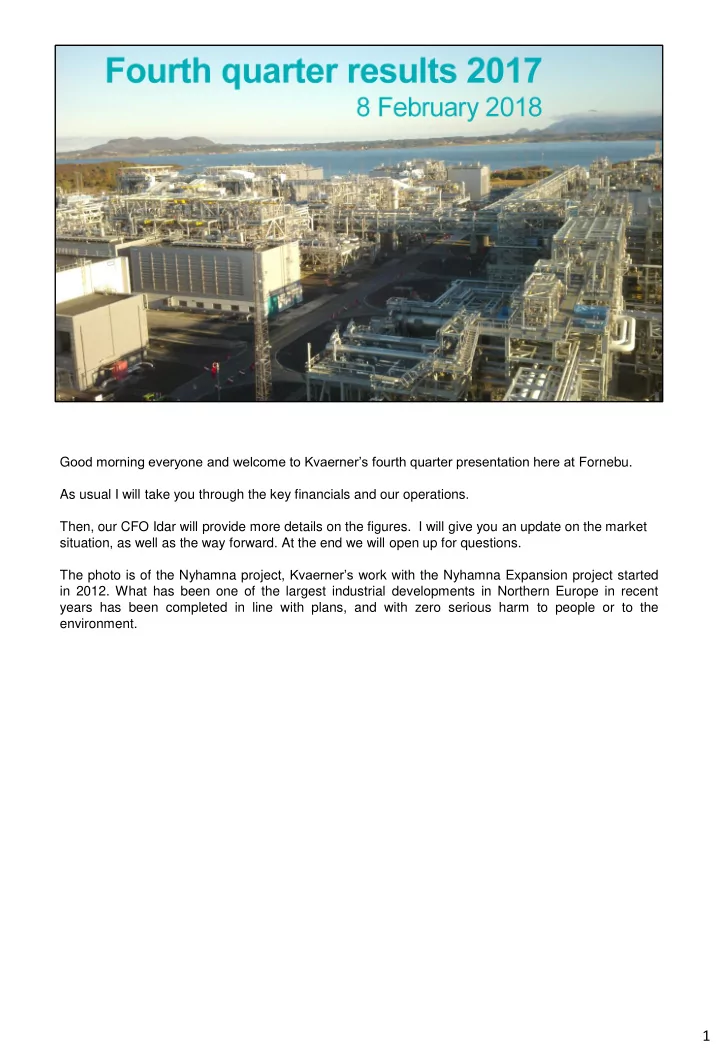

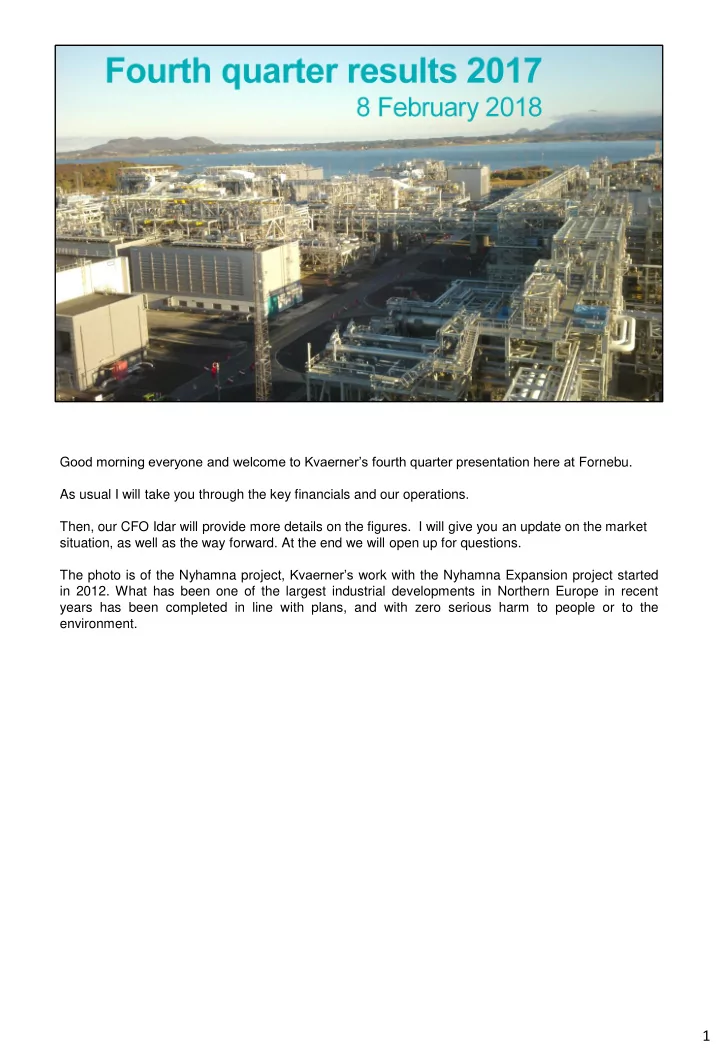

G ood morning everyone and welcome to Kvaerner’s fourth quarter presentation here at Fornebu. As usual I will take you through the key financials and our operations. Then, our CFO Idar will provide more details on the figures. I will give you an update on the market situation, as well as the way forward. At the end we will open up for questions. The photo is of the Nyhamna project, Kvaerner’s work with the Nyhamna Expansion project started in 2012. What has been one of the largest industrial developments in Northern Europe in recent years has been completed in line with plans, and with zero serious harm to people or to the environment. 1

Kvaerner continued to deliver strong performance and results also in fourth quarter. The results were driven by successful execution and projects being completed. The Nyhamna project has been delivered in line with plans. Kvaerner will during the first part of 2018 be involved in some final work and close-out activities, and in supporting Shell’s project organisation in the start up of the facility. The Hebron project was delivered as scheduled in August and the platform achieved first oil 27 of November last year. Project close-out was finalised in fourth quarter. The improved performance, including incentives and close-out activities in the project portfolio, has impacted project results positively. During the quarter, we were awarded four new contracts within both traditional and growth segments. The largest of the new contracts was the 1 billion topside and steel jacket substructure contract for Valhall Flank West. This is the first project in the Wellhead Platform Alliance with Aker BP. Additionally, after the end of the quarter, we were awarded two smaller contracts for disposal of the existing Valhall QP and Varg A installations. The backlog for our decommissioning business now has a healthy load factor until early 2020. 2

