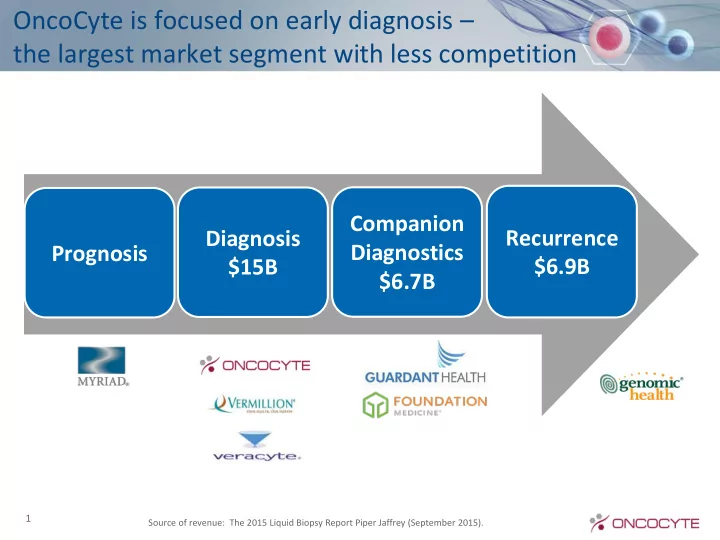

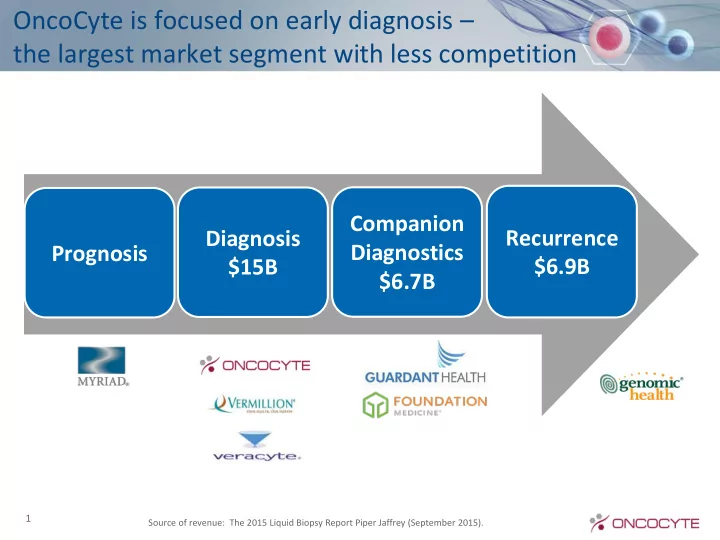

OncoCyte is focused on early diagnosis – the largest market segment with less competition Companion Companion Diagnosis Recurrence Recurrence Diagnosis Diagnostics Prognostic Prognosis Diagnostics $6.7B $6.9B $15B $15B $6.9B $6.7B 1 Source of revenue: The 2015 Liquid Biopsy Report Piper Jaffrey (September 2015).

OncoCyte is focused on areas of greatest unmet need and most attractive margins 130% C Product Contribution Opportunity ($Bs) 110% Lung 90% Confirmatory (5-year death rate) Health Outcomes $3.9 70% Colorectal Ovarian $3.2 50% $.2 Breast Confirmatory 30% $5.4 Bubbles represent product 10% contribution opportunity = gross Thyroid Prostate revenue (# of patients * diagnostic $.4 price) * estimate of product margins $.6 -10% -30% 0% 5% 10% 15% 20% 25% 30% 35% 40% Cost Savings -50% Estimated Margins Ability to avoid unnecessary and expensive follow-up procedures 25% Primary Care focus 50% Primary Care and Specialty (Probability of false-positive test under current standard of care) 75% Specialty Care focus 2 Health Outcomes is a proxy for clinician unmet need; Cost Savings is a proxy for payer unmet need.

