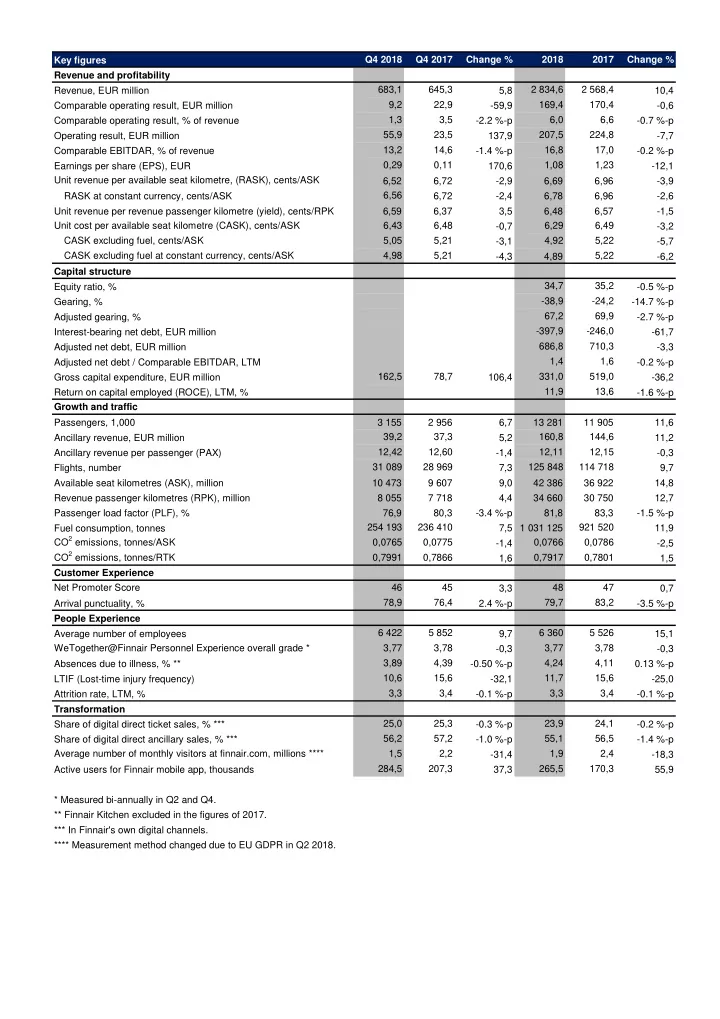

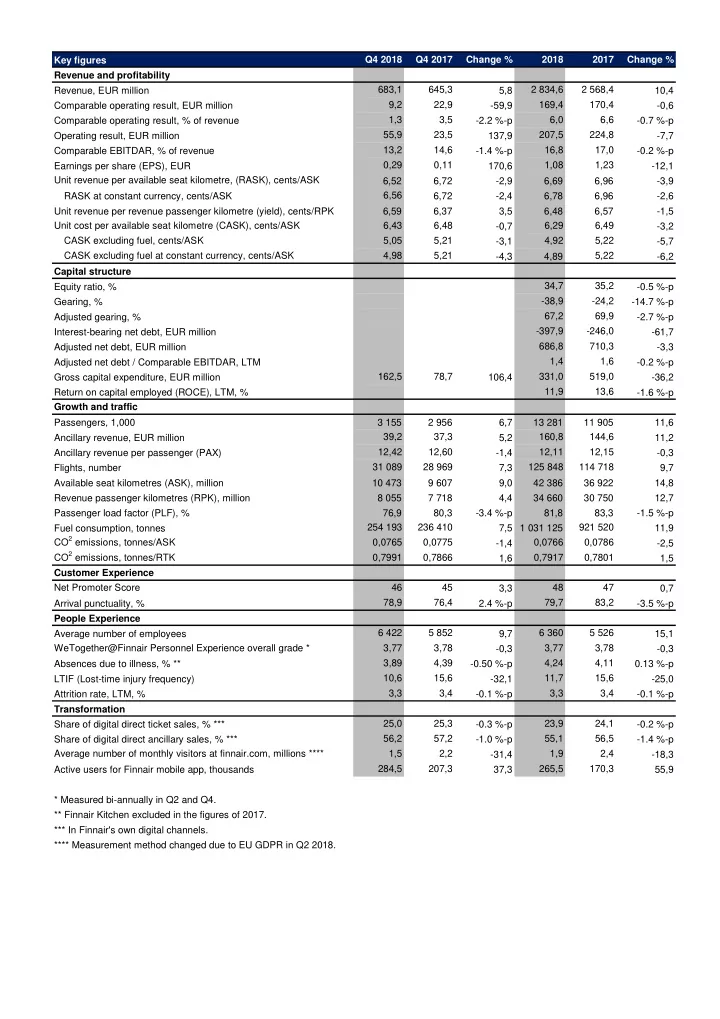

Q4 2018 Q4 2017 Change % 2018 2017 Change % Key figures Revenue and profitability 683,1 645,3 2 834,6 2 568,4 Revenue, EUR million 5,8 10,4 Comparable operating result, EUR million 9,2 22,9 -59,9 169,4 170,4 -0,6 1,3 3,5 6,0 6,6 Comparable operating result, % of revenue -2.2 %-p -0.7 %-p Operating result, EUR million 55,9 23,5 137,9 207,5 224,8 -7,7 13,2 14,6 16,8 17,0 Comparable EBITDAR, % of revenue -1.4 %-p -0.2 %-p Earnings per share (EPS), EUR 0,29 0,11 170,6 1,08 1,23 -12,1 Unit revenue per available seat kilometre, (RASK), cents/ASK 6,52 6,72 -2,9 6,69 6,96 -3,9 RASK at constant currency, cents/ASK 6,56 6,72 -2,4 6,78 6,96 -2,6 Unit revenue per revenue passenger kilometre (yield), cents/RPK 6,59 6,37 3,5 6,48 6,57 -1,5 Unit cost per available seat kilometre (CASK), cents/ASK 6,43 6,48 -0,7 6,29 6,49 -3,2 CASK excluding fuel, cents/ASK 5,05 5,21 4,92 5,22 -3,1 -5,7 CASK excluding fuel at constant currency, cents/ASK 4,98 5,21 -4,3 4,89 5,22 -6,2 Capital structure 34,7 35,2 Equity ratio, % -0.5 %-p -38,9 -24,2 Gearing, % -14.7 %-p 67,2 69,9 Adjusted gearing, % -2.7 %-p -397,9 -246,0 Interest-bearing net debt, EUR million -61,7 686,8 710,3 Adjusted net debt, EUR million -3,3 1,4 1,6 Adjusted net debt / Comparable EBITDAR, LTM -0.2 %-p 162,5 78,7 331,0 519,0 Gross capital expenditure, EUR million 106,4 -36,2 11,9 13,6 Return on capital employed (ROCE), LTM, % -1.6 %-p Growth and traffic Passengers, 1,000 3 155 2 956 6,7 13 281 11 905 11,6 39,2 37,3 160,8 144,6 Ancillary revenue, EUR million 5,2 11,2 12,42 12,60 12,11 12,15 Ancillary revenue per passenger (PAX) -1,4 -0,3 31 089 28 969 125 848 114 718 Flights, number 7,3 9,7 Available seat kilometres (ASK), million 10 473 9 607 9,0 42 386 36 922 14,8 Revenue passenger kilometres (RPK), million 8 055 7 718 4,4 34 660 30 750 12,7 Passenger load factor (PLF), % 76,9 80,3 -3.4 %-p 81,8 83,3 -1.5 %-p 254 193 236 410 921 520 Fuel consumption, tonnes 7,5 1 031 125 11,9 CO 2 emissions, tonnes/ASK 0,0765 0,0775 -1,4 0,0766 0,0786 -2,5 CO 2 emissions, tonnes/RTK 0,7991 0,7866 0,7917 0,7801 1,6 1,5 Customer