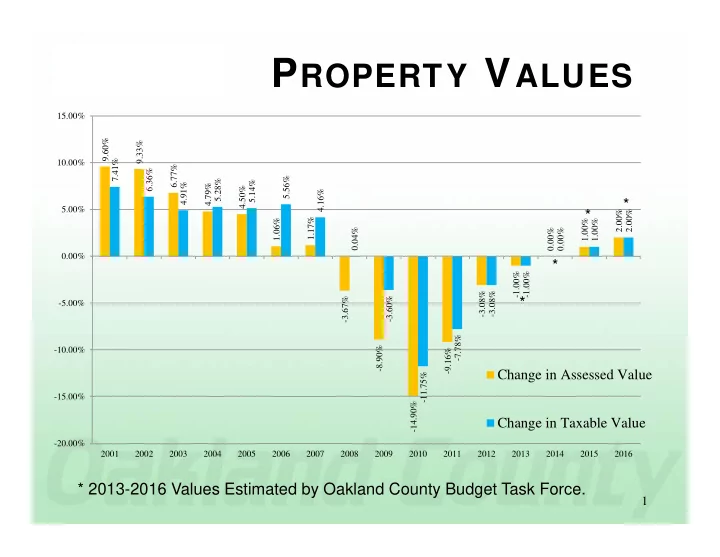

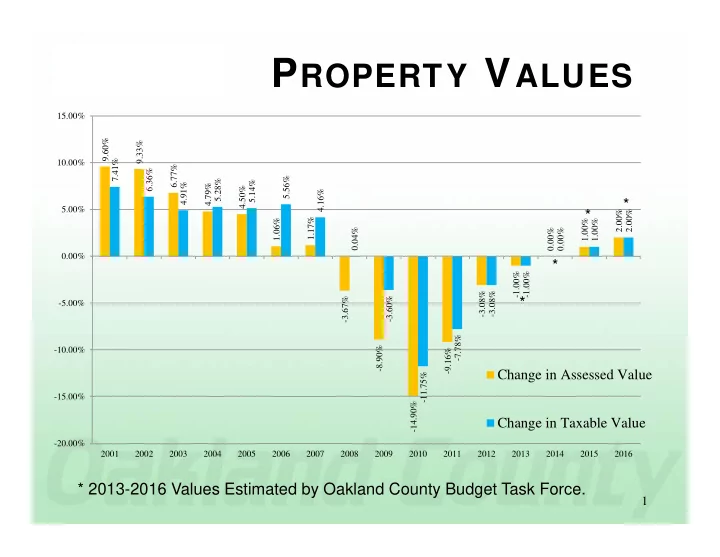

P ROPERTY V ALUES 15.00% 9.60% 9.33% 7.41% 10.00% 6.77% 6.36% 5.56% 5.28% 5.14% 4.91% 4.79% 4.50% 4.16% * 5.00% * 2.00% 2.00% 1.17% 1.06% 1.00% 1.00% 0.04% 0.00% 0.00% 0.00% * -1.00% -1.00% -3.08% -3.08% -3.60% -3.67% * -5.00% -7.78% -8.90% -10.00% -9.16% Change in Assessed Value -11.75% -15.00% -14.90% Change in Taxable Value -20.00% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 * 2013-2016 Values Estimated by Oakland County Budget Task Force. 1

How Assessments are Formulated Look for Sales within this Timeframe. 1 Year Study – (used in declining markets) 10 ‐ 1 ‐ 2011 9 ‐ 30 ‐ 2012 2 Year Study – (used in declining markets) 10 ‐ 1 ‐ 2010 9 ‐ 30 ‐ 2012 Look for properties like your own (subject) • Sales Study Timeframes are determined by the State Tax Commission. 2

Oakland County Average Residential Change 2007 2008 2009 2010 2011 2012 2013 2.00% 1.00% 0.00% -0.13% -2.00% -4.00% -3.38% -4.68% -6.00% Percent Change -8.00% -7.50% -10.00% -12.00% -12.50% -14.00% -16.00% -15.50% -18.00% 3

