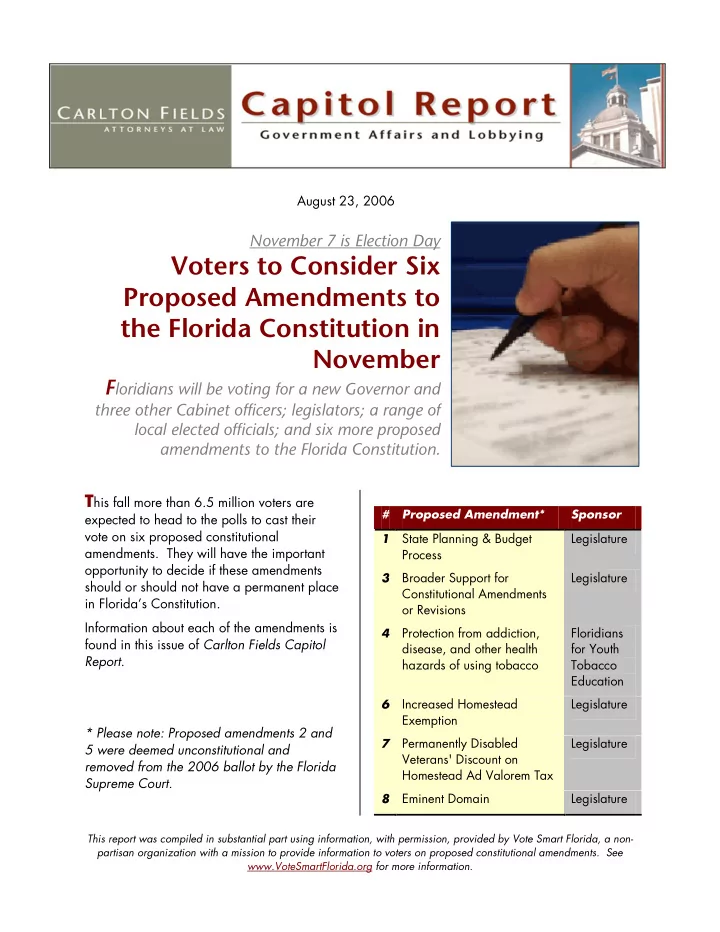

August 23, 2006 November 7 is Election Day Voters to Consider Six Proposed Amendments to the Florida Constitution in November F loridians will be voting for a new Governor and three other Cabinet officers; legislators; a range of local elected officials; and six more proposed amendments to the Florida Constitution. T his fall more than 6.5 million voters are # Proposed Amendment* Sponsor expected to head to the polls to cast their vote on six proposed constitutional 1 State Planning & Budget Legislature amendments. They will have the important Process opportunity to decide if these amendments 3 Broader Support for Legislature should or should not have a permanent place Constitutional Amendments in Florida’s Constitution. or Revisions Information about each of the amendments is 4 Protection from addiction, Floridians found in this issue of Carlton Fields Capitol disease, and other health for Youth Report . hazards of using tobacco Tobacco Education 6 Increased Homestead Legislature Exemption * Please note: Proposed amendments 2 and 7 Permanently Disabled Legislature 5 were deemed unconstitutional and Veterans' Discount on removed from the 2006 ballot by the Florida Homestead Ad Valorem Tax Supreme Court. 8 Eminent Domain Legislature This report was compiled in substantial part using information, with permission, provided by Vote Smart Florida, a non- partisan organization with a mission to provide information to voters on proposed constitutional amendments. See www.VoteSmartFlorida.org for more information.

