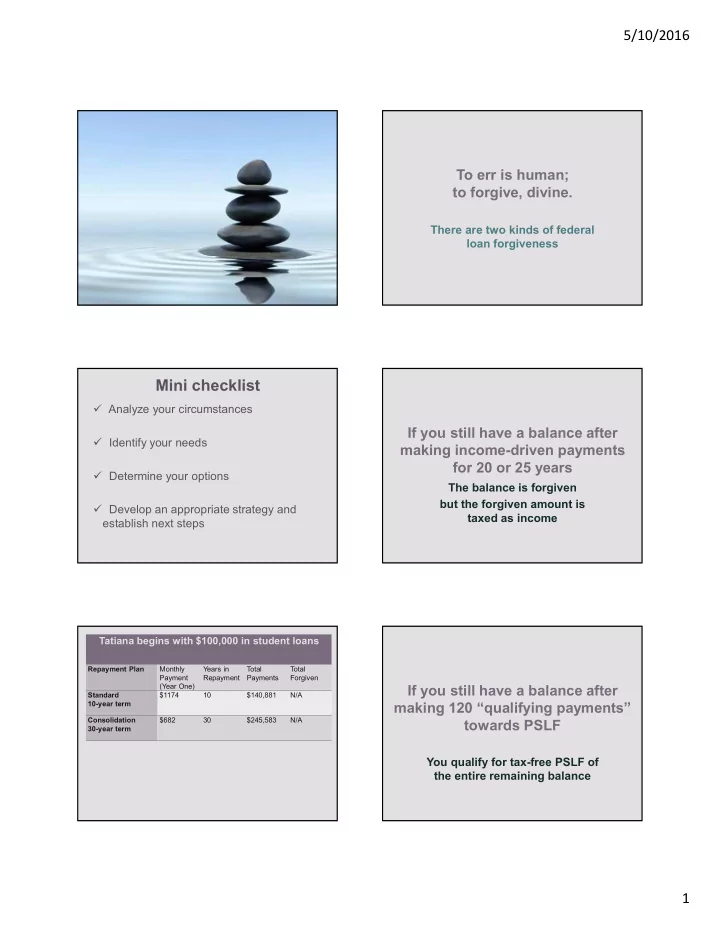

5/10/2016 To err is human; to forgive, divine. There are two kinds of federal loan forgiveness Mini checklist Analyze your circumstances If you still have a balance after Identify your needs making income-driven payments for 20 or 25 years Determine your options The balance is forgiven but the forgiven amount is Develop an appropriate strategy and taxed as income establish next steps Tatiana begins with $100,000 in student loans Repayment Plan Monthly Years in Total Total Payment Repayment Payments Forgiven (Year One) If you still have a balance after Standard $1174 10 $140,881 N/A 10-year term making 120 “qualifying payments” Consolidation $682 30 $245,583 N/A towards PSLF 30-year term You qualify for tax-free PSLF of the entire remaining balance 1

5/10/2016 Payments are 10 or 15 percent Forgiveness is tied to of “discretionary income” repayment Long-term forgiveness takes either Income-driven repayment plans 20 or 25 years are necessary for BOTH long-term, income-driven forgiveness and Public Service Loan Forgiveness takes public service forgiveness 120 “qualifying” payments Count payments . Adjusted Gross Income …99, 100, 101, Income driven repayment 102… Monthly Payments Married student loan borrowers must choose: single married with 2 kids • File taxes jointly and AGI 15% 10% 15% 10% have monthly payment $30,000 $154 $103 0 0 based on joint AGI and combined student debt, $40,000 $279 $186 0 0 or $50,000 $404 $270 0 0 • File taxes separately $60,000 $529 $353 $45 $30 and have monthly payment based on $70,000 $654 $436 $170 $114 individual AGI and $80,000 $779 $520 $295 $197 individual student debt (except under REPAYE) $90,000 $904 $603 $420 $280 $100,000 $1,029 $686 $545 $364 2

