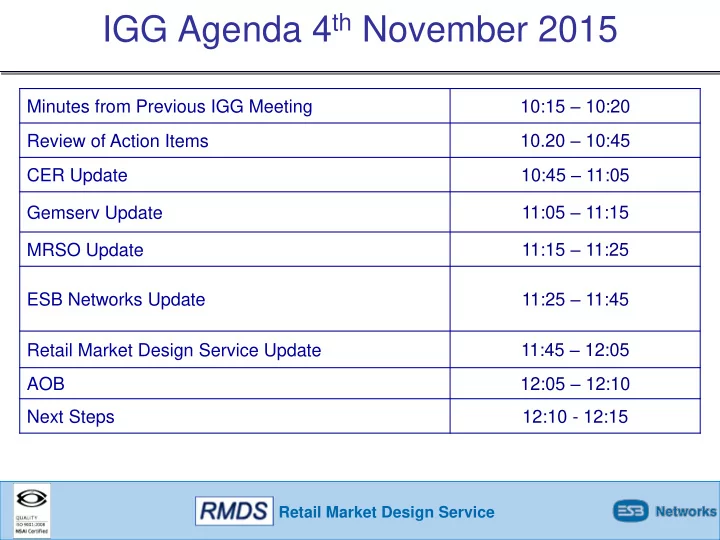

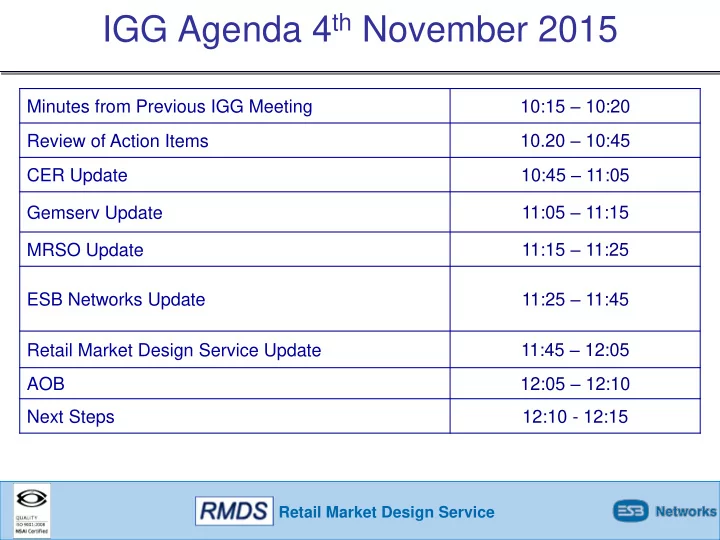

IGG Agenda 4 th November 2015 10:15 – 10:20 Minutes from Previous IGG Meeting 10.20 – 10:45 Review of Action Items 10:45 – 11:05 CER Update 11:05 – 11:15 Gemserv Update 11:15 – 11:25 MRSO Update 11:25 – 11:45 ESB Networks Update 11:45 – 12:05 Retail Market Design Service Update 12:05 – 12:10 AOB Next Steps 12:10 - 12:15 Retail Market Design Service

Minutes Minutes (v2.0) from IGG meeting 2 nd September 2015 For Approval Today Retail Market Design Service

IGG Action Items Updated IGG Action List issued in advance of meeting 11 Actions closed since last IGG meeting: 10 IGG Actions carried forward: Retail Market Design Service

