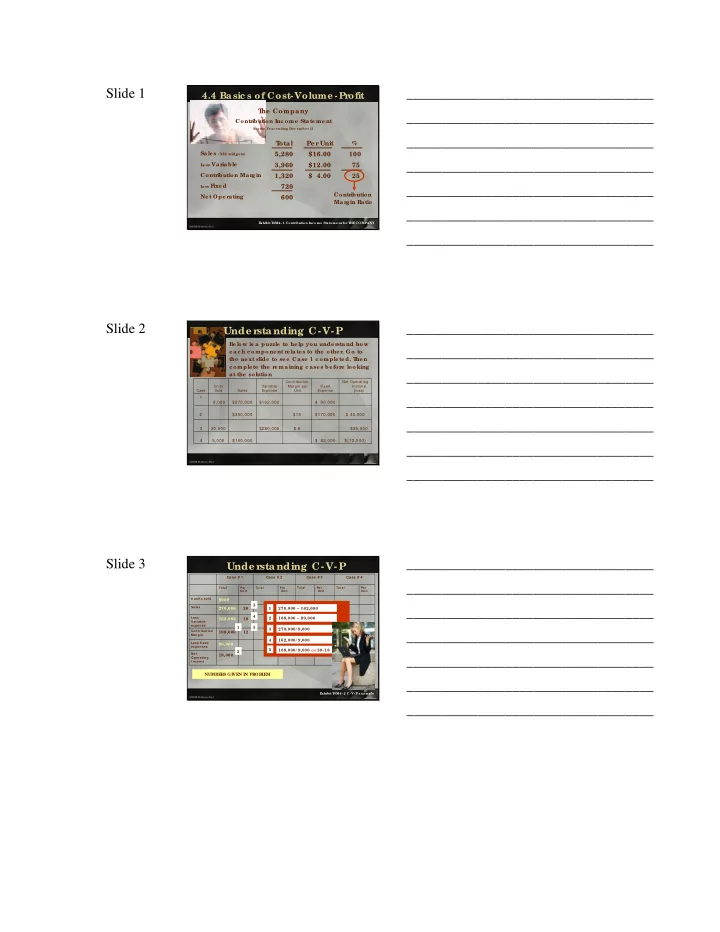

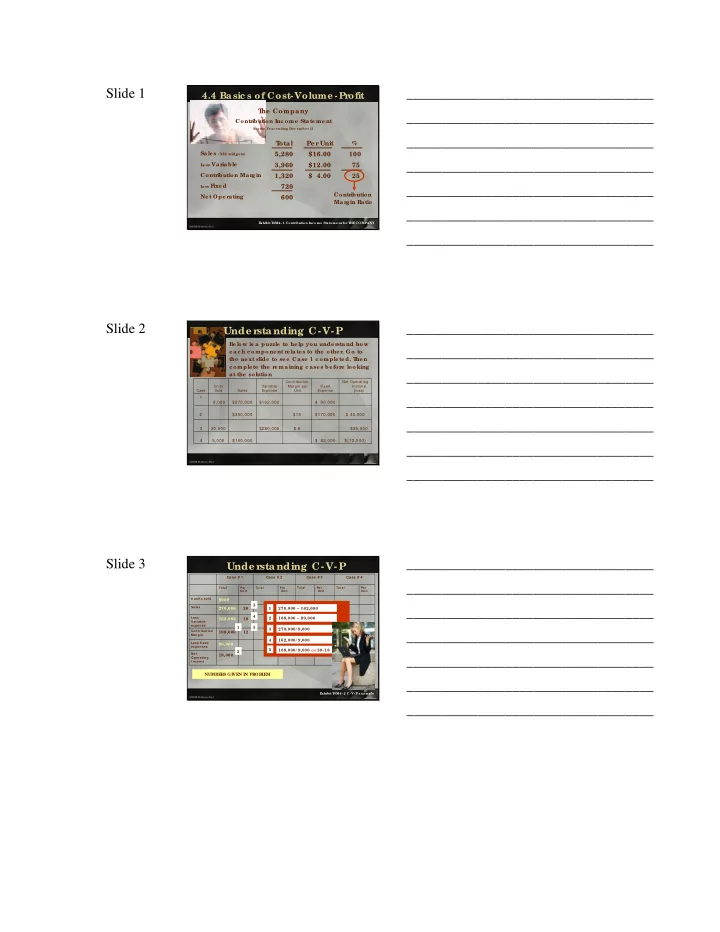

Slide 1 ___________________________________ 4.4 Basic s of Cost-Volume -Pr ofit T he Company ___________________________________ Contr ibution Inc ome State me nt F or the Ye ar ending De c e mber 31 ___________________________________ T otal Pe r Unit % Sa le s (330 widgets) 5,280 $16.00 100 ___________________________________ e ss Va r iable 3,960 $12.00 75 L Contr ibution Mar gin 1,320 $ 4.00 25 ess F ixe d 720 L ___________________________________ Contr ibution Ne t Ope rating 600 Ma r g in R atio ___________________________________ E xhibit T 4M4~1 Contribution Inc ome Sta tement for T HE COMPANY 2005 KD Ha the wa y-Dia l ___________________________________ Slide 2 ___________________________________ Unde r standing C-V-P Be low is a puzzle to he lp you unde r stand how ___________________________________ e a c h c ompone nt r e la te s to the othe r . Go to the ne xt slide to se e Case 1 c omple te d. T he n c omple te the re maining c ase s be fore looking at the solution ___________________________________ Contribution Net Operating Units Variable Margin per Fixed Income Case Sold Sales Expense Unit Expense (loss) 1 ___________________________________ 9,000 $270,000 $162,000 $ 90,000 2 $350,000 $15 $170,000 $ 40,000 ___________________________________ 3 20,000 $280,000 $ 6 $35,000 4 5,000 $160,000 $ 82,000 $(12,000) ___________________________________ 2005 KD Ha the wa y-Dia l ___________________________________ Slide 3 ___________________________________ Unde r standing C-V-P Case # 1 Case # 2 Case # 3 Case # 4 ___________________________________ Total Per Total Per Total Per Total Per Unit Unit Unit Unit # units sold 9000 3 Sales 270,000 30 1 270,000 – 162,000 ___________________________________ 4 2 108,000 – 90,000 Less 162,000 18 Variable expense 1 5 3 270,000/ 9,000 Contribution 108,000 12 ___________________________________ Margin 4 162,000/ 9,000 Less fixed 90,000 expenses 5 108,000/ 9,000 or 30- 18 2 Net 18,000 Operating ___________________________________ I ncom e NUMBE RS GIVE N IN PR OBL E M ___________________________________ E xhibit T 4M4~2 C-V- P e xample 2005 KD Ha the wa y-Dia l ___________________________________

