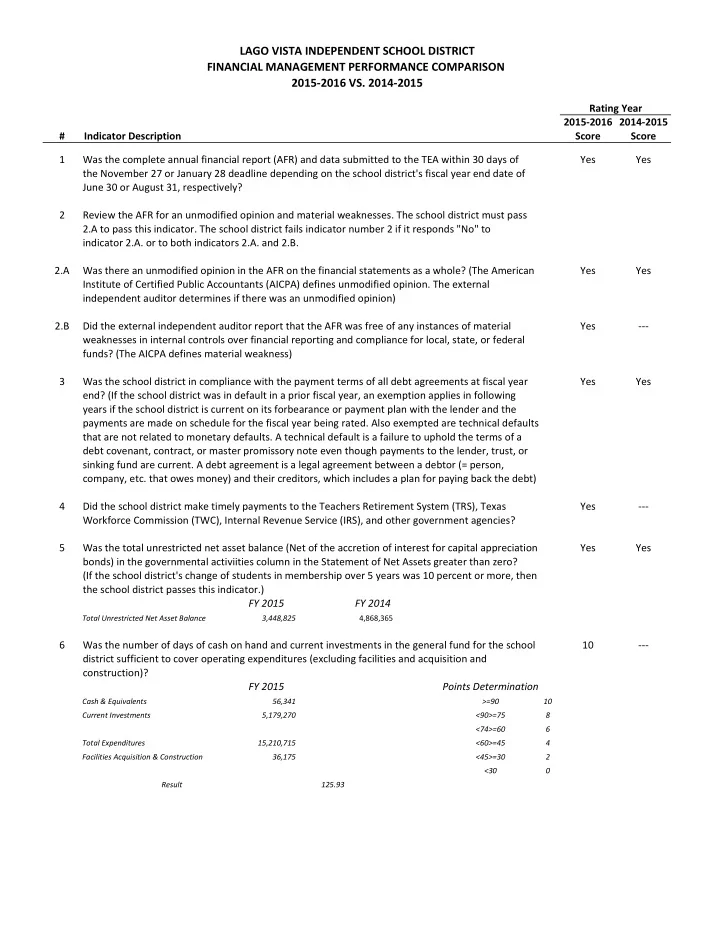

LAGO VISTA INDEPENDENT SCHOOL DISTRICT FINANCIAL MANAGEMENT PERFORMANCE COMPARISON 2015-2016 VS. 2014-2015 Rating Year 2015-2016 2014-2015 # Indicator Description Score Score 1 Was the complete annual financial report (AFR) and data submitted to the TEA within 30 days of Yes Yes the November 27 or January 28 deadline depending on the school district's fiscal year end date of June 30 or August 31, respectively? 2 Review the AFR for an unmodified opinion and material weaknesses. The school district must pass 2.A to pass this indicator. The school district fails indicator number 2 if it responds "No" to indicator 2.A. or to both indicators 2.A. and 2.B. 2.A Was there an unmodified opinion in the AFR on the financial statements as a whole? (The American Yes Yes Institute of Certified Public Accountants (AICPA) defines unmodified opinion. The external independent auditor determines if there was an unmodified opinion) 2.B Did the external independent auditor report that the AFR was free of any instances of material Yes --- weaknesses in internal controls over financial reporting and compliance for local, state, or federal funds? (The AICPA defines material weakness) 3 Was the school district in compliance with the payment terms of all debt agreements at fiscal year Yes Yes end? (If the school district was in default in a prior fiscal year, an exemption applies in following years if the school district is current on its forbearance or payment plan with the lender and the payments are made on schedule for the fiscal year being rated. Also exempted are technical defaults that are not related to monetary defaults. A technical default is a failure to uphold the terms of a debt covenant, contract, or master promissory note even though payments to the lender, trust, or sinking fund are current. A debt agreement is a legal agreement between a debtor (= person, company, etc. that owes money) and their creditors, which includes a plan for paying back the debt) 4 Did the school district make timely payments to the Teachers Retirement System (TRS), Texas Yes --- Workforce Commission (TWC), Internal Revenue Service (IRS), and other government agencies? 5 Was the total unrestricted net asset balance (Net of the accretion of interest for capital appreciation Yes Yes bonds) in the governmental activiities column in the Statement of Net Assets greater than zero? (If the school district's change of students in membership over 5 years was 10 percent or more, then the school district passes this indicator.) FY 2015 FY 2014 Total Unrestricted Net Asset Balance 3,448,825 4,868,365 6 Was the number of days of cash on hand and current investments in the general fund for the school 10 --- district sufficient to cover operating expenditures (excluding facilities and acquisition and construction)? FY 2015 Points Determination Cash & Equivalents 56,341 >=90 10 Current Investments 5,179,270 <90>=75 8 <74>=60 6 Total Expenditures 15,210,715 <60>=45 4 Facilities Acquisition & Construction 36,175 <45>=30 2 <30 0 Result 125.93