Residential Changes for 2013 Auburn Hills 0.57% Addison Township 1.59% Berkley 2.92% Bloomfield Township 4.12% Birmingham 6.33% Brandon Township 2.75% Bloomfield Hills 6.39% Commerce Township 2.66% Clarkston 1.82% Clawson 2.18% Groveland Township 5.14% Farmington 1.68% Highland Township 2.45% Farmington Hills 1.59% Holly Township 1.78% Fenton -2.22% Independence Township 3.45% Ferndale -4.53% Lyon Township 3.54% Hazel Park -15.07% Huntington Woods 4.49% Milford Township 6.03% Keego Harbor 4.12% Novi Township 1.99% Lake Angelus -0.30% Oakland Township 3.24% Lathrup Village -1.52% Orion Township 3.91% Madison Heights -7.08% Oxford Township 4.52% Northville 6.81% Novi City 4.60% Rose Township -0.22% Oak Park -10.30% Royal Oak Township -8.50% Orchard Lake -0.10% Southfield Township 5.18% Pleasant Ridge 6.37% Springfield Township 2.09% Pontiac -17.36% Waterford Township 1.14% Rochester 4.54% Rochester Hills 2.86% West Bloomfield Township 2.03% Royal Oak City 3.52% White Lake Township 2.20% Southfield City -1.76% South Lyon 0.69% Sylvan Lake 0.02% Troy 3.82% Walled Lake 1.70% Wixom 2.54% 4

Sheriff Deeds: Foreclosures 1-18-13 10,000 Oakland County - Real Properties 9,290 9,242 9,000 8486 8,000 7,643 7,371 7,000 6,000 5,108 4,855 5,000 4,000 3,000 2,623 2,168 2,024 1,755 2,000 1,170 820 1,000 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 1 in 532 1 in 377 1 in 253 1 in 225 1 in 212 1 in 174 1 in 97 1 in 62 1 in 51 1 in 56 1 in 51 1 in 65 1 in 93 Sheriff Deed totals retrieved from the Oakland County Register of Deeds office.

Guidelines for Foreclosure Sales Bulletin No. 6 August 15, 2007 6

7

IRM – Inflation Rate Multiplier 1995 2.6% 1996 2.8% 1997 2.8% 1998 2.7% 1999 1.6% 2000 1.9% 2001 3.2% 2002 3.2% 2003 1.5% 2004 2.3% Taxable Value Calculations are derived by using 2005 2.3% IRM/CPI percentages. This has been mandated 2006 3.3% since the introduction of proposal “A” in 1994. 2007 3.7% IRM/CPI is calculated by the US Department of 2008 2.3% Labor. http://www.bls.gov/cpi 2009 4.4% 2010 -0.3% 2011 1.7% IRM Also Known As: 2012 2.7% Consumer Price Index (CPI) 2013 2.4% 8

IRM – 2012 Inflation Rate Multiplier Also Known As: Consumer Price Index (CPI) State Tax Commission Issued: 9

Recent Sales Price vs. Assessment Process General Property Tax Act 206 of 1893 Sec. 27. (1) As used in this act, "true cash value" means the usual selling price at the place where the property to which the term is applied is at the time of assessment, being the price that could be obtained for the property at private sale, and not at auction sale except as otherwise provided in this section, or at forced sale. The usual selling price may include sales at public auction held by a nongovernmental agency or person if those sales have become a common method of acquisition in the jurisdiction for the class of property being valued. The usual selling price does not include sales at public auction if the sale is part of a liquidation of the seller's assets in a bankruptcy proceeding or if the seller is unable to use common marketing techniques to obtain the usual selling price for the property. (5) Except as otherwise provided in subsection (6), the purchase price paid in a transfer of property is not the presumptive true cash value of the property transferred. In determining the true cash value of transferred property, an assessing officer shall assess that property using the same valuation method used to value all other property of that same classification in the assessing jurisdiction. As used in this subsection and subsection (6), "purchase price" means the total consideration agreed to in an arms-length transaction and not at a forced sale paid by the purchaser of the property, stated in dollars, whether or not paid in dollars. State Tax Commission Bulletin No. 19 of 1997 DATE: December 12, 1997 TO: Assessing Officers, Equalization Directors FROM: State Tax Commission (STC) RE: THE ILLEGAL PRACTICES OF: A) "FOLLOWING SALES" AND B) ASSESSING OVER 50% “Proposal A does NOT authorize the assessor to AUTOMATICALLY set the assessed value of a property which has sold at 1/2 of the sale price.” 10

February 25 th 7pm to 9pm Board of Commissioners Auditorium 11

What are my options after receiving the change of Assessment Notice? 1. Review Property Record Card 2. Contact the Assessor 3. Make Appointment for MBOR 12

Residential Record Cards 13

Important Items to Review on the Property Record Card • Land Size • Square Footage of Building (exterior Measurements) • Class of Building (A, B, C, D) • Garage • Bathrooms • Basement Finish • Built-in Appliances • Year Built • Fireplaces • Out-buildings, Pools, Patios, Etc. * This is just a sample of Facts to verify and review with your assessor. 14

