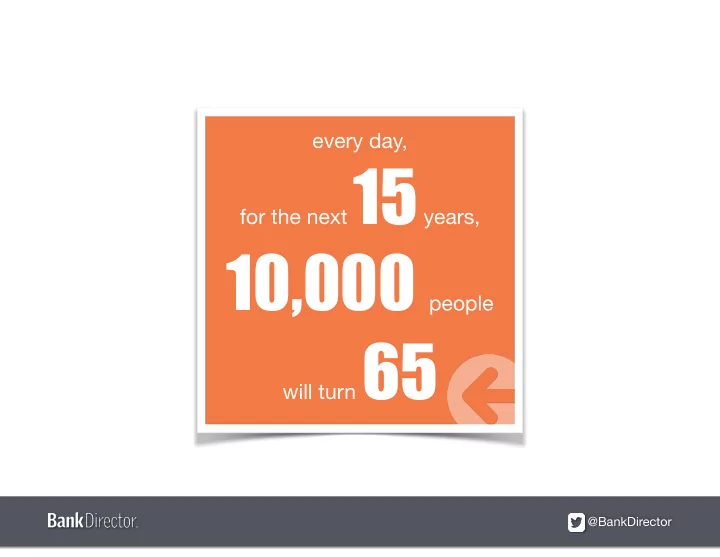

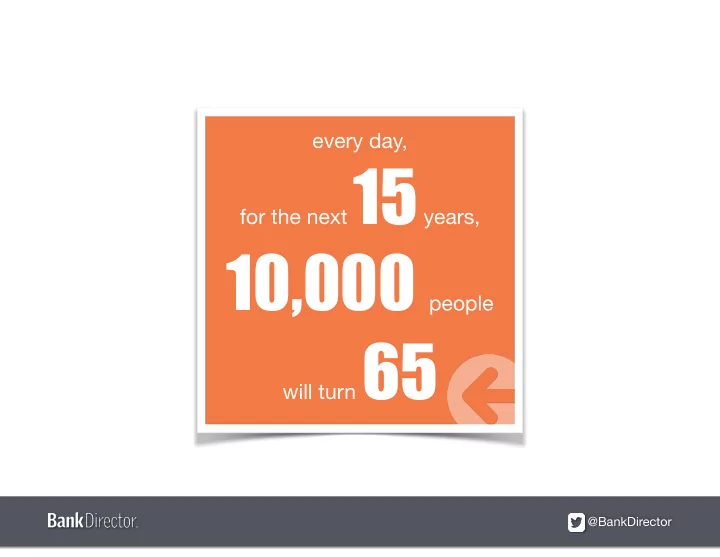

every day, for the next 15 years, 10,000 people will turn 65 @BankDirector

when it comes to recruiting & retaining younger people, banks have a bit of a public relations problem @BankDirector

Don’t Worry The NFL has the same Problem @BankDirector

Generational Characteristics Currently low income due to age, with growing market power Hold unprecedented levels of student loan debt More likely to be unemployed or under-employed Moving through important life stages Digital natives Passionate about civic responsibility Consume services and associate with brands di ff erently Distrustful of banks @BankDirector

THE TALENT ISSUE THE TALENT ISSUE M I L L E N N / R E C R U I T I N G / The Talent Issue I A L S June 2015 via BankDirector.com (click to download) BY K AREN EPPER HOFFMAN THE BANKING INDUSTRY NEEDS TO IMPROVE ITS REPUTATION WITH TODAY’S 20-SOMETHINGS AND EARLY 30-SOMETHINGS. @BankDirector

60 % … of bank CEOs & directors responding to Bank Director’s 2015 Growth Strategy Survey indicate that their bank may not be ready to serve millennials, which THIS YEAR surpassed baby boomers as the largest segment of the population. @BankDirector

Part One Interests & Aspirations Part Two Trends & Opportunities Part Three Friends & Foes Banking on Millennials Presented by Al Dominick , President, Bank Director & Kelsey Weaver , Publisher, Bank Director @BankDirector

Can It Be This Simple* *Today, there are approximately 75 million people in the U.S. under 34 @BankDirector

"The winners will be the ones that become a technology business and not remain as an old school banking company …it is a wrenching change." — Rob Alexander, Capital One’s CFO @BankDirector

People like convenience & expediency and that is almost antithetical to conventional banking @BankDirector

