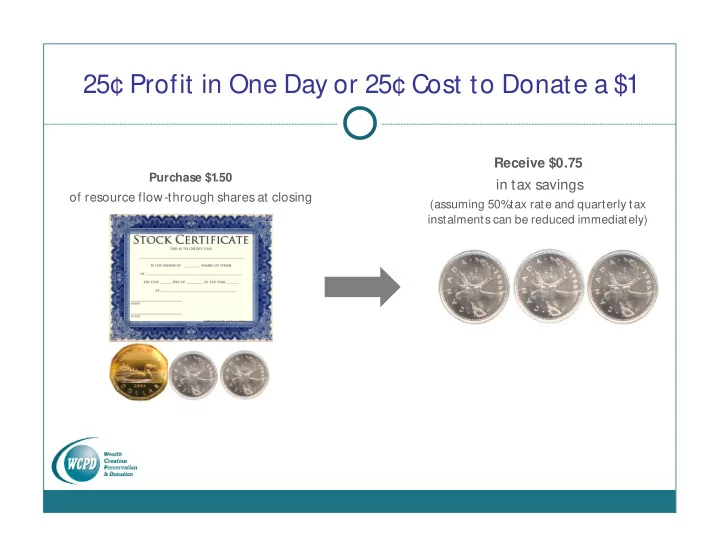

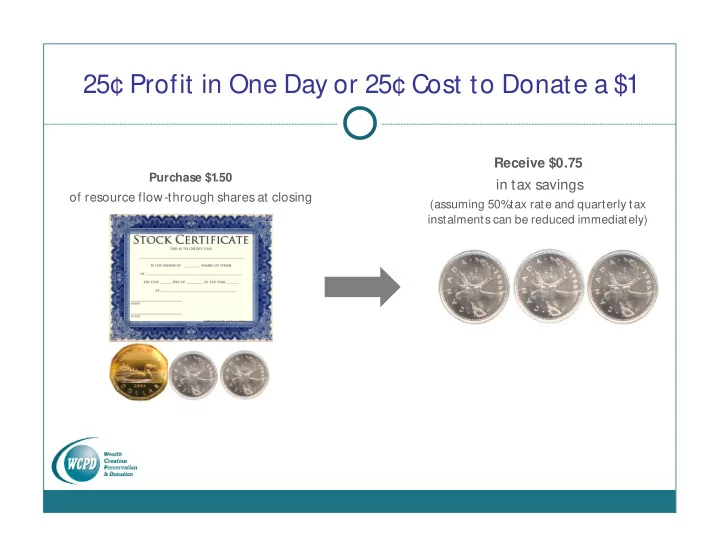

25¢ Profit in One Day or 25¢ Cost to Donate a $1 Receive $0.75 Purchase $1 .50 in tax savings of resource flow-through shares at closing (assuming 50% tax rate and quarterly tax instalments can be reduced immediately)

All Closing Steps Happen Same Day Investor sells the $1.50 of fl ow- Receive $1.00 cash from through shares to Liquidity Provider Liquidity Provider at closing. at closing for $1 . Liquidity Provider takes on Stock Risk for the bene fi t of buying the shares at 33% discount. Investor no longer has any stock market risk

Option 1 : Donate $1 for Only 25¢ Receive a Charitable Tax Receipt for This donation to charities of your donating $1 choice results in a tax savings of $0.50 The market value is based on the selling price of the share to the liquidity provider

Donate $1 for Only 25¢ .50 purchase $0.25 tax cost to donate $1 .25 in tax savings $1 $1 .00 of flow-through shares LESS $0.75 $0.50 (Flow-Through purchase) (Charitable Donation)

Summary of Your Donation through WCPD Regular donation of $1 .00 to Charity $0.50 cost Donation of $1 .00 to Charity through WCPD’s Flow- Through Offerings $0.25 cost Thus you can now double your donations to charity at no additional cost.

Option 2: Make a $0.25 Profit Keep $1 .00 Make $0.25 Profit from the sale of the share to a liquidity provider Keep Cash at closing Tax Saved Total flow-through from sale purchase of $1 .50 Total Benefit = $1 .75

Recommend

More recommend