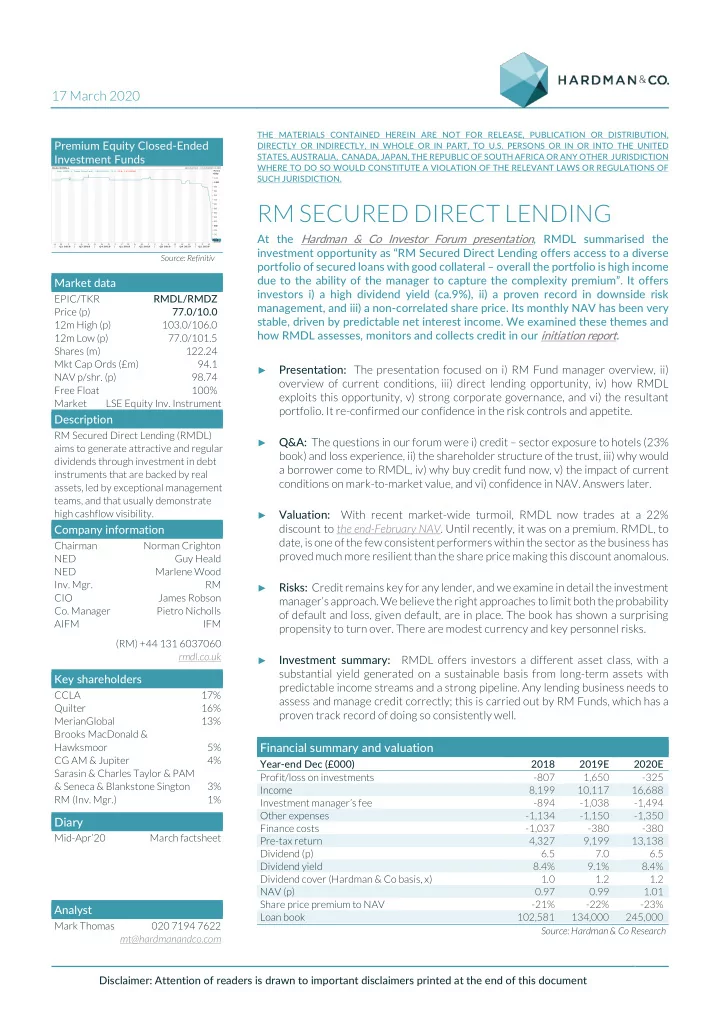

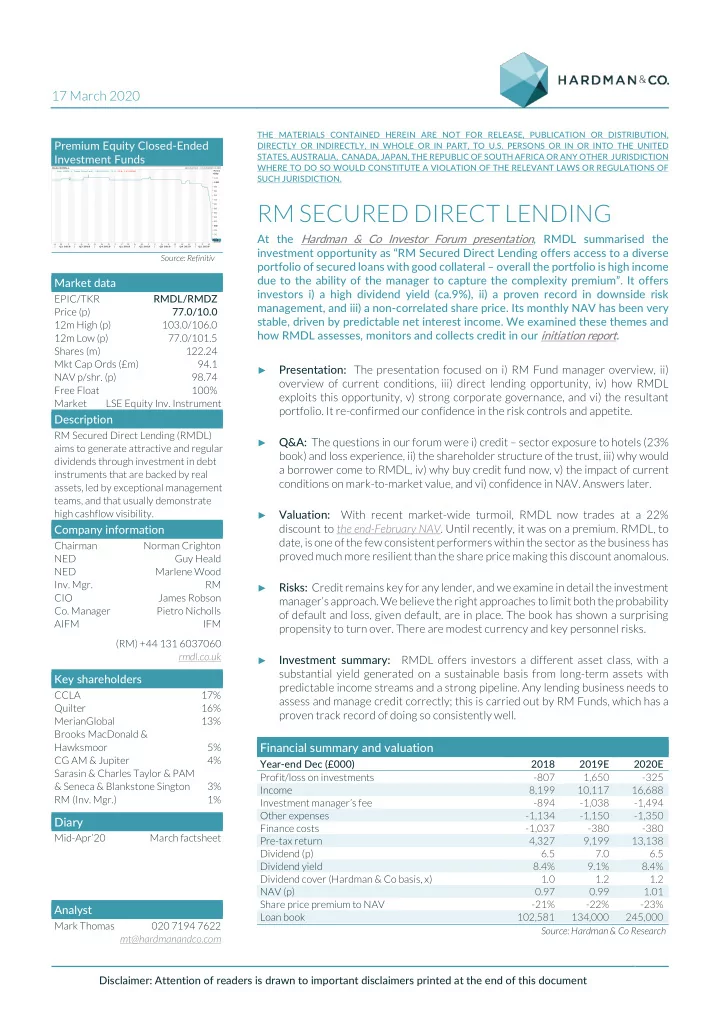

17 March 2020 THE MATERIALS CONTAINED HEREIN ARE NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, Premium Equity Closed-Ended DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, TO U.S. PERSONS OR IN OR INTO THE UNITED Investment Funds STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF Daily RMDL.L 19/03/2018 - 17/03/2020 (LON) Line, RMDL.L, Trade Price(Last), 16/03/2020, 73.5, -9.5, (-11.05%) Price SUCH JURISDICTION. GBp 102 100 98 96 94 RM SECURED DIRECT LENDING 92 90 88 86 84 82 80 78 At the Hardman & Co Investor Forum presentation, RMDL summarised the 76 74 73.5 Auto A M J J A S O N D J F M A M J J A S O N D J F M Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 investment opportunity as “RM Secured Direct Lending offers access to a diverse Source: Refinitiv portfolio of secured loans with good collateral – overall the portfolio is high income due to the ability of the manager to capture the complexity premium”. It offers Market data investors i) a high dividend yield (ca.9%), ii) a proven record in downside risk EPIC/TKR RMDL/RMDZ management, and iii) a non-correlated share price. Its monthly NAV has been very Price (p) 77.0/10.0 stable, driven by predictable net interest income. We examined these themes and 12m High (p) 103.0/106.0 how RMDL assesses, monitors and collects credit in our initiation report. 12m Low (p) 77.0/101.5 Shares (m) 122.24 Mkt Cap Ords (£m) 94.1 Presentation: The presentation focused on i) RM Fund manager overview, ii) ► NAV p/shr. (p) 98.74 overview of current conditions, iii) direct lending opportunity, iv) how RMDL Free Float 100% exploits this opportunity, v) strong corporate governance, and vi) the resultant Market LSE Equity Inv. Instrument portfolio. It re-confirmed our confidence in the risk controls and appetite. Description RM Secured Direct Lending (RMDL) Q&A: The questions in our forum were i) credit – sector exposure to hotels (23% ► aims to generate attractive and regular book) and loss experience, ii) the shareholder structure of the trust, iii) why would dividends through investment in debt a borrower come to RMDL, iv) why buy credit fund now, v) the impact of current instruments that are backed by real conditions on mark-to-market value, and vi) confidence in NAV. Answers later. assets, led by exceptional management teams, and that usually demonstrate high cashflow visibility. Valuation: With recent market-wide turmoil, RMDL now trades at a 22% ► discount to the end-February NAV . Until recently, it was on a premium. RMDL, to Company information date, is one of the few consistent performers within the sector as the business has Chairman Norman Crighton proved much more resilient than the share price making this discount anomalous. NED Guy Heald NED Marlene Wood Inv. Mgr. RM Risks: Credit remains key for any lender, and we examine in detail the investment ► CIO James Robson manager’s approach. We believe the right approaches to limit both the probability Co. Manager Pietro Nicholls of default and loss, given default, are in place. The book has shown a surprising AIFM IFM propensity to turn over. There are modest currency and key personnel risks. (RM) +44 131 6037060 rmdl.co.uk Investment summary: RMDL offers investors a different asset class, with a ► substantial yield generated on a sustainable basis from long-term assets with Key shareholders predictable income streams and a strong pipeline. Any lending business needs to CCLA 17% assess and manage credit correctly; this is carried out by RM Funds, which has a Quilter 16% proven track record of doing so consistently well. MerianGlobal 13% Brooks MacDonald & Financial summary and valuation Hawksmoor 5% CG AM & Jupiter 4% Year-end