Tail Winds from the East? The Effect of Emerging Markets on UK - PowerPoint PPT Presentation

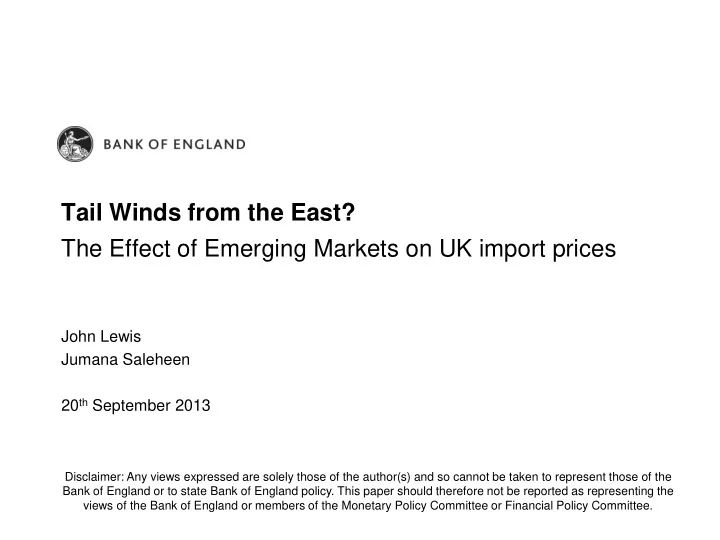

Tail Winds from the East? The Effect of Emerging Markets on UK import prices John Lewis Jumana Saleheen 20 th September 2013 Disclaimer: Any views expressed are solely those of the author(s) and so cannot be taken to represent those of the Bank

Tail Winds from the East? The Effect of Emerging Markets on UK import prices John Lewis Jumana Saleheen 20 th September 2013 Disclaimer: Any views expressed are solely those of the author(s) and so cannot be taken to represent those of the Bank of England or to state Bank of England policy. This paper should therefore not be reported as representing the views of the Bank of England or members of the Monetary Policy Committee or Financial Policy Committee.

Motivation • Widespread claims that “cheap imports“ from low -wage producers have reduced inflationary pressure. “For a number of years, the United States and other industrialized nations benefited from disinflation in manufactured goods produced in EMEs. This shift in relative prices — a positive terms of trade gain — helped contain inflation. ” - William Dudley, President New York Fed • Did the growth of imports from emerging market economies help contain inflationary pressure in the UK during the long expansion?

Imports from low cost producers: manufacturing % of manufacturing imports 14 12 10 8 6 4 2 0 1999 2001 2003 2005 2007 2009 2011 China LWC NMS • China has shown a larger increase (≈10.5pp) than other LWCs (≈2.5pp) or NMS (≈5pp)

Cost advantage of selected EMEs China Vietnam Pakistan India Russian Thailand Philippines Indonesia Turkey Ratio of PPP to market exchange rate, average 1999-2011 Mexico Brazil Bulgaria Romania Lithuania Poland Latvia Hungary Czech Rep Estonia Slovakia Slovenia 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0

Possible Channels + Beneficial terms of trade shock lowers import prices:“price level effect” – Direct effect of more “cheap imports” from EMEs – Indirect competition effect on non-EMEs + Competition from cheap imports may also put downward pressure on domestic producers prices – But rising costs in “low - wage” producers can be a “headwind”: “inflation effect” – Greater exposure to countries with rising costs generates inflationary pressure – EMEs may have pushed commodity prices up Caution about effect of lower import prices on CPI inflation i) Relative price shock may not feed through to overall prices “Tailwind” could be that domestic economy is run at a high rate of growth ii) than could otherwise be possible

Related Literature: Impact on domestic producers Effect on import prices: Kamin et al (2006) regress change in China’s market share on import prices. (But only two time periods 1993 and 2001) McCoille (2008): Simple accounting approach (no allowance for competition effects on other countries exporters) Pain et al (2006) + Nickell (2005): Mechanistic estimate based on relative price level and increase in shares (again no competition effects) Wheeler (2008): Regression based approach (but for limited number of sectors)

