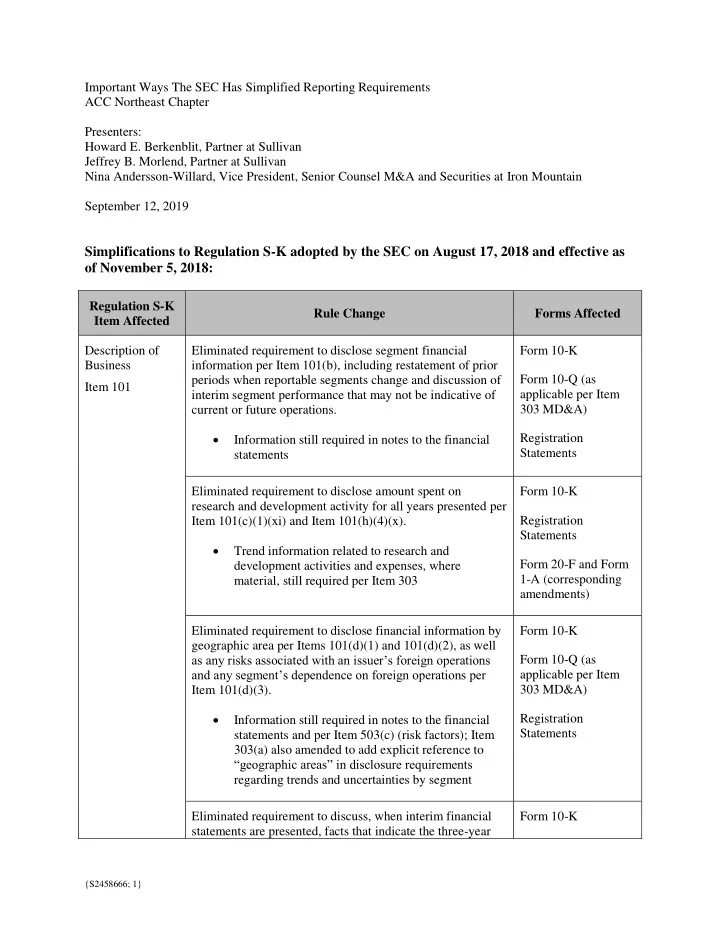

Important Ways The SEC Has Simplified Reporting Requirements ACC Northeast Chapter Presenters: Howard E. Berkenblit, Partner at Sullivan Jeffrey B. Morlend, Partner at Sullivan Nina Andersson-Willard, Vice President, Senior Counsel M&A and Securities at Iron Mountain September 12, 2019 Simplifications to Regulation S-K adopted by the SEC on August 17, 2018 and effective as of November 5, 2018: Regulation S-K Rule Change Forms Affected Item Affected Description of Eliminated requirement to disclose segment financial Form 10-K Business information per Item 101(b), including restatement of prior periods when reportable segments change and discussion of Form 10-Q (as Item 101 applicable per Item interim segment performance that may not be indicative of 303 MD&A) current or future operations. Registration Information still required in notes to the financial Statements statements Eliminated requirement to disclose amount spent on Form 10-K research and development activity for all years presented per Item 101(c)(1)(xi) and Item 101(h)(4)(x). Registration Statements Trend information related to research and Form 20-F and Form development activities and expenses, where 1-A (corresponding material, still required per Item 303 amendments) Eliminated requirement to disclose financial information by Form 10-K geographic area per Items 101(d)(1) and 101(d)(2), as well as any risks associated with an issuer’s foreign operations Form 10-Q (as and any segment’s dependence on foreign operations per applicable per Item 303 MD&A) Item 101(d)(3). Registration Information still required in notes to the financial Statements statements and per Item 503(c) (risk factors); Item 303(a) also amended to add explicit reference to “geographic areas” in disclosure requirements regarding trends and uncertainties by segment Eliminated requirement to discuss, when interim financial Form 10-K statements are presented, facts that indicate the three-year {S2458666; 1}

