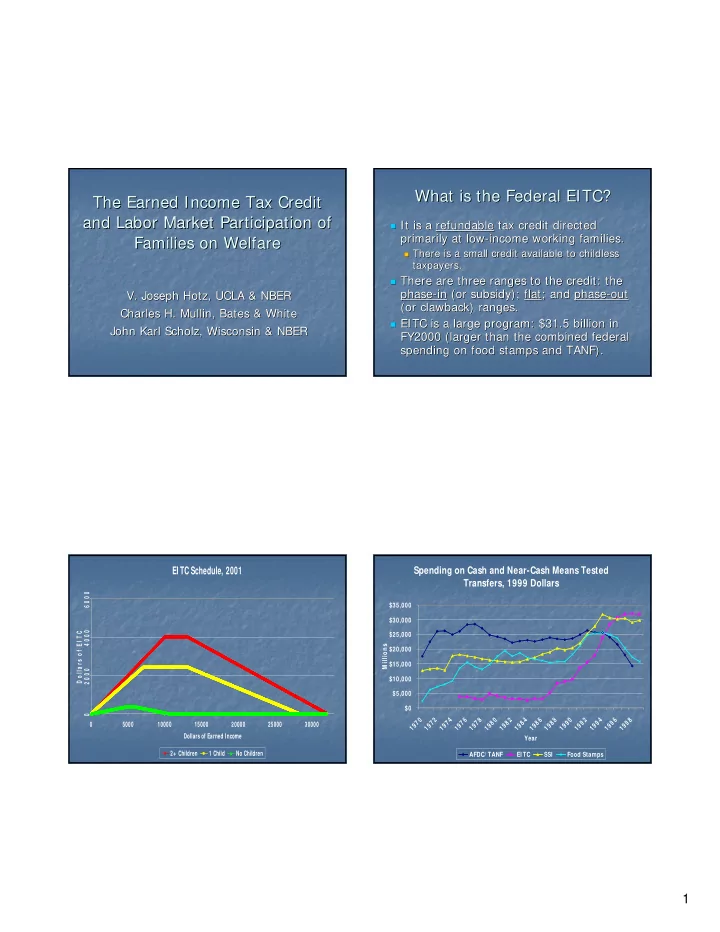

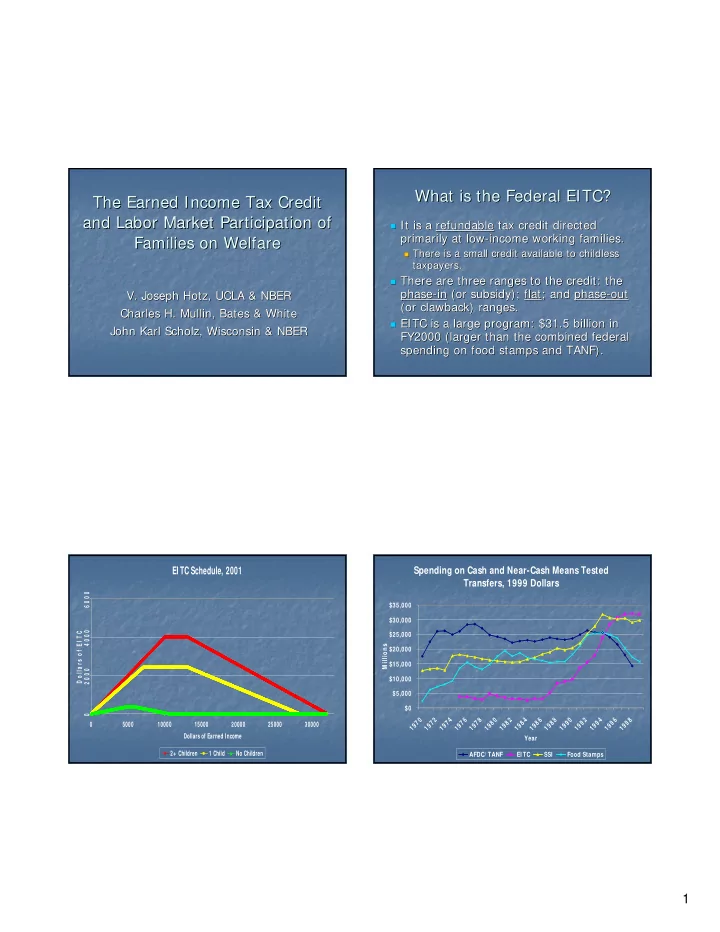

What is the Federal EITC? What is the Federal EITC? The Earned Income Tax Credit The Earned Income Tax Credit and Labor Market Participation of and Labor Market Participation of � It is a It is a refundable refundable tax credit directed tax credit directed � primarily at low- primarily at low -income working families. income working families. Families on Welfare Families on Welfare � There is a small credit available to childless There is a small credit available to childless � taxpayers. taxpayers. � There are three ranges to the credit: the There are three ranges to the credit: the � phase- -in in (or subsidy); (or subsidy); flat flat; and ; and phase phase- -out out phase V. Joseph Hotz, UCLA & NBER V. Joseph Hotz, UCLA & NBER (or clawback) ranges. (or clawback) ranges. Charles H. Mullin, Bates & White Charles H. Mullin, Bates & White � EITC is a large program: $31.5 billion in EITC is a large program: $31.5 billion in � John Karl Scholz, Wisconsin & NBER John Karl Scholz, Wisconsin & NBER FY2000 (larger than the combined federal FY2000 (larger than the combined federal spending on food stamps and TANF). spending on food stamps and TANF). EI TC Schedule, 2001 Spending on Cash and Near-Cash Means Tested Transfers, 1999 Dollars 6 0 0 0 $35,000 $30,000 4 0 0 0 D o l l a r s o f E I T C $25,000 M illions $20,000 $15,000 2 0 0 0 $10,000 $5,000 $0 0 0 2 4 6 8 0 2 4 6 8 0 2 4 6 8 7 7 7 7 7 8 8 8 8 8 9 9 9 9 9 0 5000 10000 15000 20000 25000 30000 9 9 9 9 9 9 9 9 9 9 9 9 9 9 9 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Dollars of Earned Income Year 2+ Children 1 Child No Children AFDC/ TANF EI TC SSI Food Stamps 1

