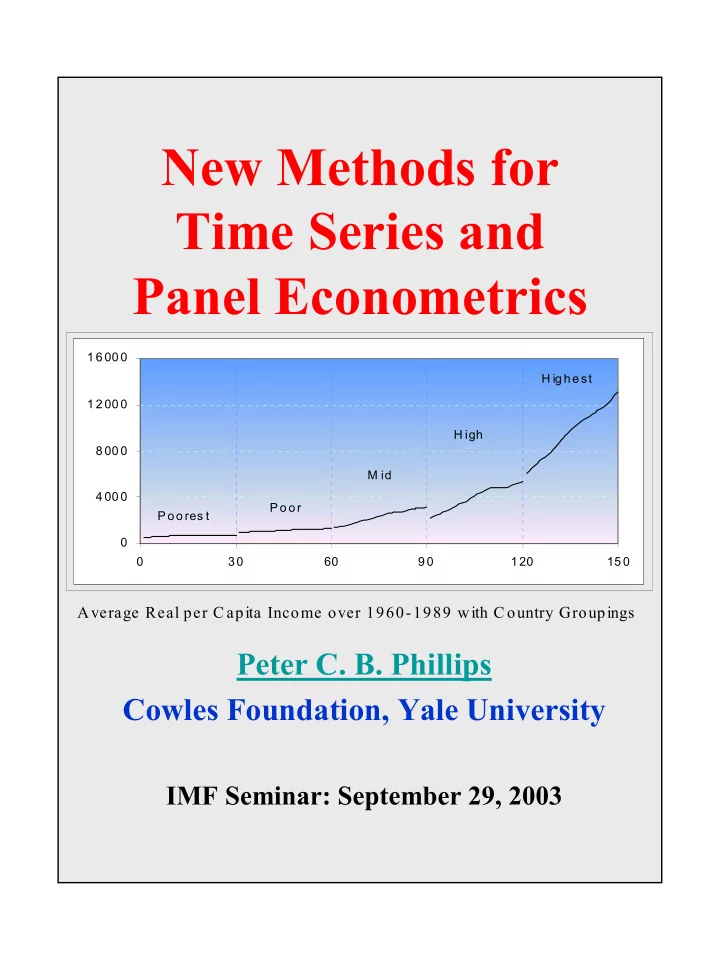

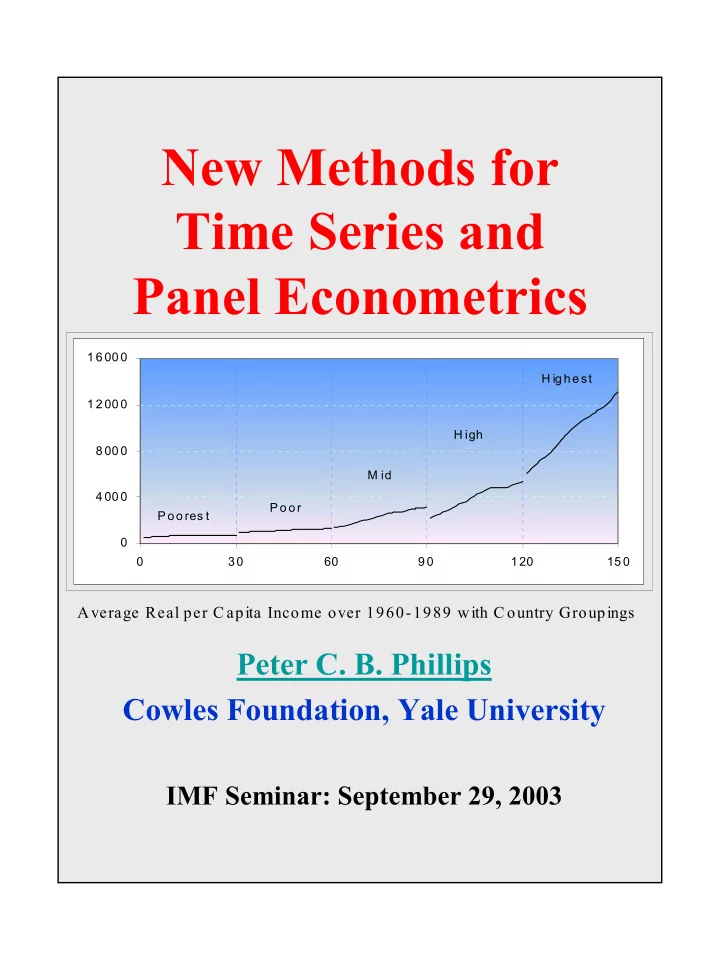

New Methods for Time Series and Panel Econometrics 1 6 00 0 H ig h e st 1 2 00 0 H igh 8 00 0 M id 4 00 0 Po o r Po o res t 0 0 3 0 60 9 0 1 20 15 0 Average Real per C apita Income over 1960-1989 with C ountry Groupings Peter C. B. Phillips Cowles Foundation, Yale University IMF Seminar: September 29, 2003