Experience Net Promoter Score 46 45 48 47 3,3 0,7 78,9 76,4 79,7 83,2 Arrival punctuality, % 2.4 %-p -3.5 %-p People Experience 6 422 5 852 6 360 5 526 Average number of employees 9,7 15,1 WeTogether@Finnair Personnel Experience overall grade * 3,77 3,78 3,77 3,78 -0,3 -0,3 3,89 4,39 4,24 4,11 Absences due to illness, % ** -0.50 %-p 0.13 %-p LTIF (Lost-time injury frequency) 10,6 15,6 -32,1 11,7 15,6 -25,0 3,3 3,4 3,3 3,4 Attrition rate, LTM, % -0.1 %-p -0.1 %-p Transformation 25,0 25,3 23,9 24,1 Share of digital direct ticket sales, % *** -0.3 %-p -0.2 %-p Share of digital direct ancillary sales, % *** 56,2 57,2 -1.0 %-p 55,1 56,5 -1.4 %-p Average number of monthly visitors at finnair.com, millions **** 1,5 2,2 1,9 2,4 -31,4 -18,3 Active users for Finnair mobile app, thousands 284,5 207,3 37,3 265,5 170,3 55,9 * Measured bi-annually in Q2 and Q4. ** Finnair Kitchen excluded in the figures of 2017. *** In Finnair's own digital channels. **** Measurement method changed due to EU GDPR in Q2 2018.

CONSOLIDATED INCOME STATEMENT in mill. EUR Q4 2018 Q4 2017 Change % 2018 2017 Change % Revenue 683,1 645,3 5,8 2 834,6 2 568,4 10,4 Other operating income 18,6 19,8 -5,8 73,7 77,0 -4,2 Operating expenses Staff costs -102,3 -113,0 -9,5 -433,4 -423,3 2,4 Fuel costs -145,4 -122,3 18,9 -581,0 -472,2 23,1 Other rents -40,9 -38,4 6,5 -154,9 -157,9 -1,9 Aircraft materials and overhaul -47,1 -40,7 15,5 -169,1 -165,7 2,0 Traffic charges -74,4 -67,0 11,1 -300,8 -266,5 12,9 Ground handling and catering expenses -65,4 -62,7 4,4 -256,9 -252,2 1,9 Expenses for tour operations -27,8 -27,7 0,4 -113,4 -100,5 12,9 Sales and marketing expenses -25,2 -25,5 -1,0 -92,4 -85,8 7,7 Other expenses -83,1 -73,9 12,6 -330,9 -285,1 16,1 Comparable EBITDAR 90,0 94,0 -4,2 475,4 436,2 9,0 Lease payments for aircraft -38,5 -36,1 6,5 -155,0 -136,6 13,4 Depreciation and impairment -42,4 -34,9 21,2 -151,1 -129,2 16,9 Comparable operating result 9,2 22,9 -59,9 169,4 170,4 -0,6 Unrealized changes in foreign currencies of fleet overhaul provisions -1,1 1,5 <-200 % -4,7 10,9 <-200 % Fair value changes of derivatives where hedge accounting is not applied 4,1 -1,2 > 200 % 0,2 0,3 -35,7 Sales gains and losses on aircraft and other transactions 43,2 0,6 > 200 % 42,7 44,1 -3,1 Restructuring costs 0,4 -0,3 > 200 % -0,1 -0,9 84,6 Operating result 55,9 23,5 137,9 207,5 224,8 -7,7 Financial income -1,1 -0,1 <-200 % -2,9 -0,3 <-200 % Financial expenses -3,4 -2,6 -29,2 -16,0 -13,4 -19,8 Result before taxes 51,3 20,7 147,6 188,6 211,1 -10,7 Income taxes -10,5 -3,6 -187,4 -37,9 -41,7 9,1 Result for the period 40,8 17,1 139,1 150,7 169,4 -11,1 Attributable to Owners of the parent company 40,8 17,1 139,1 150,7 169,4 -11,1 Earnings per share attributable to shareholders of the parent company, EUR (basic and diluted) 0,29 0,11 170,6 1,08 1,23 -12,1 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME in mill. EUR Q4 2018 Q4 2017 Change % 2018 2017 Change % Result for the period 40,8 17,1 139,1 150,7 169,4 -11,1 Other comprehensive income items Items that may be reclassified to profit or loss in subsequent periods Change in fair value of hedging instruments -194,8 36,4 <-200 % -113,5 -18,5 <-200 % Tax effect 39,0 -7,3 > 200 % 22,7 3,7 > 200 % Items that will not be reclassified to profit or loss in subsequent periods Actuarial gains and losses from defined benefit plans -2,9 0,8 <-200 % 0,7 35,9 -98,0 Tax effect 0,6 -0,2 > 200 % -0,1 -7,2 98,0 Other comprehensive income items total -158,1 29,7 <-200 % -90,2 14,0 <-200 % Comprehensive income for the period -117,3 46,8 <-200 % 60,5 183,4 -67,0 Attributable to Owners of the parent company -117,3 46,8 <-200 % 60,5 183,4 -67,0

CONSOLIDATED BALANCE SHEET in mill. EUR 31 Dec 2018 31 Dec 2017 ASSETS Non-current assets Intangible assets O 20,4 15,5 Tangible assets O 1 526,6 1 422,1 Investments in associates and joint ventures O 3,3 2,5 Loan and other receivables O 4,3 5,6 Non-current assets total 1 554,7 1 445,7 Current assets Inventories O 25,1 17,2 Trade and other receivables O 242,2 319,8 Derivative financial instruments O/IA* 52,1 104,5 Other financial assets IA 892,2 833,0 Cash and cash equivalents IA 180,9 150,2 Current assets total 1 392,5 1 424,6 Assets held for sale O 0,1 16,7 Assets total 2 947,3 2 887,1 EQUITY AND LIABILITIES Equity attributable to owners of the