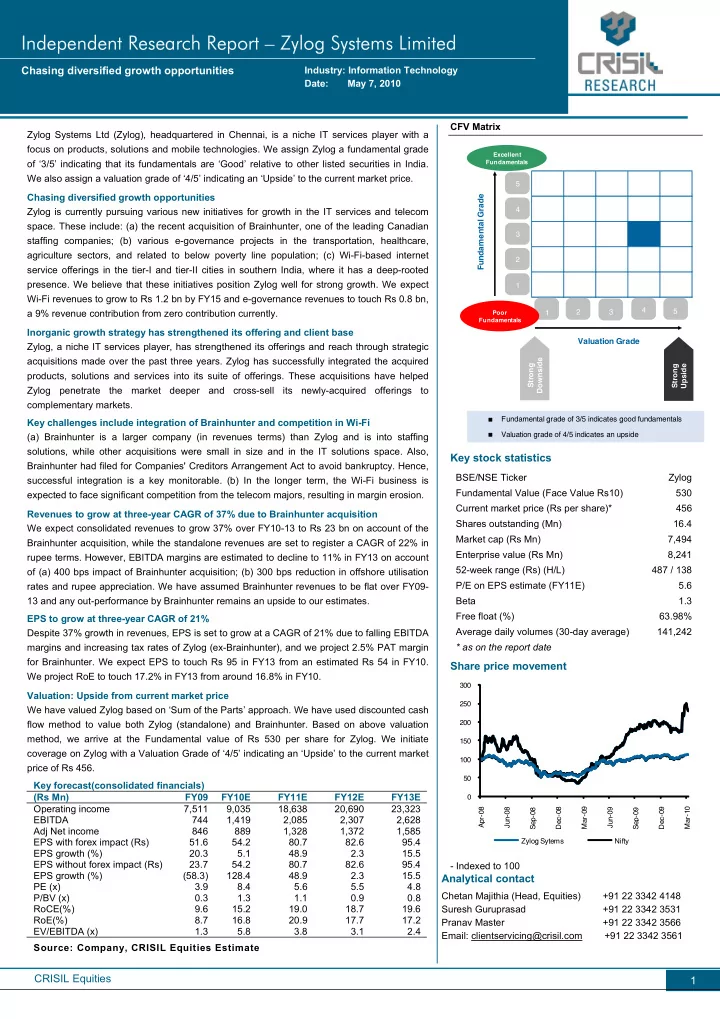

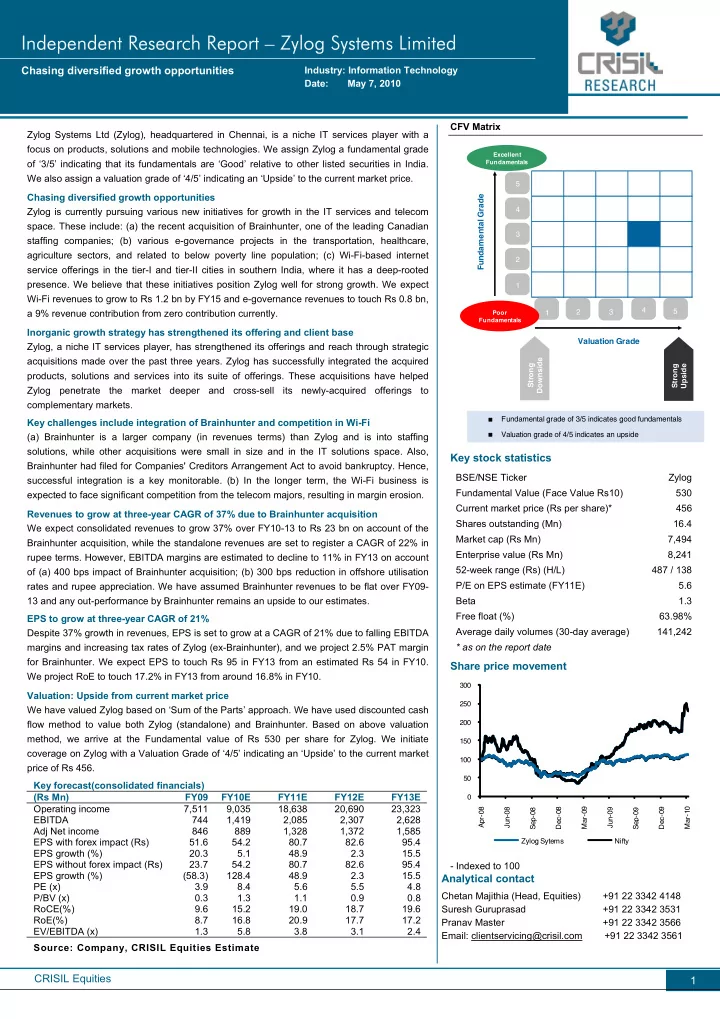

Independent Research Report – Zylog Systems Limited Independent Research Report – Zylog Systems Limited Chasing diversified growth opportunities Industry: Information Technology Zylog Systems Limited Date: May 7, 2010 CFV Matrix Zylog Systems Ltd (Zylog), headquartered in Chennai, is a niche IT services player with a focus on products, solutions and mobile technologies. We assign Zylog a fundamental grade Excellent of ‘3/5’ indicating that its fundamentals are ‘Good’ relative to other listed securities in India. Fundamentals We also assign a valuation grade of ‘4/5’ indicating an ‘Upside’ to the current market price. 5 Chasing diversified growth opportunities Fundamental Grade 4 Zylog is currently pursuing various new initiatives for growth in the IT services and telecom space. These include: (a) the recent acquisition of Brainhunter, one of the leading Canadian 3 staffing companies; (b) various e-governance projects in the transportation, healthcare, agriculture sectors, and related to below poverty line population; (c) Wi-Fi-based internet 2 service offerings in the tier-I and tier-II cities in southern India, where it has a deep-rooted presence. We believe that these initiatives position Zylog well for strong growth. We expect 1 Wi-Fi revenues to grow to Rs 1.2 bn by FY15 and e-governance revenues to touch Rs 0.8 bn, 4 2 3 5 a 9% revenue contribution from zero contribution currently. 1 Poor Fundamentals Inorganic growth strategy has strengthened its offering and client base Valuation Grade Zylog, a niche IT services player, has strengthened its offerings and reach through strategic acquisitions made over the past three years. Zylog has successfully integrated the acquired Downside Strong Strong Upside products, solutions and services into its suite of offerings. These acquisitions have helped Zylog penetrate the market deeper and cross-sell its newly-acquired offerings to complementary markets. Fundamental grade of 3/5 indicates good fundamentals Key challenges include integration of Brainhunter and competition in Wi-Fi Valuation grade of 4/5 indicates an upside (a) Brainhunter is a larger company (in revenues terms) than Zylog and is into staffing solutions, while other acquisitions were small in size and in the IT solutions space. Also, Key stock statistics Brainhunter had filed for Companies' Creditors Arrangement Act to avoid bankruptcy. Hence, BSE/NSE Ticker Zylog successful integration is a key monitorable. (b) In the longer term, the Wi-Fi business is Fundamental Value (Face Value Rs10) 530 expected to face significant competition