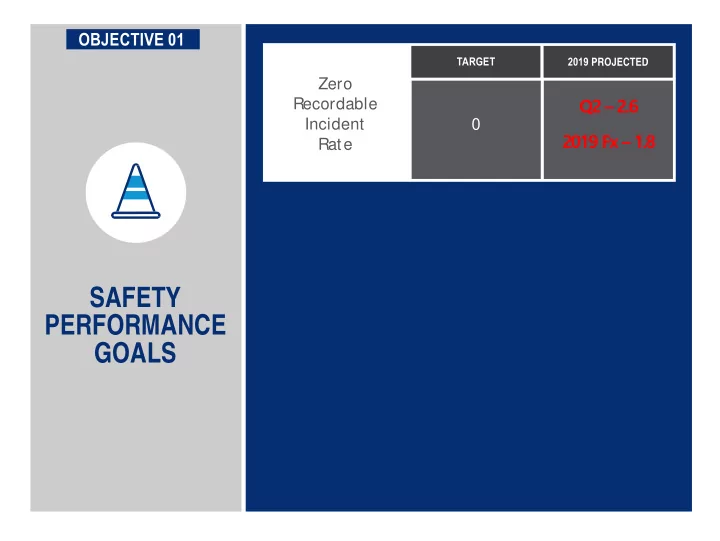

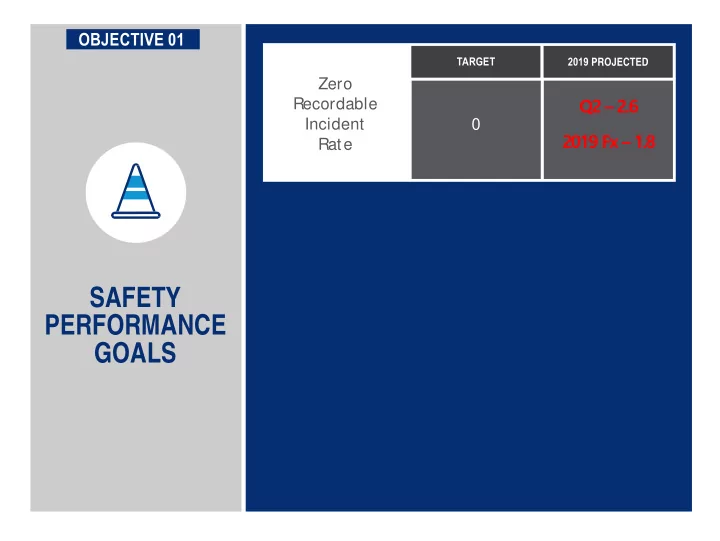

PROJECTED Zero Q2 – 2.6 Recordable Incident 0 2019 Fx – 1.8 Rate SAFETY PERFORMANCE GOALS

Electric S ystem Liquidit y $188.7 MM >= $105 MM Consolidated Return on Net 3.5% >= 3.8% Asset s MAINTAIN Consolidat ed A STRONG Debt t o Plant 58.7% Rat io <= 62% FINANCIAL POSITION Consolidated Debt S ervice 1.94X >= 1.80X Coverage

Ret ail Operating Ratio 106.5% <= 113% Adj usted "Peer Group of Excellence" Rate Index N/ A <= 100.0% <= 100.0% PROVIDE Ratio LONG TERM LOW RATES District Credit AA3 Rating >= AA3 (Moody ’ s equivalent) 2019

Average S ystem Availabilit y 99.966% >= 99.985% Index (AS AI) Customer Average Interruption Index 214.6 min < 110 min (CAIDI) PROVIDE Ret ail Customer OUTSTANDING S atisfaction TBD Fall ‘ 19 >= 85% SERVICE TO OUR S urvey CUSTOMERS PROJECTED PRP Tot al 3/6 mos – Q2 12/ 12 mos Availabilit y 8/12 mos - Fx

Financial S t atement Audit Performance TBD Spring ‘ 20 Unmodified Audit Opinion WA S t ate Audit Of fice Compliance TBD Fall ‘ 19 Audit Performance No Audit Findings FERC / NERC / WECC Electric Reliabilit y Compliance No No Audit No Audit Findings Performance OPERATE Findings RESPONSIBLY S afet y, Health, BY ATTAINING Cult ural Resource and ENVIRONMENTAL, YES Hazardous Material Zero Performance Violations CULTURAL RESOURCE AND REGULATORY Timeliness of All COMPLIANCE FERC and Regulatory Zero YES Filings Late Filings

