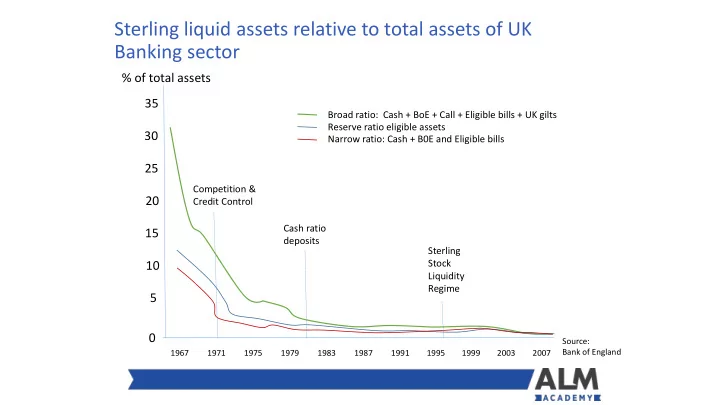

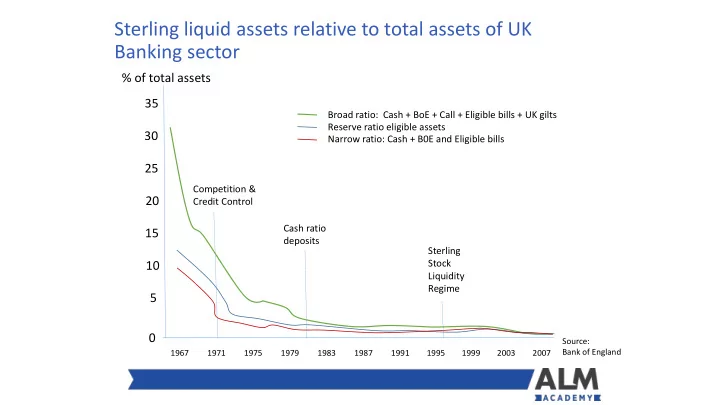

Sterling liquid assets relative to total assets of UK Banking sector % of total assets 35 Broad ratio: Cash + BoE + Call + Eligible bills + UK gilts Reserve ratio eligible assets 30 Narrow ratio: Cash + B0E and Eligible bills 25 Competition & 20 Credit Control Cash ratio 15 deposits Sterling Stock 10 Liquidity Regime 5 0 Source: Bank of England 1967 1971 1975 1979 1983 1987 1991 1995 1999 2003 2007

BIS – Principles of effective risk data aggregation and risk reporting – January 2013 • Enhance the infrastructure • Improve the speed at which information is available • Improve the quality of strategic planning Strong risk management capabilities are an integral part of the franchise value of the bank

BASEL III has two minimum standards Two separate but complementary objectives Liquidity Coverage Ratio Promote short term resilience – ensuring sufficient high- quality liquid assets to survive a significant stress lasting one month (30 days). Similar to the current PRA liquidity guidance for Standardised ILAS firms (2015) Net Stable Funding Ratio Promote resilience over a longer time horizon by creating additional incentives for Banks to fund their activities with more stable sources of funding on an on-going basis (2018)

Liquidity Coverage Requirements …maintain liquidity buffers which are adequate to face any possible imbalance between liquidity inflows and outflows under gravely stressed conditions over a period of thirty days Article 412

Guidelines on retail deposits subject to different outflows for purposes of liquidity reporting under Regulation (EU) No 575/2013, on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012 (Capital Requirements Regulation – CRR) Fixed and Notice Accounts if maturity are 30 or less days For Notice Accounts if there is notice given for a certain balance this should be split out to show the balance and the amount of notice given. Guaranteed Balance - FSCS Established Relationship Length of relationship Number of accounts If a loan held with firm in addition to the savings product(s) Transactional Accounts Including accounts to which salaries are regularly credited Three groups of retail deposit subject to higher outflows Category 1: 2 High Risk Factors Category 2: 3 High Risk Factors, or 1 High Risk Factor and 1 Very High Risk Factor Category 3: 2 Very High Factors, or 2 High Risk Factors and 1 Very High Risk Factor

CRD IV COREP – LC Outflow 1 Balance £ Non insured High risk Non Established Relationship Very High risk Guaranteed & Extremely High risk Established or Transactional 1 2 3 No risk Withdrawal rate in times of stress Non- Sticky Sticky

Recommend

More recommend