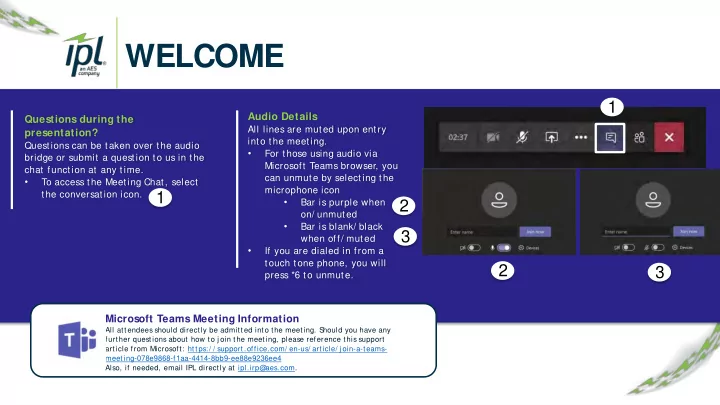

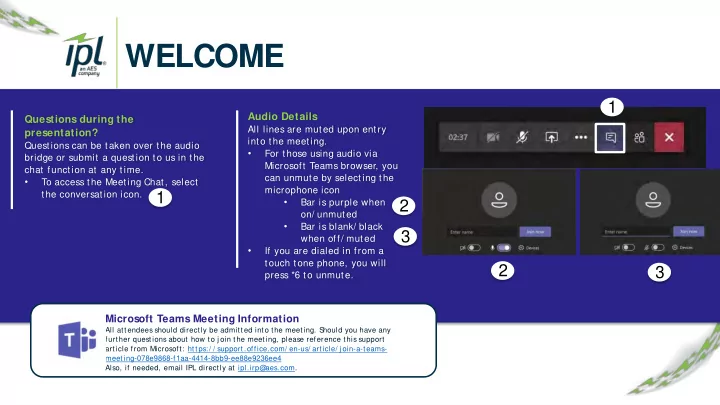

WELCOME 1 Audio Details Questions during the All lines are muted upon entry presentation? into the meeting. Questions can be taken over the audio • For those using audio via bridge or submit a question to us in the Microsoft Teams browser, you chat function at any time. can unmute by selecting the • To access the Meeting Chat, select microphone icon the conversation icon. 1 • Bar is purple when 2 on/ unmuted • Bar is blank/ black 3 when off/ muted • If you are dialed in from a touch tone phone, you will 2 3 press *6 to unmute. Microsoft Teams Meeting Information All attendees should directly be admitted into the meeting. S hould you have any further questions about how to j oin the meeting, please reference this support article from Microsoft: https:/ / support.office.com/ en-us/ article/ j oin-a-teams- meeting-078e9868-f1aa-4414-8bb9-ee88e9236ee4 Also, if needed, email IPL directly at ipl.irp@ aes.com.

INDIANAPOLIS POWER & LIGHT COMP ANY IPL 2019 IRP: PUBLIC ADVISORY MEETING #5 DECEMBER 9, 2019

INTRODUCTIONS & SAFETY MESSAGE Shelby Houston Regulat ory Analyst , IPL 3

MEETING OBJECTIVES & AGENDA S tewart Ramsey Meet ing Facilit at or, Vanry & Associat es 2019 IRP S takeholder Meeting 12.9.19 4

AGENDA Topic Time (Eastern) Presenter(s) Registration & Breakfast 9:00 – 9:30 - Introductions & Safety Message 9:30 – 9:40 Shelby Houston, Regulatory Analyst, IPL Stewart Ramsay, Meeting Facilitator, Meeting Objectives & Agenda 9:40 – 9:50 Vanry & Associates Executive Summary of Preferred Resource Plan 9:50 – 10:20 Vince Parisi, President and CEO, IPL 2019 IRP: Modeling Insights 10:20 – 10:50 Patrick Maguire, Director of Resource Planning, IPL BREAK 10:50 – 11:00 Analysis of Alternatives: 2019 IRP Modeling 11:00 – 12:00 Patrick Maguire, Director of Resource Planning, IPL LUNCH 12:00 – 12:45 Sensitivity Analysis 12:45 – 1:15 Patrick Maguire, Director of Resource Planning, IPL Preferred Resource Portfolio 1:15 – 1:30 Patrick Maguire, Director of Resource Planning, IPL & Short Term Action Plan Vince Parisi, President and CEO, IPL Stewart Ramsay, Meeting Facilitator, Vanry & Concluding Remarks 1:30 – 2:00 Associates 2019 IRP S takeholder Meeting 12.9.19 5

