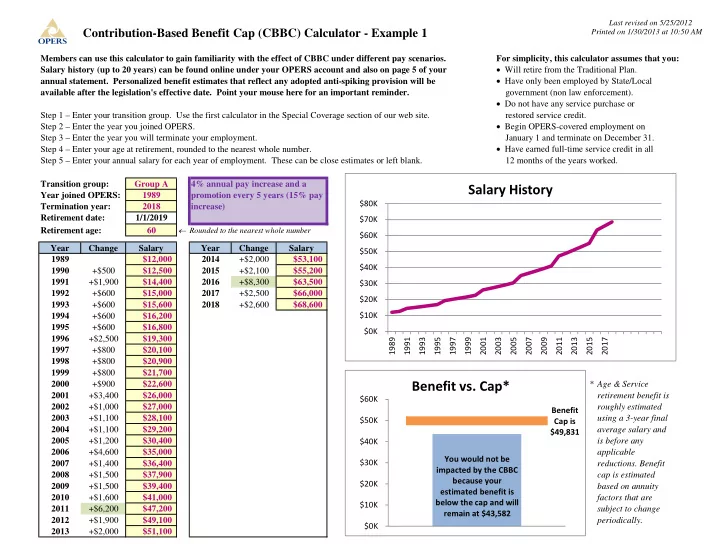

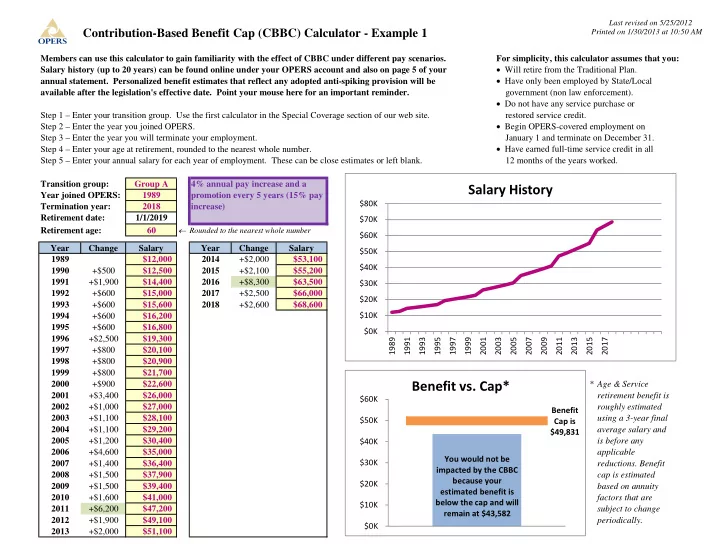

Last revised on 5/25/2012 Contribution-Based Benefit Cap (CBBC) Calculator - Example 1 Printed on 1/30/2013 at 10:50 AM Members can use this calculator to gain familiarity with the effect of CBBC under different pay scenarios. For simplicity, this calculator assumes that you: • Will retire from the Traditional Plan. Salary history (up to 20 years) can be found online under your OPERS account and also on page 5 of your • Have only been employed by State/Local annual statement. Personalized benefit estimates that reflect any adopted anti-spiking provision will be available after the legislation's effective date. Point your mouse here for an important reminder. government (non law enforcement). • Do not have any service purchase or Step 1 – Enter your transition group. Use the first calculator in the Special Coverage section of our web site. restored service credit. • Begin OPERS-covered employment on Step 2 – Enter the year you joined OPERS. Step 3 – Enter the year you will terminate your employment. January 1 and terminate on December 31. • Have earned full-time service credit in all Step 4 – Enter your age at retirement, rounded to the nearest whole number. Step 5 – Enter your annual salary for each year of employment. These can be close estimates or left blank. 12 months of the years worked. Transition group: Group A 4% annual pay increase and a Salary History Year joined OPERS: 1989 promotion every 5 years (15% pay $80K Termination year: 2018 increase) Retirement date: 1/1/2019 $70K ← Rounded to the nearest whole number Retirement age: 60 $60K Year Change Salary Year Change Salary $50K 1989 $12,000 2014 $53,100 +$2,000 $40K 1990 +$500 $12,500 2015 +$2,100 $55,200 1991 $14,400 2016 $63,500 +$1,900 +$8,300 $30K 1992 +$600 $15,000 2017 +$2,500 $66,000 $20K 1993 +$600 $15,600 2018 +$2,600 $68,600 $10K 1994 +$600 $16,200 1995 +$600 $16,800 $0K 1996 +$2,500 $19,300 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 1997 +$800 $20,100 1998 +$800 $20,900 1999 +$800 $21,700 Benefit vs. Cap* 2000 +$900 $22,600 * Age & Service 2001 +$3,400 $26,000 retirement benefit is $60K 2002 +$1,000 $27,000 roughly estimated Benefit 2003 +$1,100 $28,100 using a 3-year final $50K Cap is 2004 +$1,100 $29,200 average salary and $49,831 2005 +$1,200 $30,400 $40K is before any 2006 $35,000 +$4,600 applicable You would not be $30K 2007 +$1,400 $36,400 reductions. Benefit impacted by the CBBC 2008 $37,900 +$1,500 cap is estimated because your $20K 2009 +$1,500 $39,400 based on annuity estimated benefit is 2010 $41,000 +$1,600 factors that are below the cap and will $10K 2011 +$6,200 $47,200 subject to change remain at $43,582 2012 $49,100 +$1,900 periodically. $0K 2013 +$2,000 $51,100

