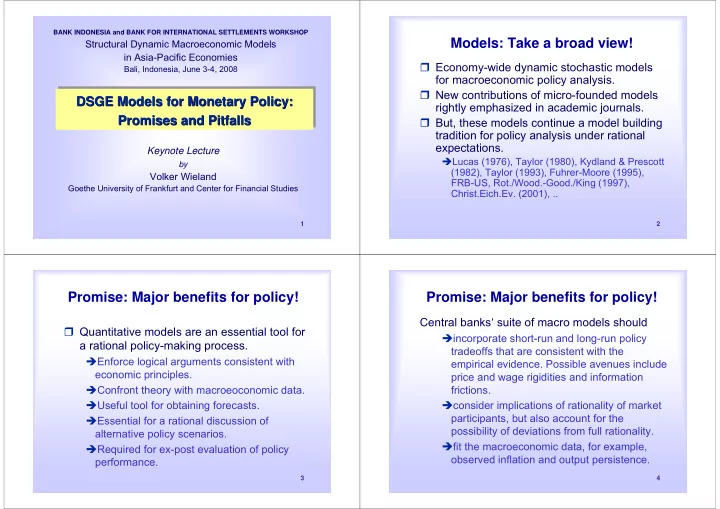

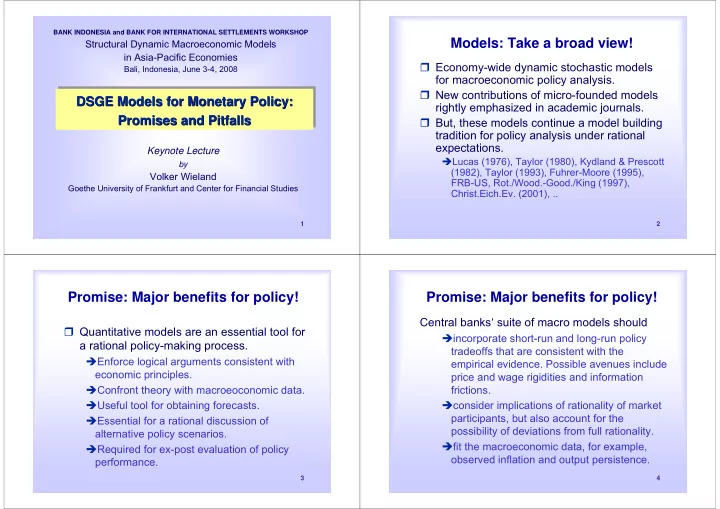

BANK INDONESIA and BANK FOR INTERNATIONAL SETTLEMENTS WORKSHOP Models: Take a broad view! Structural Dynamic Macroeconomic Models in Asia-Pacific Economies � Economy-wide dynamic stochastic models Bali, Indonesia, June 3-4, 2008 for macroeconomic policy analysis. � New contributions of micro-founded models DSGE Models for Monetary Policy: DSGE Models for Monetary Policy: DSGE Models for Monetary Policy: rightly emphasized in academic journals. Promises and Pitfalls Promises and Pitfalls Promises and Pitfalls � But, these models continue a model building tradition for policy analysis under rational expectations. Keynote Lecture � Lucas (1976), Taylor (1980), Kydland & Prescott by (1982), Taylor (1993), Fuhrer-Moore (1995), Volker Wieland FRB-US, Rot./Wood.-Good./King (1997), Goethe University of Frankfurt and Center for Financial Studies Christ.Eich.Ev. (2001), .. 1 2 Promise: Major benefits for policy! Promise: Major benefits for policy! Central banks‘ suite of macro models should � Quantitative models are an essential tool for � incorporate short-run and long-run policy a rational policy-making process. tradeoffs that are consistent with the � Enforce logical arguments consistent with empirical evidence. Possible avenues include economic principles. price and wage rigidities and information � Confront theory with macroeoconomic data. frictions. � Useful tool for obtaining forecasts. � consider implications of rationality of market participants, but also account for the � Essential for a rational discussion of possibility of deviations from full rationality. alternative policy scenarios. � fit the macroeconomic data, for example, � Required for ex-post evaluation of policy observed inflation and output persistence. performance. 3 4

Pitfall #1: Knowing the right way Pitfall #2: Taking the easy way � Fortunately, monetary economists today � Widely available benchmark models are agree on many important questions. But tremendously useful, beware of overconfidence and exclusive � but central banks should make a serious reliance on a narrow consensus approach. effort to understand and model those factors that are specific to their economies. � Develop a suite of models using different modeling and estimation approaches. � Standard tools (log-linear approx., ..) and assumptions (rational exp., Calvo fairy + � Replicability (model and data), systematic comparison of different modeling approaches. index...) help us improve our understanding and obtain easily tractable models, � Design policy recommendations that are robust to competing models. � but at the danger of neglecting important risks for policymakers. 5 6 1.1. Micro foundations and LQ Outline methodology 1. Modelling frameworks � Great! Structural interpretation in terms of 1.1 Micro foundations and LQ methodology deep parameters. 1.2. Expectations formation � Simple example: NK Phillips curve, notation 1.3. Benchmark models and emerging economies as in Walsh (2003) � 1.4. Case study: Modeling Chile‘s transition π = β π + λ 2. Policy design with models (1) E x + t t t 1 t 2.1. Robustness of policy recommendations 2.2. Central bank learning discount factor: β � 2.3. Case study: EMU and the ECB‘s models slope κ ? 3. A platform for comparison output gap x? 7 8

