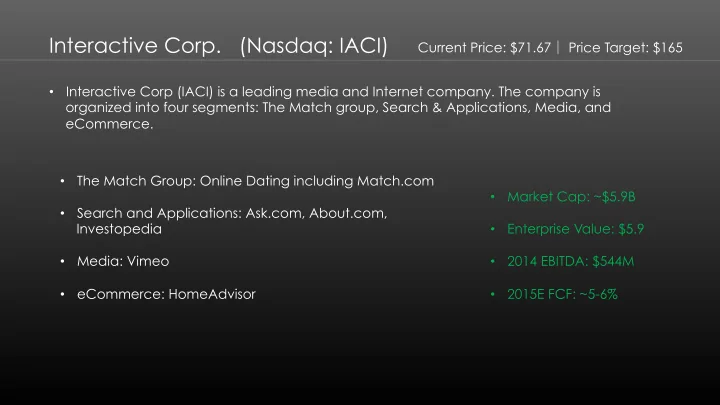

Interactive Corp. (Nasdaq: IACI) Current Price: $71.67 │ Price Target: $165 • Interactive Corp (IACI) is a leading media and Internet company. The company is organized into four segments: The Match group, Search & Applications, Media, and eCommerce. • The Match Group: Online Dating including Match.com • Market Cap: ~$5.9B • Search and Applications: Ask.com, About.com, Investopedia • Enterprise Value: $5.9 • Media: Vimeo • 2014 EBITDA: $544M • eCommerce: HomeAdvisor • 2015E FCF: ~5-6%

Investment Thesis • Sum of the Parts analysis that is (In ¡Millions) 2015 ¡EBITDA Revenue 2018 ¡EBITDA Multiple Search ¡& ¡Applications 322.0 5.0x 1,610 used by the street does not The ¡Match ¡Group ¡(ex-‑ ¡Tinder) 264.9 10.0x 2,649 acknowledge the value of Tinder, Media 203.5 2.0x 407 eCommerce 481.7 2.0x 963 giving us a free option Sum ¡of ¡the ¡Parts ¡EV $5,630 Current ¡Enterprise ¡Value $5,900 • Morgan Stanley: “There is no Tinder upside” Clearly, they have been living under a rock. Tinder changed the way people look at online dating. It’s now cool. Very cool. And it is changing the way we date.

Investment Thesis • Tinder has grown to ~50 million users, and grew 300% last year • International users represent 2/3 of user base • Tinder is 50 times larger than the next app or dating website • Online dating is here to stay. In words that it may be easier to understand for investment professionals: it brings liquidity to the market. • Once you use Tinder you will always use dating sites to find someone • The question is: which app or website will win? Spoiler alert: IAC dominates the market

Why This Opportunity Exists? • Analysts are extremely short-sighted and are valuing Tinder on 2016 EBITDA • Analysts are afraid of other free dating websites • Tinder was created in an IACI incubator, and has never had VC backing • IACI recently bought back 10% of Tinder, which explains why they’ve been modest about its potential

Keys To Investment Thesis Singles Landscape: Over the past 25 years the • marriage rate has gone down 40%. There are more single adults than married ones in the U.S. According to Pew Research Center, only 13% do not want to marry Network Effect: Although barriers to entry seem low for • online dating, the number one problem is getting enough people on board. You can go through over 100 profiles on Tinder, but you only get one match per day on competitor’s Coffee Meets Bagel Source: U.S. Census Marriage rate per 1000 Unrecognized EBITDA: Tinder has cannibalized • Match.com and OkCupid’s growth by ~20%; remarkably revenue is up 11% YoY. Competition is extremely severed. Both competitors Zoosk and Ashley Madison are rushing to IPO

4 Ways IAC Will Monetize Tinder 1.- Users will buy Tinder Plus for their unlimited swipe feature: • Tinder is a numbers game • 2.5% of Tinder’s MAU will subscribe • Tinder Plus tiered pricing. Tinder offers tremendous value for what millennials refer to as COGL Tinder ¡Plus ¡Revenue ¡for ¡#1 2015 2016 2017 2018 North ¡Americans ¡on ¡Tinder 59.7 95.5 127.1 148.4 International ¡users 133.4 241.8 360.2 480.6 Total ¡revenue ¡from ¡segment ¡1 $193.1 $337.3 $487.3 $629.0

