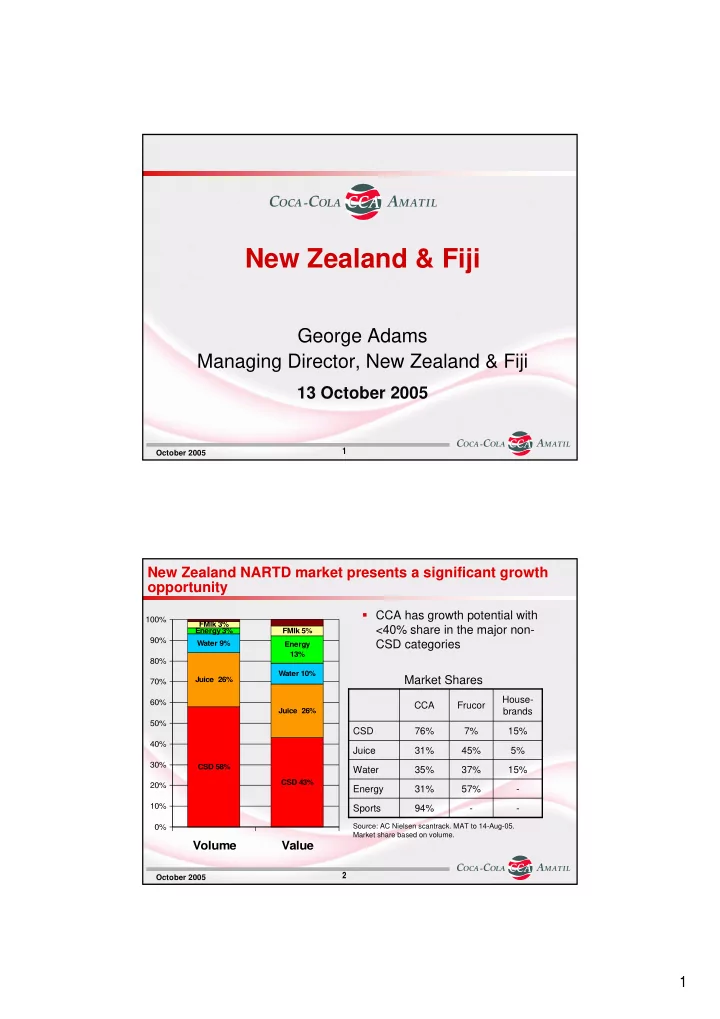

New Zealand & Fiji George Adams Managing Director, New Zealand & Fiji 13 October 2005 1 October 2005 New Zealand NARTD market presents a significant growth opportunity � CCA has growth potential with 100% FMlk 3% <40% share in the major non- Energy 3% FMlk 5% 90% Water 9% CSD categories Energy 13% 80% Water 10% Market Shares Juice 26% 70% House- 60% CCA Frucor Juice 26% brands 50% CSD 76% 7% 15% 40% Juice 31% 45% 5% 30% CSD 58% Water 35% 37% 15% CSD 43% 20% Energy 31% 57% - 10% Sports 94% - - 0% Source: AC Nielsen scantrack. MAT to 14-Aug-05. Market share based on volume. Volume Value 2 October 2005 1

CCA Outgrowing the market in all but one category MAT Volume Growth 60% 50% 40% 30% 20% 10% 0% -10% CSD Water Energy Sports & Juice Lifestyle CCA Rest of Market Source: AC Nielsen scantrack. MAT to 14-Aug-05. Growth based on volume. 3 October 2005 Consumer preference changing � NARTD volume growth 6% � Growth driven by Diet CSDs and Non-Carbonated NZ NARTD Market - 2004 NZ NARTD Market - 2005 Other Other 7% 10% Juice Sugar Sugar Juice 24% CSD CSD 25% 43% 49% Water Diet Diet 7% Water CSD CSD 8% 13% 14% Source: AC Nielsen scantrack. MAT to 14-Aug-05. Shares based on volume. 4 October 2005 2