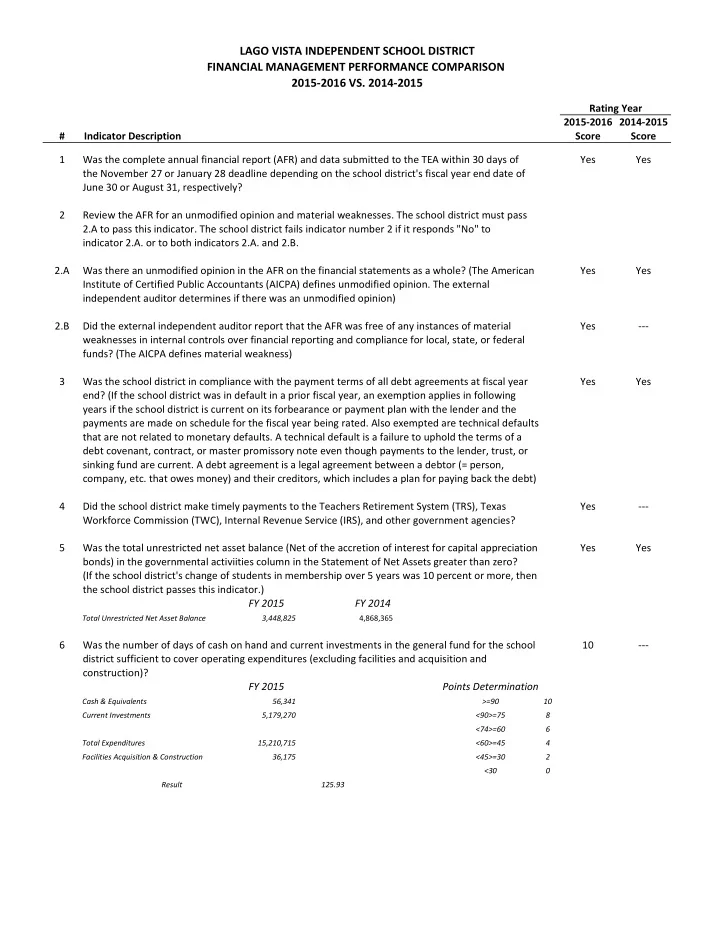

7 Was the measure of current assets to current liabilities ratio for the school district sufficient to cover 6 --- short-term debt? FY 2015 Points Determination Current Assets 6,694,586 >=3.00 10 Current Liabilities 3,134,459 <3.00>=2.50 8 Result 2.1358 <2.50>=2.00 6 <2.00>=1.50 4 <1.50>=1.00 2 <1.00 0 8 Was the ratio of long-term liabilities to total assets for the school district sufficient to support long- 6 --- term solvency? (If the school district's change of students in membership over 5 years was 10 percent or more, then the school district passes this indicator) FY 2015 Points Determination Long Term liabilities 47,885,408 <=0.60 10 Net Pension Liability 1,297,960 >0.60 <=0.70 8 Total Assets 58,426,841 >0.70 <=0.80 6 Result 0.7974 >0.80 <=0.90 4 >0.90 <=1.00 2 2015 Total Students 1363 >1.00 0 2011 Total Students 1276 Result 0.0682 >0.1 9 Did the school district's general fund revenues equal or exceed expenditures (excluding facilities 10 --- acquisition and construction)? If not, was the school district's number of days of cash on hand greater than or equal to 60 days? FY 2015 Points Determination Total Revenue 15,469,079 >=0% 10 Total Expenditures 15,210,715 <0% 0 Facilities Acquisition & Construction 36,175 Result 1.0194 Days of Cash on hand 125.93 10 Was the debt service coverage ratio sufficient to meet the required debt service? 10 --- FY 2015 Points Determination Total Revenue 18,957,136 >=1.20 10 minus Total Expenditures 18,743,070 <1.20 >=1.15 8 plus Debt Service (functions 71, 72, & 73) 3,686,357 <1.15 >=1.10 6 Plus Debt Service fund balance 574,062 <1.10 >=1.05 4 plus Function 81 36,175 <1.05 >=1.00 2 Result 1.2236 <1.00 0 11 Was the school district's administrative cost ratio equal to or less than the threshold ratio? 8 10 FY 2015 FY 2014 Points Determination Function 21 & 41 compared to functions 802,880 $ 731,697 <=0.1151 10 Functions 11, 12, 13, 31 6,631,017 $ 6,777,801 > 0.1151 <= 0.1401 8 (does not include TRS on-behalf exp) > 0.1401 <= 0.1651 6 > 0.1651 <= 0.1901 4 Result 0.1211 0.1080 > 0.1901 <= 0.2151 2 > 0.2151 0

12 Did the school district not have a 15 percent decline in the students to staff ratio over 3 years (total 10 --- enrollment to total staff)? (If the student enrollment did not decrease, the school district will automatically pass this indicator.) FY 2015 Points Determination 2014-2015 Total Enrollment 1,366 Yes 10 2014-2015 Number of FTE Staff 150.7920 No 0 9.0588 2012-2013 Total Enrollment 1,340 2012-2013 Number of FTE Staff 142.8336 9.3815 Result -3.4398% 13 Did the comparison of Public Education Information Management System (PEIMS) data to like 10 10 information in the school district's AFR result in a total variance of less than 3 percent of all expenditures by function? FY 2015 FY 2014 Points Determination Sum of Differences 22 24 Yes 10 Denominator 15,210,707 15,305,832 No 0 Result 0.0000 0.0000 14 Did the external independent auditor indicate the AFR was free of any instance(s) of material non- 10 10 compliance for grants, contracts, and laws related to local, state, or federal funds? (The AICPA defines material noncompliance.) 15 Did the school district not receive an adjusted repayment schedule for more than one fiscal year for 10 --- an over allocation of Foundation School Program (FSP) funds as a result of a financial hardship? 90 30

DETERMINATION OF RATING - 2015-2016 A. Did the district answer "No" to Indicators 1, 3, 4, 5, or 2.A? If so, the school district's rating is F for Substandard Achievement regardless of points earned. B. Determine the rating by the applicable number of points. (Indicators 6-15) A = Superior 70-100 B = Above Standard 50-69 C = Meets Standard 31-49 F = Substandard Achievement <31 DETERMINATION OF RATING - 2014-2015 A. Did the district answer "No" to Indicators 1, 2, 3, or 5? If so, the school district's rating is F for Substandard Achievement regardless of points earned. B. Determine the rating by the applicable number of points. (Indicators 6-15) Pass 16-30 Substandard Achievement <16

Recommend

More recommend