C ARLTON F IELDS C APITOL R EPORT A UGUST 23, 2006 A MENDMENT #1: B ALLOT S UMMARY A MENDMENT #3: B ALLOT S UMMARY State Planning and Budget Process Requiring Broader Public Support for Constitutional Amendments or Revisions Proposing amendments to the State Proposes an amendment to Section 5 of Constitution to limit the amount of Article XI of the State Constitution to require nonrecurring general revenue which may be that any proposed amendment to or revision appropriated for recurring purposes in any of the State Constitution, whether proposed fiscal year to 3 percent of the total general by the Legislature, by initiative, or by any revenue funds estimated to be available, other method, must be approved by at least unless otherwise approved by a three-fifths 60 percent of the voters of the state voting vote of the Legislature; to establish a Joint on the measure, rather than by a simple Legislative Budget Commission, which shall majority. This proposed amendment would issue long-range financial outlooks; to not change the current requirement that a provide for limited adjustments in the state proposed constitutional amendment imposing budget without the concurrence of the full a new state tax or fee be approved by at Legislature, as provided by general law; to least 2/3 of the voters of the state voting in reduce the number of times trust funds are the election in which such an amendment is automatically terminated; to require the considered. preparation and biennial revision of a long- range state planning document; and to Y ES V OTE : establish a Government Efficiency Task Force If approved by voters, Amendment #3 would and specify its duties. increase the number of votes needed to approve ballot initiatives from 50% +1 to Y ES V OTE : 60% +1 of those voting on the measure. If approved by voters, Amendment #1 would establish a long-range budget-planning N O V OTE : process, putting both budget and revenue If Amendment #3 is not approved by voters, estimates together in one document. It would the current requirement of 50% +1 approval create a Government Efficiency Task Force would remain in place. (appointed every four years by the Governor, Senate President and Speaker of F ISCAL I MPACT : the House) to seek input from the public, There is not a direct financial impact on state executive and judicial branches and create a or local government. Amendment #3 does long-range financial plan. not have a direct economic impact on the private sector; future individual proposals N O V OTE : may or may not have an economic impact. If Amendment #1 is not approved by voters, the current laws as set by Section 19 of Article III of the State Constitution will remain i Download a “2006 Voter Guide to in place as originally proposed by the Proposed Constitutional Amendments” by Taxation and Budget Reform Commission visiting www.VoteSmartFlorida.org, a non- and approved by the voters in 1992. profit, non-partisan organization with a F ISCAL I MPACT : mission to provide information to voters on There is not a direct financial impact on proposed constitutional amendments. taxpayers, state or local government. 2

C ARLTON F IELDS C APITOL R EPORT A UGUST 23, 2006 A MENDMENT #4: B ALLOT S UMMARY A MENDMENT #6: B ALLOT S UMMARY Protect People, Especially Youth, from Increased Homestead Exemption Addiction, Disease, and other Health Proposing amendment to the State Hazards of Using Tobacco Constitution to increase the maximum To protect people, especially youth, from additional homestead exemption for low- addiction, disease, and other health hazards income seniors from $25,000 to $50,000 of using tobacco, the Legislature shall use and to schedule the amendment to take effect some Tobacco Settlement money annually for January 1, 2007. a comprehensive statewide tobacco Y ES V OTE : education and prevention program using If approved by voters, Amendment #6 would Centers for Disease Control best practices. increase the maximum additional homestead Specifies some program components, exemption for low-income seniors* from emphasizing youth, requiring one-third of $25,000 to $50,000 effective January 1, total annual funding for advertising. Annual 2007. Therefore, a low-income senior could funding is 15% of 2005 Tobacco Settlement receive an exemption from property taxes as payments to Florida, adjusted annually for high as $75,000 inflation. Provides definitions. Effective immediately. N O V OTE : If Amendment #6 is not approved by voters, Y ES V OTE : homestead exemptions would remain as If approved by voters, Amendment #4 would currently listed in the constitution: require that 15% ($57 million) of the 2005 tobacco settlement payments to Florida • $25,000 homestead exemption to all would fund a statewide tobacco education owners of “homestead” properties. and prevention program. • Allows local governments the option of N O V OTE : offering an additional exemption to low- If Amendment #4 is not approved by voters, income seniors* of up to $25,000 Florida would continue to receive allocations (established in 1982). as set by the Legislature and approved by F ISCAL I MPACT : the Governor. Current allocations are set at There is not a direct financial impact on state 1% of the tobacco settlement money. government. If all counties were to fully implement the increased exemption and F ISCAL I MPACT : Education, prevention and enforcement costs millage rates remain the same, it could have will increase. The state will be required to an impact of negative $36 million to local appropriate approximately $57 million from revenues . Tobacco Settlement funds in 2007, which will be adjusted annually for inflation. Because the Tobacco Settlement funds are currently fully obligated, the requirement to spend these dollars on the specified programs will result in reductions to existing programs or the replacement of those dollars with $57 million of other state funds. 3

Recommend

More recommend