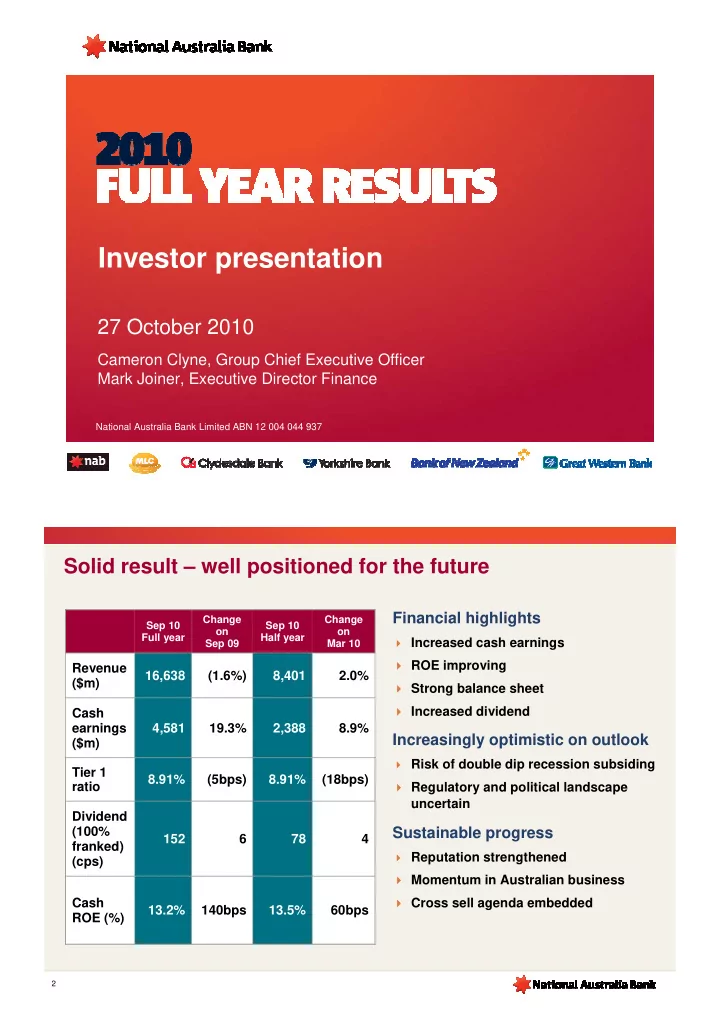

Investor presentation 27 October 2010 Cameron Clyne, Group Chief Executive Officer Mark Joiner, Executive Director Finance National Australia Bank Limited ABN 12 004 044 937 Solid result – well positioned for the future Financial highlights Change Change Sep 10 Sep 10 on on Full year Half year � Increased cash earnings Sep 09 Mar 10 � ROE improving Revenue 16,638 (1.6%) 8,401 2.0% ($m) � Strong balance sheet � Increased dividend Cash earnings 4,581 19.3% 2,388 8.9% Increasingly optimistic on outlook ($m) � Risk of double dip recession subsiding Tier 1 8.91% (5bps) 8.91% (18bps) ratio � Regulatory and political landscape uncertain Dividend (100% Sustainable progress 152 6 78 4 franked) � Reputation strengthened (cps) � Momentum in Australian business Cash � Cross sell agenda embedded 13.2% 140bps 13.5% 60bps ROE (%) 2

Macro outlook still uncertain � Global recovery underway � US stimulus efforts continue Economic outlook � UK budget measures as expected � Multi-speed Australian economy � Australian business confidence and conditions improving � Capital impact becoming clearer � Liquidity – solution yet to be determined Banking regulation � Australian Government and regulators need to consider a wider range of alternatives � Focus on financial services sector � Potential for competition and consumer regulation Political environment � NAB relatively well positioned 3 Strong progress against priorities Reputation / Rebalancing Investing for Balance sheet customers portfolio the future strength � Leading Business � Strong mortgage � Disciplined � Maintained AA rating Bank reputation – growth in Personal underlying cost � Strong Tier 1 capital active support of Bank proprietary and management creating position customers during GFC broker channels capacity for � Strong funding � Won 8 AB&F* awards increased investment � Business Bank position and Business Bank of momentum in slow � Mortgage the Year – CFO (CFI > 60%, SFI > 80%) market transformation – Magazine � Well positioned for early progress � Wealth position � Personal Bank closing regulatory change � Completed 1 st phase the gap on customer enhanced by Aviva, satisfaction JBWere and nabInvest of NextGen – 2 nd underway � MLC attracting � Managing UK and advisers GWB optionality � Innovations being � Broader community leveraged across the � Tight management of advocacy Group SGA – some rundown � Carbon neutrality Leadership, culture and talent � Improved employee engagement � Strong cross business unit collaboration � Investment in enterprise leadership * Australian Banking & Finance Corporate and Business Banking Awards 4