4 Ways IAC Will Monetize Tinder 2.- Individuals that will purchase Tinder Plus for “Tinder Travel” (Hint: they may not be single). There are three types of users that will use Tinder travel: • People wanting to have affairs: Tinder Passport gives you the perfect opportunity for an out of the city rendez-vous • Millenials who want to date and travel: Never again travel the world alone. Traveling will never be the same. • People looking to travel, having their expenses paid by someone Tinder ¡Plus ¡Revenue ¡from ¡"Tinder ¡Travel" 2015 2016 2017 2018 Market ¡Size 61 108 159 206 % ¡who ¡will ¡use ¡Tinder ¡plus 3% 3% 3% 3% Total ¡revenue ¡for ¡segment ¡2 $219.6 $389.6 $570.9 $741.4 Note: The 3% will join Tinder for the sole purpose of Tinder Travel. I.e. Cheating Chad will only download Tinder for his escapades and not part of the normal user base. This is a huge base that no analyst has mentioned.

4 Ways IAC Will Monetize Tinder 3.- Tinder will make money by members transferring to Match.com, OkCupid and 37 other websites: • Although as a percentage more IAC paid subscribers will migrate to Tinder, as an absolute number more subscribers will turn onto IAC’s other dating websites and apps • Tinder is referred to as the gateway of online dating • Not every member will want casual dating, some will turn to other options • The most likely option is Match.com and OkCupid. eHarmony is completely opposite to Tinder – turns people off Member ¡transfer ¡(in ¡millions) 2014A 2015 2016 2017 2018 Tinder ¡> ¡Paid ¡subscribers 533 1,220 2,165 3,172 4,119 Paid ¡subscribers ¡> ¡Tinder 771 836 906 982 1,064 Net ¡subscribers ¡to ¡match (238) 384 1,259 2,190 3,055 Total ¡revenue ¡for ¡member ¡transfer ($54.8) $86.7 $284.0 $494.1 $689.2

4 Ways IAC Will Monetize Tinder 4.- Tinder will start introducing ads: • Tinder users log in 11 times a day and spend 77 minutes on Tinder. To compare, the average Facebook user spends an average time of 40 minutes in the U.S. • Tinder has access to your FB account which means that they know what you like, your age, your school, your location, marriage status, and who your friends are. This is extremely valuable • FB ARPU is ~$26 in North America and ~$10 worldwide. If Tinder monetizes at 20% of FB per ARPU, Tinder is worth ~$3-5B Total ¡revenue ¡from ¡ads 2015 2016 2017 2018 ARPU $0.33 $1.00 $1.50 $2.25 Total ¡revenue ¡from ¡ads $25 $126 $258 $485

Valuation (In ¡Millions ¡ex. ¡%) Bull ¡ Base Bear • Most likely there will be a mix between Current ¡number ¡of ¡users 50 40 30 bull, base and bear case in several % ¡who ¡want ¡more ¡swipes 3.6% 2.5% 1.4% categories Tinder ¡Travel 4.0% 3.0% 2.0% Transfer ¡Match ¡> ¡Tinder 18% 22% 25% Transfer ¡Tinder ¡> ¡Match 3% 2% 1% • Growth expected to double in 2015 Ad ¡Revenue ¡/ARPU ¡2018 $3.00 $2.25 $1.50 2018 ¡EBITDA 2,361 1,272 476 • Tinder is having even more success 10X ¡Multiple 23,613 12,722 4,762 internationally 75% ¡owned ¡IACI $17,710 $9,542 $3,572 Probability 20% 40% 40% Tinder ¡+ ¡Cross-‑selling $8,787 Estimated ¡Number ¡of ¡Users (in ¡millions) 2013 2014 2015 2016 2017 2018 North ¡Americans ¡on ¡Tinder 4 13 25 37 46 52 International ¡users 9 27 57 97 136 177 Total ¡number ¡of ¡users 13 40 82 134 183 229 NA ¡Growth ~700% 300% 85% 50% 25% 12% International ¡Growth ~700% 300% 115% 70% 40% 30% Can anybody find me somebody to love? − Queen mangelo@Wharton.upenn.edu

Recommend

More recommend