Structural interpretation But, some humility is in order ... � The key Keynesian feature, that is price ( )( ) ( − ω − βω ⎡ ⎤ ⎛ + η ⎞ rigidity, is simply introduced by assumption. 1 1 1 ) π = β π + σ η − ⎢ ˆ ⎜ ⎟ ⎥ E + y z ˆ + ω σ + η t t t 1 t t � The representative agent exists for ⎝ ⎠ ⎣ ⎦ mathematical convenience. The implied � Calvo signal probability: ω (2) restrictions might be quite different from � Household‘s (CES) utility fn: η , σ those that would be consistent with optimizing behavior of heterogenous � Firms‘ prod.fn/ prod.shock: z individuals. � Lucas critique taken into account w.r.t. to � Rationality assumption of micro-foundations expectations formation and optimizing decision-making of firms and households. used for macro models is questioned in other areas of economic theory. 9 10 Linear-quadratic methodology Nonlinearities � The speed at which modelling efforts are � But, nonlinarities may have crucial influence proceeding at central banks of leading on the economy and policy design, and industrial economies, but more recently also magnify effects of uncertainty. at emerging markets is truly impressive. � Nonlinear micro-founded model may imply � This was possible due to the different disinflation costs (Ascari&Merkl). � transparency of log-linear approximations � Learning introduces a nonlinearity. of complex nonlinear macro models, � Zero bound on nominal interest rates. � the applicability of linear-quadratic � Regime change is nonlinear. methods that are easily accessible in � Policy targets and ranges. standard software. 11 12

1.2. Expectations formation Deviations from rational expectations � But, the RE hypothesis typically does not � Standard framework: fare well in empirical tests or in explaining � expectations are fully rational, unique and survey expectations. incorporate much information regarding the � RE hypothesis may overstate structural known structure of the economy. rigidities. � persistence in macro variables is due to a � Policy relevant deviations may arise due to variety of frictions, policy and serial correlation in shocks, all incorporated in � imperfect information and rational learning rational expectations. � bounded rationality, (see least-squares � Important benefit: policy recommendations learning literature, Marcet&Sargent, derived from such models do not require that Evans&Honkapohja, Orphanides&Williams) the central bank can systematically fool � belief heterogeneity, (see rational beliefs market participants. 13 14 literature, Kurz et al.) 1.3. Benchmark models and Emerging economies features emerging economies � As a first step, it is very useful to estimate a � DSGE models developed first for the U.S. standard small-open economy DSGE model such as CEE are estimated assuming with macro data of an emerging economy. � a constant, credible policy regime; � But regime change may be recent and not � a constant share of firms with fixed prices; fully credible. � a constant share of firms that are indexing to � The informal sector may be large. past inflation; � Certain sectors may be dominating the � a constant degree of persistence in shocks. economy (raw materials prices, etc.) � These assumptions may hold up for a � Certain institutions may be changing, (legal sufficiently long estimation period in the U.S., system, rule of law, property rights..) and some industrial economies, but probably not in emerging economies. 15 16

� 1.4. Case study: Modeling Chile‘s Inflation targeting in Chile experience � Sep 1990: First official target. Chilean inflation 15-20% annual CPI inflation Dec 90 to Dec 91 (late 1980s) � 1991-2001: annual targets lowered gradually, target ranges or point targets. � Since 2001: constant range of 2 to 4 %. 17 18 Inflation targeting in Chile Chile‘s successful disinflation Year Range Midpoint 1991 15-20 17.5 1992 13-16 14.5 1993 10-12 11 1994 9-11 10 1995 8 8 1996 6.5 6.5 1997 5.5 5.5 1998 4.5 4.5 1999 4.3 4.3 2000 3.5 3.5 2001 2-4 3 19 20 From Schmidt-Hebbel and Werner (2002) extended to 2007.

Wieland (2008) NK Phillips curve with indexation 1. Allows for adaptive learning by price setters. � Christiano, Eichenbaum, Evans (01, 05) introduce exogenous degree of backward- 2. Endogenizes the degree of backward- looking indexation by linking it to learning. looking indexation, κ : 3. Investigates disinflation costs with temporary versus long-run targets. κ β λ π = π + π + E x (3) − + + βκ + βκ + βκ Lesson for models: Treating backward- t t 1 t t 1 t 1 1 1 looking indexation as exogenous overstates the cost of disinflation. ( ) − κ − β π 1 (1 ) + S Lesson for policy: Announcing temporary + βκ 1 targets helps reducing the cost of disinflation. 21 22 Long-run target vs temporary targets Gradual disinflation to a long-run target � Inflation declines gradually, � Market participants revise their beliefs regarding the persistence of inflation and inflation expectations decline, � Thus, disinflation costs decline. � Gradual disinflation implies smaller output losses than immediate disinflation. 23 24

Indexation and temporary targets Indexation and temporary targets � Temporary inflation targets that are achieved induce firms to move away from backward-looking indexation and index to the announced targets. � Perceived inflation persistence also declines. � These two effects together ensure that temporary targets achieve disinflation at lower output costs. 25 26 2.1. Robustness of policy 2. Policy design with models recommendations � Models with rational expectations emphasize 2.1. Robustness of policy recommendations that policy should be thought of in terms of rules and deviations from such rules. � These models emphasize the benefits from 2.2. Central bank learning committing to a rule. � Simple rules capture most of the benefits that � 2.3. Case study: EMU and the ECB‘s may be attained by fully optimal policy under models commitment. � Simple rules may be more robust in terms of performance across a range of models. (Taylor (1999), Levin et al. 1999). 27 28

Recommend

More recommend