EXECUTIVE SUMMARY OF SHORT TERM ACTION PLAN Vince Parisi, President and CEO, IPL 2019 IRP S takeholder Meeting 12.9.19 6

IPL 2019 IRP INTEGRATED RESOURCE PLAN (IRP): What is a preferred resource IPL's plan to provide safe, reliable, and portfolio? sustainable energy solutions for the “ ‘Preferred resource portfolio’ communities we serve means the utility's selected long term supply-side and demand-side • IRP submitted every three years resource mix that safely, reliably, • Plan created with stakeholder input efficiently, and cost-effectively • meets the electric system demand, 20-year look at how IPL will serve load taking cost, risk, and uncertainty into • Modeling and analysis culminates in a consideration.” preferred resource portfolio 170 IAC 4-7-1(cc) 2019 IRP S takeholder Meeting 12.9.19 7

2019 IRP STAKEHOLDER PROCESS January 29 th March 13 th May 14 th September 30 th December 9 th • 2016 IRP Recap • S • S • S • Final Model Results takeholder ummary of ummary of • 2019 IRP Timeline, Presentations S takeholder Feedback S takeholder Feedback • Full set of portfolio • Commodity • Present Final • Preliminary Model Obj ectives, metrics and scoring S takeholder Process Assumptions S cenarios Results criteria • Capacity Discussion • Capital Cost • Modeling Update • S • Preferred Plan cenario Descriptions • IPL Existing Resources • Assumptions Review • S Assumptions and Results hort Term Action • IPL-Proposed S • Portfolio metrics and and Preliminary Load cenario and Updates Plan Forecast Framework scoring • Introduction to • S cenario Workshop • MPS Ascend Analytics Update and Plan • S upply-S ide Resource Types • DS M/ Load Forecast S chedule IPL set out to conduct a robust and collaborative stakeholder process. Multiple communication avenues were provided to ensure that all viewpoints and suggestions were heard from stakeholders wanting to participate in the 2019 IRP process. 8

IPL PORTFOLIO DIVERSIFICATION: 2009 - 2018 2009 2011 2013-2015 2016 2016 2018 S igned 100 S igned 200 S igned 96 Retired 260 Finalized Eagle Valley MW PP A at MW PP A at MW PP A for MW of coal conversion 671 MW Hoosier Lakefield solar in at Eagle of 630 MW Gas-Fired Wind Park Wind Farm Indianapolis Valley of coal-fired Combined in NW in Minnesota through generation Cycle Plant Indiana Rate REP at Harding Completed S treet to natural gas 2019 IRP S takeholder Meeting 12.9.19 9

IPL PREFERRED PORTFOLIO & SHORT-TERM ACTION PLAN RETIRE REPLACE SAVE MONITOR Maintain cost- Retire 630 MW of Competitively bid Target ~130,000 effective units to coal generation by for approximately MWh per year of retain flexibility and 2023: 200 MW of firm new DS M as part continue to monitor • Pete 1: 2021 capacity with all- of the 2021-2023 market conditions • Pete 2: 2023 source RFP DS M Plan leading to our 2022 IRP 10

BENEFITS OF PREFERRED RESOURCE PORTFOLIO Customer Least Centricity Cost Focus on customer needs Considers current and and wants forecasted market economics IPL Preferred Portfolio: Areas of Focus Flexibility & Greener Energy Future Balance Moves the company to Measured approach more renewables maintaining optionality 2019 IRP S takeholder Meeting 12.9.19 11