Achieve Planned Capital Build for NO 100% Current Year 2019 PROJECTED TARGET Q2 56.4% Average S ystem Take Rate >=56.5% >=56.5% 2019 Fx - YES 2019 Fx DEVELOP A SUSTAINABLE BROADBAND NETWORK

2019 PROJECTED TARGETS 2019 TARGET PROJECTED Q 2 - 2.6 Zero Recordable Incident Rate 0 2019 Fx 1.8 SAFETY PERFORMANCE GOALS Electric System Liquidity >=$105 MM $188.7 MM MAINTAIN Consolidated Return On Net Assets >= 3.8% 3.5% A STRONG Consolidated Debt To Plant Ratio <= 62% 58.7 % FINANCIAL POSITION Consolidated Debt Service Coverage 1.94X > 1.80X <= 113.0% 106.5% Retail Operating Ratio – Adjusted PROVIDE "Peer Group of Excellence" Rate Index Ratio <= 100.0 % N/A LONG TERM LOW RATES >= AA 3 District Credit Rating AA3 (Moody's equivalent) Average System Availability Index (ASAI) >= 99.985% 99.966 % Customer Average Interruption Index (CAIDI) PROVIDE < 110 MIN 214.6 MIN OUTSTANDING TBD Retail Customer Satisfaction Survey >= 85% Fall 2019 SERVICE TO OUR 3/6 mos - Q2 CUSTOMERS PRP Total Availability 12/12 m os 8/ 12 mos - Fx Financial Statement Audit Performance UNMODIFIED TBD 2020 AUDIT OPINION NO AUDIT WA State Audit Office Compliance Audit Performance TBD Fall ‘ 19 FINDINGS OPERATE NO NO AUDIT FERC / NERC / WECC Electric Reliability Compliance RESPONSIBLY FINDINGS ZERO Safety, Health, Cultural Resource & Hazardous Material YES VIOLATIONS ZERO LATE Timeliness of All FERC and Regulatory Filings YES FILINGS Achieve Planned Capital Build for Current Year 100% NO DEVELOP A Q2 56.4% Average System Take Rate SUSTAINABLE >= 56.5% 2019 Fx YES BROADBAND NETWORK

Fish and Wildlife Quarterly Business Report Grant PUD Commission Meeting September 10, 2019 Operate Responsibly by Attaining Environmental, Cultural Resource and Regulatory Compliance Powering our way of life.

Business Unit Purpose & Goal The Fish and Wildlife Business Unit uses technology, innovation, strategic thinking, good stakeholder relations and skilled negotiations to ensure we are achieving compliance with our Natural Resources regulatory requirements in a safe, cost efficient and biologically sound manner while helping to maintain the long-term financial health of the District.

2019 Safety Review Safety No Recordable Incidents to Date; A total of 419 Job Briefs (as of 8/15/2019); 156 Job Briefs on 6/11/2019 A total of 71 Job Site Reviews (as of 8/15/2019); Goal = 10%. Currently at 16.9 %; Overall Safety Meeting Attendance = 100% ;

2019 Safety Review Tracking Safety Concerns Lockout/Tag Out Procedure & Switch for rotary intake screen at Nason Creek Video Fish Count Stations (Access Hatches); Carlton Acclimation Facility Eye Wash Station Priest Rapids Hatchery Safety Measures; Adult Volunteer Trap Adult Holding Pond Incubation Building Raceways Channel Ponds Safety Showers Badge Scanner at FW Shop;

2019 Safety Review Completed Safety Issues Safety Rail System on bow of electrofishing boat; Safety/Continuous Improvement – Setline Retrieval System Developed/Updated JHA for Shoreline Work; Developed/Updated JHA for Turbine/Fishway; Clarification on Fish Counting Stations as Not a Confined Space; Completed several safety issues at PR Hatchery; Completed review Boat Guidance Document for Environmental Affairs.

