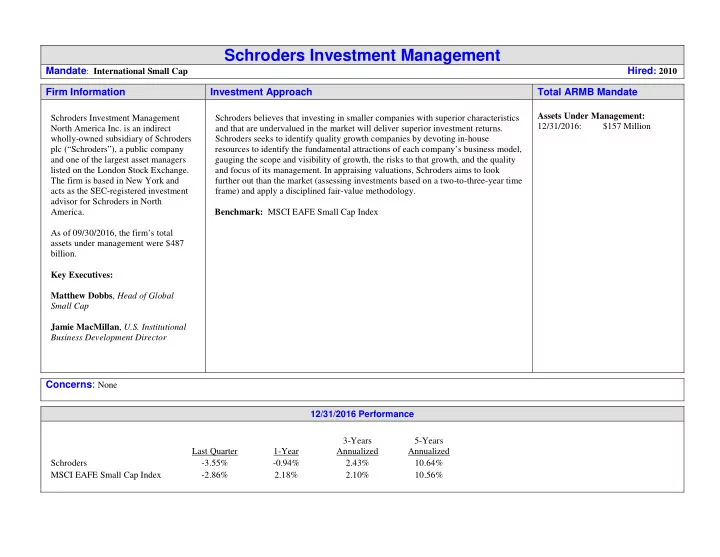

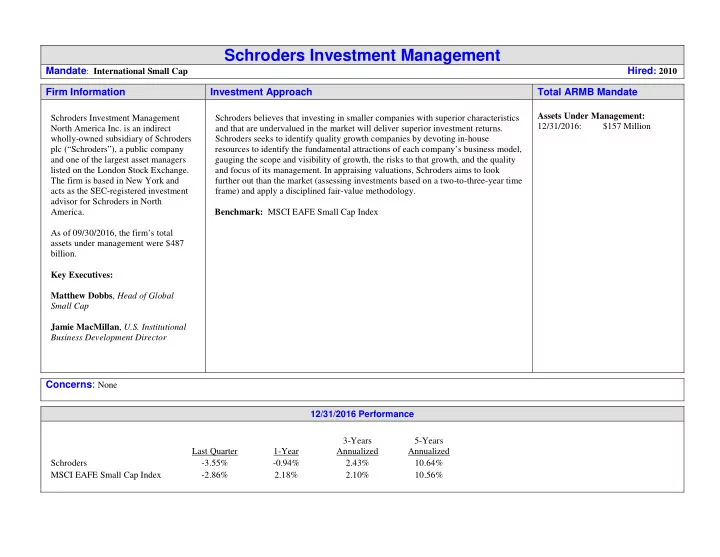

Schroders Investment Management Mandate : International Small Cap Hired : 2010 Firm Information Investment Approach Total ARMB Mandate Assets Under Management: Schroders Investment Management Schroders believes that investing in smaller companies with superior characteristics 12/31/2016: $157 Million North America Inc. is an indirect and that are undervalued in the market will deliver superior investment returns. wholly-owned subsidiary of Schroders Schroders seeks to identify quality growth companies by devoting in-house plc (“Schroders”), a public company resources to identify the fundamental attractions of each company’s business model, and one of the largest asset managers gauging the scope and visibility of growth, the risks to that growth, and the quality listed on the London Stock Exchange. and focus of its management. In appraising valuations, Schroders aims to look The firm is based in New York and further out than the market (assessing investments based on a two-to-three-year time frame) and apply a disciplined fair-value methodology. acts as the SEC-registered investment advisor for Schroders in North America. Benchmark: MSCI EAFE Small Cap Index As of 09/30/2016, the firm’s total assets under management were $487 billion. Key Executives: Matthew Dobbs , Head of Global Small Cap Jamie MacMillan , U.S. Institutional Business Development Director Concerns : None 12/31/2016 Performance 3-Years 5-Years Last Quarter 1-Year Annualized Annualized Schroders -3.55% -0.94% 2.43% 10.64% MSCI EAFE Small Cap Index -2.86% 2.18% 2.10% 10.56%

International small companies Presenting to: The State of Alaska – Alaska Retirement Management Board March 2017 Richard Sennitt | Small Cap Specialist Jamie Macmillan | Institutional Director March 2017 | For professional advisers only. This material is not suitable for retail clients

