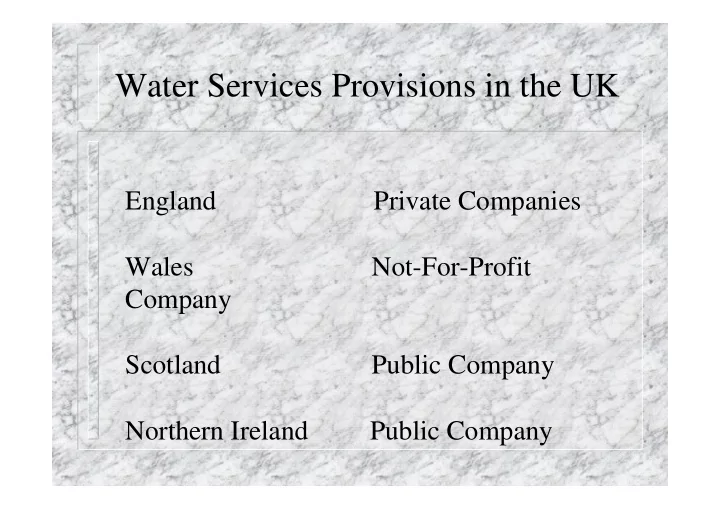

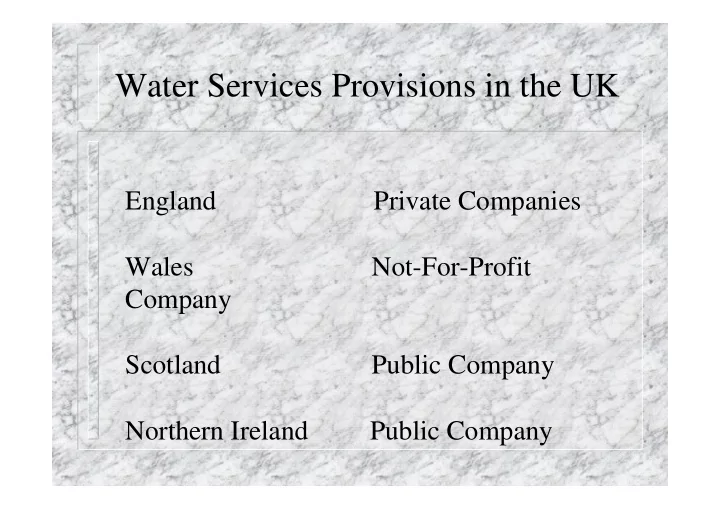

Water Services Provisions in the UK England Private Companies Wales Not-For-Profit Company Scotland Public Company Northern Ireland Public Company

Development of Water Services 1 1970 Statutory Water Companies 33 Local Authorities 64 Joint Boards 101 Total 198 1393 Sewerage Undertakers in 1970 29 River Authorities

Development of Water Services 2 � Water Act 1973 � 10 Regional Water Authorities � Provider and Regulator � Cost recovery � Capital from Borrowings from Central Government � Separate Bills for Water Services � 50% of Board Members Local Authorities

Development of Water Services 3 � Water Act 1983 � Reduction in Role of Local Authorities � Chief Executives from Private Sector � Operation More Like Private Companies � Could Raise Capital from Open Market not Widely Used

Development of Water Services 4 � Regional Water Authorities Limited Success � Regulatory Functions (DSS) Weak compared to Operations � Approximately 20% of Staff Regulatory and 80% Operation � Government Finances Under Strain

Development of Water Services 6 � Water Act 1989 � Privatisation of the Water Services � Formation of the National Rivers Authority which in 1995 became the Environment Agency � Creation of Ofwat � Creation of Drinking Water Inspectorate

Reasons for Privatisation •Government Policy at the Time •Large Investment Requirements (DWD, Bathing Water Directive, proposed UWWTD) •Freedom from Government Borrowing (under strain at the time) •Chief Executives from Private Sector •Independence from Government