2019 Compliance Review NMFS 2008 File 22 annual reports and plans with various agencies; Biological Opinion Progress & Implementation Report (8 Combined) Aquatic Invasive Species Control & Prevention Priest Rapids Bull trout report and 10 year review Salmon and WADOE White Sturgeon annual report Steelhead 401 Settlement Certification Pacific Lamprey annual report Agreement Priest Rapids Northern Wormwood Conservation Plan Project Gas Abatement Plan FERC License Transmission Line Collision Protection Bald Eagle Perching/Roosting Protection Plan Wildlife Habitat Monitoring, Info & education Native Resident Fish Fish Spill and total dissolved gas report Hanford USFWS USFWS Annual Recovery report Reach Fall 2008 Chinook USFWS Annual – Special Use Permit Biological Protection Opinion Program File 12 reports related to mitigation sites; Potential Boundary Adjustment for Nason Creek Acclimation Facility with FERC. Further research is necessary.

2019 Budget Review Fish & Wildlife Business Unit - Allocated Resources Fish & Wildlife Staff 15 Full-Time Regulars (FTRs) Labor = 13.8% 11.06 Full-Time Equivalents (FTEs) Fish and Wildlife Manager (1 FTR) Cap = 2.4% 0.6 FTEs Hatchery & Habitat (6 FTRs) 5.0 FTEs Anadromous & Resident Fish (5 FTRs) 3.0 FTEs Wildlife/Botanical (3 FTRs) 3.0 FTEs Budget Operation & Maintenance = $12,807,101 Capital = $ 365,000 Operations and Maintenance = 83.8% Labor = $ 2,108,471 2019 Total Budget $15,280,572

2019 Budget Review – Allocated Budget Year-End Year-End Actuals ($) Category Budget Projection Projection For Month Ended ($) (%) (7/31/2019) O&M $12,807,101 $5,292,957 $12,349,386 96.4% Capital $365,000 $26,732 $217,773 59.7% Labor $2,108,471 $1,125,706 $2,088,471 99.1% Total $15,280,572 $6,445,395 $14,655,630 96.9%

2019 Business Activities Engineering alternatives analysis and development the necessary permit level designs to address Carlton Acclimation Facility Intake Structure issues. Issue: Methow River migrating away from intake structure . Completed Draft Channel Assessment & Conceptual Alternatives Analysis. ($1.2 – $5.3Million) 2 In-river Alternatives - 2 Infiltration Gallery Alternatives – ($2.3 – $3.2 Million) Water Reuse Alternative – ($2.9 Million) Cost Estimates DO NOT include Mitigation Costs or Internal Labor In Progress District Staff Reviewing and Discussion Options .

2019 Business Activities Rehabilitation or New Wells at Priest Rapids Hatchery. Issue: Three of the eight wells were inoperable during a majority of the timeframe when the Priest Rapids Reservoir was operated at lower elevations for Priest Rapids Spillway work/evaluation. Completed Rehabilitation and testing has been completed on 1 of the 3 wells. Efforts to rehabilitate the first well were successful. Next Steps Rehabilitation and testing of the two remaining wells will Fall/Winter 2019 or 2020 after fish are off station.

2019 Business Activities Develop financial and strength, weakness, opportunities and threat analysis (SWOT) for the operation of the Priest Rapids Hatchery. Completed Financial analysis completed. 4 scenarios reviewed; Status quo: WDFW performs all work (M&E, all Tagging and O&M). Case 2: WDFW - M&E/All Tagging. GPUD – Hatchery O&M. Case 3: WDFW - M&E/Some Tagging. GPUD – Hatchery O&M & marking trailer. Case 4: WDFW - M&E. GPUD – Hatchery O&M and purchases 2 marking trailers. In Progress Reviewing Analysis with Business and Financial Planning Analysts; Gathering information on need to develop an Affirmative Action Plan; Exploring different contracting options with USCOE; Finalizing SWOT Analysis; Schedule Recommendation to Managing Director of PP, COO and CEO/GM October 31, 2019

2019 Business Activities Summer Subyearling Survival standards. Current evaluations are scheduled for 2020, 2021 & 2022. Completed Reduced No-Net-Impact Fund contributions for subyearling summer Chinook by $105,857.94 annually through the use of existing data. Based on a revaluation of the estimated NNI liability a $2.7M NPV over the life of the agreement/license term will be realized. In Progress Statement of Agreement presented to PRCC to defer survival and behavior evaluations. Deferment is based on life history and technology challenges.

Recommend

More recommend