CUSTOMER CENTRICITY Focus on cust omer needs and want s • IPL’ s Preferred Resource Portfolio delivers safe, reliable, and economic electricity to customers at j ust and reasonable rates • The preferred resource portfolio best serves IPL customers today and into the future, contemplates customers’ evolving energy needs, and relies on data - driven models 2019 IRP S takeholder Meeting 12.9.19 12

LEAST COST Minimizes t ot al port folio cost Reference Case Scenario A Scenario B Scenario C Scenario D Preferred Resource Portfolio is the lowest cost ←Higher Cost Lower Cost → portfolio across a wide range of futures, mitigating rate impact and allowing customers to take advantage of low cost renewables in the short term $6.6 $7.6 $7.2 $8.1 $7.7 $8.5 $6.4 $7.2 $7.3 $8.5 Preferred Portfolio Present Value Revenue Requirement ($Billion) 2019 IRP S takeholder Meeting 12.9.19 13

FLEXIBILITY & BALANCE Measured approach maint aining opt ionalit y 2019 IRP 2022 2025 2028 Preferred Portfolio provides lowest cost plan considering information known today IPL has built-in flexibility to change direction in future IRPs with new information Preferred portfolio contains embedded optionality with Petersburg Units 3 and 4 14

GREENER ENERGY FUTURE Moves t he company t o more renewables Forecast → Short-tons/MWh 1.06 1.05 1.06 1.04 1.05 1.05 1.08 1.04 1.05 0.89 0.85 0.81 0.80 0.77 0.80 0.80 0.80 0.81 0.82 0.82 Status Quo Portfolio 0.79 IPL Coal Capacity 0.69 Preferred 2014 2024 0.59 0.56 0.54 0.56 0.57 0.55 Portfolio 2,600 MW 1,000 MW 48% Decrease in carbon -60% intensity by 2024 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2019 IRP S takeholder Meeting 12.9.19 15

BENEFITS OF PREFERRED RESOURCE PORTFOLIO Customer Least Centricity Cost Focus on customer needs Considers current and and wants forecasted market economics IPL Preferred Portfolio: Areas of Focus Flexibility & Greener Energy Future Balance Moves the company to Measured approach more renewables maintaining optionality 2019 IRP S takeholder Meeting 12.9.19 16

2019 IRP: MODELING INSIGHTS Patrick Maguire Direct or of Resource Planning, IPL 2019 IRP S takeholder Meeting 12.9.19 17

HIGH IMPACT MARKET FORCES • S ignificant market changes over the past 10 years have impacted IPL’s existing resources • Opportunities and risk associated with alternative resources • Present Value Revenue Requirement (PVRR) is key cost metric that is impacted by relative economics of resource technologies o Look at underlying fundamentals key to understanding high impact variables on all of the candidate portfolios 2019 IRP S takeholder Meeting 12.9.19 18

COAL ECONOMICS (1 OF 3) Variable Fuel Cost: Coal vs. Gas, 1997 - 2018 Petersburg Natural Gas Combined Cycle $70 $60 Fuel Cost ($/MWh) $50 50-60% decrease in natural gas prices $40 $30 $20 ~130% increase in coal cost $10 from 2005 to 2012 $0 2019 IRP S takeholder Meeting 12.9.19 19

COAL ECONOMICS (2 OF 3) MISO Generation Supply Stack $300 MISO Min Load: MISO Avg Load: MISO Peak Load: ~50,000 MW ~75,000 MW ~120,000 MW $250 Variable Production Cost ($/MWh) $200 PRICE $150 Low natural gas prices 2014 flatten the supply curve, $100 and natural-gas units Wind additions shift displace coal in stack 2018 supply curve right and depress off-peak prices $50 $0 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 180,000 200,000 Cumulative Capacity (MW) Petersburg Units S ource Dat a: S &P Global QUANTITY 2019 IRP S takeholder Meeting 12.9.19 20

Recommend

More recommend