The common denominator for the entire portfolio is: Kvaerner delivers as committed! Both the Johan Sverdrup drilling platform and production platform jackets are being assembled in Verdal: Important milestones for the drilling jacket were the last roll-up of the four main frames in October and installation of the third pile cluster in December. This jacket will be delivered this spring and the third one this summer. For the Johan Sverdrup ULQ topside, all prefabricated modules have been lifted in place and installed according to schedule. The load out to barge and jacking of the platform up to 13 metres was completed in November. The assembly of the living quarter is on-going and the utility module will be powered up for testing in February. Commissioing activities will start in March. The Valhall Flank West project will be executed by the alliance, and Kvaerner’s scope includes procurement, fabrication, sea-fastening and load-out, as well as offshore hook-up and commissioning assistance. The fabrication management will be based at Kvaerner’s yard in Verdal, where prefabrication and assembly will now start in May. For the Njord A platform, the main activities in Construction last period has been fabrication of steel sections in Verdal and structural reinforcement inside and outside the hull at Stord. After hook up of the Aasta Hansteen SPAR Substructure and topside early December, Kvaerner has now worked 24/7 with hook-up and completion of the platform. Our inshore scope will continue until early spring when the platform is towed to the field. Kvaerner will also assist Statoil with offshore hook-up and preparations for production start-up. For the hook up of the Sverdrup riser platform: Preparation and verification of work packages are ongoing. The modules for offshore hook-up are expected to arrive in Norway in second quarter, and the offshore execution will start spring this year. We are currently working on two decommissioning projects: the disposal and demolition of the Subsea Compression Pilot at Nyhamna and the dismantle and recycling of a North Sea platform. Currently there are 5 000 tonnes at our yard that are being disposed. Preparations are ongoing for receipt of 40 000 tonnes of structures this spring. As I repeat every quarter, good HSSE performance is not only our licence to operate. It is also a pre-requisite in order to be on the bidders list! 3