Pipeline diagnostics based on gene expression classifier and binary call Diagnostic Strategy *Potentially malignant, clinician to determine follow-up procedure. 3

Lung opportunity driven by poor outcomes with little improvement over the last 40 years Lung cancer is typically diagnosed at later stages, limiting survival rates 57% of lung cancer diagnoses are made in stage IV FDA approval for prostate screening test Prostate FDA approval for prostate progression test Breast Bladder Colorectal Five year survival rate Lung Sources: Cancer SEER Stat Fact Sheets; NCCN Guidelines Lung Cancer Screening (February 2014); 4 USPSTF Screening Guidelines for Lung Cancer (December 2013).

Post-LDCT biopsies are risky and expensive • Lung biopsies – via needle, bronchoscopy or surgery – are much riskier than other biopsies Incidence Complication Annual (%) Events (~#) 0.5 – 1% Mortality 600 – 1,300 4 – 20% Major 5,000 – 26,000 Complications (including collapsed lung) For an average patient, a lung biopsy has a • Mean cost of $14,634 per biopsy higher likelihood of leading to a serious • Frequent LDCTs expose patients to potentially complication than that of unnecessary radiation confirming lung cancer Sources: Gould, MK et al. Evaluation of Individuals with Pulmonary Nodules: When is it lung cancer? CHEST 2013; 143(5)( Suppl ):e93S – 120S; OncoCyte absolute number estimated using TAM 10M and 65% specificity; Lokhandwala, T el al. Costs of Diagnostic Workup for Lung Cancer – A Medicare Claims Analysis. ASTRO Abstract presented Thursday, October 30, 2014. 5

Large market opportunity for lung tests Lung Imaging Studies USPSTF and Incidental Nodules Overall Lung Nodule Market (12 – 15 Million Patients) Expanded Use All indeterminate diagnoses (LDCT +) Lung-RADS 3, 4a and 4b (~1.4 Million Patients) Downstream procedures 1 st Launch performed on Lung-RADS 4a and 4b indeterminate (~400,000 – 600,000 Patients) diagnoses TAM Numbers based on company estimates and secondary data: 7-10 Million screening patients (USPSTF, NCI); 6 4.9 Million patients with incidental nodules (Gould MK, et al. Am J Respir Crit Care Med 2015 Nov 15; 192 (10):1208-1214).

OncoCyte’s initial focus is on a confirmatory diagnostic solution Confirmatory 7 – 10M Americans 30 Pack-year history Malignant USPSTF Guidelines recommended screening – covered by Medicare Biopsy Benign Nodules nodule High-risk Follow-up LDCT scans patients No nodules LDCT screening Clear Additional 5M Americans Incidentally detected nodules 7

Current standard of care is not meeting needs of many women • Mammograms perform poorly for one out of six women – Dense breast tissue (sensitivity 62-69%) – BRCA mutation positive (adjunctive MRI) – Family history (adjunctive MRI) • Guidelines recommend annual screening – Mammogram – Follow-up MRI or ultra-sound • Number of unnecessary procedures putting burden on system – About 1.7M breast biopsies are performed annually – Cost of unnecessary procedures ($2.8B from false-positive mammograms) • Creates confusion and uncertainty in women – “Angelina Jolie effect” – Increase in number of prophylactic mastectomies 8 Source: ACOG Guidelines; ACOG Committee Opinion March Number 625 (March 2015); Journal Health Affairs (April 2015).

Breast confirmatory diagnostic second product focus due to high unmet need Follow-up MRI Two potential intended use profiles • Confirmatory for suspicious mammograms • Adjunct for high-risk patients 9

Large market opportunity for breast cancer diagnostic tests for specific patient profiles Guidelines suggest annual mammogram screen Overall screening market (39 Million Patients in 2016) Guidelines suggest MRI (dense tissue, BRCA, family history) Supplemental screening test (6 Million Patients) and/or Indeterminate Confirmatory test mammograms (1.6 – 1.9 Million BI-RADS 3-4) 10 TAM numbers based on company estimates and secondary data

Recommend

More recommend