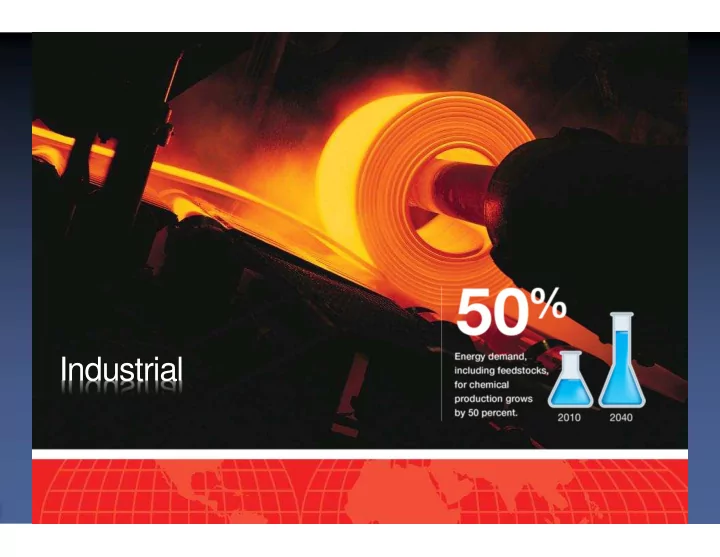

Industrial

Industry Energy Demand Increases 250 Quadrillion BTUs 200 Paint Paint Fertilizer Fertilizer Plastics Plastics 150 Chemicals Textiles Textiles 100 Automobiles Automobiles Steel Steel Manufacturing & Industry Natural Gas Natural Gas Coal Coal Liquid Liquid 50 Fuels Fuels Energy Industry Lubricants Lubricants Asphalt Asphalt Other Agriculture Agriculture 0 1990 2015 2040 ExxonMobil 2013 Outlook for Energy

Industrial Energy Demand By Fuel By Region Quadrillion BTUs Quadrillion BTUs 250 250 Market Heat Electricity Rest of 200 200 Non OECD Renewables Coal 150 150 India 100 Gas 100 China 50 50 Oil OECD 0 0 2000 2020 2040 2000 2020 2040 ExxonMobil 2013 Outlook for Energy

Electricity generation

Electricity Demand by Region Non OECD OECD Thousand TWh Thousand TWh 25 25 Other Non OECD 20 20 Russia/Caspian Southeast Asia 15 15 Middle East Africa Other OECD 10 10 India Europe OECD 5 5 China North America 0 0 2000 2020 2040 2000 2020 2040 ExxonMobil 2013 Outlook for Energy

Fueling Electricity Generation Varies by Region Electricity Generation Electricity Generation Growth in Fuels from 2010 to 2040 Quadrillion BTUs Quadrillion BTUs Quadrillion BTUs 120 300 300 Renewables 250 250 90 Renewables Nuclear 200 200 Non OECD Nuclear 60 150 150 Gas Coal 30 100 100 Coal 0 50 50 Oil OECD Gas Oil -30 0 0 Non OECD OECD 2000 2000 2020 2020 2040 2040 ExxonMobil 2013 Outlook for Energy

Global Electricity Generation Mix Evolves Global Capacity Utilized Global Capacity By Generation GW GW k TWh 35 1200 1200 30 1000 1000 Gas 25 800 800 20 600 600 Coal 15 400 400 Nuclear 10 Wind & Solar 200 200 5 Other Renewables Oil 0 0 0 Nuclear Nuclear Wind Wind Solar Solar 2000 2020 2040 ExxonMobil 2013 Outlook for Energy

Transportation

Transportation Demand Sector Demand Demand by Region MBDOE MBDOE 75 30 Rail ‘40 25 60 Marine Aviation ‘25 20 45 15 Heavy Duty ‘10 30 10 15 5 Light Duty 0 0 2000 2020 2040 AP NA Europe LA ME ROW ExxonMobil 2013 Outlook for Energy

