Resource Rich Colorado Colorado s National and Global Position in - PowerPoint PPT Presentation

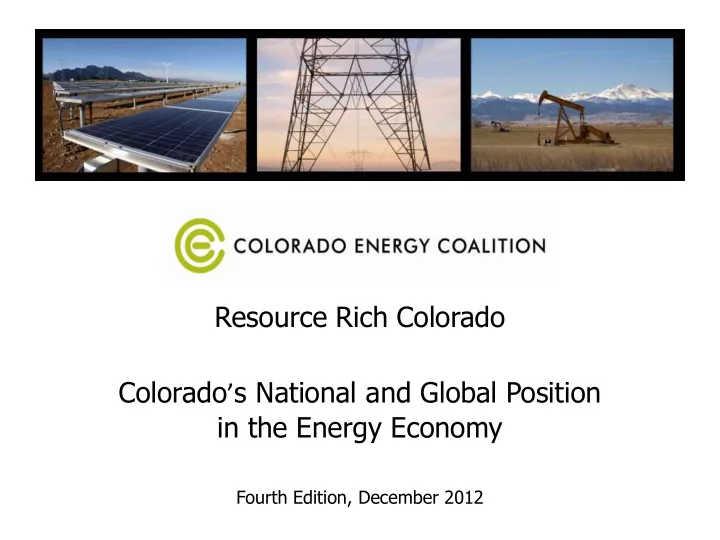

Resource Rich Colorado Colorado s National and Global Position in the Energy Economy Fourth Edition, December 2012 Resource Rich Colorado This annual report analyzes Colorados broad energy industry cluster, in order to illustrate how

Resource Rich Colorado Colorado ’ s National and Global Position in the Energy Economy Fourth Edition, December 2012

Resource Rich Colorado This annual report analyzes Colorado’s broad energy industry cluster, in order to illustrate how Colorado stacks up to the competition domestically, and how the U.S. stacks up to the competition internationally.

Resource Rich Colorado Acknowledgements Competitive Analysis Committee Members Chris Hansen, IHS, Committee Chair John Armstrong, Enserca LLC. Beth Chacon, Xcel Energy Brian Payer, URS Corporation Matthew T. Palmer, Encana Marketing (USA) Inc. Larry Holdren, Pure Brand Communications

Oil

Crude Oil Prices, 1999-2011 Colorado produced oil prices trend below the national average; U.S. average price in 2011 was $94.88 per barrel 120 Colorado crude oil $88.26 U.S. Crude Oil $/Barrel 100 Colorado Crude Oil $/Barrel Dollars per Barrel 80 60 40 20 0 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Fig. 1 Source: U.S. Department of Energy, OK-WTI, Energy Information Administration

Crude Oil Production by State, 2008-2011 Colorado ranks 10th in crude oil production; Colorado production is on the rise 600 2008 500 Million Barrels per Year 2009 2010 400 2011 300 200 CO ranks 10th in production 39 million barrels 100 0 TX AK CA ND OK NM LA WY KS CO Source: U.S. Department of Energy, Energy Information Administration Note: Crude oil includes all liquid hydrocarbons at surface, including lease condensates Fig. 2

Crude Oil Reserves & Utilization Rate Technology improvements contribute to growing reserves 7,000 6.72% Reserves 2009 6,000 Reserves 2010 Million Barrels Production 2010 5,000 5.91% 4,000 6.84% CO ranks 10th 3,000 in reserves at 501 million barrels with a 6.59% annual 5.99% utilization rate 2,000 7.34% 7.05% 6.44% 1,000 12.64% 4.83% 0 TX AK CA ND OK NM WY LA UT CO Source: U.S. Department of Energy, Energy Information Administration Fig. 3 Note: Utilization rate is the amount of reserves developed/produced annually; crude oil reserves include lease condensate

Oil Production Leaders, 2008-2011 U.S. ranks 3rd in production; domestic production on the rise 4000 Top eight producers represent over 50% of global production; 3500 total global production for U.S. ranks 3rd in 2011 was 29.4 billion barrels. global production 3000 with 2.54 billion barrels Million Barrels 2008 2500 2009 2010 2000 2011 1500 1000 500 0 Saudi Arabia Russia U.S. Iran China Canada United Arab Venezuela Emirates Source: International Energy Agency (IEA), 2009-2012 Key World Energy Statistics Note: Includes crude oil, natural gas liquids, feedstocks, additives, and other hydrocarbons Fig. 4

U.S. Crude Oil Production & Consumption, 1973-2011 The gap is narrowing, as domestic production has increased since 2009 and domestic consumption has decreased since 2006 25 20 Million Barrels per Day Where does Latin America, the U.S. get 19.6% its oil? 15 U.S., 38.8% Canada, 15.1% Persian Gulf, 10 12.9% Other, Africa, 3.1% 10.3% 5 U.S. Oil Consumption U.S. Oil Production 0 Source: U.S. Department of Energy, Energy Information Administration; NPR in conjunction with Nelson Hsu Fig. 8

Natural Gas

Natural Gas Wellhead Prices, 1999-2011 The Colorado price trends below the national average to account for fuel transportation costs to markets outside the state 9 U.S. Natural Gas 8 Colorado Natural Gas Dollars per Thousand Cubic Feet 7 CO price in 2011 6 was $3.75 5 4 3 2 1 0 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Source: U.S. Department of Energy, Energy Information Administration Fig. 9

Natural Gas Production by State, 2007-2010 Colorado ranks 5th in production; production is increasing due to resource development technology improvements 7 6 2007 Trillion Cubic Feet (Tcf) 2008 5 2009 2010 4 CO ranks 5th 3 in production 1.5 (Tcf) 2 1 0 TX WY LA OK CO NM AR PA UT AK Source: U.S. Department of Energy, Energy Information Administration Note: Top 10 producers including Colorado Fig. 10

