2019 2019/20 /20 – An n oi oil prod product dra uct drama SEB Commo SE Commodi diti ties es Resea esearch rch Bjarne Schieldrop Head of SEB Commodities Research Bjarne.schieldrop@seb.no +47 9248 9230

Hi Histori storica cal vi view ew of US crude of US crude producti production on An i n inc ncredi redibl ble p pro rodu ducti tion i inc ncrea ease US crude oil production in m bl/d. NGL, bio and refinery gains not included 2

Larg rge e loss oss of suppl of supply y in n many ny pl places ces More More tha than n tw two o mi million on ba barrel rrels s of of supp supply y ha has s been been lost ost in d n diff ffere erent nt pl places es Cumulative loss of supply in selected countries since end of 2016 in 1,000 bl/d 3

Medi Medium um sour sour crude crude vs. vs. Sha Shale e oi oil Medium Medi um sour sour crude rude ha has s much much more more mi mid d to to hea heavy vy mol molec ecul ules es Volume content of hydrocarbon for different crudes Crude type \ Product type Lights Mid Heavy Mid+Heavy Ultra-light sweet shale (API, S%) = (45, 0.08%) 41% 34% 24.2% 59% Brent crude (API, S%) = (38.1, 0.42%) 30% 35% 34.6% 70% Medium-Sour (API, S%) = (31.3, 1.4%) 22% 32% 46.0% 78% 4

Crude Crude curves curves now now a and one yea nd one year r ago Long onger er ter term m pri price e anc nchor hor more more or or less ess uncha unchang nged ed around round $6 $60/ 0/bl bl Forward crude curves end of 2017 vs. end of 2018 5

US g US gasol soline ne stocks stocks a at t record record hi high But the “normal” is high as well US Gasoline stocks in 1,000 barrels 6

Ga Gasol soline ne cra cracks cks ha have cra ve crashed shed Ga Gasol soline ne – a p premi remium um produc product, t, no no long onger er yi yiel elds ds a p prof rofit Oil product cracks in ARA (USD/bl) 7

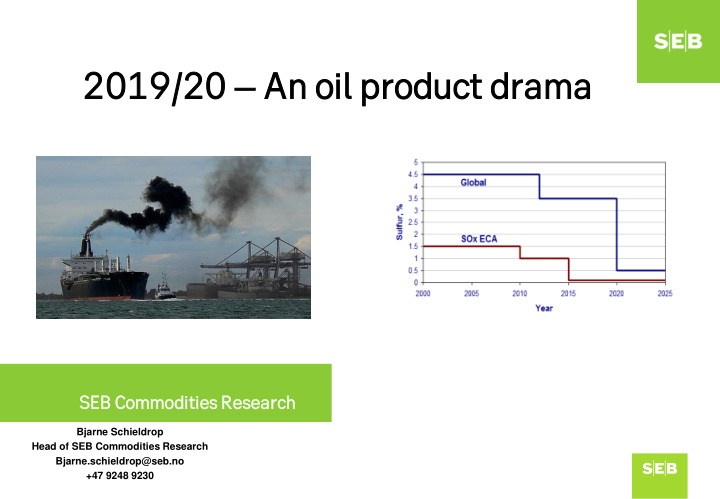

Shi Shippi pping ng - the “graveyard for dirty oil” since the 70i 70ies es Now it has to stop says the International Maritime Organization (IMO) In 2020 you’ll need to run on cleaner fuel or have a scrubber Ship burning high sulphur fuel oil Ship exhaust scrubber 8

GOFO GOFO pea peaked ked at $700/ton t $700/ton in 2008 n 2008 But ut th then en Bren rent t crude crude ra rallied ed to to $14 $148/ 8/bl bl The Gasoil 0.1% to HFO 3.5% spread (USD/ton) 9

The 2008 he 2008 Ga Gasoi soil squeeze squeeze The he sc scatt tter er poi points nts fro from m 20 2008 08 rea really y sta stands nds out out fro from m the the crow rowd. d. The he Ga Gasoi soil cra crack ck over over Bren rent t crude crude in n USD USD/ton /ton is s nor norma mally y arou round nd $85 $85/ton /ton Gasoil to Brent crude crak in USD/ton 10

The 20 he 2008 08 Ga Gasoi soil cra crack ck squeeze squeeze In 20 n 2008 08 a ti tight ht Ga Gasoi soil ma mark rket et led ed to to an n upw upwards rds spi spira ral mov move e bet between een Ga Gasoi soil and nd light ht sw sweet eet crude. crude. Unt Until th the e globa obal economy economy fe fell apa part rt 11