Previous Work on Relationship Previous Work on Relationship Coincident Trends: Are They Coincident Trends: Are They between EITC & Employment between EITC & Employment Related? Related? � Large number of published papers on this issue Large number of published papers on this issue � � Between 1990 and 1999 Between 1990 and 1999 � � Dickert, Houser, Scholz (1995, TPE); Keane & Moffitt (1998, IER) Dickert, Houser, Scholz (1995, TPE); Keane & Moffitt (1998, IER). . � � Real EITC spending increased from $9.6 billion to Real EITC spending increased from $9.6 billion to � � Eissa & Liebman (1996, QJE); Ellwood (2000, NTJ); Meyer & Eissa & Liebman (1996, QJE); Ellwood (2000, NTJ); Meyer & � $31.9 billion (in 1999 dollars). $31.9 billion (in 1999 dollars). Rosenbaum (2000 NTJ; 2001 QJE); Grogger (2003, ReStat) Rosenbaum (2000 NTJ; 2001 QJE); Grogger (2003, ReStat) � Between 3/1990 and 3/2000 Between 3/1990 and 3/2000 � All find All find positive, large EITC effects on employment. EITC effects on employment. � � � Employment rates of single women with children rose Employment rates of single women with children rose � � Employment elasticities with respect to net income of 0.69 to 1. Employment elasticities with respect to net income of 0.69 to 1.16. 16. � to 73.9% from 55.2% . to 73.9% from 55.2% . � (See Hotz & Scholz, 2003 for survey of these results.) (See Hotz & Scholz, 2003 for survey of these results.) � � Welfare caseloads fell to 2.3 million from 4.1 million Welfare caseloads fell to 2.3 million from 4.1 million � � Hoynes and Eissa (2004, JPubE) find negative EITC employment eff � Hoynes and Eissa (2004, JPubE) find negative EITC employment effects ects for secondary workers in 2 for secondary workers in 2- -parent families. parent families. (though caseloads rose until 1994, peaking at 5.0 (though caseloads rose until 1994, peaking at 5.0 million families). million families). � All but first two papers use “Diff All but first two papers use “Diff- -in in- -Diff” approach. Diff” approach. � � Standard static labor supply model: Standard static labor supply model: � � Use episodic “expansions” in EITC and compare changes between Use episodic “expansions” in EITC and compare changes between � � Expansions of a wage subsidy like EITC should groups who were “eligible” and “not eligible” for EITC (e.g., single groups who were “eligible” and “not eligible” for EITC (e.g., si ngle increase employment of low-skilled workers. mothers vs. single women). mothers vs. single women). Given All the Previous Work, Why Given All the Previous Work, Why F Fr ra ac ct ti io on n Fr ra ac ct ti io on n F Another EITC Employment Study? Another EITC Employment Study? Fr ra ac ct ti io on n Fr ra ac ct ti io on n Fr ra ac ct ti io on n Fr ra ac ct ti io on n of f of f F F F F o o o of f C Ca as se es s of o f C Ca as se es s o of f C Ca as se es s o of f C Ca as se es s Nu N um mb be er r H Hs se eh hl ld ds s Ch C hi il ld dr re en n Other trends � Other