To Make the Companies Attractive for Privatisation � £5 Billion Debt Written Off � £1.5 Billion Subsidy for Urgent Improvements In turn � £5.225 Billion Raised from Investors � £1.673 Billion Withdrawn by Labour Government in 1997 - Windfall Tax

Structure of Water Companies in 1989 Water Holding Company Thames Plc Regulated Non-Regulated Water Services Company Other Subsidiaries Thames Water Ltd e.g Plumbing Services

Ownership of Water Services Companies � Taken over by Electricity Supplier - Southern Water � Taken over by Private Company - Yorkshire Water by Kelda Plc � Several Private Companies -Wessex by Enron and Malaysian Company � Taken over by Private Company -Re-floated on Stock Exchange - Northumbrian Water

Example of Current Water Company Structure Various EU,CN,AU Funds Various Macquaire Funds 47.65% 52.35% Kemble Water Holding Ltd 100% Intermediate Holding Comp 100% Thames Water Holding 100% Thames Water PLC 100% Thames Water Services 100%

Changes to Welsh Water � Take over by Western Power USA � Sold to Glas Cymru - Not-For Profit Company Financed by Bond Issue � Operated as if Registered on Stock Exchange but no Dividend/Profits � Customers not Liable for Losses � Operations - North West � Customer Services - Thames water

Water-Only Companies � Numbers Reduced from 29 to 11 through Mergers � 3 Owned by French Company Veolia � 2 Owned by other Water Services Companies � Even if Owned by Other Companies the 11 Need to be Ring-Fenced from other Activities - Ofwat - Comparative Efficiency

New Companies � Ofwat Duty to Encourage Competition � Competition so far Restricted to Industrial Supplies >50ML/d � One Company has Applied to Provide the Water Services to a New Development. � If Approved Company would be Regulated by Ofwat as the Other Water Companies � Total 12 WSCs and 14 WoCs

Water Services System 1 � Mature System – 99% Connected to Water Supply – 98% Connected to Sewerage System � System is Quite Old – 50% of Sewers before 1944 – 25% of Sewers before 1918 � In London 1/2 of Water Mains >100 years and 1/3 >150 years

Water Services System 2 � High Leakage – 5112 ML/d (30%) in 1994/95 which has been Reduced to 3291ML/d in 2008/09, a 35 % reduction � Approximately a Third of Properties have Lead Supply and Communication Pipes � Lead Drinking Water Standard Complied with through Water Treatment

Water Services System 3 � Only 20% of Properties had Water Meters in 2000, this has Increased to 35% in 2009 � One Company Applied for Water Scarcity Status - Compulsory Installation of Meters - 64% of Properties Currently Metered � Highest Meter Penetration - 69% Tendring Hundred Water Company � Lowest Northumbrian Water -23%

Provision of Sewerage Services 1997 2008 Population connected 96 98 to sewer % Primary or less Treatment % 19 0.1 Secondary Treatment % 61 54.4 Tertiary Treatment % 18 44.9 Other 2 0.6

Regulatory System in E+W � Environment � Water Resources Agency (EA) � Permitting+Enforcement � Office of Water � Economic Regulations of Services (Ofwat) Water Companies � Level of Service � Consumer Interests � Drinking Water � Auditing of Companies Inspectorate (DWI) in Meeting Drinking Water Regulations

Setting of Price Limits 1 � Ofwat to Balance between Quality Improvements and Affordability � EA and DWI Lay down Quality Improvements Required and Desired � Ofwat Considers Impact on Water Prices � In Case of Conflict Defra Gives Advice � Based on Outcome Water Companies have to Prepare Business Plans

Setting of Price Limits 2 � Business Plans Contain Information on the Investment needs and Operating Costs to Meet Quality Improvements � Ofwat Uses the Business Plans, which have to be Prepared every 5 Years, to Assess Investment Needs, Operating Costs and Efficiency Improvements Based on the Annual “July Returns” of the Companies � This is called “Yard Stick” Regulation