parent Share capital E 75,4 75,4 Other equity E 946,2 940,3 Equity total 1 021,7 1 015,7 Non-current liabilities Deferred tax liabilities O 73,5 73,9 Interest-bearing liabilities IL 561,0 586,2 Pension obligations O 17,0 6,4 Provisions O 91,3 79,0 Other liabilities O 4,8 1,1 Non-current liabilities total 747,6 746,7 Current liabilities Provisions O 21,2 21,1 Interest-bearing liabilities IL 108,4 132,4 Trade payables O 72,6 90,7 Derivative financial instruments O/IL* 107,1 81,3 Deferred income and advances received O 548,9 475,3 Liabilities related to employee benefits O 105,6 139,2 Other liabilities O 214,2 173,4 Current liabilities total 1 178,0 1 113,4 Liabilities related to assets held for sale O 11,2 Liabilities total 1 925,6 1 871,4 Equity and liabilities total 2 947,3 2 887,1 Finnair reports its interest-bearing debt, net debt and adjusted gearing to give an overview of Finnair's financial position. Balance sheet items included in interest-bearing net debt are marked with an "IA" or "IL". The calculation of capital employed includes items marked with an "E" or "IL". Other items are marked with an "O". Additional information to Balance Sheet: Interest-bearing net-debt and adjusted gearing 31 Dec 2018 31 Dec 2017 Interest-bearing liabilities 669,4 718,6 Cross currency Interest rate swaps * 5,8 18,5 Adjusted interest-bearing liabilities 675,2 737,1 Other financial assets -892,2 -833,0 Cash and cash equivalents -180,9 -150,2 Interest-bearing net debt -397,9 -246,0 7 x Lease payments for aircraft for the last twelve months 1 084,7 956,4 Adjusted interest-bearing net debt 686,8 710,3 Equity total 1 021,7 1 015,7 Adjusted gearing, % 67,2 % 69,9 % * Cross-currency interest rate swaps are used for hedging the currency and interest rate risk of interest-bearing loans, but hedge accounting is not applied. Changes in fair net value correlate with changes in the fair value of interest-bearing liabilities. Therefore, the fair net value of cross-currency interest rate swaps recognised in derivative assets/liabilities and reported in Note 5, is considered an interest-bearing liability in the net debt calculation.

Recommend

More recommend