Light Duty Vehicle Fleet Grows, Mix Changes Powertrain Technology Powertrain Technology Powertrain Technology Millions of Vehicles Millions of Vehicles Millions of Vehicles 2010 2025 2040 500 500 500 PHV/EV 400 400 400 Advanced* Advanced* Full Hybrid CNG CNG CNG LPG LPG LPG 300 300 300 Conv. Diesel Conv. Diesel Diesel Conv Conv. Gasoline Conv. Gasoline Mogas Conv 200 200 200 100 100 100 0 0 0 North North North Europe Europe Europe Other Other Other China China China India India India Middle East Middle East Middle East Latin Latin Latin Other Non Other Non Other Non America America America OECD OECD OECD OECD OECD OECD America America America OECD OECD OECD *Full Hybrid, Plug-in Hybrid, Electric Vehicles ExxonMobil 2013 Outlook for Energy

Light Duty Vehicle Sales & Efficiency Annual New Car Sales by Type Incremental Vehicle Efficiency Gains Million Cars Miles per Gallon 47 MPG 150 20 Elec/PHV Full Hybrid 125 Natural Gas Hybrid Conv. Diesel 15 Conv. Gasoline 100 Vehicle Size 75 10 Body & Accessories 50 Average 5 27 MPG 25 Powertrain 0 0 2010 2015 2020 2025 2030 2040 2010 2020 2030 2040 ExxonMobil 2013 Outlook for Energy

T oday’s Vehicle T echnology Choices Estimated Driving Distance per Fill-up 5-Year Cost & Savings 2012$k Full hybrid: 515 miles 20 Diesel: 435 miles 15 Cost above Conventional Gasoline: 350 miles E85: 260 miles 10 Fuel Savings CNG: 210 miles 5 Electric: Up to 100 miles PHV: Up to 40 miles + 450 miles 0 Full Hybrid CNG Plug-in Elec Hybrid ExxonMobil 2013 Outlook for Energy

Heavy Duty Transportation Efficiency New Truck Efficiency Efficiency Impact MBDOE % Improvement, 2010-2040 45 75 Truck Demand w/o Efficiency Demand Size 60 30 45 Hybrid Body Powertrain 30 Logistics & 15 Congestion 15 Body Powertrain 0 0 '10-'25 '25-'40 Other 2010 2025 2040 Regional Technology Impact ExxonMobil 2013 Outlook for Energy

Transportation Fuel Mix Fuel Demand Growth in Demand from 2010 to 2040 MBDOE MBDOE 15 75 Non OECD Other OECD Natural Gas 12 60 Fuel Oil 9 Jet Fuel 45 6 Biodiesel 3 30 Diesel 0 Ethanol 15 -3 Gasoline -6 0 Gasoline Diesel Jet Fuel Fuel Oil Natural Other 2000 2020 2040 Gas ExxonMobil 2013 Outlook for Energy

S UPPLY

Sources of Energy in the US since 1850 100% 90% 80% Renewable 70% Nuclear 60% Gas Oil 50% Hydro 40% Coal 30% Wood 20% 10% 0% 1850 1880 1910 1940 1970 2000 Source

Sources of Energy: Global Scale 50% 6.3% 45% Nuclear 6.0% 40% Oil Hydro 35% 36.4% Oil Coal 30% Oil 25% 27.8% Gas Coal 20% 15% 10% Natural gas Hydro 23.5% 5% Nuclear 0% 1970 1975 1980 1985 1990 1995 2000 2005

The main problem: Dislocation of Fossil Fuel Source from their Consumers 3 Largets Energy Markets ROW (N.America + Europe + Asia Pacific) 12% 22% 35% 39% 85% 90% 88% 78% 65% 61% 15% 10% Consumption Reserves Consumption Reserves Consumption Reserves OIL GAS COAL ROW = Rest of World Source: BP Statistical Review 2006

BUT… Availability of oil resources as a function of economic price Source: IEA (2005)

