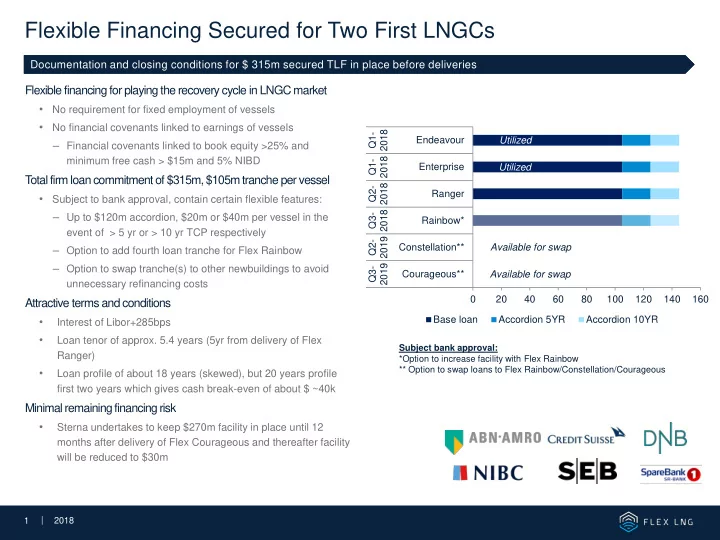

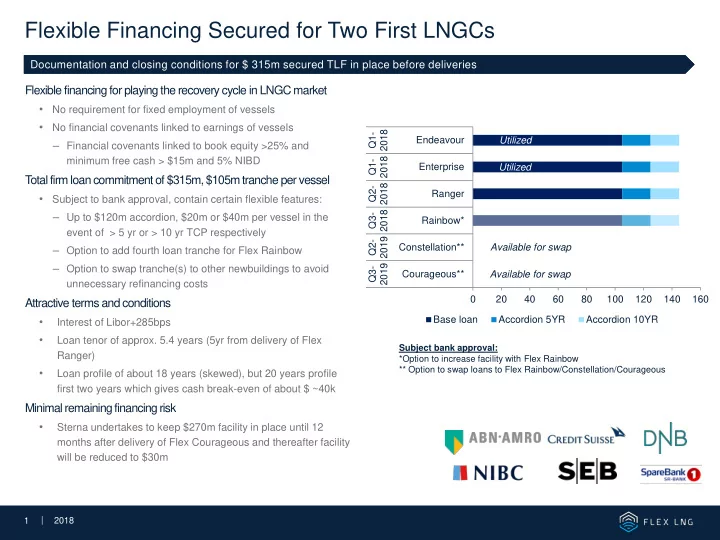

Flexible Financing Secured for Two First LNGCs Documentation and closing conditions for $ 315m secured TLF in place before deliveries Flexible financing for playing the recovery cycle in LNGC market • No requirement for fixed employment of vessels • No financial covenants linked to earnings of vessels 2018 Q1- Endeavour Utilized – Financial covenants linked to book equity >25% and 2018 minimum free cash > $15m and 5% NIBD Q1- Enterprise Utilized T otal firm loan commitment of $315m, $105m tranche per vessel 2018 Q2- Ranger • Subject to bank approval, contain certain flexible features: 2018 – Up to $120m accordion, $20m or $40m per vessel in the Q3- Rainbow* event of > 5 yr or > 10 yr TCP respectively 2019 Q2- Constellation** Available for swap – Option to add fourth loan tranche for Flex Rainbow – Option to swap tranche(s) to other newbuildings to avoid 2019 Q3- Courageous** Available for swap unnecessary refinancing costs 0 20 40 60 80 100 120 140 160 Attractive terms and conditions • Base loan Accordion 5YR Accordion 10YR Interest of Libor+285bps • Loan tenor of approx. 5.4 years (5yr from delivery of Flex Subject bank approval: Ranger) *Option to increase facility with Flex Rainbow ** Option to swap loans to Flex Rainbow/Constellation/Courageous • Loan profile of about 18 years (skewed), but 20 years profile first two years which gives cash break-even of about $ ~40k Minimal remaining financing risk • Sterna undertakes to keep $270m facility in place until 12 months after delivery of Flex Courageous and thereafter facility will be reduced to $30m | 1 1 | 2017 1 | 2017 2018

Evolution of LNGC Financing LNG evolving from utility business to global tradeable commodity business LNG 1. 1.0 LNG 2.0 LNG 3.0 • 1960s to mid 2000s • Mid-2000s - today • Today - Future • Traditional model • Portfolio players • Commoditization of LNG • Point-to-point trade • More portfolio trade • Worldwide opportunistic trade • Back2back contracts 20yr+ • Term contracts (7-15yr) • Short and medium term contracts Utility business MLP business Capital market business • • • • Steam vessels • DFDE/TFDE vessels • Gas injection vessels (MEGI/XDF) • Leverage 80-100% • Leverage 70-80% • Leverage 50-75% • Libor spread yield • MLP yield • ROCE FLEX LNG is finance anced d for the LNG 3.0 model with h flexible xible financin ncing | 2 2 | 2017 2 | 2017 2018

Capital in Scarce Supply for Shipping Sector Reduction in volume for both bank financing as well as capital market products (bonds and public/private equity) • Shipping sector, including LNGC, have historically been “over - banked” which have resulted in relative low historical capital return due to over-investment in new tonnage for most segments • Less available and dearer capital will lead to more capital discipline as well as credit rationing • This structural change is positive for companies like FLEX LNG which can leverage it’s relationship through Geveran/Seatankers to source capital which might not otherwise be available for independent shipping companies Source: Dealogic and Marine Money | 3 3 | 2017 3 | 2017 2018

Thank You | 4 4 | 2017 4 | 2017 2018

Recommend

More recommend