Transformation program 2010 Achievements 2011 Priorities � Customer satisfaction gap narrowed � WealthHub Customer � Strong wealth adviser growth � Continued development of NextGen experience release 2 capability – UBank, Broker and Redstar � Customer-led innovation � Mortgage processing – productivity, policy � Infrastructure and network transformation Simplicity, simplification, improved conversion rate � Docklands 2 commenced efficiency & � Technology incidents down >30% � Payments transformation - SWIFT Gateway risk mitigation � Network upgrade � Product rationalisation � Enterprise convergence � Mortgage Transformation Program � Securitisation engine implemented � Delivery of key NextGen information Enterprise capability � Single Australian/NZ SAP upgrade systems & > Single Australian/NZ General Ledger � Upgrade to nab.com.au website information > Campaign management � Implementation of a ‘requisition to pay’ system � Significant improvement in employee � Capability development – Academy, Employee engagement operations and service experience � Carbon neutral � Diversity � 2010 Employer of Choice for Women (EOWA) 5 2011 outlook � Continued focus on progressing strategic priorities � Navigate economic, regulatory and political uncertainty � NAB well positioned 6

FY10 Financials Group financial result Sep 10 Change on Sep 10 Change on $m Full year Sep 09 Half year Mar 10 Net interest income 12,288 1.8% 6,174 1.0% Other operating income (incl MLC) 4,350 (10.0%) 2,227 4.9% Net operating income 16,638 (1.6%) 8,401 2.0% Operating expenses (7,862) (3.7%) (4,001) (3.6%) Underlying profit 8,776 (5.9%) 4,400 0.5% B&DDs (2,263) 40.7% (1,033) 16.0% Cash earnings 4,581 19.3% 2,388 8.9% Cash ROE (%) 13.2% 140bps 13.5% 60bps NIM (%) 2.25% 9bps 2.24% (2bps) Tier 1 ratio 8.91% (5bps) 8.91% (18bps) 8

Business unit contributions Home currency (m) Sep 10 Change on Sep 10 Change on Full Year Sep 09 Half Year Mar 10 Cash earnings Business Banking 2,193 37.1% 1,098 0.3% Personal Banking 743 (15.1%) 426 34.4% Wholesale Banking 705 (38.6%) 302 (25.1%) UK Banking £118 53.2% £57 (6.6%) NZ Banking NZ$524 1.4% NZ$269 5.5% MLC & NAB Wealth 549 32.9% 285 8.0% Specialised Group Assets (262) 54.6% (45) 79.3% Other ^ 33 large 11 (50.0%) Group cash earnings 4,581 19.3% 2,388 8.9% Underlying profit – attribution analysis by business ($m, constant currency) (152) 41 130 (28) (16) 27 24 (7) (30) 35 4,400 4,376 Mar 10 Business Personal Wholesale UK NZ MLC & GWB SGA Other * FX Sep 10 Banking Banking Banking Banking Banking NAB Wealth * Includes Group Treasury and Other ^ Other comprises Group Funding, Group Business Services, other supporting units, Asia Banking, GWB, IoRE and 9 minority interest within MLC & NAB Wealth Key elements of the result (1) Average GLAs Change in market share (FX & acquisitions reported separately) Basis Points ($bn) 120 3.1 (2.1) 94 6.4 (1.2) 0.7 0.8 (0.6) (0.5) (0.2) 3.5 40 443.2 10 433.3 Australian Business Australian Retail NZ Lending* Housing** Super^ Housing^^ M O B P W U N M S A F S e G X t e Sep 09 – Aug 10 Sep 09 – Aug 10 Jun 09 – Jun 10 Sep 09 – Aug 10 a u h K Z L c r h p r s C A q s o B B e 1 i u n o l r 1 0 e a a & i e n s 0 s n n s i * ^ a a k k N t APRA monthly banking statistics. Plan for Life Australian retail & wholesale s l i i l i n A o B e n B B n g g Represents APRA data adjusted historically investments market share & dynamics report - 2010 a B a s n a W n k n k to include Business Markets Flexible Rate Loans ^^ RBNZ – Aug 2010 i e i n k n a i g g n l t g h ** RBA Financial System / NAB including wholesale banking data as at Aug 2010 Group net interest margin Increased cost of funding an Australian variable – attribution analysis rate mortgage 140 Funding cost April 2009 last increase over the RBA 33bps above RBA rate cash rate (bps) increase 120 (0.02% ) since 0.05% (0.05% ) Apr 09 100 Liquidity Portfolio Costs Total 80 Term Funding increase since 2.26% 2.24% Jun 07 60 118bps Total Customer Deposits 40 recovered 92bps 20 Mar 10 Lending Deposit Funding & Sep 10 Gap 26bps Margin Margin Liq Costs Bank Bill / Overnight Index Swap Spread 0 Pre-Crisis Mar 08 Sep 08 Mar 09 Sep 09 Mar 10 Sep 10 Based on management estimates. Applies to NAB Ltd only 10

Recommend

More recommend