Our Success Continues to be Driven by Execution of our Pillars of Growth 1. Product and package innovation 2. Non-carbonated beverage expansion 3. Growing product availability through cold drink placements and outlet expansion 4. Customer service improvement 5. Revenue management and cost discipline 5 October 2005 Changing preferences being met through innovation and focus on diets and non-carbonated beverages Water - Pump & Kiwi Blue Energy - E2Energy, Lift � Plus and Lift Plus 1H Volume +44% � SugarFree Pump #1 single serve brand � E2 Energy 1/3 size of Lift Plus � Energy category +50% H1 � V entrenched as category leader but CCA making inroads - combined YTD Market share in petroleum 28.1% vs 20% last year. Near Water - Aquashot L&P Sweet As � � Launched July ’04 Launched late in H1 � � 4 flavours – Apple, Berry, Lime, Mandarin Contributed to L&P 1H growth +12% � Latest market share in Flavoured Water in Petroleum is 24% 6 October 2005 3

L & P Successes delivers 12% growth � Reinvigorated this CCA owned brand � Repackaged � Kiwi iconography � Supported launch of “Sweet As” sugar free variant � H1 12% growth overall � Australasian Television awards – 5 top awards � Kodak Gongs (best in advertising across the whole of the Asia Pacific region) 7 October 2005 L & P award winning advertising 8 October 2005 4

World First – Coke Raspberry � In a global first for the Coca-Cola System, New Zealand launched ‘Coke with Raspberry’ and ‘diet Coke with Raspberry’ in June 2005 � It was the first time that the Coca-Cola flavour and the diet Coke flavour have been launched simultaneously � Sales are in line with expectations � Early 2006 rotation planned 9 October 2005 Maintained excellent juice market share over past 12 months despite heavy competition MAT Fruit Juice/Drinks Brand Shares | Grocery 25.0% 23.5% 23.3% 23.3% 23.3% 23.1% 23.0% 22.7% 22.5% 22.3% 21.8% 21.6% 21.1% 20.7% 20.7% 20.5% 20.3% 20.1% 20.0% 20.0% 19.8% 19.8% 19.6% 19.5% 19.4% 19.4% 19.3% 19.2% 19.2% 19.0% Keri Brand #1 15.0% 13.6% 13.4% 13.2% 13.0% 12.8% 12.9% 12.7% 12.6% 12.5% 12.6% 12.5% 12.4% 12.6% 12.6% 10.0% 8.3% 8.0% 7.8% 7.5% 7.7% 7.5% 7.6% 7.4% 7.5% 7.4% 7.5% 7.5% 7.5% 7.3% 7.2% 7.2% 7.1% 7.1% 7.1% 7.1% 7.1% 7.1% 7.0% 7.0% 6.8% 6.9% 6.9% 6.7% 6.4% 6.4% 6.1% 5.8% 5.7% 5.5% 5.2% 5.2% 5.0% 5.0% 5.0% 5.0% 4.9% 4.6% 4.7% 4.6% 4.4% 4.3% 4.2% 4.1% 3.9% 3.8% 3.6% 3.7% 3.8% 3.7% 3.7% 3.7% 3.7% 3.7% 3.7% 3.6% 3.7% 3.7% 3.7% 3.5% 3.6% 3.6% 3.5% 3.6% 3.4% 3.4% 3.3% 3.4% 3.4% 3.2% 3.2% 3.2% 3.2% 3.2% 3.2% 3.2% 3.2% 3.2% 3.2% 3.2% 3.2% 3.0% 2.9% 2.6% 2.5% 2.4% 2.4% 2.2% 2.2% 2.2% 2.3% 2.2% 2.1% 2.1% 2.1% 1.9% 1.9% 1.9% 1.9% 2.0% 1.9% 1.7% 1.6% 1.4% 1.3% 1.1% 0.9% 0.8% 0.7% 0.0% 12 SEP 04 10 OCT 04 07 NOV 04 05 DEC 04 02 JAN 05 30 JAN 05 27 FEB 05 27 MAR 24 APR 05 22 MAY 19 JUN 05 17 JUL 05 14 AUG 11 SEP 05 05 05 05 T. JUST JUICE T. FRESH UP T. CITRUS TREE T. TWIST T. KERI T. KERI THEXTONS T. KERI SPLICE T. SIMPLY SQUEEZED T. CHARLIES T. GOLDEN CIRCLE TOTAL CONTROLLED LABEL 10 October 2005 5