financial data for geographic performance may not be Form 10-Q (as indicative of current or future operations per Item 101(d)(4). applicable per Item 303 MD&A) Item 303(a) amended to add explicit reference to add explicit reference to “geographic areas” as Registration Statements example of subdivision of a business required to be discussed when management believes such discussion would be appropriate to an understanding of the business Eliminated requirement to identify SEC Public Reference Form 10-K Room and disclose its physical address and phone number, Registration but all issuers must disclose SEC internet address and statement that electronic SEC filings are available there per Statements Item 101(e)(3). Form 20-F and Form F-1 (corresponding amendments) All issuers now required to disclose their internet address, if Form 10-K they have one, per Item 101(e)(2) and Item 101(h)(5)(iii). Registration Statements Form 20-F and Form F-1 (corresponding amendments) Market for Where primary shares are traded on a principal U.S. Form 10-K Registrant’s exchange, eliminated requirement to provide high and low Registration Common Equity sale prices for two prior fiscal years. Instead, issuers with one or more classes of common equity required to disclose Statements Item 201(a)(1) principal U.S. market(s) where each class is traded and Form 20-F trading symbol(s) for each class of common equity per Item (corresponding 201(a)(1). amendments) Foreign issuers also required to identify the principal foreign public trading market, if any, and the trading symbol(s), for each class of their common equity. Warrants, Rights Eliminated requirement, where the class of common equity Form S-1 and Convertible has no established U.S. public trading market, to disclose Form 10 Instruments amount of common equity subject to outstanding options, warrants or convertible securities per Item 201(a)(2)(i). Item 201(a)(2)(i) Information still required in notes to the financial statements {S2458666; 1}

Dividends Eliminated requirement to disclose frequency and amount of Form 10-K cash dividends declared per Item 201(c)(1). Item 201(c)(1) Registration Statements Still required to disclose amount of dividends in interim periods per Rule 3-04 of Regulation S-X Certain disclosures regarding restrictions that currently or are likely to materially limit issuer’s ability to pay dividends on its common equity (including restrictions on the ability of issuer’s subsidiaries to transfer funds to it in the form of cash dividends, loans or advances) per Item 201(c)(1) consolidated into single requirement per Rule 4-08(d)(2) of Regulation S-X MD&A – Eliminated requirement to provide interim seasonality Form 10-Q Seasonality disclosures per Instruction 5 to Item 303(b). Item 303(b) Information still required in notes to the financial (Instruction 5) statements; issuers also still required to provide annual seasonality disclosures per Item 101(c)(1)(v) Eliminated all references to “extraordinary items”, including Supplementary Form 10-K replacing required disclosure of “income (loss) before Financial Information extraordinary items and cumulative effect of a change in Registration accounting” with “income (loss) from continuing Statements Item 302(a) operations” and reference to “per share data based upon such income” with “per share d ata based upon income (loss) from continuing operations” and “per share data based upon net income (loss)”, per Item s 302(a)(1) and 302(a)(3). Ratio of Earnings Eliminated requirement, for issuers that register debt Form 10-K to Fixed Charges securities, to disclose historical and pro forma ratios of Form 10-Q earnings to fixed charges per Items 503(d), 503(e) and Items 503(d), 601(c) and Item 1010(a)(3) of Reg. M-A. 503(e) and 601(c) Registration and Item Statements Also eliminated corresponding exhibit per Item 1010(a)(3) of 601(b)(12) (see below) Regulation M-A Form 20-F (Instruction 7) (corresponding amendments) {S2458666; 1}

Exhibits Eliminated requirement to provide the following Item 601 Form 10-K exhibits: Item 601 Form 10-Q 601(b)(11): Computation of earnings per share in Form 8-K annual filings Registration 601(b)(12): Computation of earnings to fixed Statements charges (All as applicable) 601(b)(19): Incorporation of report furnished to security holders by reference into Form 10-Q 601(b)(22): Published report regarding matters submitted to vote of security holders 601(b)(26): Invitations for competitive bids 601(c): Computation of earnings to fixed charges {S2458666; 1}

