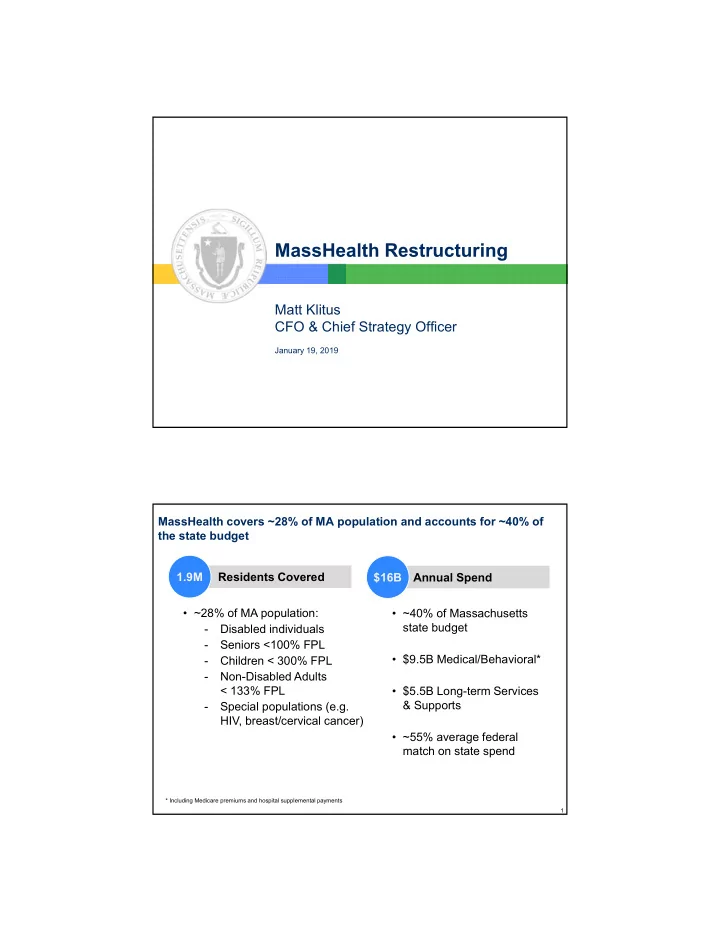

MassHealth Restructuring Matt Klitus CFO & Chief Strategy Officer January 19, 2019 MassHealth covers ~28% of MA population and accounts for ~40% of the state budget 1.9M Residents Covered $16B Annual Spend • ~28% of MA population: • ~40% of Massachusetts state budget - Disabled individuals - Seniors <100% FPL • $9.5B Medical/Behavioral* - Children < 300% FPL - Non-Disabled Adults < 133% FPL • $5.5B Long-term Services & Supports - Special populations (e.g. HIV, breast/cervical cancer) • ~55% average federal match on state spend * Including Medicare premiums and hospital supplemental payments 1

We have reduced MassHealth spending from double-digit annual growth to single-digits, but reforms required for sustainable growth CAGR MassHealth Program Spending $ billions FY10 FY13 FY18 -FY13 -FY15 FY16 FY17 FC Gross Program Spend Net State Cost 15.7 12.5% 8.5% 2.7% 4.4% 5.1% 15.0 14.6 13.5 11.8 10.7 10.3 10.1 9.2 6.1 6.1 6.1 5.9 16.9% 9.2% 3.1% 0.0% 0.7% 5.4 5.0 4.7 3.5 3.1 FY10 FY11 FY12* FY13 FY14 FY15 FY16 FY17 FY18 FC Note: 1) Commonwealth lost >$1B in federal revenue with sunset of enhanced revenues under the American Recovery and Reinvestment Act (ARRA) 2) Excludes ELD Choices spending for all years. 2 Affordability, rising health care costs, and other factors have resulted in more residents covered by MassHealth, fewer by Commercial insurance MA population by primary health coverage type* Change Millions of residents 2011-2016 6.7 6.7 6.8 6.8 Uninsured 4% 3% 3% 3% Connector 2% 3% 3% 3% MassHealth 14% 15% 21% + 491k 21% Medicare 15% 15% 15% 16% Commercial 65% 63% 59% 58% (523k) 2011 2013 2015 2016 * MassHealth enrollment including members with primary Medicare or commercial coverage represents 28% of population in 2017. Source: CHIA 3

Shift in volume toward public coverage puts significant pressure on fiscal health of health care organizations MA hospital payor mix Relative unit price by payor (approximate) % of Gross Patient Service Revenue (GPSR) % of Medicare fee schedule* CHIA data Change 7% 8% 7% (1%) Other -32% 14% 16% 17% MassHealth +3% 1.25 1.00 Medicare 37% 38% 0.85 40% +3% 40% Commercial 38% 36% (4%) FY12 FY14 FY16 Commercial Medicare MassHealth Medicare + 54% 57% 51% Medicaid Share * Approximate. Commercial % of Medicare estimated by comparing 2015 payment-to-cost ratios as reported on 2015 hospital cost reports; MassHealth % of Medicare does not include supplemental payments to hospitals. 4 MassHealth restructuring roadmap 1. Eligibility integrity 2. Program integrity 3. ACO restructuring and DSRIP investments 4. Behavioral health care + Opioids 5. MassHealth reform package 5