Investment Philosophy and Team

Investment philosophy Stock selection primary source of value added Growth and Quality, but at a reasonable price Long-term time horizon Strong risk framework A fully resourced and focused team 2

Resources International small cap team – A fully resourced and focused team 21 specialists in international Lead Portfolio Manager small company research Matthew Dobbs 35 (35) and investment Core team of Lead Portfolio Small Cap Specialist – Japan Small Cap Specialist – Pacific x Jap Small Cap Specialist – Pan Europe Manager and Regional Takuya Furutani 13 (22) Richard Sennitt 2 23 (23) Jean Roche 1 (17) Paul Rathband 5 (25) Andrew Lynch 18 (18) Specialists have an average of 23 years investment experience Small Cap Analyst – Japan Small Cap Analyst – Pacific x Jap Small Cap Analyst – Pan Europe Andrew Rose 2 35 (35) Yoon Hee Kyoung 9 (17) Andy Brough 29 (29) and an average of 16 years Ayumi KobayashI 12 (27) Kim Young Roe 8 (17) Luke Biermann 10 (10) tenure at Schroders Kota Takahashi 3 (10) Jacqueline Kuek 11 (16) Iain Staples 4 (17) Jing Li 6 (12) Hannah Piper 4 (6) Local presence and knowledge Rebecca Xu 6 (6) Alexander Deane 3 1 (6) Gina Kim Ji Yong 4 (17) the key - primary research Nina Chen <1 (7) conducted out of Schroder Focus List Analysts 9 1 Focus List Analysts 30 1 Focus List Analysts 15 1 research offices globally Team can draw on the broader Schroder focus list analysts – approximately 20% of holdings covered by focus list analysts Cross fertilization of investment ideas between regions and with Global Sector Experts # = Number of years with Schroders. (#) = Numbers of years investment experience. Source: Schroders as of December 31, 2016. 1 June 30, 2016. 2 Located in London. 3 Includes other coverage 3

Performance

Performance Investment environment – 2016 Equities market made modest progress in S&P EPAC SmallCap Index vs. MSCI MSCI EAFE and MSCI EAFE Small Cap 2016 with the MSCI EAFE Index rising EAFE Index 1 Index Performance in US$(%) 2 +1.0%. Smaller companies bettered their June 1989 = 100 12 months to 31 December 2016 large cap peers with the MSCI EAFE Small Cap Index returning +2.2%. 150 10 8 Smaller companies outperformed in 140 6 continental Europe and Japan. In the latter, 130 4 the more domestic focus of smaller companies has benefited them relative to 2 120 large cap during a period of strength in the 0 110 Japanese yen. Meanwhile they trailed in the -2 United Kingdom and Pacific ex Japan. In the 100 -4 United Kingdom, the vote to leave the -6 90 European Union on 23rd June hit more -8 domestically focused smaller companies 80 -10 particularly hard. 70 -12 EAFE Cont UK Japan Pacific 89 92 95 98 01 04 07 10 13 16 By sector, small caps notably outperformed Europe ex in health care and consumer staples. There Japan was some offset from relative underperformance in energy and real estate. MSCI EAFE MSCI EAFE Small Cap In Q4, there has been a decided shift towards value versus growth. 1 Source: Schroders, S&P, MSCI, 31 December 2016 2 Source: Schroders, MSCI Performance shown is past performance. Past performance is not necessarily a guide to future performance. The value of investment can go down as well as up and is not guaranteed 5

Performance State of Alaska International Smaller Companies Benchmark: MSCI EAFE SmallCap Index Value: US$ 156,818,751 as at 31 December 2016 Inception date: September 30, 2010 Performance to 31 December 2016 (in US$%) 3 months 6 months 1 year 3 years* 5 years* Since Inception* State of Alaska International Smaller Companies -3.5 +6.5 -0.9 +2.4 +10.6 +7.6 MSCI EAFE Small Cap Index -2.9 +5.5 +2.2 +2.1 +10.6 +7.3 Relative to MSCI EAFE Small Cap Index -0.6 +1.0 -3.1 +0.3 0.0 +0.3 Performance Attribution against MSCI EAFE Small Cap Index Contribution from 3 months 6 months 1 year 3 years* 5 years* Stock Selection -0.2 +1.5 -3.4 +0.3 +0.2 Region Allocation +0.5 -0.5 +0.3 +0.2 0.0 Residual +0.1 0.0 0.0 -0.2 -0.2 Difference Relative to MSCI EAFE Small Cap Index -0.6 +1.0 -3.1 +0.3 0.0 *Annualized Source: Schroders, MSCI, Factset PA2. Gross of fees. Past performance is not an indication of future performance. Please see full disclosures at the end of the presentation 6

