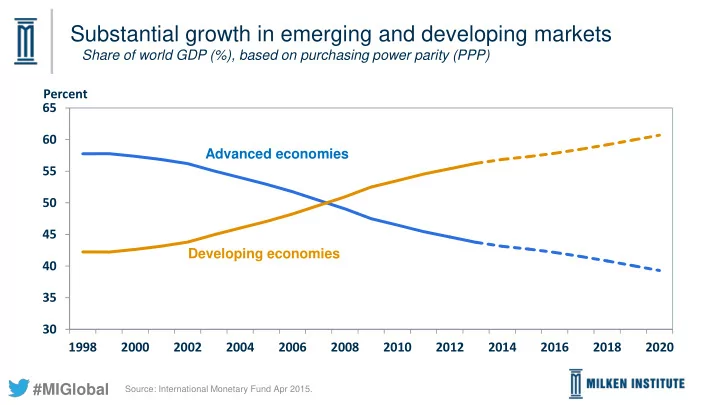

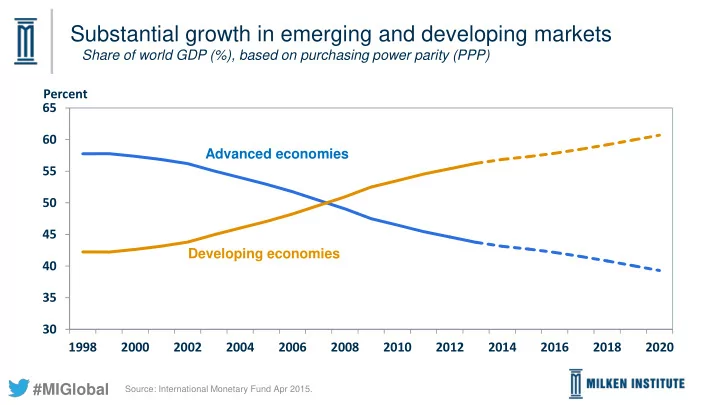

Substantial growth in emerging and developing markets Share of world GDP (%), based on purchasing power parity (PPP) Percent 65 60 Advanced economies 55 50 45 Developing economies 40 35 30 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 #MIGlobal Source: International Monetary Fund Apr 2015.

World’s fastest growing economies Countries with population > 10 million Annual average GDP growth Ethiopia Angola 11.1% 8.8% Mozambique China 10.5% 8.2% Myanmar Myanmar 10.3% 7.8% 2001 - 2010 2011 - 2020 Congo, D.R. Nigeria 8.9% 7.6% Cambodia Ethiopia 8.4% 7.2% Rwanda 7.2% Kazakhstan 8.2% 7.9% India 7.1% Chad 7.1% 7.9% Uzbekistan Mozambique 7.0% 7.7% China Cambodia 7.0% 7.6% Tanzania Rwanda #MIGlobal Source: International Monetary Fund Apr 2015.

Global growth forecasts Key countries/regions, 2014-2020 Percent 7 6 5 4 3 2 1 0 Developing Asia Sub-Saharan Africa MENA United States Latin America EU Japan #MIGlobal Source: International Monetary Fund Apr 2015.

FDI to Sub-Saharan Africa – a six-fold increase since 2000 US$ billions 45 40 35 30 25 20 15 10 5 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 #MIGlobal Source: UNCTAD Apr 2015.

Market capitalization of Sub-Saharan Africa firms has tripled since 2000 US$ billions 800 700 600 500 400 300 200 100 0 2000 2013 #MIGlobal Source: World Bank Apr 2015.

Market capitalization of listed Sub-Saharan African firms Selected countries US$ billions 60 South Africa = $534 billion 50 40 30 20 10 0 Nigeria Kenya Mauritius Botswana Zimbabwe Zambia Ghana Malawi #MIGlobal Source: Bloomberg, April 13, 2015. Note: Values do not include ETFs and ADRs.

Sub-Saharan Africans still under-banked Percentage of adults with an account at a financial institution, 2014 Percent 80 70 60 50 40 30 20 10 0 Developing Asia Developing Latin America South Asia Sub-Saharan Developing Europe Africa Middle East #MIGlobal Source: World Bank Global Financial Inclusion Database.

Commodity prices are falling and are expected to drop further Percent change 2013 to 2014 Percent 25 20 15 10 5 0 -5 -10 -15 -20 Energy Metals Grains Fats and Other food Beverages Raw Fertilizers Precious oils materials metals #MIGlobal Source: World Bank Commodity Market Outlook Jan 2015.

Annual infrastructure financing gap of $48 billion US$ Billions 100 90 80 70 60 50 40 30 20 10 0 Actual Estimated Investment Total Needed #MIGlobal Source: InfrastructureAfrica.org.

Increase in U.S. corporate cash balances US$ billion 155 160 Q4 2007 Q4 2014 138 140 120 90 100 80 65 61 52 60 45 33 40 25 23 22 15 15 14 14 20 8 8 7 0 Apple GE +126% Microsoft Google Cisco Oracle Pfizer Chevron Merck +909% +285% +323% +134% +537% +31% +79% +74% #MIGlobal Source: Bloomberg. Note: Cash and marketable securities.

Africa’s share of the world’s population is rising Percent 25 2050 20 2010 15 1980 10 5 0 Africa India China Latin America Europe North America #MIGlobal Source: Population Resource Bureau.

Recommend

More recommend