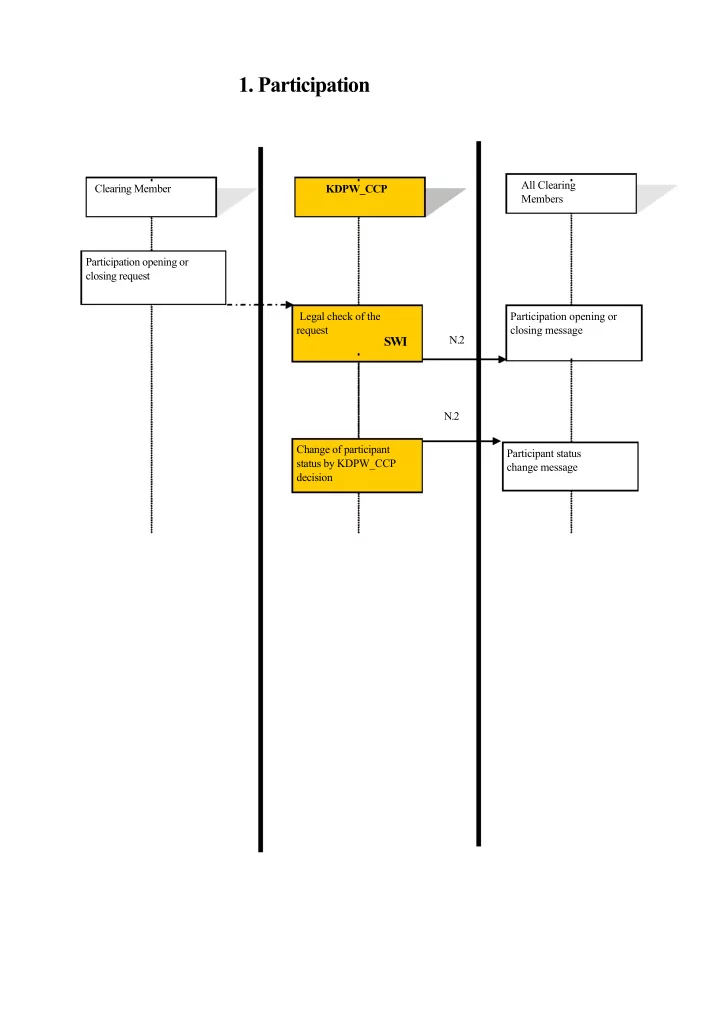

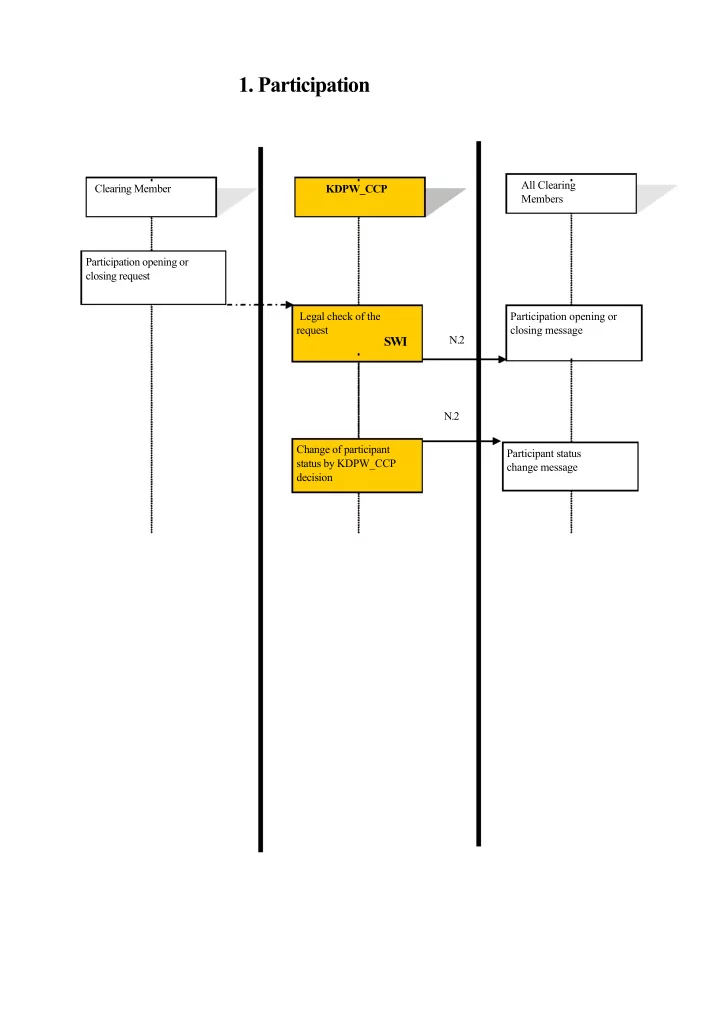

1. Participation All Clearing Clearing Member KDPW_CCP Members Participation opening or closing request Legal check of the Participation opening or request closing message N.2 SWI N.2 Change of participant Participant status status by KDPW_CCP change message decision

2. Opening and Closing Accounts KDPW_CCP Clearing Member Account opening or closing message K.1 Check of: (a) account opening request (b) account closing request - if any K.4 Message receipt confirmation. (a) for an account opening request – account opening confirmation (b) for an account closing request – change of request status to PEND. End of day Check whether: (a) there are active transactions in the PA account, (b) this is the last PA account for the PB account (phase 2) (c) there is collateral in the PB account. Change of the account database. Receipt of confirmation / rejection of the account database change and entry of changes in the kdpw_stream K.4 database. Account closing success / failure message