Performance Value versus growth – 2016 Small Cap value versus growth PE FY1 2 MSCI EAFE Small Cap value versus growth performance 1 December 31, 2015 = 100 110 15 12 105 9 6 100 3 95 0 -3 90 -6 -9 85 -12 80 -15 Dec 15 Mar 16 Jun 16 Sep 16 Dec 16 Jun 89 Jun 92 Jun 95 Jun 98 Jun 01 Jun 04 Jun 07 Jun 10 Jun 13 Jun 16 MSCI EAFE Small Cap MSCI EAFE Small Cap Growth S&P EPAC Small Cap growth minus value PE FY1 Average MSCI EAFE Small Cap Value 1 Source: Datastream, MSCI, 31 December 2016 2 Source: Factset, MSCI, 31 December 2016 Performance shown is past performance. Past performance is not necessarily a guide to future performance. The value of investment can go down as well as up and is not guaranteed 7

Performance Attribution 12 months to 31 December 2016 State of Alaska International MSCI EAFE Small Cap Small Cap End Weight Total Return End Weight Total Return Stock Selection Regional Allocation Total Effect UK 15.2 -14.4 17.6 -10.5 -0.8 0.3 -0.5 39.2 0.6 38.8 2.9 -1.0 0.1 Continental Europe -0.9 Japan 28.2 2.3 31.7 7.6 -1.3 -0.2 -1.5 Pacific ex Japan 7.8 4.7 11.9 7.5 -0.3 -0.1 -0.4 Emerging Markets 7.4 4.6 - - - 0.1 0.1 Cash 2.2 - - - - 0.1 0.1 Residual - - - - - - 0.0 Total 100.0 -0.9 100.0 2.2 -3.4 0.3 -3.1 Top 5 Active Contributors Top 5 Active Detractors 12 months to December 31, 2016 12 months to December 31, 2016 Return (%) Contribution (%) Return (%) Contribution (%) Logitech International 66.8 0.62 Kumiai Chemical -43.5 -0.41 Ambu 32.6 0.32 windeln.de -67.9 -0.40 Aica Kogyo 36.4 0.26 Nippon Densetsu -26.4 -0.39 Borregaard 80.6 0.22 Dalata Hotel -22.4 -0.32 Interroll Holding 29.3 0.22 Anima Holding -34.5 -0.31 Source: Schroders, MSCI, Factset PA2. Gross of fees. * Stock not held by portfolio, index return shown. 8

Fund* risk characteristics * State of Alaska International Smaller Companies Source: Schroders Risk Report , Style Research as at December 31, 2016 Portfolio characteristics are subject to change and should not be viewed as an investment recommendation. Please see full disclosures at the end of the presentation. 9

Fund characteristics Schroders* vs MSCI EAFE Small Cap Index As at 31 December 2016 Schroders* Index Schroders* Index No of stocks 196 2,228 Percentage>$3Bn 15.3% 14.6% Free Market Capitalization US$M Percentage>$1Bn<$3Bn 32.5% 51.3% Minimum 78 75 Percentage>$0.5Bn<$1Bn 32.4% 21.6% 12,537 6,816 19.8% 12.4% Maximum Percentage<$0.5Bn Weighted Average 1,571 1,703 Total 100.0% 100.0% Median 868 642 Valuation factors Schroders* Index Valuation factors Schroders* Index P/E (12mo trailing) 16.8 15.5 3 Year Sales Growth 8.9 7.5 P/CF 11.9 10.8 3 Year Earnings Growth 19.6 16.4 2.0 1.5 36.5 36.7 P/BV Dividend Payout Ratio LT Debt/Capital 21.4 26.9 Dividend Yield 2.2 2.4 ROE 15.5 11.6 *State of Alaska International Smaller Companies Source: Schroders, Style Research, Factset 10

Recommend

More recommend