Bank Audit & Risk Committees Peer Exchanges and Primer BANK AUDIT & RISK June 13, 2016 COMMITTEES CONFERENCE Bank Audit & Risk Committees Peer Exchanges and Primer June 14-15, 2016 Insight on Oversight Chicago | Swissôtel Major Topics Addressed + Audit & Risk Committees’ Role and Responsibilities + Changing Regulatory Environment 2015 | YEAR IN REVIEW 169 + Risk vs the Audit Function Financial Institutions + Top Accounting Issues for Banks Represented Public vs Private Bank Asset Breakdown Regional Location About The 2015 Attendees Privately $250M-$1B 263 $1B + 5 % Held Publicly CEO/Pres 46% 46% Held 59% 5 % Northeast West Chairman Central 27 % 41% 9 % 54 % 4 % Financial CFO 8% Southeast Executives 10 % 70 % and Board Director Members in Senior Bank $250M and below Attendance 16 % Executive To receive an attendee list, please contact Kelsey Weaver . 2016 | BANK DIRECTOR @BankDirector

The relationships that community bankers nurtured for decades will be increasingly of less value with the technologically sophisticated younger generation of entrepreneurs who have grown up in a digital world and value the speed with which it operates. @BankDirector

Income growth is expected to improve in the future, causing positive momentum on the consumer side. How a bank responds to these trends is important: a proactive or reactive decision could make a big di ff erence. Doug Duncan, Chief Economist June’s Bank Audit & Risk Committees Conference @BankDirector

Instead of millennials, banks have been finding most of their growth in loans to businesses and in commercial real estate. @BankDirector

“ The lack of home-buying activity from millennials thus far is decidedly not because this generation isn’t interested in homeownership, but instead because younger Americans have been delaying getting married and having children , two key drivers in the decision to buy that first home.” Doug Duncan, Chief Economist June’s Bank Audit & Risk Committees Conference @BankDirector

RBC “romantic” videos @BankDirector

Young adults aren't buying things like homes and cars because they have lower-paying jobs & heavy student debt , not because they don't value possessions. @BankDirector

Key Findings 2015 Growth Survey @BankDirector

@BankDirector

@BankDirector

@BankDirector

should you (and can you) design your products and services with this information in mind? *While this line of thinking is seductive, we think it is misguided. Millennials, like all generational cohorts, have as much that divides as unites. Treating them as a homogenous entity is likely to fail—or worse—backfire. @BankDirector

Improving Financial Health? a BIG Opportunity Financial service providers have an opportunity to design products and services that help households plan & save for the future. For consumers who currently save as part of a group, a savings tool that has social or community features may be e ff ective. For individuals who say they would plan ahead if they could, a simulation tool that shows various time frames, payments options and incentives for reaching a savings goal might help consumers envision what is possible and adopt the behaviors necessary to reach their goals. By leveraging learnings from behavioral economics , such as well-designed nudges, defaults and prompts, financial services providers can design products that help consumers save automatically, plan ahead and reach their goals. @BankDirector

The promise of Fintech: Cheaper / Faster / Clearer Lending, Payments, Personal Finance, Money Transfers and Digital Currencies @BankDirector

We assume you know these well-known Disruptors @BankDirector

A Chinese based peer-to-peer lender founded in 2011 and headquartered in Shanghai, it is one of the largest peer-to-peer lender in China. Value: $10 billion. A U.S. based company founded in 2009, Square specializes in small business loans and online payments. Headquartered in San Francisco, it originally focused on smartphone card readers. Value: $6 billion. A U.K. based financial information and data provider founded in 2003, the London based company started as credit derivative pricing platform. Value: $5.1 billion. @BankDirector

An increasing number of new fintech start-ups* are attacking the core functions of payments, lending, investing, money transfer & advising. *Services such as Lending Club , Funding Circle , Nutmeg , Transfer Wise and Venmo are only the largest (and most successful) of the new entrants. @BankDirector

@BankDirector

Small Business Lending Not-so-friendly Friendly @BankDirector

Consumer Lending Not-so-friendly Friendly @BankDirector

Consumer Tools Not-so-friendly Friendly @BankDirector

Personal Finance Management Not-so-friendly Friendly @BankDirector

Robo-Advisors Not-so-friendly Friendly @BankDirector

@BankDirector

Contact Info BankDirector.com Kelsey Weaver Al Dominick Publisher President kweaver@bankdirector.com adominick@bankdirector.com @aldominick @bankdirectorpub @BankDirector

Recommend

More recommend