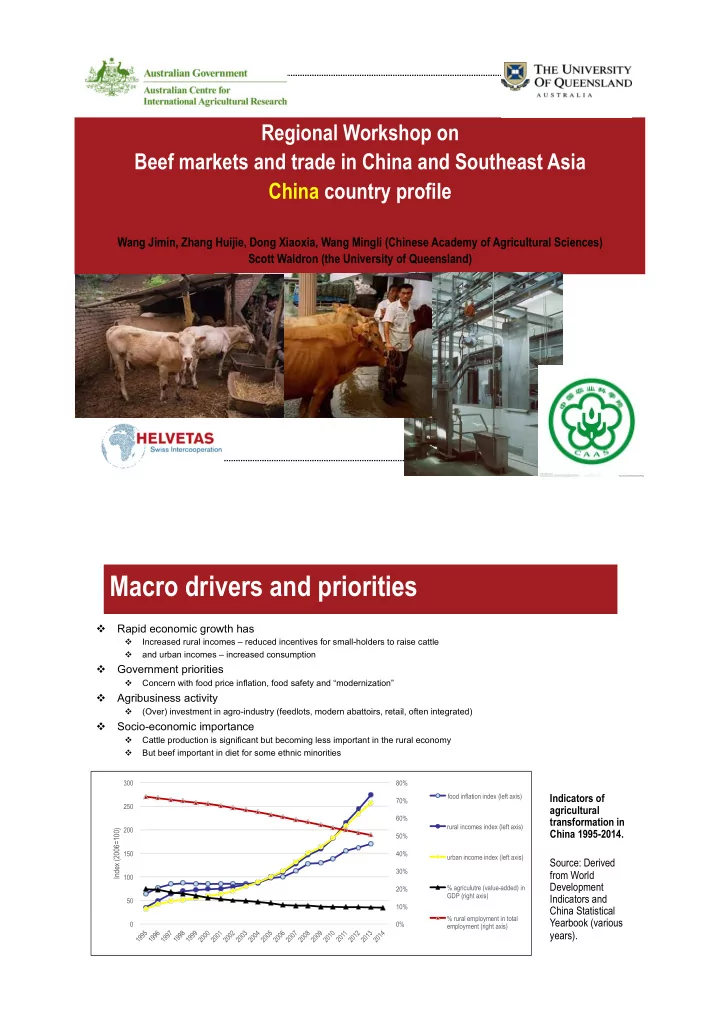

Regional Workshop on Beef markets and trade in China and Southeast Asia China country profile Wang Jimin, Zhang Huijie, Dong Xiaoxia, Wang Mingli (Chinese Academy of Agricultural Sciences) Scott Waldron (the University of Queensland) Helvetas Vietnam Macro drivers and priorities ! Rapid economic growth has ! Increased rural incomes – reduced incentives for small-holders to raise cattle ! and urban incomes – increased consumption Government priorities ! ! Concern with food price inflation, food safety and “modernization” ! Agribusiness activity (Over) investment in agro-industry (feedlots, modern abattoirs, retail, often integrated) ! ! Socio-economic importance ! Cattle production is significant but becoming less important in the rural economy ! But beef important in diet for some ethnic minorities 300 80% food inflation index (left axis) Indicators of 70% 250 agricultural 60% transformation in rural incomes index (left axis) Index (2006=100) 200 China 1995-2014. 50% 150 40% urban income index (left axis) Source: Derived 30% from World 100 Development % agriculutre (value-added) in 20% GDP (right axis) Indicators and 50 10% China Statistical % rural employment in total Yearbook (various 0 0% employment (right axis) years).

Production indicators 160 8 Statistical Statistical Bovine numbers and turnoff (million head) correction 1st correction 2nd agricultral agricultral 140 7 Bovine meat output (million tonnes) census census 120 6 Reform from commune era Advantaged Area Households allowed to program own livestock 100 5 Straw for & lease land Beef program 80 Cow & 4 State Council "Modern Pig Slaughter breeding Opinion on Agriculture" No. Management subsidies Accelerating 1 Document Agricultural Regulations Development of markets Agricultural 60 3 liberalised Processing Slaughter 40 2 bans on State-owned draught cattle abattoirs relaxed expanded but lose Beef Quality Livestock Law Revised monopoly 20 1 Grading & Food Safety System Food Qulaity & Law introduced Safety Law 0 0 Bovine numbers (left axis) Bovine turnoff (left axis) Bovine meat output (right axis) Production trends and policies in the Chinese beef industry, 1979-2013. Source: China Livestock Yearbook (various years) and authors Regional trends West! China! North! east! Central! Plains! Other! South west! China! ≈ 150,000 cattle ! Burma, through ≈ 700,000 t various routes beef, 100,000 ≈ 300,000 t cattle Vietnam beef HK Beef cattle distribution by province in China, 2013. Data from China Livestock Yearbook (2014), map generated by authors. One dot equals 10,000 beef cattle.

Sub- Continuum of agrifood value chains, agricultural modernisation sectors and Low value Mid value High value agrifood chains agrifood chains agrifood chains chains Demand for quality Generic beef Food safety, service Mid value beef attributes Premium beef Consumption, markets markets markets prices and in: in: Most relevant alignment of industry sub-systems in value chains in: retailing Most markets & Markets, supermarkets, HRI, select supermarkets restaraunts HRI Lower cost L o w c o s t Scale & Food safety Certified modernisation Processing Uncertified centralised Modern abattoirs sector slaughter slaughter points households L o w c o s t Lower cost Segments of the Chinese Internalisation of Open market Group marketing Collectivisation costs individualistic Contract Marketing sector domestic beef trading through: marketing specialised villages & by: Externalisation Flexibility groups markets, dealers, agents of costs industry Source: authors Scale production Specialisation Unspecialised Specialised Large scale Production cow-calf cattle feeding commercial sector households households feedlots Lower costs Diversfiication most relevant & dominant Additional alignment in Major Major Legend flow of product flows drivers agrifood constraints product across of/to chains mdernisation categories Prices 70 3.0 60 2.5 50 2.0 Meat prices (Rmb/kg) Corn prices (Rmb/kg) 40 1.5 30 1.0 20 0.5 10 0 0.0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Beef Mutton Pork Chicken Corn (right axis) Monthly meat and corn prices in Beijing (1995-2015) Source: China Livestock Yearbook (various years) and Ministry of Agriculture

Trade Formal beef imports: Informal beef imports: • 300,000 tonnes in 2013 • Mainly from Australia Perhaps 1 million tonnes of beef entered through informal channels in 2013 400 Route: • 300,000 t through HK 350 • Rest through Vietnam and other channels Beef$traded$(kilotonnes) Source: 300 • Brasil 430,000 tonnes 250 India 470,000 tonnes • • The US 90,000 tonnes 200 150 Informal cattle imports: 100 Perhaps 350,000 cattle entered through the border trade in 2014 (if 200kgs carcass weight = 50 70,000 tonnes beef): • 100,000 cattle from Vietnam 0 • 100,000 directly from Burma Year 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 • 150,000 indirectly from Burma through Thailand and Laos. Mainland4China4beef4imports Hong4Kong4SAR4beef4net4trade China4beef4exports Beef imports and exports, mainland China and Hong Kong But China is cracking down Special Administrative Region (SAR), 1992-2014. on the informal trade. What Source: UNComtrade (2014) are the implications? Industry priorities and strategies

Recommend

More recommend