Dec (£000) 2018 2019E 2020E Sarasin & Charles Taylor & PAM Profit/loss on investments -807 1,650 -325 & Seneca & Blankstone Sington 3% Income 8,199 10,117 16,688 RM (Inv. Mgr.) 1% Investment manager’s fee -894 -1,038 -1,494 Other expenses -1,134 -1,150 -1,350 Diary Finance costs -1,037 -380 -380 Mid-Apr’20 March factsheet Pre-tax return 4,327 9,199 13,138 Dividend (p) 6.5 7.0 6.5 Dividend yield 8.4% 9.1% 8.4% Dividend cover (Hardman & Co basis, x) 1.0 1.2 1.2 NAV (p) 0.97 0.99 1.01 Share price premium to NAV -21% -22% -23% Analyst Loan book 102,581 134,000 245,000 Mark Thomas 020 7194 7622 Source: Hardman & Co Research mt@hardmanandco.com Disclaimer: Attention of readers is drawn to important disclaimers printed at the end of this document

RM SECURED DIRECT LENDING IMPORTANT INFORMATION THE MATERIALS CONTAINED HEREIN ARE NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, TO U.S. PERSONS OR IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION. The information and materials contained in this report are exclusively intended for persons who are not residents of the United States and who are not physically present in the United States. The information contained herein and on the preceding pages follow do not constitute an offer of securities for sale or a solicitation of an offer to purchase securities in the United States or in any jurisdiction or jurisdictions in which such offers or sales are unlawful. The securities referred to herein and on the pages that follow have not been nor will they be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or with any securities regulatory authority of any state or other jurisdiction of the United States and may not be offered, sold, resold, taken up, exercised, renounced, transferred, delivered or distributed, directly or indirectly, within the United States or to or for the account or benefit of U.S. Persons (as defined in Regulation S of the Securities Act) except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable state securities laws. There will be no public offer of the securities in the United States, Australia, Canada, Japan or the Republic of South Africa or any jurisdiction in which such an offer would constitute a violation of the relevant laws or regulations of such jurisdiction. RM Secured Direct Lending Plc will not be registered under the U.S. Investment Company Act of 1940, as amended, and investors will not be entitled to the benefits of that Act. An investment in the securities referred to herein and on the pages that follow are only suitable for institutional investors and professionally-advised private investors who understand and are capable of evaluating the merits and risks of such an investment and who have sufficient resources to be able to bear any losses (which may equal to whole amount of amount invested) that may result from such an investment. Subject to certain exceptions, the securities referred to herein and on the pages that follow may not be offered, sold, resold, taken up, exercised, renounced, transferred, delivered or distributed, directly or indirectly, in Australia, Canada, Japan, the Republic of South Africa or any jurisdiction where to do so would constitute a violation of the relevant laws or regulations of such jurisdiction or to any resident or citizen of Australia, Canada, Japan or the Republic of South Africa. The offer and sale of the securities referred to herein and on the pages that follow have not been and will not be registered under the applicable securities laws of Australia, Canada, Japan or the Republic of South Africa. Recipients of this information in any other jurisdiction should inform themselves about and observe any applicable legal requirements in their jurisdiction. 17 March 2020 2

Recommend

More recommend