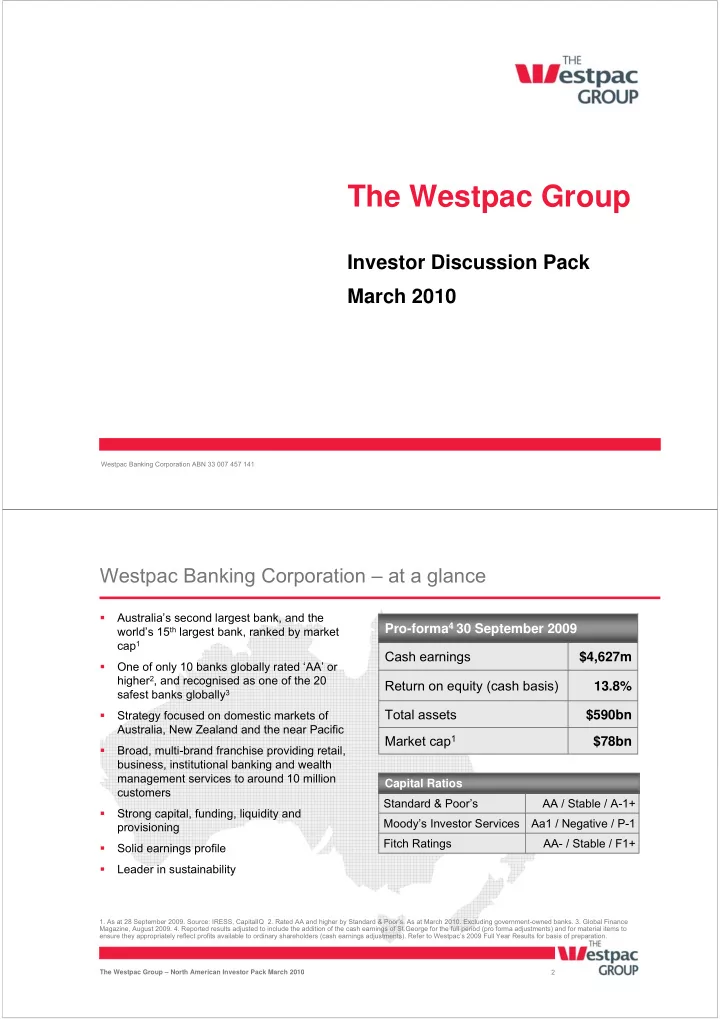

The Westpac Group Investor Discussion Pack March 2010 Westpac Banking Corporation ABN 33 007 457 141 Westpac Banking Corporation – at a glance � Australia’s second largest bank, and the world’s 15 th largest bank, ranked by market Pro-forma 4 30 September 2009 cap 1 Cash earnings $4,627m � One of only 10 banks globally rated ‘AA’ or higher 2 , and recognised as one of the 20 Return on equity (cash basis) 13.8% safest banks globally 3 Total assets � Strategy focused on domestic markets of $590bn Australia, New Zealand and the near Pacific Market cap 1 $78bn � Broad, multi-brand franchise providing retail, business, institutional banking and wealth management services to around 10 million Capital Ratios customers Standard & Poor’s AA / Stable / A-1+ � Strong capital, funding, liquidity and Moody’s Investor Services Aa1 / Negative / P-1 provisioning Fitch Ratings AA- / Stable / F1+ � Solid earnings profile � Leader in sustainability 1. As at 28 September 2009. Source: IRESS, CapitalIQ 2. Rated AA and higher by Standard & Poor’s. As at March 2010. Excluding government-owned banks. 3. Global Finance Magazine, August 2009. 4. Reported results adjusted to include the addition of the cash earnings of St.George for the full period (pro forma adjustments) and for material items to ensure they appropriately reflect profits available to ordinary shareholders (cash earnings adjustments). Refer to Westpac’s 2009 Full Year Results for basis of preparation. 2 The Westpac Group – North American Investor Pack March 2010

Australia well positioned during global downturn � Australia avoided recession and was one of few GDP growth: international comparison (%) countries to expand in 2009. GDP increased by Australia * 1.3% (year avg) and by 2.7% (through the year) year to US * Sep 2009 � Unemployment is low by global standards and at NZ * yr to Dec '09 5.3% in January is down from a high of 5.8% in 2009 Canada UK * � Policy stimulus played a key supportive role: Euro zone Germany − Variable mortgage rates fell to a 41 year low. Japan The RBA is in the process of lifting rates Ireland towards average levels given positive conditions -8 -6 -4 -2 0 2 4 − Fiscal stimulus has been timely, targeted and Sources: Treasury budget papers effective − 2008/09 stimulus represented 2.3% of GDP Unemployment rate (%) (focus on cash payments). Stimulus in 2009/10 12 12 also 2.3% of GDP (focus on building schools) 10 10 Eur o Ar e a � Government debt remains low and manageable - Aust r a li a 8 8 Federal government had no net debt prior to crisis 6 6 US � Strong banking system: 4 major banks all AA rated 4 4 � Other positives have been the momentum in mining J a pa n 2 2 infrastructure projects and the boost from Asia 0 0 Jan-90 Jan-94 Jan-98 Jan-02 Jan-06 Jan-10 Sources: Facset, Westpac Economics The Westpac Group – North American Investor Pack March 2010 The Westpac Group – North American Investor Pack March 2010 3 3 Strategy and St.George merger