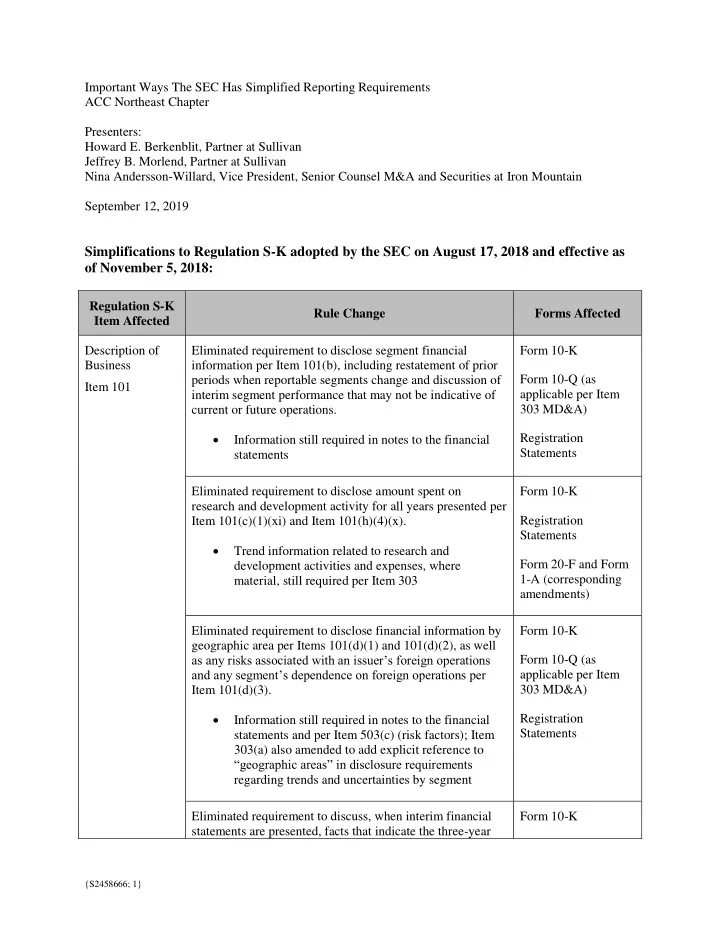

Further disclosure simplifications adopted by the SEC on March 20, 2019 and effective as of May 2, 2019 (note: the amendments to the rules governing the redaction of confidential information in material contracts became effective on April 2, 2019): Regulation S- Forms K Item Rule Change Affected Affected Exhibits Confidential Treatment Requests : May redact from exhibits filed Form 10-K under 601(b)(10) (material contracts) and 601(b)(2) (plans of Item 601 Form 10-Q acquisition, reorganization, arrangement, liquidation or succession) confidential information that is not material and would cause a Form 8-K company competitive harm if made public without first filing a CTR, so long as (i) the exhibit index is marked to indicate that portions of Registration the redacted exhibit have been omitted, (ii) a prominent statement is Statements included on the first page of the redacted exhibit that certain information has been excluded from the exhibit because it is both not (All as material and would be competitively harmful if publicly disclosed, applicable) and (iii) brackets are included to indicate where the information has been omitted from the filed version of the exhibit. May also omit personally identifiable information (i.e., information the disclosure of which would be “a clearly unwarranted invasion of personal privacy,” suc h as bank account numbers, social security numbers, home addresses and similar information) from exhibits without the need for a CTR or other conditions. See Item 601(a)(6). Schedules and Exhibits to Material Contracts : May omit attachments to material contracts if such attachments do not contain material information or were not otherwise disclosed. Required to instead provide with each filed exhibit a list briefly identifying the contents of the omitted attachments to the extent such information is not already included in the exhibit. See Item 601(a)(5). Material Contracts - Two Year Period : Except for newly reporting companies, no longer required to file material contracts that were fully performed but entered into less than two years before the applicable filing. See Item 601(b)(10)(i). Documents Incorporated by Reference – 5 Year Limitation : Eliminated the five year limit for incorporation by reference without being under an exception (including documents identified by file number). See Item 10(d). Cover Page Interactive Data File : Required to file new exhibit for “Cover Page Interactive Date File” per changes to cover page as noted below. See Item 601(b)(104). {S2458666; 1}

Recommend

More recommend