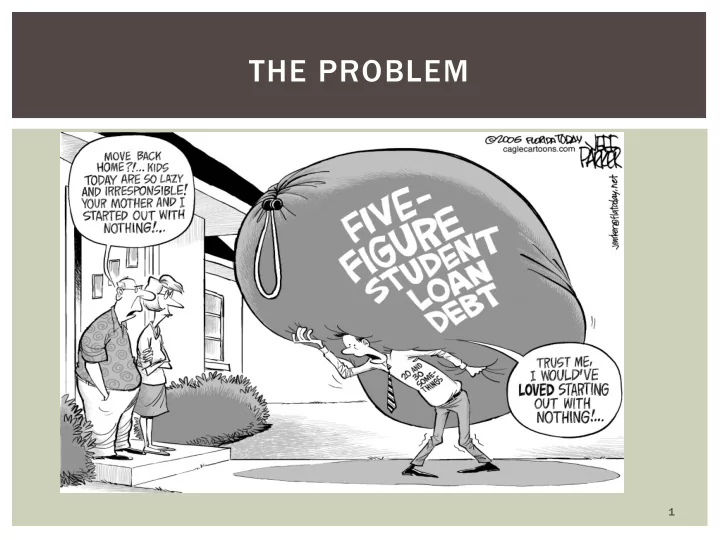

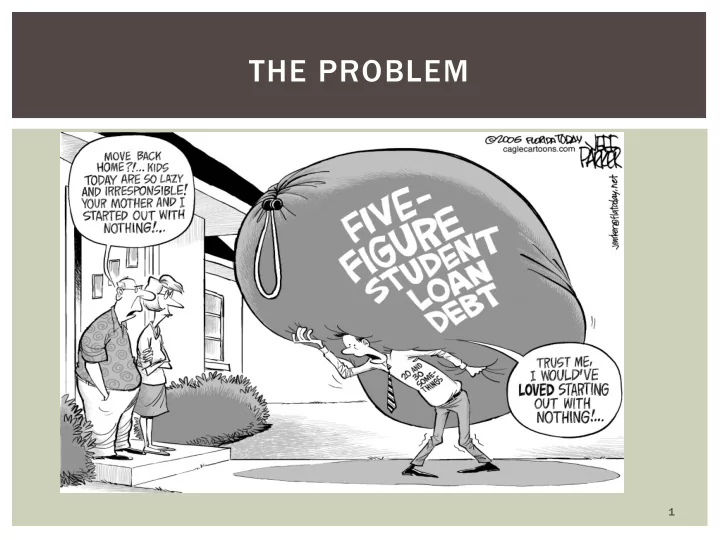

THE PROBLEM 1

SOLUTIONS What do you think the solutions are? 2

PROPOSED SOLUTIONS • Increase need-based federal aid, like Pell Grants, which now cover less than one-third of the cost of attendance at public four-year universities; especially for minority-serving institutions. • Make student loans more affordable, by allowing federal student loans to be refinanced when interest rates decline instead of balancing budgets on the backs of our students. 3

PROPOSED SOLUTIONS Streamline federal loan repayment plans. Re-invest state funds in higher education. Enhance federal loan forgiveness programs and expand them to include faculty and staff at all levels of employment at colleges and universities - including contingents. 4

DEGREES NOT DEBT CAMPAIGN Educate about the extent of the crisis. Make it personal & practical: Help our members avoid or lower their own student debt load. Take action: Advocate for affordable higher education for all AND for state & federal reinvestment in higher education. Grow stronger IEA /NEA locals.

REDUCE YOUR STUDENT LOAN 6

OUR BASIC MESSAGE TO YOU TONIGHT FIGHT TO FUND PUBLIC HIGHER EDUCAT ATION! 1. 1. Apply for “Public Service Loan Forgiveness.” 30 hour a week public education employee 2. Apply to reduce your monthly student debt payments. 3. Make qualified payments for ten years (120 payments). THE REST OF THE LOAN IS FORGIVEN 7

STEP 1: THE PLEDGE AND YOU • Digital pledge at http://www.nea.org/degreesnotdebt • Pledge signers get added to our e-list for updates, action. We ask that each of you take the pledge and promote the campaign. Spread the pledge! Put a link on your website! 8

STEP 2: FAFSA PIN https://studentloans.gov 9

STEP 3: PUBLIC SERVICE LOAN FORGIVENESS • Ten years of public service plus 120 qualified payments equals student loan forgiveness. • Applies to full time- public sector educators and ESPs Applies to Federal Direct • Loans • Loans are consolidated and transferred to Federal Loan Servicing Effective Oct. 2007 • • Resubmit your PSLF Certification Form yearly or when you change jobs 10

STEP 4: REDUCE YOUR MONTHLY PAYMENTS WITH INCOME-DRIVEN REPAYMENT PLAN (IDR) Go to studentloans.gov, using your FAFSA Pin complete the Repayment Plan Request Form You must be enrolled in one of three IDR plans while enrolled in the PSLF program: Income Based Repayment (IBR) Income Contingent Repayment (ICR) Pay As You Earn (PAYE) Use the payment estimator calculator to find which plan provides you with the lowest monthly payment to maximize the amount of your loan forgiven after 10 years. https:/studentloans.gov/mydirectloan/mobile/repayment/rep aymentestimator.action 11

INCOME DRIVEN REPAYMENT PLANS Never higher than Standard Repayment Plan Amount (which can be 20-25 years in length) Income Based Repayment (IBR) Plans: New borrowers starting July 1, 2014 – 10% of discretionary income. Borrowers before July 1, 2014 – 15% of discretionary income. DISCRETIONARY INCOME: difference between your income and 150% of poverty guideline for family size and state residence. 12

THE WEBSITES!!! studentloans.gov TO APPLY FOR INFORMATION StudentAid.ed.gov/repay-loans NEA.org/degreesnotdebt 13

STEP 5: SPREAD THE WORD ABOUT DEGREES NOT DEBT BRINGING DEGREES NOT DEBT INTO YOUR LOCAL ON THE GROUND RECEPTION Help organize a 10 minute meeting in your building Host a 30-45 minute workshop in your local or building Gather statistics and stories New employee outreach Participate in phonebanking and outreach for future events. 14

QUESTIONS, COMMENTS, REACTIONS HELP US GATHER THE INFORMATION WE NEED TO EFFECTIVELY SPREAD THE WORD.

Recommend

More recommend