVERING ON ACQUISITIONS LIIGA SUCESSFULLY LAUNCHED DELIVERING ON OUR ACQUISITIONS Cumulative adjusted EBITDA vs. business cases, YTD Q3 NEBULA INMICS 18% Target Outcome Target Outcome ABOVE BUSINESS CASES CLOUD PROPENTUS SOLUTIONS 50% new customers to Telia Target Outcome Target Outcome 55% on the high ARPU Liiga pass • Four companies acquired 2017/2018, representing 43% of sales online a full ICT portfolio • Delivering on the business cases 4

GET/TDC NORWAY DEAL CLOSED – THE NEXT ERA STARTS SYNERGIES TO REALIZE DEAL CLOSED Q3 PERFORMANCE* Revenues y-o-y, KPI’s q-o-q SEK 1 BILLION REVENUES Norway FLAT NOK 0.4 BILLION • Deal approved without remedies TV • Closed on October 15 UNCHANGED** • Clear integration roadmap RGU’s established Norway NOK 0.7 BILLION BROADBAND (Full run-rate by end of 2021, including SEK 0.1 billion in +3,000 RGU’s CAPEX) * Preliminary and unaudited numbers in local currency based on the accounting principles and definitions applied under TDC’s ownership ** Excluding a clean out of 8,000 non-revenue generating RGU’s from shutting down the analogue network RGU= Revenue Generating Unit BONNIER BROADCASTING UPDATE THE KEY RATIONALE THE FINANCIALS OFFENSIVE SEK in millions 2020 2021 2022 DIFFERENTIATION / UNIQUE EXPERIENCES 1 EBITDA synergies 100 600 2 AD-ENGINE AND COMPETENCE FOR THE FUTURE Integration costs -200 -200 0 DATA ANALYTICS & CUSTOMER KNOWLEDGE 3 • Operational free cash flow of SEK 500 million 2020 DEFENSIVE 4 WELL POSITIONED IN TRADITIONAL TV AND AVOD IMPROVED POSITION IN MEDIA/AD LANDSCAPE & 5 FLEXIBILITY IN CONTENT USAGE IMPROVED CONVERGENCE TO REDUCE CHURN 6 MERGER FILING PROCESS INITIATED & ON-GOING DIALOGUE WITH EU COMMISSION MERGER FILING PROCESS INITIATED & ON-GOING DIALOGUE WITH EU COMMISSION RE-ITERATE EXPECTED CLOSING IN H2 2019 RE-ITERATE EXPECTED CLOSING IN H2 2019 5

INTERIM REPORT JANUARY – SEPTEMBER 2018 CHRISTIAN LUIGA EXECUTIVE VICE PRESIDENT & CFO Q3 PRESSURE ON LEGACY AND LOW MARGIN REVENUES NET SALES DEVELOPMENT SERVICE REVENUE DEVELOPMENT Organic growth Organic growth, external service revenues +0.1% -1.9% Service revenues -1.9% -1.9% Q3 SWE FIN NOR DEN LIT EST LAT Telia Other Q3 Q3 17 Equipment Mobile Fixed Other Q3 18 Carrier 17 18 • Net sales flat - equipment growth of 13 percent • Sweden pressured mainly by fixed telephony • Telia Carrier down from drop in low-margin volumes 6

CONTINUED POSITIVE GROUP EBITDA DEVELOPMENT EBITDA DEVELOPMENT- REPORTED EBITDA DEVELOPMENT - ORGANIC Organic growth, excluding adjustment items Reported growth, excluding adjustment items +6.4% +1.8% Q3 17 Organic M&A FX Q3 18 Q3 SWE FIN NOR DEN LIT EST LAT Other Q3 17 18 • Continued FX tailwind on reported numbers • Overall strong cost control in the group • Sweden burdened by legacy and higher costs • Good operational development in Finland • Synergy realization and strong cost control in Norway OTT TV MOMENTUM IN SWEDEN MORE ACTIVE TV USERS SERVICE REVENUES MOBILE – B2C Users and usage Organic growth, external revenues In local currency Mobile B2C postpaid ARPU B2C incl. fiber installation revenues +21,000 +21,000 Mobile B2C revenue growth B2C excl. fiber installation revenues 262 +0.5% +0.5% TV NET ADDS TV NET ADDS IN Q3 2018 IN Q3 2018 -0.4% -0.4% +38% +38% B2B -2.7% -2.7% ACTIVE PLAY ACTIVE PLAY +3% +3% B2C USERS Y-O-Y USERS Y-O-Y +74% +74% MINUTES PER MINUTES PER Q3 17 Q4 17 Q1 18 Q2 18 Q3 18 Q3 17 Q4 17 Q1 18 Q2 18 Q3 18 PLAY USER Y-O-Y PLAY USER Y-O-Y • Slower mobile growth due to • Less tailwind from VAS behind • Telia Play increasingly attractive tougher comparisons slower growth pace Q3 • Stable but still challenging in B2B 7

GOOD MOBILE AND EBITDA DEVELOPMENT IN FINLAND SERVICE REVENUES* & EBITDA** MOBILE SUBSCRIPTIONS AND ARPU SEK million, reported currency & organic growth Total subscription base in 000’, ARPU in local currency +0.8% +0.8% 3 400 20 3 258 19 2 911 3 300 +4% +4% 18 +6.1% +6.1% 3 200 1 291 17 1 089 3 100 16 3 000 15 Q3 17 Q3 18 Q3 17 Q3 18 Q3 17 Q4 17 Q1 18 Q2 18 Q3 18 Service revenues EBITDA Subscriptions ARPU • B2C mobile stable – increasing growth in B2B • Added subscriptions in both B2C and B2B Q3 • Cost focus and M&A execution drive EBITDA • Several new large B2B contracts • ARPU growth driven by mix and core ARPU = Organic growth * External service revenues ** Excluding adjustment items SIGNIFICANT EBITDA GROWTH IN NORWAY SERVICE REVENUES* & EBITDA** EBITDA** DEVELOPMENT SEK million, reported currency & organic growth NOK million, adjusted EBITDA, R12 -0.9% -0.9% 4 000 Adjusted EBITDA (R12) 2 303 2 187 3 500 +15% +15% 3 000 1 126 925 2 500 2 000 Q3 17 Q3 18 Q3 17 Q3 18 Q3 17 Q4 17 Q1 18 Q2 18 Q3 18 Service revenues EBITDA • Similar revenue trend as previous quarters • Strong operating leverage from Phonero synergies • Headwind from lower special-number revenues • Highest absolute EBITDA so far (NOK 30 million impact) = Organic growth * External service revenues ** Excluding adjustment items 8

Recommend

More recommend