from the telecom majors, resulting in margin erosion. Current market price (Rs per share)* 456 Revenues to grow at three-year CAGR of 37% due to Brainhunter acquisition Shares outstanding (Mn) 16.4 We expect consolidated revenues to grow 37% over FY10-13 to Rs 23 bn on account of the Market cap (Rs Mn) 7,494 Brainhunter acquisition, while the standalone revenues are set to register a CAGR of 22% in Enterprise value (Rs Mn) 8,241 rupee terms. However, EBITDA margins are estimated to decline to 11% in FY13 on account 52-week range (Rs) (H/L) 487 / 138 of (a) 400 bps impact of Brainhunter acquisition; (b) 300 bps reduction in offshore utilisation P/E on EPS estimate (FY11E) 5.6 rates and rupee appreciation. We have assumed Brainhunter revenues to be flat over FY09- 13 and any out-performance by Brainhunter remains an upside to our estimates. Beta 1.3 Free float (%) 63.98% EPS to grow at three-year CAGR of 21% Average daily volumes (30-day average) 141,242 Despite 37% growth in revenues, EPS is set to grow at a CAGR of 21% due to falling EBITDA margins and increasing tax rates of Zylog (ex-Brainhunter), and we project 2.5% PAT margin * as on the report date for Brainhunter. We expect EPS to touch Rs 95 in FY13 from an estimated Rs 54 in FY10. Share price movement We project RoE to touch 17.2% in FY13 from around 16.8% in FY10. 300 Valuation: Upside from current market price 250 We have valued Zylog based on ‘Sum of the Parts’ approach. We have used discounted cash 200 flow method to value both Zylog (standalone) and Brainhunter. Based on above valuation method, we arrive at the Fundamental value of Rs 530 per share for Zylog. We initiate 150 coverage on Zylog with a Valuation Grade of ‘4/5’ indicating an ‘Upside’ to the current market 100 price of Rs 456. 50 Key forecast(consolidated financials) (Rs Mn) FY09 FY10E FY11E FY12E FY13E 0 Operating income 7,511 9,035 18,638 20,690 23,323 Apr-08 Jun-08 Dec-08 Mar-09 Jun-09 Dec-09 Mar-10 Sep-08 Sep-09 EBITDA 744 1,419 2,085 2,307 2,628 Adj Net income 846 889 1,328 1,372 1,585 EPS with forex impact (Rs) 51.6 54.2 80.7 82.6 95.4 Zylog Sytems Nifty EPS growth (%) 20.3 5.1 48.9 2.3 15.5 EPS without forex impact (Rs) 23.7 54.2 80.7 82.6 95.4 - Indexed to 100 EPS growth (%) (58.3) 128.4 48.9 2.3 15.5 Analytical contact PE (x) 3.9 8.4 5.6 5.5 4.8 Chetan Majithia (Head, Equities) +91 22 3342 4148 P/BV (x) 0.3 1.3 1.1 0.9 0.8 RoCE(%) 9.6 15.2 19.0 18.7 19.6 Suresh Guruprasad +91 22 3342 3531 RoE(%) 8.7 16.8 20.9 17.7 17.2 Pranav Master +91 22 3342 3566 EV/EBITDA (x) 1.3 5.8 3.8 3.1 2.4 Email: clientservicing@crisil.com +91 22 3342 3561 Source: Company, CRISIL Equities Estimate CRISIL Equities 1

