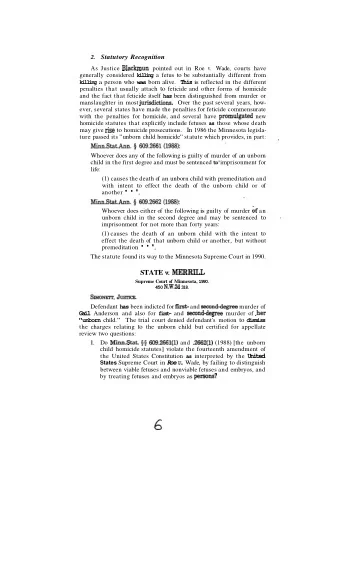

POTSDAM SUMMER ACADEMY JULY 2006 Program : Banking, Insurance and - PowerPoint PPT Presentation

POTSDAM SUMMER ACADEMY JULY 2006 Program : Banking, Insurance and the Public Sector: Empirical Evidence and Policy Advice Course : Financing the Welfare State: Economical Social Protection Lecturer : Professor Glenn Withers, ANU 1

POTSDAM SUMMER ACADEMY JULY 2006 Program : Banking, Insurance and the Public Sector: Empirical Evidence and Policy Advice Course : Financing the Welfare State: Economical Social Protection Lecturer : Professor Glenn Withers, ANU 1

Sessions: � 2.00-3.30, Monday 10 July � 4.00-5.30, Monday 10 July � 6.00-7.30, Monday 10 July � 2.00-3.30, Tuesday 11 July � 4.00-5.30, Tuesday 11 July � 2.00-3.30, Wednesday 12 July 2

Course Sequence � Theory of Welfare Intervention � Evolution of the Australian Welfare State � Providing and Financing Infrastructure- especially Private Finance Initiatives � Providing and Financing Education- especially Income Contingent Loans � Providing and Financing Retirement Incomes-especially Compulsory Superannuation � The Demographic Future-especially labour participation and immigration 3

Session 3: The Economical Welfare State PHYSICAL CAPITAL: INFRASTRUCTURE PROVISION AND FINANCING 4

Traditional Thinking � Historically we have generally related infrastructure to long-lived, fixed assets � The traditional approach to infrastructure typically included a focus on � the type of network or service � provision by government departments or agencies � reasonable access and cost (probably involving some subsidy) 5

A Changing World � However perceptions have broadened � Nowadays, infrastructure policies can also involve, eg � relatively short-lived assets (eg communications) � a combination of various networks � some competition and choice in usage - provision and/ or operation by the private sector - some sizeable, direct costs of access 6

Infrastructure and Public Policy � Infrastructure recognised as touching on a wide range of policy interests, for example � trade and industry policies � economic management � national security � the environment � urban and regional development � “social justice” 7

Underlying Policy Rationales � Allocative inefficiency: monopoly pricing sheltered by economies of scale and scope � Technical and dynamic inefficency: due to shelter offered by economies of scale and scope � Externality and Essential service implications of network characteristics 8

Types of Infrastructure • Often, two types are distinguished Hard infrastructure, including roads, rail • track, ports, electricity grids, telephone networks, airports, gas pipelines, dams Soft infrastructure, such as schools, • universities, hospitals, cultural facilities • Both are critical to national economic health and community well-being – the distinction is not all that useful these days 9

The Cost of Underperformance � Can be due to inadequacy or inefficiency � Reduced national/ regional competitiveness � higher costs to industry (time, reliability) � lost market opportunities � burden on consumers (prices, availability) � Congestion (time, costs, emissions) � Safety (loss of life, injury, health) � Loss of amenity (eg poor design, noise) 10

Two Distinct Policy Issues � Creating new infrastructure � Managing existing infrastructure � In a policy sense, both are critical to economic and community outcomes � New infrastructure investment should not usually be considered without a thorough examination of the potential of existing infrastructure to meet needs 11

Managing Existing Infrastructure � Access issues, eg mass and dimensions of trucks, hours of operation � Maintenance requirements � Use of technology to manage/ monitor usage, eg intelligent transport systems � Use of pricing to influence usage/ provision � Networking with related providers – and linkages with new projects � Choice of manager and service providers – private or public? 12