Last revised on 5/25/2012 Contribution-Based Benefit Cap (CBBC) Calculator - Example 2 Printed on 1/30/2013 at 10:50 AM Members can use this calculator to gain familiarity with the effect of CBBC under different pay scenarios. For simplicity, this calculator assumes that you: • Will retire from the Traditional Plan. Salary history (up to 20 years) can be found online under your OPERS account and also on page 5 of your • Have only been employed by State/Local annual statement. Personalized benefit estimates that reflect any adopted anti-spiking provision will be available after the legislation's effective date. Point your mouse here for an important reminder. government (non law enforcement). • Do not have any service purchase or Step 1 – Enter your transition group. Use the first calculator in the Special Coverage section of our web site. restored service credit. • Begin OPERS-covered employment on Step 2 – Enter the year you joined OPERS. Step 3 – Enter the year you will terminate your employment. January 1 and terminate on December 31. • Have earned full-time service credit in all Step 4 – Enter your age at retirement, rounded to the nearest whole number. Step 5 – Enter your annual salary for each year of employment. These can be close estimates or left blank. 12 months of the years worked. Transition group: Group A Same as example 1, except for a Salary History Year joined OPERS: 1989 300% pay increase 5 years before $200K Termination year: 2018 retirement. $180K Retirement date: 1/1/2019 ← Rounded to the nearest whole number $160K Retirement age: 60 $140K Year Change Salary Year Change Salary $120K 1989 $12,000 2014 $153,300 +$102,200 $100K 1990 +$500 $12,500 2015 +$6,100 $159,400 $80K 1991 $14,400 2016 $165,800 +$1,900 +$6,400 $60K 1992 +$600 $15,000 2017 +$6,600 $172,400 1993 +$600 $15,600 2018 +$6,900 $179,300 $40K 1994 +$600 $16,200 $20K 1995 +$600 $16,800 $0K 1996 +$2,500 $19,300 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 1997 +$800 $20,100 1998 +$800 $20,900 1999 +$800 $21,700 Benefit vs. Cap* 2000 +$900 $22,600 * Age & Service 2001 +$3,400 $26,000 retirement benefit is Benefit $80K 2002 +$1,000 $27,000 roughly estimated Cap is $70K 2003 +$1,100 $28,100 using a 3-year final $74,175 2004 +$1,100 $29,200 average salary and $60K You would be 2005 +$1,200 $30,400 is before any $50K impacted by the CBBC 2006 $35,000 +$4,600 applicable because of your salary $40K 2007 +$1,400 $36,400 reductions. Benefit history and the 2008 $37,900 +$1,500 cap is estimated $30K estimated benefit of 2009 +$1,500 $39,400 based on annuity $113,850 will be $20K 2010 $41,000 +$1,600 factors that are capped at $74,175 2011 +$6,200 $47,200 $10K subject to change 2012 $49,100 +$1,900 periodically. $0K 2013 +$2,000 $51,100

Last revised on 5/25/2012 Contribution-Based Benefit Cap (CBBC) Calculator - Example 3 Printed on 1/30/2013 at 10:50 AM Members can use this calculator to gain familiarity with the effect of CBBC under different pay scenarios. For simplicity, this calculator assumes that you: • Will retire from the Traditional Plan. Salary history (up to 20 years) can be found online under your OPERS account and also on page 5 of your • Have only been employed by State/Local annual statement. Personalized benefit estimates that reflect any adopted anti-spiking provision will be available after the legislation's effective date. Point your mouse here for an important reminder. government (non law enforcement). • Do not have any service purchase or Step 1 – Enter your transition group. Use the first calculator in the Special Coverage section of our web site. restored service credit. • Begin OPERS-covered employment on Step 2 – Enter the year you joined OPERS. Step 3 – Enter the year you will terminate your employment. January 1 and terminate on December 31. • Have earned full-time service credit in all Step 4 – Enter your age at retirement, rounded to the nearest whole number. Step 5 – Enter your annual salary for each year of employment. These can be close estimates or left blank. 12 months of the years worked. Transition group: Group A Mid career spiking Salary History Year joined OPERS: 1989 $70K Termination year: 2018 Retirement date: 1/1/2019 $60K ← Rounded to the nearest whole number Retirement age: 60 $50K Year Change Salary Year Change Salary $40K 1989 $12,000 2014 $26,300 +$1,000 1990 +$500 $12,500 2015 +$1,100 $27,400 $30K 1991 $13,000 2016 $28,500 +$500 +$1,100 1992 +$500 $13,500 2017 +$1,100 $29,600 $20K 1993 +$500 $14,000 2018 +$1,200 $30,800 $10K 1994 +$600 $14,600 1995 +$600 $15,200 $0K 1996 +$600 $15,800 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 1997 +$600 $16,400 1998 +$700 $17,100 1999 +$700 $17,800 Benefit vs. Cap* 2000 +$700 $18,500 * Age & Service 2001 +$37,000 $55,500 retirement benefit is $45K Benefit 2002 +$2,200 $57,700 roughly estimated $40K Cap is 2003 +$2,300 $60,000 using a 3-year final $40,202 $35K 2004 +$2,400 $62,400 average salary and You would be 2005 +$2,500 $64,900 $30K is before any impacted by the CBBC 2006 $19,200 -$45,700 applicable $25K because of your salary 2007 +$800 $20,000 reductions. Benefit $20K history and the 2008 $20,800 +$800 cap is estimated estimated benefit of $15K 2009 +$800 $21,600 based on annuity $41,206 will be 2010 $22,500 +$900 $10K factors that are capped at $40,202 2011 +$900 $23,400 subject to change $5K 2012 $24,300 +$900 periodically. $0K 2013 +$1,000 $25,300

Recommend

More recommend