Overview Our Empirical Analysis • Uses data on the volume and value of UK imports in over 3000 goods categories over the period 1999-2011 to estimate panel regressions of EME effect on import prices • Allow for cross sectional dependence in the error term, and use dataset with much richer cross sectional and time series dimensions than most existing studies. • We show that allowing for differences in coefficients across sectors can lead to larger estimates of the effect of Chinese market share. • 4 key questions – Did growth of low cost producers reduce import prices? China yes, others no – How big is it? -0.92pp in manufacturing (= - 0.63pp per year overall) – Has this effect changed over time? No sign of drop-off so far – Has higher inflation in low cost producers fed through to UK import prices: No Putting this in the broader context • How do our results compare with the rest of the literature: Bigger downward pressure, but still relatively small • Effect of EMEs on commodity prices: Hard to quantify but may have offset tailwind

Dataset: Imports • Import data taken from UK Customs (HMRC) Tradeinfo database, containing volumes and values of imports by trading partner and industry over the period 1999-2011 – Restricted to 45 countries to keep dataset computationally manageable • EU, OECD, plus Brazil, China, Hong Kong, Indonesia, India, Mexico, Philippines, Pakistan, Russia, Singapore, Thailand, Turkey, Vietnam • Around 90% of UK imports – More than 3000 industries using Standard Industrial Trade Classification (SITC) at 5-digit level – Raw data contains nearly 2 million datapoints

Intermezzo: SITC System • Each industry has 5-digit code: – e.g. “ Battery/AC powered alarm clocks”: 88574 – First digit denotes broadest classification – Subsequent digits give finer levels of disaggregation 5-digit code 5-digit code 5-digit code 5-digit code 5-digit code Industry Name Industry Name Industry Name Industry Name Industry Name No. of inds No. of inds No. of inds No. of inds No. of inds INSTRUMENT PANEL CLOCKS AND CLOCKS OF A SIMILAR TYPE, FOR PREFABRICATED BUILDINGS; SANITARY, PLUMBING, HEATING & WRIST WATCHES, POCKET WATCHES AND OTHER WATCHES 881xx 0xxxx PHOTOGRAPHIC APPARATUS AND EQUIPMENT, N.E.S. FOOD AND LIVE ANIMALS 346 15 88571 81xxx 17 1 8853x VEHICLES, AIRCRAFT, SPACECRAFT OR VESSELS (INCLUDING STOP WATCHES) WITH CASE OF PRECIOUS METAL OR LIGHTING FIXTURES AND FITTINGS, N.E.S. 3 882xx PHOTOGRAPHIC AND CINEMATOGRAPHIC SUPPLIES 6 1xxxx BEVERAGES AND TOBACCO 22 CLOCKS WITH WATCH MOVEMENTS (EXCLUDING INSTRUMENT PANEL METAL CLAD WITH PRECIOUS METAL 82xxx FURNITURE AND PARTS THEREOF; 23 1 88572 CINEMATOGRAPHIC FILM, EXPOSED AND DEVELOPED, WHETHER OR 2xxxx CRUDE MATERIALS, INEDIBLE, EXCEPT FUELS 277 CLOCKS), BATTERY POWERED WRIST WATCHES, POCKET WATCHES AND OTHER WATCHES 883xx 83xxx TRAVEL GOODS, HANDBAGS AND SIMILAR CONTAINERS 9 NOT INCORPORATING SOUND 2 8854x (INCLUDING STOP WATCHES), WITH CASES NEITHER OF PRECIOUS 3 CLOCKS WITH WATCH MOVEMENTS (EXCLUDING INSTRUMENT PANEL 3xxxx MINERAL FUELS, LUBRICANTS AND RELATED MATERIALS 41 88573 1 84xxx ARTICLES OF APPAREL AND CLOTHING ACCESSORIES 99 884xx OPTICAL GOODS, N.E.S. 11 CLOCKS), OTHER THAN BATTERY POWERED METAL NOR CLAD WITH PRECIOUS METAL 4xxxx ANIMAL AND VEGETABLE OILS, FATS AND WAXES 46 85xxx FOOTWEAR 19 885xx ALARM CLOCKS (WITH CLOCK MOVEMENTS), BATTERY, OR AC 8855x WATCHES AND CLOCKS WATCH MOVEMENTS, COMPLETE AND ASSEMBLED 26 2 88574 1 5xxxx CHEMICALS AND RELATED PRODUCTS, N.E.S. 487 POWERED PROFSSIONAL, SCIENTIFIC AND CONTROLLING INSTRUMENTS AND 8857x CLOCKS 9 87xxx 66 6xxxx MANUFACTURED GOODS CLASSIFIED CHIEFLY BY MATERIAL 837 APPARATUS, N.E.S. 1 88575 ALARM CLOCKS (WITH CLOCK MOVEMENTS), N.E.S. TIME MEASURING EQUIPMENT AND ACCESSORIES, N.E.S.; PARTS AND 8859x 9 PHOTOGRAPHIC APPARATUS, EQUIPMENT & SUPPLIES & OPTICAL 7xxxx MACHINERY AND TRANSPORT EQUIPMENT 682 WALL CLOCKS (WITH CLOCK MOVEMENTS), BATTERY, OR AC ACCESSORIES FOR CLOCKS 88xxx 60 1 88576 GOODS, N.E.S.; WATCHES AND CLOCKS POWERED 8xxxx MISCELLANEOUS MANUFACTURED ARTICLES 444 89xxx MISCELLANEOUS MANUFACTURED 151 88577 1 WALL CLOCKS (WITH CLOCK MOVEMENTS), N.E.S. 9xxxx COMMODITIES AND TRANSACTIONS 13 CLOCKS (WITH CLOCK MOVEMENTS), N.E.S., BATTERY OR AC 88578 1 POWERED 88579 1 CLOCKS (WITH CLOCK MOVEMENTS), N.E.S.