Seminar 2002 � Limitations of the Econometric Approach � Laws of Econometrics � Limits to Empirical Knowledge & Forecasting � Proximity Theorems � A Look to the Future � Online Econometric Services � Dynamic Panel Modeling � Estimation of Long Memory

Outline � Dynamic Panels with Incidental Trends & Cross Section Dependence � Bias & Inconsistency � Adjusting for Bias � Homogeneity testing � Modeling & Handling Cross Section Dependence � Nonstationary Panel Models � Unit Roots, Near unit roots, incidental trends � Testing unit roots & CSD � Cointegration & spurious regression � Applications � Growth convergence & transitions � FH savings/investment regressions � Bias corrections – PPP & demand for gas

Papers List of Relevant Papers • Phillips & Moon (1999). Linear regression limit theory for nonstationary panel data, Econometrica, 67, 1057- 1111. • Moon & Phillips (1999). Maximum likelihood estimation in panels with incidental trends. Oxford Bulletin of Economics and Statistics , 61,711–48. • Phillips & Sul (2003). Dynamic panel estimation and homogeneity testing under cross section dependence. Econometrics Journal , 6, 217-259. • Phillips & Sul (2003). Bias in Dynamic Panel Estimation with Fixed Effects, Incidental Trends and Cross Section Dependence. CFDP # 1438, Yale University • Moon, Perron & Phillips (2003). Incidental trends and the power of unit root tests. CFDP # 1435, Yale University http://cowles.econ.yale.edu/

Dynamic Panel Models Dynamic Panel Models Latent variable equation y i , t 1 2 u i , t , u i , t iidN 0, i y i , t 1,1 Panel Models , M1: y i , t y i , t , M2: y i , t i y i , t , M3: y i , t i i t y i , t Initialization 2 i N 0, 1 2 1,1 y i ,0 . O p 1 1

Dynamic Estimation Bias Estimation Bias Background & New Issues � Common autoregressive bias source & exacerbation with intercept and trend Orcutt (1949), Orcutt and Winokur (1969), Andrews (1993) � Panel autoregressive bias accentuated by pooling & effect of CS dependence Phillips & Sul (2003) � Panel autoregressive estimates inconsistent in presence of individual effects & incidental trends Nickell (1982), Neyman & Scott (1948), Moon & Phillips (1999) � Problems of Weak Instruments in IV & GMM estimation Hahn & Kuersteiner (2000), Moon & Phillips (2004)

Weak Instrument Examples Weak Instrument Examples � Applied Microeconometrics: earnings & schooling regressions Angrist & Krueger (1991, 2001) � Panel Models with Near Unit Roots Hahn & Kuersteiner (2000) Moon & Phillips (2001, 2004) 1 c y it i y it 1 u it T 1 c y it y it 1 u it T Instrument is weak because y it 2 c y it 1 i T y it 2 u it How does this affect inference?

Analysis of Firm Size Analysis of Firm size Gibrat’s Law (proportional effect) Z it Z it 1 Z it 1 e it , i.e. z it z it 1 e it Popular Empirical Formulation Sutton (1997), Hall & Mairesse (2000) z it t y it , y it y it 1 it , 1 Panel Model with Near Unit Root g p t c z it i i T z it 1 it Moon & Phillips (2004) Implications z it c 0 if c 0 z it 1 T

Dynamic Estimation Bias Dynamic estimation bias Models M1, M2, M3: pooled estimator T N t 1 i 1 it 1 u it y t 1 T i 1 N it 1 2 y Asymptotic Bias M2 – Nickell (1981) G , T 1 T 1 O T 2 plim N Unit Root Case M2 3 1 p lim N T 1 also holds for heterogeneous case: N i 2 2 N i 1 1 2 i 2 , E u it lim N

Inconsistency for Model M2 Asymptotic ( N ) Bias Function | G , T | G , T for Model M2.