Natural Gas Reserves & Utilization Rate Technology is contributing to growing reserves nationwide 100 7.38% 90 2009 Reserves 80 2010 Reserves Trillion Cubic Feet (Tcf) 2010 Production 70 60 50 CO ranks 5th in reserves at 25.37 (Tcf) with a 40 6.02% 6.21% utilization rate 10.05% 7.05% 30 20 7.21% 8.52% 8.09% 10 0 TX WY LA OK CO NM AR PA Source: U.S. Department of Energy, Energy Information Administration Note: Top eight states including Colorado; utilization rate is the amount of reserves developed/produced annually Fig. 11

Natural Gas Production Leaders, 2008-2011 U.S. is 2nd and growing; top 8 producers equal 61.6% of global production 30 2008 U.S. ranks 2nd 25 with 19.2% of 2009 Trillion Cubic Feet (Tcf) global production 22.99 (Tcf) 2010 20 2011 15 10 5 0 Russia U.S. Canada Qatar Iran Norway China Indonesia Source: International Energy Agency Fig. 12

Fig15

U.S. Shale Gas Production by Major Resource Play Technology has led to quickly expanding resource development 22 Eagle Ford (TX) 20 Woodford (OK) 18 Marcellus (OH, WV, PA, NY) Billion Cubic Feet per Day Haynesville (TX, LA) 16 Fayetteville (AR) 14 Barnett (TX) 12 10 8 6 4 2 - 2007 2008 2009 2010 2011 Source: HPDI; Encana Corporation Fig. 16

U.S. Natural Gas Production & Consumption Domestic production has increased steadily since 2006 30 25 Trillion Cubic Feet (Tcf) 20 15 Natural Gas Production Natural Gas 10 Consumption 5 0 1950 1960 1970 1980 1990 2000 2010 Fig. 18 Source: U.S Department of Energy, Energy Information Administration

Coal

U.S. Coal Production by State, 2008-2011 Colorado coal production recovering after low point in 2010 500 450 2008 400 2009 350 Million Short Tons 2010 2011 300 250 200 150 Colorado ranks 11th with 27 million short tons 100 50 0 WY WV KY PA MT TX IN IL ND OH CO Source: U.S. Department of Energy, Energy Information Administration Fig . 20 Note: Top 10 states plus Colorado; short ton equals 2,000 pounds

U.S. Coal Reserves & Utilization Rate, 2010 Percent equals utilization rate of state reserves; coal reserves are massive, contributing to an extremely small utilization rate 80 0.06% 70 60 Billion Short Tons 50 1.16% 0.09% 40 CO ranks 8th in reserves 30 with 9.61 billion short tons and has a 0.26% utilization rate 0.78% 20 0.73% 0.52% 0.24% 0.44% 10 0.29% 0.43% 0.89% 0 MT WY IL WV KY PA OH CO TX NM ND IN Source: U.S. Department of Energy, Energy Information Administration; Note: Reserves are "Estimated Recoverable Reserves"; short ton equals 2,000 pounds; 2010 is most recent year for domestic coal reserves data Fig. 21

Global Coal Production Leaders, 2008-2011 U.S. production holding steady as resource diversity expands; China coal production is increasing rapidly to match growing demand 4.5 4 3.5 2008 Billion Short Tons 2009 3 2010 2011 2.5 U.S. ranks 2nd with 1.09 billion 2 short tons 1.5 1 0.5 0 China U.S. India Australia Indonesia Russia South Africa Germany Poland Kazakhstan Source: U.S. Department of Energy, Energy Information Administration Fig. 22

Power

Net Generation History by Resource, 1950-2012 100% 90% 80% 70% % of Generation 60% 50% Renewables 40% Hydro 30% Nuclear Natural Gas 20% Oil 10% Coal 0% Source: U.S Department of Energy, Energy Information Administration Fig. 34

U.S. Nameplate Capacity vs. Net Generation, 2011 Available installed capacity versus utilized capacity U.S. Operating Nameplate Capacity by Resource U.S. Net Generation by Resource 1.14 terawatts of installed capacity 4,123 terawatt hours of total generation Renewables Renewables Hydro 5% 6% Hydro 8% Oil 9% 1% Oil 5% Coal Coal 30% Nuclear 43% Nuclear 19% 9% Gas Gas 41% 24% Source: U.S. Department of Energy; Energy Information Administration Fig. 35

Levelized Costs for Electric Generation Plants Assuming a plant start date of 2017, the total levelized cost measures competitiveness of different generating technologies; levelized costs include transmission, fuel, operations and maintenance, and capital 180 Transmission Investment 160 Variable O&M (including fuel) Dollars per Megawatt Hour 140 Fixed O&M Levelized Capital Cost 120 100 80 60 40 20 0 Combined Wind Geothermal Advanced Advanced Biomass Combustion Solar PV Cycle Coal Nuclear Turbine Source: U.S. Department of Energy, Energy Information Administration Note: 2017 is referenced due to the long lead time required for some technologies and projects; estimates expressed above will vary by region Fig. 33

Average U.S. Capacity Factor by Resource, 2011 The average capacity factor of a power plant is the ratio of actual output per year compared to the output of operating at full nameplate capacity 100 90 Average Capacity Factor (%) 80 70 60 50 40 30 20 10 0 Nuclear Coal Hydro Wind Natural Gas Oil Fig. 36 Source: U.S. Department of Energy, Energy Information Administration

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.