3. Account Configuration Management KDPW_CCP Clearing Member Setting account limit U.1 and/or attributes Updating account limits and/or attributes U.2 Confirmation

4. Accepting New Transactions Clearing Member KDPW_CCP SWIFT Accord MarkitWire Concluding the transaction Suspending the processing of Matching the new transactions transaction Receipt of a new transaction N.1 Formal check Transaction rejection message due to errors of substance or participant suspension or default Calculating margin requirements, limit check N.1 (a) accepting the (a) Receipt of a message that transaction, NOVATION the transaction is covered by guarantees and, where the collateral limit is exceeded, (b) suspending the transaction and suspending also the time limit for the Clearing Member adjusting the collateral (c) suspending the (b) Where the collateral limit is transaction exceeded – transaction suspension message (c) Where a mandatory individual limit is exceeded – transaction suspension message N.2 If (b) – Clearing Member suspension message (status change to SUSPENDED_PRIVATE)

5. Depositing Collateral Intra-day KDPW_CCP Clearing Member Collateral Register Depositing collateral in securities and in cash. G.4 Updating the Collateral Register; Updating the available collateral and use of limits message.

6. Releasing Collateral Intra-Day Clearing Member KDPW_CCP Collateral release request (cash or securities) G.4 Collateral release request: securities: xml , cash — ESDI Only one request per PB. Suspending the processing of transactions Collateral release request: amount to be released – delta. Calculating new collateral amount (after release). Checking limits at PB level (if any) and the collateral amount. (a) collateral can be released Updating the Collateral Register, updating collateral for the PB (b) collateral cannot be released G.5 (a) Collateral release message. (b) Collateral release request rejection. Accepting new transactions

7. OTC Guarantee Fund KDPW_CCP Clearing Member End of day Calculating daily uncovered risk. Calculating final uncovered risk (ORN). Calculating the Guarantee Fund amount Calculating Clearing F.2 OTC Guarantee Fund update message. Members’ contributions to the OTC Guarantee Fund, revaluation of collateral deposited in securities, calculating final contributions (SA), calculating additional margins (DD). OTC additional margin F.3 update message. Netting of Clearing Member and payment agent credits and debits. Payment instructions.

8. Hypothetical Transaction Margin Requirement Request KDPW_CCP Clearing Member Transaction margin requirement request. W .1 Calculating the impact of the hypothetical transaction on collateral and limits Margin requirement, collateral amount, use of limits message. N.1 Message to the Clearing Member

9. Closing Positions (Auction) KDPW_CCP Clearing Members Starting an auction Generating portfolios SWI Starting an auction A.1 Preparing for an auction Auction Identification and distribution of auction portfolios, internal A.2 hedges. A.3 Preparing quotes Receipt of quotes A.4 Formal check Receipt of error message Awaiting all quotes or time-out A.5 Time-out message Aggregating offers Setting the auction price Assigning portfolios to auction winner participants Ending the auction A.6 Receipt of winning/ losing confirmation Transaction conclusion confirmation N.1 Transaction conclusion Auction status confirmation

10. Closing Positions On Demand Clearing Member KDPW_CCP Banks – Termination Participants Checking the impact of termination Position closing request on the collateral limit of the T.1 Clearing Member (initiator). Transaction ID matching. Manual set-up of auction start time. T.2 Manual process Receipt of KDPW_CCP decision to start the Starting an auction from “Identification and distribution of auction portfolios” termination process to “Awaiting all quotes or time-out” using SWI See point 1 (auction) Starting an auction from “Aggregating offers” to “Setting the auction price” using SWI – see point 1 (auction) Impact of termination on the collateral limit of the Clearing Member participating in termination T.3 Auction result acceptance/rejection T.4 Starting an auction from “Assigning portfolios to auction winning participants” to “Auction status” using SWI See point 1 (auction)

11. Clearing at the End of Day KDPW_CCP Clearing Member Start:17:00 End of day Blocking new operations Incoming transactions get the status QUEUED Calculating margin requirements at two levels: PB level: IM, VM, SA, coupons, PAI, PA level: IM E.1 Receipt of end-of-day messages with current margin requirements. Cancelling opposite transactions. E.3 Receipt of cancelled transaction messages. Start:~18:00 Revaluation of collateral deposited in securities E.2 Receipt of end-of-day messages: Netting of clearing current margin member and payment requirements, cash agents credits and debits settlement and the collateral amount. Payment instructions (to MOROP).

12. Cash Settlement at the End of Day KDPW_CCP Clearing Members Cash settlement (MOROP) End of day Calculating IM, VM, SA, coupons, PAI for each PB. E.1 Receipt of end-of-day message with margin Recognition of collateral requirements and marking-to- in securiting, End of market calculating current clearing margin amounts. day Netting of credits and E.2 process debits. Cash settlement Updating the Collateral Register after payment. Morning settle- ment session Authorisation to accept a new transaction from the platform

13. Charging Fees KDPW_CCP Clearing Member Calculating fees post Printing invoices Receipt of an invoice

14. Clearing and Settlement of Repo Transactions KDPW_CCP Bondspot CM Sending an order Concluding a transaction Accepting a transaction N.1 Transaction acceptance message Preparing the settlement of the first or second leg of the transaction (DvP and payment instruction – MtM) R.3 Sent instruction message Preparing a message with balances on the next day R.2 for enrichment Calculated settlement amount message Instruction enrichment, if any R.3 Enrichment message Correct settlement R.3, R.4 Successful settlement message Reduction of the collateral requirement.

Table of Changes Document Version Changes 1.0 Source document 1.1 Adding detailed information to Figure 4

Recommend

More recommend