Quantiles of Pooled OLS Estimator of = 0.9 Quantiles of pooled OLS estimator Sample Model M1 Model M2 Model M3 5% 95% 5% 95% 5% 95% N 1, T 50 0.710 0.962 0.628 0.937 0.548 0.904 N 1, T 100 0.787 0.948 0.749 0.935 0.713 0.920 N 10, T 50 0.858 0.928 0.799 0.889 0.735 0.843 N 10, T 100 0.874 0.920 0.847 0.902 0.820 0.882 N 20, T 50 0.872 0.921 0.816 0.880 0.755 0.831 N 20, T 100 0.882 0.915 0.857 0.896 0.830 0.874 N 30, T 50 0.878 0.917 0.824 0.875 0.763 0.825 N 30, T 100 0.885 0.913 0.861 0.893 0.835 0.870 N t 1 T pols i 1 y it 1 y i. 1 y it y i. N t 1 T i 1 y it 1 y i. 1 2 For Model M2

Implications for Estimation of Half life implications Half-Life of Unit Shock h = 6.5, = 0.9 Sample Model M1 Model M2 Model M3 Quantile 5% 95% 5% 95% 5% 95% N 1, T 50 2.027 18.036 1.487 10.730 1.153 6.905 N 1, T 100 2.890 13.034 2.403 10.393 2.051 8.342 N 10, T 50 4.532 9.244 3.086 5.897 2.248 4.071 N 10, T 100 5.130 8.332 4.184 6.753 3.487 5.518 N 30, T 50 5.313 8.019 3.573 5.171 2.561 3.614 N 30, T 100 5.698 7.617 4.645 6.095 3.847 4.973 h ln0.5/ ln pols

Panel Autoregression Panel AR density estimates density estimates 0.2 0.16 POLS PEMU 0.12 0.08 Single OLS 0.04 0 0.8 0.82 0.84 0.86 0.88 0.9 0.92 0.94 0.96 Empirical Distributions of Single Equation OLS, POLS and PEMU No Cross Section Dependence N = 20, T = 100, 0.9

Bias Reduction in Dynamic Bias reduction Panel Regression � Use Bias Correction Methods � asymptotic bias formulae – Hahn & Kuersteiner (2002), Phillips & Sul (2003) � Median Unbiased Estimation Lehmann (1959), Andrews (1993), Cermeno (1999), Phillips & Sul (2003) � use invariance property & median function of panel pooled OLS estimator � median function m m T , N � panel median unbiased estimator pols m 1 , 1 if pemu m 1 pols pols m 1 , if m 1 pols m 1 , 1 if

Panel MU Estimation Panel MU Estimation � Works well …. but � Uses Gaussianity � Need to have/find median functions by simulation � Is the median function increasing? Does the inverse function exist? pols , m 1 m 1 pfgls � Is it Invariant? � What about more complex models?

Model M3 Model M3 Fitted Trend: pooled estimator bias H , T 2 1 plim N T 2 O T 2 Unit Root Case M3 7 .5 1 p lim N T 2 holds in heterogeneous error case inconsistency is > twice incidental trend case for T < 20, bias is very substantial

Inconsistency for Model M3 Asymptotic ( N ) Bias Function | H , T | H , T for Model M3.

Effect of Detrending Bias on Panel Data 10 y t 5 0 y t-1 -10 -5 0 5 10 -5 -10 0.90 Sample Data before Detrending ( T 4, N 1,000, 0.9, Panel Model y it y it 1 it , it iid N 0, 1 t 1, . . . , T ; i 1, . . . , N

After Detrending 2 y t 1 0 y t-1 -2 -1 0 1 2 -1 -2 Detrended Data ( T 4, N 1,000; 0.9, plim N 0.502, 0.53 ). Panel Model y it y it 1 it , it iid N 0, 1 t 1, . . . , T ; i 1, . . . , N

Models with Exogenous Panel AR density estimates Variables Model M4 y y 1 Z u Asymptotic Bias M4, | | < 1 2 A , T plim N 2 B , T plim N , 1 1 N Z Q Z Z , 1 j Z , t it j j 0 i Z plim Z 1 Z Z plim Z , 1 plim N N N

Models with Cross Section Models with cross section dependence Dependence I Model M2 + CSD K is st it y it a i y it 1 u it , u it s 1 where 2 over t st s 1, . . . , K iid 0, s N N i 1 1 2 2 si s lim N Asymptotic Bias M2 + CSD, | | < 1 2 A , T AT plim N 2 B , T BT K s 1 2 s 2 s 2 1 s 1 T 1 1 o a . s . T K T 2 s 1 2 s 2 s

Recommend

More recommend