Setting of Price Limits 3 � Ofwat Publishes Draft Determinations of the Price Limits � Water Companies Prepare Responses � Ofwat Issues Final Determinations � Right of Companies to Refer the Price Limits to Competition Commission � Final Price Limits

Setting of Price Limits 4 � Prices are based on the Performance of the Best Group of Companies for Investment and Operating Costs � Price Limits Include a Maintenance Allowance for Underground Assets � Depreciation for above Ground Assets

Setting of Price Limits 5 � Price Limits are Set for a Basket of Charges - Metered and Un-metered Water and Sewage and Trade Effluent � Price limit P (%) for each company P = RPI +K RPI = Retail Price Index K = Price increase above RPI

Drivers For Change In Prices 2004/05 to 2009/10 Average Household Bill 2004/05 £249 Past and Future Efficiency Savings -£3/-£13 Maintaining Basic Services £18 Maintaining Security Of Supply £11 Improvement Drinking Water, £33 Environment, Service Performance Average Household Bill in 2009/10 £295 Change 2004-05 to 2009-10 £46

Drivers For Change in Bills 2004/05 to 2009/10 Maintaining Basic Services £18 • -£6 Changes in Revenue • £10 Changes in Operating Costs • £7 Changes in Capital Maintenance • £5 Changes in Impact of Taxation • 2 Financing

Annual Price Limit K % 05/06 06/07 07/08 08/09 09/10 Ave WSC 9.4 4.0 3.4 2.7 2.2 4.3 * WoC 12.4 1.9 1.5 0.4 -0.3 3.1 * Indus 9.6 3.6 3.2 2.5 2.0 4.2 try * * Weighted Average, Ave equal Geometric Average

Setting of Price Limits 6 � Price Limits Tend to be Highest in First Year to Take into Account Any Unforeseen Price Increases during the previous Five Year Period � Interim Determinations can be Made if there are Significant Changes i.e. If Companies have to Install more Water Meters than Predicted

Final Price Limits vs Business Plans for 2004/05-2009/10 Price 05/06 06/07 07/08 08/09 09/10 AVE Limits BP 13.4 7.1 4.6 3.4 2.9 6.2 FD 9.6 3.9 3.2 2.5 2.0 4.2 BP – Industry Business Plans, FD – Final Determination by Ofwat

Water Prices in E+W 350 300 250 200 150 100 50 0 0 1 3 4 5 6 7 8 9 0 1 . . . . . . . 2 3 4 5 6 7 8 9 9 9 9 9 9 9 9 9 0 0 0 0 0 0 0 0 0 / / / / / / / / / / / 9 0 2 3 4 5 6 7 8 9 0 / / / / / / / 1 2 3 4 5 6 7 8 9 9 9 9 9 9 9 9 9 0 0 0 0 0 0 0 0

Water Price Development � Water Prices Increased in Real Terms since 1989 by 42% equal to 1.8% per year � 35% Households with Water Meters � Rateable Value of the Property Used to charge for Non-metered Services � Metered Charge - Standing and Volumetric Charge

Water and Sewerage Charges in 2009-10 (£) Metered Un- Metered Un- Sewage metered Water metered Sewage Water Lowest 104 123 102 131 Northum Thames Thames Southern 280 Highest 225 417 171 South W South W South W South W Lowest WoC Portsmouth £89/93

Investments � Since 1989 the Industry Invested £85 billion Capital for New and the Maintenance of Existing Assets � The debts of the Companies Increased from near Zero to £35 Billion moderating the Increase in Prices � Gearing of the Companies Increased from near Zero in 1989 to 71% in 2008/09.

Water Mains Improvements 1999/00 to 2008/09 Water Mains Total % Relined (Km) 16 361 338051 4.8 Replaced (km) 28 245 8.2 Total Improved (km) 44 606 13 Communication 1.4 24 6 Pipes Replaced (million)

Recommend

More recommend