Basic Regression Setup • In keeping with Kamin et al, we clean up the dataset: – Any unit value inflation of more than 900% or below -90% is dropped • Standard panel form used in the literature: – Country and time fixed effects – Robust standard errors, clustered w.r.t. i CHINA CHINA NMS NMS LWC LWC ψ ' S S S S S S e X it 1 it 1 2 it 1 it 1 2 it 1 it 1 2 it it i t it • X is a vector of within period averages of each explanatory variable, calculated for each 4 -digit industry, similar in spirit to Kapetanios et al (2011)

Total Effect • Given earlier results, we focus on effect of China • Total effect of China across all manufacturing industries is: CHINA Total w S it it i it i • Aggregation effects may be important if more than one of the following holds: – If β differs across industries – If the change in China’s market share differs across industries – The relative weights of the industries differs across time • Compute measure under different assumptions about β – Common across all industries – Common within 1-digit industry group (separate regressions for each 1d ind) – Common within 2-digit industry group (separate regressions for each 2d ind) • .

Effect of China at different levels of disaggregation (manufacturing) China Effect, pp on manufacturing import price inflation 0.4 -0.1 -0.6 -1.1 Common β across all industries Common β within each 1 digit industry Common β within each 2 digit industry -1.6 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 • Poolability test: – Common vs 1-digit: p-value 0.000; 1-digit vs 2-digit: p-value 0.000

Bootstrapping a confidence interval for the price- level effect (China) pp 0.00 -0.50 -1.00 -1.50 -2.00 -2.50 2000 2002 2004 2006 2008 2010 95% CI Mean Tail Winds from the East? 4 th May 2012

Bootstrapping the Inflation Effect (China) pp 1.00 0.00 -1.00 -2.00 -3.00 -4.00 -5.00 -6.00 2000 2002 2004 2006 2008 2010 95% CI Mean Tail Winds from the East? 4 th May 2012

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.

![Race Condition Shared Data: 5 6 4 1 8 5 6 20 9 ? InterProcess Communication tail A[]](https://c.sambuz.com/952236/race-condition-s.webp)