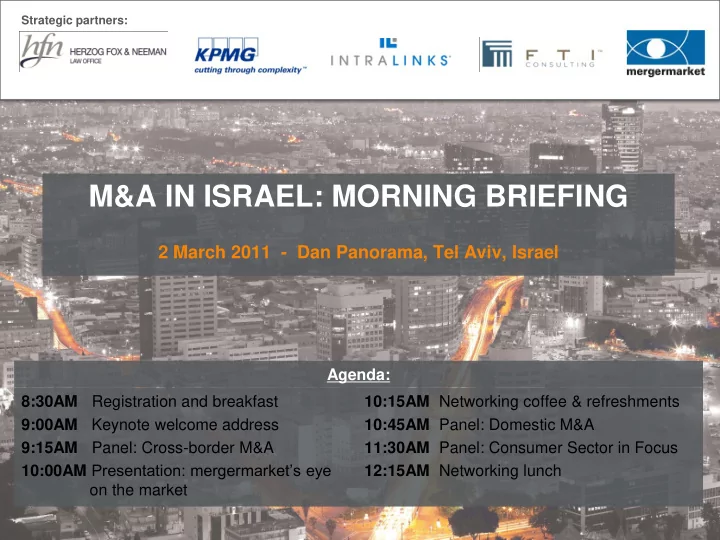

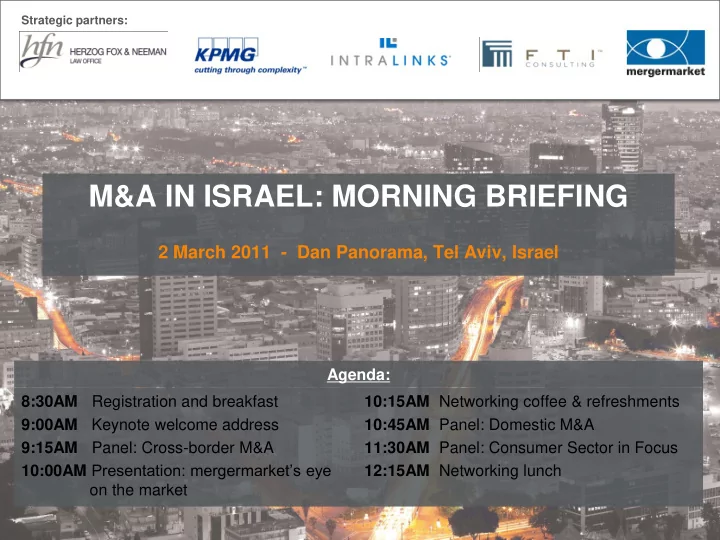

Strategic partners: M&A IN ISRAEL: MORNING BRIEFING 2 March 2011 - Dan Panorama, Tel Aviv, Israel Agenda: 8:30AM 10:15AM Networking coffee & refreshments Registration and breakfast 9:00AM Keynote welcome address 10:45AM Panel: Domestic M&A 9:15AM 11:30AM Panel: Consumer Sector in Focus Panel: Cross-border M&A 10:00AM Presentation: mergermarket’s eye 12:15AM Networking lunch on the market

Strategic partners: Israeli M&A trends 30 7,000 6,000 25 5,000 20 Deal value (US$m) Number of deals 4,000 15 3,000 10 2,000 5 1,000 - - Number of deals Deal value (US$m)

Strategic partners: Top 10 Israeli M&A deals, 2010 Announced Status Target company Target sector Bidder company Bidder Seller company Seller Deal value date country country (US$m) Oct-10 P British Israel Real Estate Melisron Ltd; Ofer Israel Leo Noe; Pujo Zabludowicz UK 1,998 Investment Ltd Investments (70.65% stake) Oct-10 P 012 Smile Telecom TMT Partner Israel Ampal-American Israel Corporation Israel 415 Ltd Communications Company Ltd Aug-10 P Attenti Holdings SA Industrials & 3M Company US Francisco Partners LP; Cavendish US 230 Chemicals Asset Management; Sequoia Capital Israel Sep-10 P Enter Holdings 1 Ltd Financial Services Elbit Imaging Ltd Israel 217 (90.00% stake) Apr-10 C ICQ Ltd TMT Digital Sky Russia AOL, Inc US 188 Technologies Ltd Apr-10 C Medingo Ltd Pharma, Medical Roche Holding Ltd Switzerland Elron Electronic Industries Ltd; Israel 160 & Biotech Radius Ventures LLC; Rafael Development Corporation Ltd Oct-10 P Shamir Optical Pharma, Medical Essilor International France 132 Industry Ltd (50.00% & Biotech SA stake) Nov-10 C Tivall (1993) Ltd Consumer Osem Investment Ltd Israel Kibbutz Lohamei Haghettaot Israel 129 (42.00% stake) Aug-10 P Derech Eretz Construction Israel Infrastructure Israel Africa Israel Investments Ltd Israel 125 Highways (1997) Ltd Fund (37.50% stake) Oct-10 P Shaldieli Ltd Industrials & Israel Petroleum US 114 Chemicals Company, LLC C = Completed; P = Pending

Strategic partners: Sector split by volume, 2010 10% 4% TMT 4% 34% Pharma, Medical & Biotech Industrials & Chemicals 4% Consumer Financial Services Real Estate 7% Energy, Mining & Utilities Leisure Defence 7% Other 8% 12% 10%

Strategic partners: Sector split by value, 2010 4% 2% 3% 3% 5% Real Estate TMT 6% 40% Industrials & Chemicals Pharma, Medical & Biotech Consumer Financial Services 7% Construction Defence Business Services Other 9% 21%

Strategic partners: Israeli M&A deal size splits by volume 90 81 80 76 3 1 72 5 1 70 3 70 10 4 3 59 5 8 60 >US$500m 56 4 US$251m-US$500m 12 3 Number of deals 5 43 3 US$101m-US$250m 50 32 7 8 US$15m-US$100m <US$15m 40 36 Not disclosed 18 33 25 30 20 25 22 13 18 9 14 10 11 8 7 7 4 4 0 2005 2006 2007 2008 2009 2010

Strategic partners: Outbound M&A trends 12 12,000 10 10,000 8 8,000 Deal value (US$m) Number of deals 6 6,000 4 4,000 2 2,000 - - Number of deals Deal value (US$m)

Strategic partners: Inbound M&A trends 16 6,000 14 5,000 12 4,000 10 Deal value (US$m) Number of deals 8 3,000 6 2,000 4 1,000 2 - - Number of deals Deal value (US$m)

Strategic partners: mergermarket Heat Chart Sector Israel TMT 26 Pharma, Medical & Biotech 19 Financial Services 15 Hot Warm Cold Energy, Mining & Utilities 12 16 10 4 Consumer 9 14 8 2 Business Services 7 12 6 0 Industrials & Chemicals 5 Real Estate 4 Construction 3 Leisure 3 Transportation 2 Defence 1 Government 1 Total 107 The Intelligence Heat Chart is based on ‘Companies for Sale’ tracked by mergermarket in Israel between 1 -Jul-10 and 31-Dec-10.

Recommend

More recommend