5/10/2016 Tatiana begins with $100,000 in student loans Make the right kind of payments Repayment Plan Monthly Years in Total Total Taxable as Payment Repayment Payments Forgiven (Year One) income Standard $1174 10 $140,881 N/A 10-year term Consolidation $682 30 $245,583 N/A 30-year term 15% of $466 25 $209,362 $64,644 discretionary income 15% of $310 20 $102,257 $142,743 discretionary income AGI $54,000; 3% annual increases; family size = 1 1. Make the right kind of payments, Payments based on income (ICR, IBR, PAYE, REPAYE) 2. on the right kind of loans, Federal Direct Loans ONLY 3. while working in the right kind of job. Full-time and paid government or nonprofit work Eligibility for specific 4. Repeat 120 times. repayment options Any fewer gets you nothing 5. Prove it. Depends on WHEN you got your first federal student loan Tatiana in a Public Service Career Did you have a balance on a federal student loan on: Repayment Plan Monthly Years in Total Total Payment Repayment Payments Forgiven Not (Year One) Standard $1174 10 $140,881 N/A taxable! 10-year term Consolidation $682 30 $245,583 N/A July 1, October 1, 30-year term 2014? 2007? 15% of $466 10 $68,438 $107,812 discretionary income 10% of $310 10 $45,625 $129,375 discretionary income AGI $54,000; 3% annual increases; family size = 1 3

5/10/2016 New IBR 10%, 20 • No balance on July 1, 2014 years PAYE • No balance on Oct 1, 2007 & 10%, 20 Partial Financial Hardship • A loan from after Oct 1, 2011 years Old IBR Required debt to income ratio 15%, 25 • Loans from whenever years in order to qualify for most income-driven repayment plans REPAYE 10%, 25 • Loans from whenever Years Income-driven repayment Old IBR PAYE REPAYE plans: ICR Partial Financial No Partial Hardship Partial Financial Financial required Old IBR Hardship Hardship required required New IBR No balance on a federal loan on PAYE Oct, 1, 2007 Doesn’t matter Doesn’t matter REPAYE when you when you Federal loan borrowed borrowed disbursed on or after Oct 1, 2011 Old IBR PAYE REPAYE Friends don’t let friends 10% of choose New IBR. income 15% of joint 10% of joint or separate or separate PAYE and REPAYE have better rules about income income Always based on interest accrual and capitalization BOTH spouses’ income 4

5/10/2016 Mary and Joe Old IBR PAYE REPAYE • Mary earns $45,000 as a social worker. Qualifies for • Her husband Joe earns $60,000 as a vet. PSLF Qualifies for Qualifies for • Mary and Joe have no children. PSLF PSLF 20 year • Joe owes $25,000 on his eligible federal forgiveness for borrowers with student loans only undergrad loans • Mary owes $75,000 on her loans (She 25 year 25 year 20 year forgiveness for owes 75 percent of the total marital borrowers with forgiveness forgiveness student loan debt). any graduate or professional loans Comparing Taxation Comparing how much tax they’ll pay Old IBR PAYE REPAYE Tax Filing Adjusted Gross Annual Tax Due Combined Annual Status Income Tax Due Jointly $102,500 $14,439 $14,439 Just 50 percent of Separately Hers: His: Hers: His: $15,061 No special Capitalization interest $60,000 $45,000 $9,401 $5,660 limitation to limited to 10 accrues interest percent of during capitalization principal Difference Filing jointly saves periods of or accrual balance $622 on this year’s negative tax payment. amortization Comparing student loan payments Tax Filing Monthly IBR Combined Combined Annual Status Payment Monthly IBR IBR Payment Payment Jointly Hers: His: $248 $991 $11,892 $743 (25% of (75% of total) total) Separately Hers: His: $272 $731 $8,772 $459 Difference Filing jointly Filing jointly requires $260 requires $3,120 more monthly in more annually in student loan student loan payments payments 5

5/10/2016 on the right kind of loan ONLY FFEL Direct FEDERAL DIRECT Before July 2010, federal loans came from two FFEL different sources Federal Student Loans Federal Direct FFEL Stafford FFEL So if you started borrowing before the summer of 2010 Direct Stafford You need to check NSLDS for loans that don’t say “Direct” and consolidate those first Direct Consolidation Loan 6

5/10/2016 The right kind of job Prove it 501(c)(3) Government Non-profit Public AmeriCorps Peace Corps Service Position Organization Repeat 120 times The paperwork matters verify income & family size annually certify employment annually Must be in qualifying employment when each of 120 payments are made, AND when applying for forgiveness, AND when forgiveness is granted apply for forgiveness 7

5/10/2016 Should I: Anticipate any taxable loan forgiveness? Choose a repayment plan tied to income? Choose the “married filing separately” tax status? Consolidate any federal loans? Why or why not? Which loans? askheatherjarvis.com Mini checklist Analyze your circumstances Identify your needs Determine your options Develop an appropriate strategy and establish next steps Questions? 8

Recommend

More recommend