Zylog Systems Limited Zylog: Business environment Parameter IT offerings (excluding e-governance) New initiatives: E-Governance and Internet Brainhunter services Consolidated % Revenue contribution (FY09) 100.0% 0% 0% % Revenue contribution (FY13) 56.4% 6.2% 37.4% Product / service offering Managed services Insurance products: Phoenix, Claim E-Governance Staffing solutions Point Data warehousing and Business Banking: RTGS Paymanager, Smart card solutions (95% of revenues) Intelligence Cheque truncation Mobile computing Telecom: Field Power, Z*Connect, Internet services SMS.Companion Replacement technology Pharma: Vesalius, Sales Rxcelerator Wi 5 IT solutions Web 2.0 Manufacturing: Infor Syteline (ERP (5% of revenues) solution) QA and testing Inventory management: Silvanus Geographic Presence North America, Western Europe, North America, Western Europe, India Largely Canada APAC, Middle East APAC, Middle East Current market position Relatively small-size player Among the top 3 staffing solutions company End market BFSI, Telecom, Pharma, Retail BFSI, Telecom, Pharma, Retail and E-governance: Government of India IT and engineering services company, and Manufacturing Manufacturing Wi-Fi: Residences in cities and towns including the government of Canada Key competitors Global: MTM Technologies and Global: Covansys Corp, Syntel Inc E-governance: TCS, Wipro, Oracle CGI Group, EDS Canada RWD Technologies and Trizetto Group Offshore: Infosys Technologies, Offshore: Infosys Technologies, Wi-Fi: All integrated telecom operators (in Tata Consultancy Services, Wipro Tata Consultancy Services, Wipro particular BSNL due to its wide presence) and and HCL Technologies and HCL Technologies other local / national ISPs Sales growth forecast 22% CAGR over FY10-13 1.1% CAGR in rupee terms over FY11-13 Demand drivers Higher IT spend in North America, Asia-Pacific and Middle-eastern E-Governance: Replication of similar projects Revival in global IT spends regions in other states and recurring maintenance revenues Capitalising on cross-selling opportunities in the Canadian market Wi-Fi: Attractive tariffs and coverage in underpenetrated towns Growth in its niche offerings of replacement technology and consumer electronics New opportunities, if any Higher offshore component would improve operating margins Cross-sell offerings to complementary markets Source: Company reports and CRISIL Equities CRISIL Equities 2

Zylog Systems Limited Grading Rationale Niche player in IT services and products Zylog (ex-Brainhunter) derives around 60% revenues from IT services, 40% from Presence in niche segments with products business, of which one-fourth is from product sale and balance from an onsite-based model implementation. It is a niche player with specialisation in field service automation, mobile solutions, inventory management, RFID applications, banking and insurance solutions, and replacement technologies. We expect the company to continue offering niche services where the Indian IT giants lack focus. The key competition for Zylog is local vendors and some of the large Indian players in few projects. Zylog operates largely on an onsite-based model with an effort mix of 65:35 in favour of onsite, which is significantly higher than other Indian IT companies. While this results in high employee and other project costs such as visa processing and travel, it leads to better client servicing. The company’s IT services segment has grown at a 40% CAGR over the past three years due to organic and inorganic initiatives, and 90% of its revenues are dependent on the US geography. We expect this business to grow at 18% CAGR over the next three years. Figure 1: Projected revenues for the IT services segment ( Rs B n) 1 5.0 20% 1 8% 1 9% 1 7% 1 2.0 1 6% Driven by revival in key markets and verticals 9.0 1 2% 6.0 8% 6% 1 3.2 1 1 .3 9.6 3.0 4% 8.0 0.0 0% FY1 0E FY1 1 E FY1 2E FY1 3E Revenues Revenue growth Source: CRISIL Equities Estimate Figure 2: Effort mix comparison (2008-09) ( Per cent ) 80 76 75 71 70 65 63 60 50 37 40 35 29 30 25 24 20 1 0 0 Infosys Patni Zylog Hexaware M astek Onsite Offshore Source: Company reports and CRISIL Equities CRISIL Equities 3

Recommend

More recommend