Slide 4 ___________________________________ Unde r standing C-V-P Case # 1 Case # 2 Case # 3 Case # 4 ___________________________________ Total Per Total Per Total Per Total Per Unit Unit Unit Unit # units sold 9000 14,000 20,000 5,000 Sales 270,000 30 350,000 25 400,000 20 160,000 32 ___________________________________ Less Variable expense 162,000 18 140,000 10 280,000 14 100,000 20 Contribution 108,000 12 210,000 15 120,000 6 60,000 12 ___________________________________ Margin Less fixed 90,000 170,000 85,000 82,000 expenses Net Operating ___________________________________ I ncom e 18,000 40,000 35,000 (12,000) NUMBE RS GIVE N IN PR OBL E M ___________________________________ 2005 KD Ha the wa y-Dia l ___________________________________ Slide 5 ___________________________________ WHAT IF … Using the Contr ibution Inc ome ___________________________________ State me nt c an be use ful in what if ana lysis…a nswe r the following what if que stions be low ___________________________________ 1. Wha t if…volume of sa le s inc re a se d by 20% by inc re a sing a dve rtising by $15,000 ___________________________________ 2. What if… the sale s pric e inc re ase s by $0.80 pe r unit but volume de c re a se d by 10% 3. Wha t if…the sale s pric e inc re a se d by 10% , ___________________________________ varia ble e xpe nse s inc re a se d by $0.80, and volume de c re a se d by 20% ___________________________________ 2005 KD Ha the wa y-Dia l ___________________________________ Slide 6 ___________________________________ WHAT IF …Using this as the or ig inal infor mation T he Company ___________________________________ Contribution Inc ome Sta te me nt F or the Ye a r ending De c e mber 31 ___________________________________ T otal Pe r Unit % Sale s (330 widgets) 5,280 $16.00 100 ___________________________________ e ss Va ria ble L 3,960 $12.00 75 Contr ibution 1,320 $ 4.00 25 ___________________________________ Mar gin e ss F ixe d 720 L Ne t Ope rating 600 ___________________________________ E xhibit T 4M4~3 Contribution Inc ome Sta tement for T HE COMPANY 2005 KD Ha the wa y-Dia l ___________________________________

Slide 7 ___________________________________ WHAT IF #1… 1. Wha t if…volume of sa le s inc re a se d by 20% by inc re a sing a dve rtising by $150 ___________________________________ OLD NEW 1 330 units 396 units ___________________________________ 2 $720 $870 Total Per Unit % 1 330 X 1.20 ___________________________________ Sales 3 6,336 $16.00 100 Less Variable 4,752 $12.00 75 2 720 + 150 4 CM 1,584 $ 4.00 25 3 396 X $16.00 Less 870 ___________________________________ Fixed 396 X $12.00 * 4 Net 714 operating Good De c ision? Ye s… Ne t Ope ra ting inc rea se d by $114 or 19% ___________________________________ * Common e r ror is to use the old volume to c a lc ula te va r ia ble c osts 2005 KD Ha the wa y-Dia l ___________________________________ Slide 8 ___________________________________ WHAT IF #2… 2. What if… the sale s pric e inc r e ase s by ___________________________________ $0.80 pe r unit but volume de c re ase d by 10% OLD NEW 1 $16.00 $16.80 ___________________________________ 2 330 units 297 units Total Per Unit % 1 $16.00 + $0.80 ___________________________________ Sales 3 4,990 $ 16.80 100 Less Variable 3,564 $ 12.00 71 2 330 X 0.90 4 CM 1426 $ 4.50 29 3 297 X $16.80 Less 720 ___________________________________ Fixed 4 297 X $12.00 Net 706 operating Good De c ision? Ye s… Ne t Ope ra ting inc rea se d by $106 or 18% ___________________________________ 2005 KD Ha the wa y-Dia l ___________________________________ Slide 9 ___________________________________ WHAT IF #3… 3. What if… the sale s pric e inc r e ase d by 10%, variable e xpe nse s inc re ase d by ___________________________________ $0.80, and volume de c re a se d by 20% OLD NEW 1 $16.00 $17.60 ___________________________________ 2 $12.00 $12.80 330 264 3 Total Per Unit % ___________________________________ 1 $16.00 X 1.10 Sales 4 4,646 $17.60 100 2 $12.00 + 0.80 Less Variable 3,379 $12.80 73 5 3 330 X 0.80 (80% ) CM 1,267 $ .80 27 ___________________________________ Less 720 4 264 X $17.60 Fixed Net 547 5 264 X $12.80 operating ___________________________________ Good De c ision? NO… Ne t Ope ra ting de c re ase d by $53 or 9% 2005 KD Ha the wa y-Dia l ___________________________________

Recommend

More recommend