Kvaerner’s ambition is to openly share our HSSE results. Both because we want to drive continuous improvement in this industry, and because we believe HSSE should be an important bid criteria also for contracts in Norway. There has been a further decline in serious incidents in fourth quarter, but still there was one serious incident related to work at height. Investigation has initiated several actions to ensure safe operations. No Lost Time Incident occurred in fourth quarter, ending on five Lost Time Incidents in total for 2017. Total injury frequency (TRIF) ended on 2.5 for 2017. The majority of the injuries are related to cuts in hands and fingers. The HSSE results for fourth quarter positively impacts the HSSE results for the whole year, but still we are not satisfied with the HSSE performance and need to improve in this area. Campaign and incentive programme to increase reporting is ongoing, and a smart phone App for reporting is piloted in the period. In addition we will focus on compliance, visible leadership, proactive risk awareness and HSSE in relation to our subcontractors and partners. The sick leave for fourth quarter is slightly increasing to 5.4 percent and is above the target of 4.8 percent. The improvement programme to reduce sick leave continue. 4

As we have commented earlier, the Field Development Segment figures include our share of revenues from jointly controlled entities. We focus on the Field Development figures in this presentation, as this reflects our complete operations. The revenues in fourth quarter were almost 1.85 billion. And the EBITDA was 234 million for the quarter and the margin was 11.1 percent in 2017. The order intake was 1.7 billion in fourth quarter. The order backlog was 8.1 billion at the end of fourth quarter. The graph shows that 70 percent of the total backlog is estimated for execution in 2018 and the rest for 2019 and onwards. ---------------------------------------- Then I leave the word to Idar to comment more detailed on the financials. 5

Thank you Jan Arve and good morning! The financial highlights in fourth quarter were: - Good margins reflecting improved quality performance including incentives and close out activities - We maintain a robust balance sheet Let’s look at the details, starting with Field Development review 6

Field Development revenues was almost 1.85 billion in fourth quarter and EBITDA was 234 million in the quarter. The revenues for full year 2017 ended at 7.6 billion with an EBITDA of 846 million, resulting in a margin of 11.1 percent. Provision for excess office capacity due to market downturn has been provided for by 53 million. The good performance, including incentives and close out activities has impacted project results, and the quarterly results, positively. As we have said earlier, quarterly fluctuations in earnings are to be expected due to phasing of projects, project portfolio mix and performance related bonuses. During first half of 2018, positive effects from projects being delivered and projects reaching 20 percent completion are expected to impact results. For full year 2018, margins will be lower than for 2017 due to few major projects in completion phases and the composition of the project portfolio. 7

Moving to the group’s cash flow, the net current operating assets (NCOA), or working capital was negative 650 million at year end. We expect the working capital to increase in 2018 due to projects being completed and the portfolio mix. Looking at the cash flow statement, net cash inflow from operating activities was 297 million in fourth quarter mainly reflecting positive EBITDA. The cash flow from operating activities for 2017 was negative at 113 million due to negative working capital developments of 884 million, more than offsetting the positive EBITDA. Net cash outflow from investing activities was 67 million in the quarter, related to capital expenditure. Main capex items were investments in decommissioning facilities, and productivity enhancing equipment such as welding robots and machines. Our guiding for maintenance capex is 30-50 million annually. Additional strategic and capacity investments at the yards such as equipment and digitalisation tools may increase capex in the year. Net cash outflow from financing activities was 15 million, related to the share purchase programme for employees and fees paid. Net increase in cash and bank deposits during the quarter amounted to 217 million, resulting in cash and bank deposits at year end 2017 of 2.8 billion. 8

A few comments to the balance sheet: At the end of the quarter our credit facilities were undrawn and net cash at quarter end was close to 2.8 billion. Movements in working capital is impacting cash balances and at year end, net cash excluding negative working capital was 2.2 billion. Kvaerner maintains a robust balance sheet with an equity ratio of 55 percent. Thank you for the attention. I now leave the floor to Jan Arve for an update on market and outlook. 9

Recommend

More recommend