Update on actions - Closed Org. Assigned AP No. Title to Date Closed Date Raised CER to adjudicate on Supplier's position on the Revenue Code of Practice - provide formal 949 response to group. CER 02/09/2015 11/02/2015 959 CER to provide on update on the Vulnerable Customer Initiative - phase 2 at next IGG CER 02/09/2015 08/04/2015 960 Suppliers to respond back to ESBN on the Vulnerable Customer Data Suppliers 02/09/2015 08/04/2015 RMDS Private Website - RMDS to circulate an e-mail to Suppliers requesting a designated 976 email address for access to the new RMDS private website for sensitive documents RMDS 02/09/2015 08/07/2015 Longstanding MCRs - RMDS to circulate the 5 oldest outstanding MCRs to Suppliers. Suppliers to review and bring their position to the next IGG. Suppliers to respond before 977 12/08/2015 RMDS/Suppliers 02/09/2015 08/07/2015 Eircodes - DR 1140 to be brought back to the next IGG for MCR approval. Suppliers to investigate the issues for them in implementing the MCR and also advise the earliest they 978 can implement the new Eircodes ESBN/Suppliers 02/09/2015 08/07/2015 Publication of information on the RMDS website. All MPs are to consider their position on 982 what information is published on the RMDS website. ALL 02/09/2015 05/08/2015 ESBN and EI to have offline discussion on the format of the report in relation to PAYG 981 Installations. ESBN/EI 07/10/2015 05/08/2015 MRSO CoLE Figures - Suppliers to check internally and ensure that they are not inputting Alpha Strings in the Name field of the 010 MM. Correct the issue if they are and report to 984 RMDS who will refer to MRSO Suppliers 07/10/2015 02/09/2015 Long Term Non Access - ESBN to summarise the responses they received from Long Term 987 Non Access Communication excercise with Customers and send to Suppliers via RMDS. ESBN 07/10/2015 02/09/2015 Vulnerable Customers - Determine if V C attributes are retained on a customer following 990 COLE. Identify implications of COLE in reconcilliation exercise. ESBN 07/10/2015 02/09/2015 Retail Market Design Service

Update on actions – Open Org. AP No. Title Assigned to Date Due Date Raised Data Protection - ESBN to report back on how the COLE process currently records the moving out of an occupant to identify whether the moved out customer details are retained in the ESBN system. If details are retained data protection concerns 948 need to be investigated ESBN 04/11/2015 14/01/2015 CER to review whether the lock moratorium over the Christmas period should apply 956 for IC sites CER 04/11/2015 04/03/2015 Email encryption - Suppliers to contact MRSO via RMDS if they wish to set up the 962 secure email encryption as discussed at the forum. Suppliers 04/11/2015 08/04/2015 Following CER review of Supplier submissions to pause or continue LTCA the CER 979 is to advise the approval, or not, of the Independent Consultant and the next steps CER 04/11/2015 05/08/2015 MRSO to present a slide of statistics at the next IGG for messages where Eircodes 980 are being used MRSO 04/11/2015 05/08/2015 Green Source Products - CER invited further comment or questions on the GSP decision. Any response to query which had relevance to the market would be 983 circulated by CER via RMDS to market. CER 04/11/2015 02/09/2015 MRSO CoLE Figures - Suppliers to check internally and ensure that they are not inputting Alpha Strings in the Name field of the 010 MM. Correct the issue if they are 985 and report to RMDS who will refer to MRSO. Suppliers 04/11/2015 02/09/2015 Technical Details - DR covering the importance of appropriate Technical Details 986 (name and phone) to the 010 to be drafted. Detail to be added to MPD 01 & 02 ESBN 04/11/2015 02/09/2015 Long Term Non Access - Suppliers to review ESBN's suggestions on Long Term Non Access and review their own working practices with a view to improving information to customers about ESBN requiring access. Report back findings to 988 RMDS for discussion at next CC or IGG Suppliers 04/11/2015 02/09/2015 Vulnerable Customers - A decision around the frequency & yearly timing of an 989 annual reconcilliation exercise needs to be determined. ESBN/CER 04/11/2015 02/09/2015 Retail Market Design Service

CER Update Industry Governance Group 4 th November 2015

Retail Market Assurance Services for the Irish Electricity Market Lizzie Montgomerie Nirav Vyas IGG 4 November 2015 Belfast

Assured Parties - October 2015 Number and type of live participants assured by Gemserv since 2005 DSU Large 8 8 Small 7 Self [VALU E] NB this is not a reflection of the live market position. Gemserv 8

Assurance Services: October 2015 Re- Market Design New Entrant Qualification Releases TIBCO Upgrade One Large One Large Supplier • Issue: revised Supplier changes to SAP PI Complete One Small Supplier Schema MDR Complete Three Self Non-Schema Suppliers MDR Complete Gemserv 9