Refi efini ning ng: A : Atm tmosp ospheri heric c or or Va Vacuum di cuum disti stillati tion? on? Atm tmospheri ospheric c Resi esidue due (A (AR) ) conta contains ns va valua uabl ble Va Vacu cuum um Ga Gasoi soil (VG (VGO) O) whi hich ch is s usua usually y stri stripped pped out out by va by vacuum cuum di disti stillation n lea eavi ving ng onl only y hi high h sul sulphur phur, hi high h densi density ty Va Vacuum uum Resi esidue due (VR (VR). ). Done Done due due to to ec economi onomics Simple and semi-simple refining of the Global crude oil barrel Gl Globa obal ba barrel el: API: : 32 32 S% S%: 1. 1.3% 3% AR S% S%: : 2. 2.2% 2% VR VR S% S%: : 3. 3.2% 2% VG VGO S O S%: : 1. 1.7% 7% 12

Crude S% ≤ 0.24% will do the IMO 2020 trick It will yield an ARS% = 0.5%. If you also want the VRS% ≤ 0.5% then the Crude Crude S% S% needs needs to to be be bel below ow 0. 0.14%. 14%. I.e. e. Bonny onny Light ht ty type pe of of crude crude Simple and semi-simple refining of crude with (API; S%) = (37; 0.24%) Crude ude input nput typ type: e: API: : 37 37 S% S%: 0. 0.24% 24% Refi efiner nery y outp output: ut: AR S% S%: : 0. 0.5% 5% VR VR S%: S%: 0. 0.8% 8% VG VGO S O S%: : 0. 0.4% 4% 13

Still a Sti almo most st 30 m 30 m bl bl/d of /d of crude crude with S% th S% <0. <0.5% 5% But ut crude crude with th S% S% = = 0. 0.5% 5% is s not not enou enough. h. Crude Crude with th S% S% = 0. = 0.5% 5% will yi yiel eld d AR S% S% = 1. = 1.0% 0% and nd VR VR S% S% = 1. = 1.6% 6% Global crude oil by sulphur concentration 14

Crude Crude S% needs S% needs to to be be low ower tha er than n 0. 0.24% 24% In order n order to to produce produce AR S% of S% of 0. 0.5% 5% or or low ower. er. The Crude he Crude S% S% needs needs to to be be bel below ow 0. 0.12% 12% to to produce produce VR VR S% S% bel below ow 0. 0.5% 5% Crude sulphur % versus AR S% and VR S%. Assuming crude fixed at API = 38 15

Plenty of enty of stra straight run ht run MFO MFO 0. 0.5% 5% if f VGO i VGO is s not stri not stripped out pped out The price of MFO 0.5% just needs to be high enough to incentivise refineries to leave the VGO in the residue. Leave it as straight run fuel oil. Leaving VGO in the fuel oil => a tighter Gasoil market. So So th the e MFO MFO 0.5% price needs to be ≥ than the Low Sulphur VGO price Cumulative volume of Atmospheric Residue and Vacuum Residue vs. Sulphur % 16 Total VR with marginal S% ≤ 0.5%: 1.2 m bl bl/d /d Total AR with marginal S% ≤ 0.5%: 7.1 m bl bl/d /d

Spot: B Spot: Both oth Ga Gasoi soil and HFO expensi nd HFO expensive ve In the n the sp spot ot ma market rket for for the the ti time me bei being ng both both Ga Gasoi soil and nd HFO HFO 3. 3.5% 5% are re expensi expensive e ver versus sus th thei eir r nor norma mal rel relati tion onshi ships ps to to Bren rent t crude crude oi oil Spot prices for Gasoil 0.1% and HFO 3.5% less their normal price vs. Brent crude 17

Forw Forward rd product pri product price ce curves curves XXXX XXXX Forward product price curves 18

Ga Gasoi soil to HSFO 3. to HSFO 3.5% 5% forw forward sprea rd spread Gasoil and Fuel oil forward curves in USD/ton 19

GOFO GOFO vs vs hi histori storica cal crude oi crude oil pri prices ces Spot Spot sprea spread d to toda day y is s just ust $20 $200/ton 0/ton as s HFO HFO 3. 3.5% 5% is s unusua unusually ti tight ht The Gasoil 0.1% to HFO 3.5% spread (USD/ton) 20

Very Very littl ttle e HFO 3 HFO 3.5% d 5% discount scount versus versus norm norms Ma Mark rket et is s pri prici cing ng in n a s surpl urplus us and nd a depress depressed ed HFO HFO 3. 3.5% more 5% more or or less ess onl only y in n 202 2020 be 0 befo fore re tu turni rning ng to to more more or or less ess nor norma mal alrea ready dy in 20 n 2021/2 21/22 Gasoil and HFO forward prices minus Brent crude and versus historical norms 21

Very Very littl ttle e HFO 3 HFO 3.5% d 5% discount scount versus versus norm norms Mark Ma rket et is s pri prici cing ng in n stron strong ref refine nery ry ma marg rgins ns fo for r bot both h Ga Gasoi soil and nd HFO HFO ver versus sus hi histori storica cal nor norms ms Gasoil and HFO forward prices minus Brent crude and minus historical norms 22

Ga Gasol soline ne cra cracks cks ha have cra ve crashed shed Ga Gasol soline ne – a p premi remium um produc product, t, no no long onger er yi yiel elds ds a p prof rofit Oil product cracks in ARA (USD/bl) 23

Recommend

More recommend