MassHealth restructuring roadmap 1. Eligibility integrity: right-sizing caseload 2. Program integrity: 3. ACO restructuring and DSRIP investments: 4. Behavioral health care + Opioids: 5. MassHealth reform package 6 Eligibility: historically-low enrollment growth due to fixing eligibility system defects and enhancing eligibility controls Total MassHealth Enrollment FY14-FY18 YTD Average Member Months Dec 2014 = 2.0M 2,100,000 2,000,000 1,900,000 1,800,000 1,700,000 Oct 2017 = 1.8M 1,600,000 1,500,000 1,400,000 1,300,000 Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17 Sep-17 7

MassHealth restructuring roadmap 1. Eligibility integrity: right-sizing caseload 2. Program integrity: $350M+ in recurring annual savings 3. ACO restructuring and DSRIP investments: 4. Behavioral health care + Opioids: 5. MassHealth reform package 8 MassHealth restructuring roadmap 1. Eligibility integrity 2. Program integrity 3. ACO restructuring and DSRIP investments: 17 ACOs, $1.8 billion in new funding starting March 2018 4. Behavioral health care + Opioids: 5. MassHealth reform package 9

ACO Reforms: Overview ▪ 17 ACOs will start March 2018 – Cover ~900,000 MassHealth members – Accountable for quality and cost of population – Majority of ACOs (13 of 17) chose fully capitated model – Almost all areas of the Commonwealth have 1 or more ACOs ▪ ACOs will receive portion of $1.8B in new DSRIP funding (through MassHealth waiver) over 5 years ▪ Uses of $1.8B in DSRIP – Enhancing care coordination/ member engagement, clinical and non-clinical – Both staff and non-staff (e.g., IT) investments – Clinical workforce development (loan repayment programs for community-based PCPs, BH clinicians, etc.; new residency slots at safety net providers) 10 ACO Reforms: 3 types of ACO models Member enrollment MassHealth Model A MCO Options MCO Options Model B MCO Options PCC plan Partnership Primary Plan Care ACO Model C ACO Model C Provider Provider MCO-Admin MCO-Admin Provider ACO ACO Provider Provider Provider Provider Provider Provider Provider Provider Model C: Model A: Integrated Model B: ACO/MCO model Direct to ACO model MCO-administered ACO model • Fully integrated: an • ACO provider contracts • ACOs contract and work with ACO joins with an directly with MassHealth MCOs MCO to provide full for overall cost/ quality • MCOs play larger role to support range of services • Based on MassHealth/ population health management • Risk-adjusted, MBHP provider network • Various levels of risk; all include prospective • ACO may have provider two-sided performance (not capitation rate partnerships for referrals insurance) risk • ACO/MCO entity and care coordination takes on full • Advanced model with two- insurance risk sided performance (not insurance) risk Increasing levels of sophistication, care coordination, and DSRIP $ 11

ACO Reforms: Pricing Model ▪ Single risk pool across ACO, MCO, FFS – 1.2 million members ▪ 5 regions x 6 rating categories ▪ State-wide base rates ▪ Quarterly risk adjustment (including social determinants) ▪ Blend of uniform rate with historical performance ▪ Quality measures ▪ Risk corridors 12 ACO Reforms: Selected Partners • Atrius Health with Tufts Health Plan • Baystate Health Care Alliance with Health New England • Beth Israel Deaconess Care Organization with Tufts Health Plan • Boston Accountable Care Organization with Boston Medical Center HealthNet Plan • Cambridge Health Alliance with Tufts Health Plan • Children’s Hospital Integrated Care Organization with Tufts Health Plan • Community Care Cooperative (13 federally qualified health centers) • Health Collaborative of the Berkshires with Fallon Community Health Plan • Lahey Health • Mercy Health Accountable Care Organization with Boston Medical Center HealthNet Plan • Merrimack Valley ACO with Neighborhood Health Plan • Partners HealthCare ACO • Reliant Medical Group with Fallon Community Health Plan • Signature Healthcare Corporation with Boston Medical Center HealthNet Plan • Southcoast Health Network with Boston Medical Center HealthNet Plan • Steward Medicaid Care Network • Wellforce with Fallon Community Health Plan ACOs will cover 900,000 MassHealth members and manage $6B in annual spending 13

MassHealth restructuring roadmap 1. Eligibility integrity 2. Program integrity 3. ACO restructuring and DSRIP investments: 4. Behavioral health care + Opioids: integration of care, expanding services 5. MassHealth reform package 14 MassHealth restructuring roadmap 1. Eligibility integrity 2. Program integrity 3. ACO restructuring and DSRIP investments: 4. Behavioral health care + Opioids: 5. MassHealth reform package 15

Questions? 16

Recommend

More recommend