TIBCO Hub Upgrade Assurance Progress • PQs Complete & Reported 1/9/15 – Addendum 16/10/15 • Formal Assessment Complete & Reported 16/10/15 • Revised changes & Trimming Issue : – Assurance plan to be delivered COB 10/11/15 • Revised changes & Trimming Issue : – impact on current assurance strategy for Schema / Non Schema MDR 2015 10/11/15 • Next steps: – Assurance of Revised Changes & Trimming Issues Nov – Dec 2015 – IPT Jan – Feb 2016 – Final Assurance report 22/02/16 Gemserv 10

Non Schema Assurance Progress • PQs Completed & Reported • Formal Assessment Completed • Final Report Completed – To be issued to CER TBC Gemserv 11

Assurance Services: Forward Work Plan October 2015 March 2016 March 2016 ‘Cut Over’ IPT (Jan-Feb) • TIBCO • Schema One Large Supplier IPT (TBC) RA Decisions (Feb) • TIBCO / Schema • Non-Schema Gemserv 12

Thank You Lizzie Montgomerie Head of Assurance T: +44 (0) 20 7090 7750 E: Elizabeth.montgomerie@Gemserv.com W: www.gemserv.com

MRSO Update Joe Browne 04 November 2015

Market Message 010 40,000 2013 2014 2015 35,000 30,000 25,000 20,000 15,000 10,000 5,000 0 January February March April May June July August September October November December 2013 22,930 24,475 26,327 28,580 29,120 26,426 32,371 29,258 26,997 27,646 25,232 19,063 2014 24,339 27,531 28,279 33,915 30,387 28,754 33,560 31,262 33,495 36,321 35,743 24,768 2015 29,927 32,316 31,311 30,378 31,002 31,954 32,226 28,638 33,248 15 esbnetworks.ie

Market Message 105L 40,000 2013 2014 2015 35,000 30,000 25,000 20,000 15,000 10,000 5,000 0 Septembe January February March April May June July August October November December r 2013 18,434 19,665 23,585 23,382 25,581 22,922 26,192 25,831 22,357 22,640 22,600 18,078 2014 18,159 22,308 24,568 28,254 30,517 22,914 28,014 26,735 28,590 28,553 33,776 24,219 2015 22,833 28,140 26,116 23,970 26,989 26,800 27,591 23,591 27,768 16 esbnetworks.ie

COS in-progress 2nd November 2015 – 9,621 • Reviewed Monthly • Suppliers notified of individual Apr 2015 1 switches outstanding and reason • Switch outstanding for Energisation May 2015 5 or Token Meter Removal will not time-out • Contact Customer or submit Jun 2015 9 cancellation • 16 Switches held due to an existing Jul 2015 11 Open Service Order 17 esbnetworks.ie

COS and CoLE % Explicit Inferred Total Total Explicit % Total Month CoLE CoLE CoLE 010 CoLE CoLE Jul-15 5,368 6,748 12,116 32,226 17% 38% Aug-15 5,361 5,899 11,260 28,638 19% 39% Sep-15 7,074 6,570 13,644 33,248 21% 41% 18 esbnetworks.ie

Registration Rejections % 6.0% 2013 2014 2015 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% Septembe January February March April May June July August October November December r 2013 1.7% 1.6% 2.2% 2.1% 1.7% 1.8% 2.1% 2.3% 2.7% 2.7% 3.0% 2.5% 2014 2.6% 2.0% 2.1% 2.1% 2.4% 2.3% 2.8% 2.6% 2.8% 2.9% 2.5% 2.9% 2015 2.2% 2.1% 2.2% 2.4% 2.3% 5.7% 2.9% 4.1% 3.4% 0.0% 0.0% 0.0% 19 esbnetworks.ie

Debt Flagging Jul-15 Aug-15 Sep-15 Total MPRNs received 716 540 666 Total CoLEs returned to outgoing supplier 332 282 333 Returned for other reason to outgoing 53 29 35 supplier (invalid MPRN, switch completed) Valid Debt Flags issued to gaining supplier 331 229 298 Total not cancelled 227 134 213 Total cancelled 104 95 85 Valid Debt Flags as % of total COS 1.2% 1.0% 1.1% 20 esbnetworks.ie

Recommend

More recommend