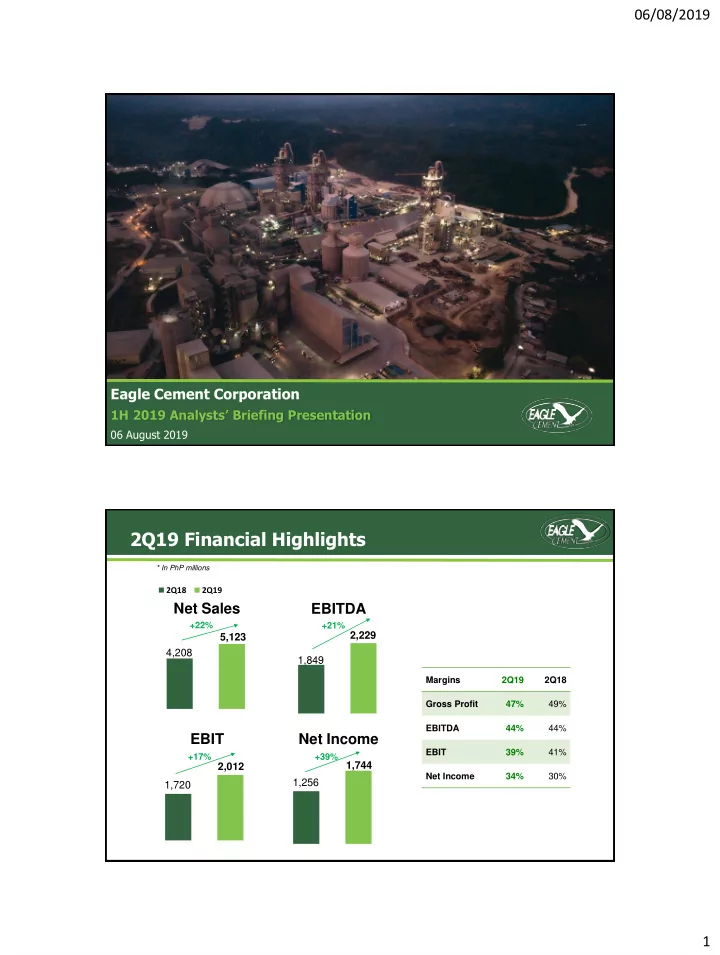

06/08/2019 Eagle Cement Corporation 1H 2019 Analysts’ Briefing Presentation 06 August 2019 2Q19 Financial Highlights * In PhP millions 2Q18 2Q19 Net Sales EBITDA +22% +21% 2,229 5,123 4,208 1,849 Margins 2Q19 2Q18 Gross Profit 47% 49% EBITDA 44% 44% EBIT Net Income EBIT 39% 41% +17% +39% 1,744 2,012 Net Income 34% 30% 1,256 1,720 1

06/08/2019 1H19 Financial Highlights * In PhP millions 1H18 1H19 Net Sales EBITDA +28% +21% 10,494 4,241 8,211 3,519 Margins 1H19 1H18 Gross Profit 45% 48% EBITDA 40% 43% EBIT Net Income EBIT 36% 39% +18% +44% 3,796 3,335 Net Income 32% 28% 3,212 2,322 Income Statement In M Php` 1H 2019 1H 2018 % change Net Sales 10,494 8,211 28% Cost of Goods Sold 5,800 4,257 36% Gross Profit 4,694 3,954 19% Operating Expense 926 790 17% Income from Operations 3,768 3,164 19% Finance Costs (253) (178) 42% Interest Income 433 229 89% Other Income/(Loss) – net 28 49 (42%) Income before Income Tax 3,976 3,264 22% Provision in Income Tax 641 942 (32%) Net Income 3,335 2,322 44% 2

06/08/2019 Financial Position In M Php 30-June-19 31 Dec-18 % change Cash and Financial Assets 18,673 16,359 14% Trade and Other Receivables 545 483 13% Inventories 1,807 1,504 20% Other Current Assets 1,134 1,098 3% Total Current Assets 22,159 19,444 14% Total Non current Assets 26,597 26,020 2% Total Assets 48,756 45,464 7% Current Liabilities 6,610 4,658 42% Noncurrent Liabilities 7,472 7,985 (6%) Interest Bearing Loans 7,883 8,323 (5%) Total Liabilities 14,083 12,643 11% Equity 34,674 32,820 6% Liquidity & Gearing Ratios *In PhP millions Total Assets Total Liabilities & Equity 48,756 45,464 Equity Equity 34,674 32,820 Liabilities Liabilities 14,083 12,643 31-June-19 31-Dec-18 31-Dec-18 30-June-19 30 June 2019 31 Dec 2018 Current Ratio 3.35x 4.17x Debt to Equity 0.41x 0.39x Financial Debt to Equity 0.23x 0.25x Net Financial Debt to Equity -0.27x -0.24x 3

06/08/2019 Business Updates Expansion Plans Location Annual Capacity Status (in M MT) Finish Mill 5 Bulacan 1.5 million On going construction Malabuyoc, Production Line 4 2.0 million 2021 completion Cebu Overview @ Feed Bin Tank Bldg. for FM5 Overview @ Finish Mill 5 proper Key Messages ➢ First half net sales increased by 28% on the back of strong sales volume growth ➢ Margins were maintained at healthy levels, outperforming peer’s average. ➢ Net income grew by 44%. 4

06/08/2019 End of Presentation Thank you! 5

Recommend

More recommend