New Issues in Management � New public management structures � commercialisation and corporatisation � Privatisation programs of public assets � what should stay public? � need for new regulatory regimes � A more sophisticated approach to regulation � National competition policy � More active pricing regimes (eg congestion ) 13

Creating New Infrastructure � Important considerations “up front” concern the respective public/ private sector roles in � overall infrastructure strategy � planning and decision-making processes � financing and funding � construction � operation � access � accountability 14

Strategy and Planning � A “one-off’ project, or part of a broader network or plan? � Link with land-use planning and environment authorities (externalities) � Coordination within and across levels of government � Choice of decision-making authorities � Information gathering and analytical methods to be used 15

Financing � Relates to life of project, ownership and viability � Public financing cheaper, but out of favour � Private ownership and financing has grown � also “cocktails” mixing public and private � Complexities in taxation treatment � eg Australia's ill-fated history of tax subsidy schemes (Infrastructure Bonds, IBTOS) � Important issues of who bears risks � relates to funding issues (who pays, and when?) 16

Construction and Operation � The past history of Public Works departments and day-labour gangs � Now benefit seen in competitive tendering for construction � Thinking about operation is also changing � agnostic views about “public versus private” � If it is to be public management, seeing creation of new public authorities � often with expectation of a “rate of return” 17

Access and Accountability � Impact of competition policy � “rights” of access � who determines access and its cost? � Pricing to manage demand and usage patterns � who should pay, and how? � Community service obligations? � Possible need for enabling legislation � Reporting arrangements and accountability 18

Case Study: Urban Toll Roads � Considerations of demand and type of usage (eg commuters, local traffic, freight) � Debate about the respective roles of � the various levels of government � the private sector � Linked to choice of freeway or tollway � Recognition of broader economic and community impacts � Increasing complexity of analysis 19

Case Study: Residential Infrastructure � Costs of incremental urban expansion � and broader network services (eg water) � The respective roles of governments and private land developers � The need for strategic, coordinated planning � The financing of development � Who should pay, and why? 20

Innovative Financing for Infrastructure: PPP/ PFI � Definition: A relationship between a government party and a private party to deliver public infrastructure and related services - a contract is used to allocate responsibilites, rights, risks and rewards 21

PPP advantages claimed � More focus on delivery rather than property, by government agencies � Projects completed on time and without cost blow-outs � Access to technical and management skills � Accountability of operators � Better outcomes in pricing, delivery and innovation � Access to finance 22

Key mechanisms to deliver advantages � Competitive bidding processes � Contracts specifying output not input requirements � Linkage of payments to performance-plus bonuses � Allow mechanisms for government-initiated variations � Public choice: the requirement for bureaucratic expertise and an absence of public debt fetishism 23

Key Issues: Risk � Risks associated with establishment-design, construction, commissioning � Risks associated with operations- unexpected costs increases, demand changes, changes in requirements � Risks associated with the regulatory environment, including treatment of market power, price-setting, quality of service, time frames, multiple regulators 24

Key issues: price setting � Regulators set prices to rise less than CPI by a factor X- as in CPI-X � X is usually an efficiency parameter to share gains with consumers as well as reward producers � Often estimated as total factor productivity (TFP), an index of outputs to factor inputs 25

Options for Private Participation Option Ownership Operations Finance Risk Duration Application Service Public Public/Private Public Public 1-2yrs Chile Contract Management Public Private Public Public 3-5 yrs Gaza Contract Lease Public Private Public Shared 5-15 yrs Poland BOT Public Private Private Private 20-30 yrs Australia Concession Public Private Private Private 25-30 yrs Argentina Divestiture Private Private Private Private indefinite England 26

Proceeds from Privatisation, 1990-2000 Country Total ($USm) Per Capita ($US) Australia 69,628 3627 Sweden 17,295 1943 France 75,489 1273 Japan 37,670 298 Germany 22,450 271 United States 6,750 24 27

Session 4: The Economical Welfare State Education Provision and Financing 28

Investment in Human Capital � Is a better educated workforce more productive? ( does human capital raises the level of productivity? ) � Does a better educated workforce enhance the adaptation and implementation of new technologies? ( does human capital raise the rate of growth of productivity?) � How does education affect fertility and population structure? ( does human capital raise participation and child productivity ) 29

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.