Projection of Primary Energy Sources ’04 – ’04 – ’30 Annual Growth ’30 Annual Growth ’04 ’04 – – ’30 Annual Growth ’30 Annual Growth Rate (%) Rate (%) Rate (%) Rate (%) Other Renewables Other Renewables Other Renewables Other Renewables 6.5 18.000 18.000 18.000 18.000 16.000 16.000 16.000 16.000 Biomass & waste Biomass & waste Biomass & waste Biomass & waste 1.3 14.000 14.000 14.000 14.000 2.0 Hydro Hydro Hydro Hydro 12.000 12.000 12.000 12.000 10.000 10.000 10.000 10.000 0.7 Nuclear Nuclear Nuclear Nuclear 8.000 8.000 8.000 8.000 2.0 Gas Gas Gas Gas 6.000 6.000 6.000 6.000 4.000 4.000 4.000 4.000 1.3 Oil Oil Oil Oil 2.000 2.000 2.000 2.000 1.8 Coal Coal Coal Coal 0 0 0 0 1980 1980 1980 1980 2004 2004 2004 2004 2010 2010 2010 2010 2015 2015 2015 2015 2030 2030 2030 2030 Note: ‘Other renewables’ include geothermal, solar, wind, tide and wave energy for electricity generation Source: IEA World Energy Outlook 2006 (Reference Case )

Fossil Fuel Supply 6.000 Yet to Find 5.000 Reserves & Resources (bnboe) Reserves & Resources (bnboe) Reserves & Resources (bnboe) Reserves & Resources (bnboe) 4.000 Unconventional Unconventional 3.000 R/P Ratio R/P Ratio R/P Ratio R/P Ratio 164 yrs. 164 yrs. 164 yrs. 164 yrs. 2.000 1.000 R/P Ratio R/P Ratio R/P Ratio R/P Ratio R/P Ratio R/P Ratio R/P Ratio R/P Ratio 41 yrs. 41 yrs. 67 yrs. 67 yrs. 41 yrs. 41 yrs. 67 yrs. 67 yrs. 0 Oil Oil Oil Oil Gas Gas Gas Gas Coal Coal Coal Coal Source: World Energy Assessment 2001, HIS, WoodMackenzie, BP Stat Review 2005, BP estimates

World Oil Reserves • World resource base is expanding in view of new technologies and price deck Oil Reserves (2011) Billion bo 300 250 Total Reserves: 1.471 trillion bo 200 R/P = 46 yrs (*) Including extra heavy and oil sands 150 260 211 100 175 138 115 50 102 98 75 60 46 37 30 25 21 20 13 12 12 10 7 7 0 Source: EIA , International Energy Outlook Issue: October 2011

World Liquid Fuel Consumption • Liquid fuels will continue as the largest component of the energy matrix • Growth of oil production, in both Opec and non Opec countries will meet most of the demand • Non-conventional liquid fuels also growing significantly World Crude Oil and Liquid Fuels Consumption MMb/day 120 Non Conv Source: EIA Outlook 108 Issue: October 2011 Conv Non Opec 100 Conv Opec 87.8 Current Prod Proj 80 60 40 20 0 1990 1995 2000 2005 2010 2015 2020 2025 2030 Liquids: Conventional (oil, condensate, natural gas plant liquids, refinery gains) Non-Conventional (oil sands, extra heavy oil, biofuels, GTL, CTL)

Key Drivers and Constraints - Liquid Production Changes Opec Liquids Production Non Opec Liquids Production 2008 2008 2035 mmb/day Mmb/day 2035 16 16 12 12 8 8 4 4 0 0 Liquids: Conventional (oil, condensate, natural gas plant liquids, refinery gains) Source: EIA , International Energy Outlook Non-Conventional (oil sands, extra heavy oil, biofuels, GTL, CTL) Issue: October 2011 • New production from unconventional, heavy crude, ultra deep waters and reservoirs • Increasingly more challenging and more expensive • Increasingly more stringent Health and Safety Executive requirements

Major New Oil and Gas Developments Ultra deep Gulf of Mexico Orinoco Extra heavy oil Pre Salt deep offshore Brazil Lower Aptian reconstitution (122 m.y.)

Major New Oil and Gas Developments Santos Basin largest oil discoveries (mmbo) Source: IHS, ANP, Woodmac

World Gas Reserves World Gas Reserves (2010) -TCF Source: BP Statistical Review, 2011 • World resource base is expanding in view technologies and price deck 1600 • World Reserves: 6,608 tcf • R/P = 58.6 yrs • USA gas shale resources: 6,600 1200 tcf 800 400 0

Recommend

More recommend