2 nd Half 3L pack innovation to restore value to category � Move focus away from price competition exclusively to packaging and price � Launch of Easy Grip bottle a competitive advantage for CCA according to consumer research � Price increase of 16% in September 2005 � Some volume decline anticipated, but positive profit contribution 11 October 2005 Easy Grip Bottle Ad 12 October 2005 6

New Customers Being Won For The Business Targeting 2,500 (16%) Net New Customers � 1,500 non-traditional new business � 1,000 cafés – HORECA strategy 1200 1000 800 600 400 200 0 Jan Feb Mar Apr May Jun New Customer s T a r get 13 October 2005 Bars and Pubs being targeted with mini mixers – a $12m opportunity annually Mini Mixer Conversion Targets Volume Per Outlet Per Week 500 14 450 12 400 10 350 Number of Outlets 300 8 250 6 200 150 4 100 2 Target Outlets 50 Actual Outlets 0 0 Target VPO 1 2 3 4 5 6 7 8 9 10 Actual VPO Months � 175ml TCCC and 150ml Schweppes mixers 14 October 2005 7

Reinvigorating the C&L channel � In October 2005 we established a new 50 seat National Contact Centre � Changed sales model to conceptual sell Result � Sales staff spend quality time with customers, understanding the needs of their business and how best to grow it � Promotions, ranging, asset placement etc � C&L channel in growth 15 October 2005 Auckland Automated Warehouse to reduce costs and improve customer service Key Benefits – Payback of 5.8 years on $80m investment � Eliminating the costs of up to 5 external warehouses � Reduce the costs of multiple handling of product � Create efficient warehouse system with single pick face for the upper North Island � Reduce heavy vehicle movements of up to 30% � Reduce working capital � Operational early 2008 16 October 2005 8

Fiji continues to deliver excellent growth and returns for CCA and the outlook remains very positive � Market share 80% - 4 out of 5 products consumed by Fijian’s are CCA products � Significant progress made in cooler location, focusing on increasing self service availability from 33% to 49% of coolers this year. Product and pack innovations, particularly cans, contributing to growth. YTD September � ROCE in excess of 30% � Volume growth of 11% � EBIT growth 26% 17 October 2005 First half performance effected by change of ownership of Progressives and juice pricing. � CSD decline due to Progressive supermarkets shifting focus to profit rather than revenue and volume growth. Combined with the lower retail price of juice cost the business 6% EBIT v PY � COGS increase ahead of NSR increase � High value product strategies slower off the ground than planned e.g. Mini Mixers 18 October 2005 9

Improved outlook for 2 nd half of 2005 � Juice value issue addressed in October � New agreement on promotional strategy with Progressive will help to deliver Q4 volume growth of 6% � Cross channel price increase of 5% taken in July to fully recover COGS increase � Product Launches in last quarter include Coke Citra and Keri Fruit Freshers � 2 nd half NZ$ EBIT improvement expected on PY with Full Year expectations for volume and EBIT in line with 2004 19 October 2005 Confident outlook for 2006 � In the event that the transaction is completed, CCA welcomes the arrival of Woolworths in Q1 – excellent relationship in Australia � Juice market returns to long term profitability � Strong new product pipeline for both Carbonated and Non carbonated categories � Coke Zero in the pipeline for early in Q1 � C&L momentum to grow driven by Sales Force Effectiveness programme � Continued focus on outlet development, volume per outlet growth and cooler placement 20 October 2005 10

Recommend

More recommend