trends th t ha at t a ar re e t th ha at t a ar re e th t ha at t a ar re e th t ha at t a ar re e o of f K Ki id ds s i in n wi w it th h 2 2+ + Le L es ss s t th ha an n � Hard to account for with repeated, cross- -sectional data sectional data Ye Y ea ar r Wh W hi it te e B Bl la ac ck k Hi H is sp pa an ni ic c As A si ia an n H Hs sh hl ld d. . K Ki id ds s Ag A ge e 6 6 � � Hard to account for with repeated, cross Welfare programs (AFDC/TANF, Food Stamps, Child Care Welfare programs (AFDC/TANF, Food Stamps, Child Care � � 19 1 99 91 1 0. 0 .4 46 6 0. 0 .2 23 3 0 0. .2 21 1 0. 0 .0 09 9 1 1. .9 92 2 0. 0 .5 55 5 0. 0 .4 44 4 subsidies) subsidies) 1 19 99 92 2 0 0. .4 47 7 0 0. .2 23 3 0. 0 .2 20 0 0 0. .0 08 8 1 1. .9 93 3 0. 0 .5 54 4 0 0. .4 47 7 Aggregate labor market conditions could be driving changes in Aggregate labor market conditions could be driving changes in � � 19 99 93 3 0. .4 45 5 0. .2 22 2 0. .2 23 3 0. .0 09 9 1. .9 91 1 0. .5 53 3 0. .4 49 9 1 0 0 0 0 1 0 0 employment rates. employment rates. Use of “Second Diff” in “Diff- Use of “Second Diff” in “Diff -in in- -Diff” strategy requires Diff” strategy requires 19 1 99 94 4 0 0. .4 43 3 0. 0 .2 21 1 0. 0 .2 28 8 0 0. .0 07 7 1 1. .8 89 9 0 0. .5 54 4 0 0. .4 47 7 � � composition of “comparison group” doesn’t change composition of “comparison group” doesn’t change 19 1 99 95 5 0 0. .4 42 2 0 0. .2 20 0 0 0. .3 30 0 0 0. .0 08 8 1 1. .8 85 5 0. 0 .5 53 3 0 0. .4 46 6 over time. over time. 19 99 96 6 0. .4 41 1 0. .2 20 0 0. .3 30 0 0. .0 07 7 1. .8 85 5 0. .5 52 2 0. .4 48 8 1 0 0 0 0 1 0 0 Previous studies use Repeated Cross Repeated Cross- -Sectional Sectional data data – – typically typically � � Previous studies use 1 19 99 97 7 0. 0 .3 39 9 0 0. .2 21 1 0. 0 .3 31 1 0 0. .0 07 7 1 1. .8 84 4 0. 0 .5 51 1 0. 0 .4 48 8 from CPS – from CPS – in Diff in Diff- -in in- -Diff analyses. Diff analyses. 19 1 99 98 8 0. 0 .3 37 7 0. 0 .2 22 2 0 0. .3 33 3 0 0. .0 07 7 1. 1 .8 84 4 0 0. .5 51 1 0 0. .4 48 8 Population we analyze – – single mothers on welfare in single mothers on welfare in � Population we analyze � 19 99 99 9 0. .3 36 6 0. .2 24 4 0. .3 33 3 0. .0 06 6 1. .8 86 6 0. .5 51 1 0. .4 47 7 1 0 0 0 0 1 0 0 California during 1990s California during 1990s – – 2 20 00 00 0 0 0. .3 30 0 0. 0 .2 26 6 0. 0 .3 35 5 0. 0 .0 07 7 1 1. .8 87 7 0 0. .5 51 1 0 0. .4 49 9 � � Sizeable changes in racial composition, family structure and other Sizeable changes in racial composition, family structure and oth er characteristics. characteristics. % % C Ch hg ge e. ., , 1 19 99 91 1- - We have new data and a new approach that (we We have new data and a new approach that (we 2 20 00 00 0 -3 - 35 5. .3 3% % 17 1 7. .2 2% % 69 6 9. .1 1% % - -1 18 8. .1 1% % - -2 2. .9 9% % -6 - 6. .6 6% % 11 1 1. .5 5% % � � argue) provides more reliable evidence on the EITC’s argue) provides more reliable evidence on the EITC’s employment effects. employment effects. 2

Recommend

More recommend