MILFORD TOWNSHIP 15

NEIGHBORHOOD S3M 16

2013 Sales Study Against 2012 Values Parcel Number Address Sale Date Sale Type Nghbd Sale Price 2012 Asd Val Ratio L -1605102012 1993 Charles Ct 5/26/2011 Valid Bank S3M $286,150 $153,750 53.73 L -1605103014 1940 Scenic Dr 9/27/2011 Valid Sale S3M $365,000 $170,550 46.73 L -1605103020 1894 Bristol Ct 6/14/2011 Valid Sale S3M $385,000 $169,940 44.14 L -1605103024 1891 Bristol Ct 12/2/2010 Valid Bank S3M $360,000 $170,170 47.27 L -1605178012 1791 Bristol Dr 6/22/2011 Valid Sale S3M $480,000 $193,720 40.36 L -1605200009 1983 Scenic Dr 9/27/2011 Valid Sale S3M $335,000 $149,110 44.51 L -1605202012 1976 Scenic Dr 9/13/2011 Valid Sale S3M $325,000 $158,020 48.62 L -1605253007 1592 Boulder Lk Dr 2/24/2011 Valid Sale S3M $290,000 $161,010 55.52 $2,826,150 $1,326,270 46.93 Target Ratio 49.0% to 50.0% / Ratio 46.93% = +6% Sales in neighborhood suggest all property values in neighborhood S3M should receive an average increase in value of +6% for 2013. 1 Year Sales Study Timeframe 9 ‐ 30 ‐ 2012 10 ‐ 1 ‐ 2011 17

2013 Sales Study Against 2013 Values Parcel Number Address Sale Date Sale Type Nghbd Sale Price 2013 Asd Val Ratio L -1605102012 1993 Charles Ct 5/26/2011 Valid Bank S3M $286,150 $158,750 55.48 L -1605103014 1940 Scenic Dr 9/27/2011 Valid Sale S3M $365,000 $174,330 47.76 L -1605103020 1894 Bristol Ct 6/14/2011 Valid Sale S3M $385,000 $183,850 47.75 L -1605103024 1891 Bristol Ct 12/2/2010 Valid Bank S3M $360,000 $188,220 52.28 L -1605178012 1791 Bristol Dr 6/22/2011 Valid Sale S3M $480,000 $206,850 43.09 L -1605200009 1983 Scenic Dr 9/27/2011 Valid Sale S3M $335,000 $152,190 45.43 L -1605202012 1976 Scenic Dr 9/13/2011 Valid Sale S3M $325,000 $160,740 49.46 L -1605253007 1592 Boulder Lk Dr 2/24/2011 Valid Sale S3M $290,000 $164,260 56.64 $2,826,150 $1,389,190 49.15 The average assessment change was applied to the neighborhood as a whole. 1 Year Sales Study Timeframe 9 ‐ 30 ‐ 2012 10 ‐ 1 ‐ 2011 18

How Assessments Are NOT Formulated WRONG Parcel Number Address Sale Date Sale Type Nghbd Sale Price 2012 Asd Val Ratio 2013 Asd Val % Chg L -1605102012 1993 Charles Ct 5/26/2011 Valid Bank S3M $286,150 $153,750 53.73 $143,070 -6.95% L -1605103014 1940 Scenic Dr 9/27/2011 Valid Sale S3M $365,000 $170,550 46.73 $182,500 7.01% L -1605103020 1894 Bristol Ct 6/14/2011 Valid Sale S3M $385,000 $169,940 44.14 $192,500 13.28% L -16-05103024 1891 Bristol Ct 12/2/2010 Valid Bank S3M $360,000 $170,170 47.27 $180,000 5.78% L -1605178012 1791 Bristol Dr 6/22/2011 Valid Sale S3M $480,000 $193,720 40.36 $240,000 23.89% L -1605200009 1983 Scenic Dr 9/27/2011 Valid Sale S3M $335,000 $149,110 44.51 $167,500 12.33% L -1605202012 1976 Scenic Dr 9/13/2011 Valid Sale S3M $325,000 $158,020 48.62 $162,500 2.84% L -1605253007 1592 Boulder Lk Dr 2/24/2011 Valid Sale S3M $290,000 $161,010 55.52 $145,000 -9.94% $2,826,150 $1,326,270 46.93 $1,413,070 50.00 Ratio Assessors are responsible for valuing ALL properties in the neighborhood, not just the sold properties. 1 Year Sales Study Timeframe 9 ‐ 30 ‐ 2012 10 ‐ 1 ‐ 2011 19

MADISON HEIGHTS 20

NEIGHBORHOOD RRM 21

Recommend

More recommend