A Transformational year Sept Sept Movements 09 08 � Customers 7m 10m 40% distribution uplift � Branches (Aust) 1,045 1,645 Customers � NPS 1 Westpac RBB -15 -24 Improving NPS -9 � NPS 1 St.George -13 23% � Housing 14% Around 1% of the increase in 18% � Business 13% Australian mortgage and deposit market share 23% � Household Deposits 14% Market share has been from organic growth 20% � Wealth platforms 13% � Expense/income 44% 40% $400m in merger synergies Productivity ratio � Tier 1 Ratio 7.8% 8.1% Balance sheet Positioned to support customers � Stable funding ratio 70% 84% Brands � Market capitalisation $41bn Size $77bn Up almost 90% 1 Source for Consumer NPS (Net Promoter Score): Roy Morgan Research – NPS of main financial institution Aged 14+. Data at Sep09. The Westpac Group – North American Investor Pack March 2010 5 Westpac differentiated by its focus and strong franchise � Major Australian bank most focussed on Australia and New Zealand Focus on core � Leveraging customer-focussed, multi-brand strategy to grow both customers and markets products per customer � Westpac Bank of the Year 2009 1 ; St.George Home Lender of the Year 1 ; RAMS Best Non-Bank Lender of Year 1 ; Institutional Banking in lead position for relationships and products 2 ; BTFG best investment platform 3 � Strong banking momentum, with consistent growth in market share in mortgages and Strategically well deposits placed � Growing share in wealth, with business model well suited to emerging industry changes including having transparent fees, open architecture Wrap, and low cost Super for Life product � Portfolio of strong, distinctive brands increases strategic options � Adds multi-brand capability � Increased Australian distribution network by 40%; total customers now around 10m Transformational St.George merger � Improved efficiency path, seeking a sub 40% expense to income ratio by FY11 � Larger revenue base from which to leverage investment � Global sustainability leader Sustainability leader � Employer of choice 1. Money Magazine June 2009. 2. Peter Lee July 2009. 3. BT Wrap ‘smart investor award for best investment platform and best margin loan’ Aug 09. 6 The Westpac Group – North American Investor Pack March 2010

Good progress on our strategic priorities Objective 2009 and 1Q10 Progress � Products per customer - best of Australian banks 1 Earn all of our � Growing share across key products with Australian mortgages up 17% and total Customers customers’ business customer deposits up 17% in 2009 � Improving cross sell – Insurance, BT Super for Life � Westpac Local being rolled out, largely complete. Continuing roll-out in NZ Strengthen and drive locally empowered � 13 new branches, 4 new business centres, and 124 new ATMs in 2009 Distribution business � St.George regional structure established, leveraging off successful BankSA model Transform service � Simplifying processes, eliminating unnecessary requests, improving online tools Operations delivery � Effective use of overflow space and capacity between Westpac and St.George � Built IT management bench strength and completed strategic roadmap incorporating merger Strengthen capability & improve � Projects focused on improving the customer experience, including online capabilities Technology and an improved collections system flexibility / simplicity � Improved systems reliability Drive one team � Staff engagement up 3 percentage points to 81%, results consistent across brands People approach � Successful head office integration � Grew St.George customer numbers and had no disruption to Westpac RBB momentum Integrate without � St.George momentum has been restored, consistently increasing market share in key Merger products customer disruption � Expense synergies progressing ahead of plan 1. Source: Business Intelligence Group based on August 2009 data. The Westpac Group – North American Investor Pack March 2010 7 Customers are at the centre of everything we do Australian Consumer NPS 2 – 6 month moving � Fully supported customers through the more challenging times: − Institutional – continued to lend as capital markets closed average (%) − Consumer – funding for mortgage borrowers including first 0% home buyers; improved deposits focus − Business – supporting debt reduction/consolidation through education Extended Westpac Assist 1 across small business and St.George − introduced St.George Assist − New and fairer exception fee structure -10% � Investment focused on further improving customer experience: − Continued roll-out of Westpac Local business model (largely complete) putting more decision making in the front Westpac line. Model being rolled out in NZ − New regional operating structure in St.George bringing senior management closer to customers − 13 new branches, 4 new business centres, and 124 new Major banks -20% ATMs across Westpac and St.George brands in 2009 � Work in progress: − Improved call centre management and complaint resolution − Installing St.George sales and service desktop to Westpac − Program of cultural change across the organisation � Measuring success of putting customers at the centre is based on ‘NPS’ 2 . NPS measures the propensity of customers to -30% recommend our brands. Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 1 Dedicated call centre designed to support customers in early stress, including through adjusting loan terms/duration. 2 Net Promoter Score (NPS). Source for NPS: Roy Morgan Research – NPS of main financial institution Aged 14+. Major banks includes WBC, ANZ, CBA, and NAB (simple average). 8 The Westpac Group – North American Investor Pack March 2010

Recommend

More recommend