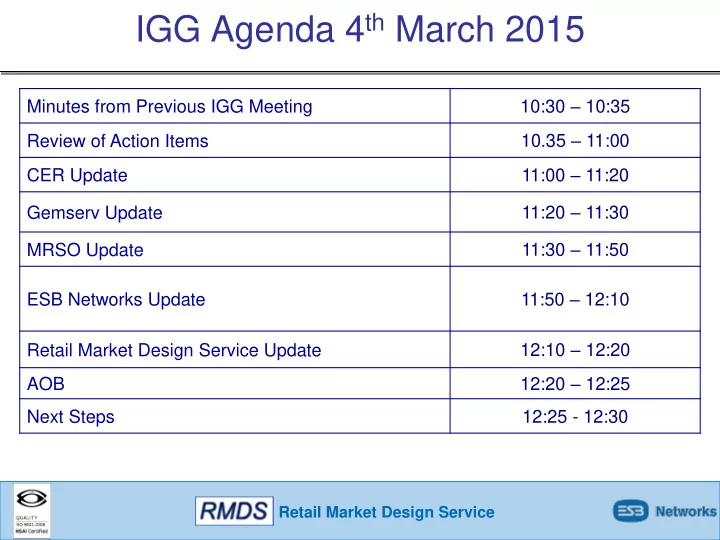

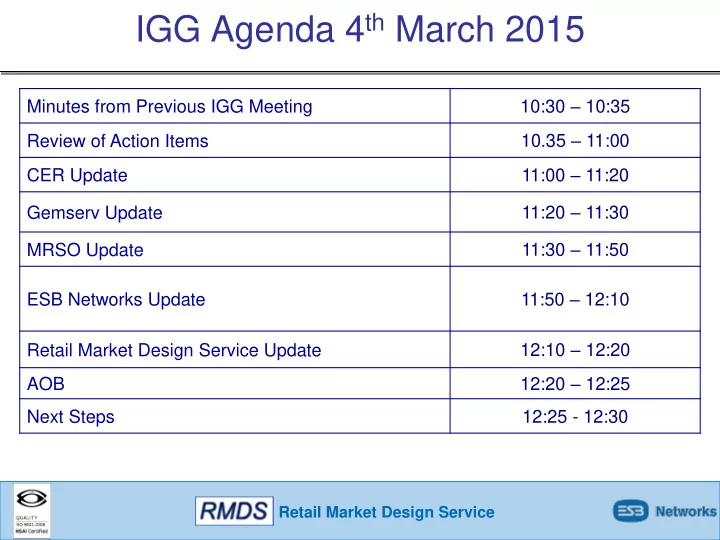

IGG Agenda 4 th March 2015 10:30 – 10:35 Minutes from Previous IGG Meeting 10.35 – 11:00 Review of Action Items 11:00 – 11:20 CER Update 11:20 – 11:30 Gemserv Update 11:30 – 11:50 MRSO Update 11:50 – 12:10 ESB Networks Update 12:10 – 12:20 Retail Market Design Service Update 12:20 – 12:25 AOB Next Steps 12:25 - 12:30 Retail Market Design Service

Minutes Minutes from IGG meeting 14 th January 2015 For Approval today Retail Market Design Service

IGG Action Items Updated IGG Action List issued in advance of meeting 12 Actions closed since last IGG meeting: 12 IGG Actions carried forward: Retail Market Design Service

Update on actions - Closed AP No. Title Org. Assigned to Date Closed 915 CER to ensure gas revenue protection processes are shared with the IGG CER 14/01/2015 925 CER to get back with a formal response as to what further information they require on LTCA. CER 14/01/2015 927 Meter Tampering - Market to provide feedback as to how they recommend ESBN to handle sites Suppliers 11/02/2015 929 ESBN to provide a step by step process for tampering CER 11/02/2015 932 MRSO / RMDS to co-ordinate the raising of a DR in relation to Cancellation Reason Code OS MRSO/RMDS 11/02/2015 Suppliers to revert with position on the Revenue Code of Practice in light of supporting or otherwise, the 933 revised version Suppliers 11/02/2015 DR1149 - Suppliers asked to consider if they can check the MPBREFon 016 and 300MM on their side so as to 934 validate the correct Market Message. Linked to previous action 924 Suppliers 11/02/2015 ESBN to contact NIE regarding the Anti-PAYG Meter Tampering workshops recently held. S. Gray agreed to 937 action this item ESBN 11/02/2015 On receipt of the processes in action items 929 and 930 above Suppliers to review the processes and submit 938 comment Suppliers 11/02/2015 Statement of Charges. CER to feedback Supplier concerns in relation to timing and applicability of ESBN Charges to Paul Brandon. Paul to circulate a response Statement of Charges. CER to feedback Supplier 940 concerns in relation to timing and applicability of ESBN Charges to Paul Brandon. Paul to circulate a response CER 11/02/2015 Meter Tampering – CER to write a terms of reference for the Work stream 942 Suppliers 11/02/2015 ESBN to create generic note to Suppliers detailing items to be considered outside of the Revenue Code of 943 Practice. The items include but not limited to costs, dates, re-registrations etc. ESBN 11/02/2015 Retail Market Design Service

Update on actions – Open Org. AP No. Title Assigned to Date Due Date Raised Notification Address - Suppliers to complete data cleanse & update training 917 material as a preventative measure for future incidents. Suppliers 04/03/2015 10/09/2014 RMDS to provide a list of outstanding approved MCRs, including date raised & 922 any previous inclusion in a prioritisation exercise RMDS 04/03/2015 10/09/2014 CER to convene a meeting re Disconnection Taskforce actions as well as 928 circulating actions CER 04/03/2015 05/11/2014 CER to review comments on processes from Suppliers (Action 938) and set up a Revenue Protection Workshop. Action 923, 925, 926 to be used as supporting 939 documentation CER 04/03/2015 03/12/2014 941 ESBN to investigate the addition of UK addresses to BGE customers ESBN 04/03/2015 03/12/2014 944 CER to develop terms of reference for Revenue Protection (linked to action 933 CER 04/03/2015 14/01/2015 Retail Market Design Service

Update on actions – Open(Cont.) Org. AP No. Title Assigned to Date Due Date Raised Suppliers to provide feedback to CER on CoS/Debt Transfer Workshops that 945 were held Q4 2014. Suppliers 04/03/2015 14/01/2015 CER with the assistance of MRSO to analyse and report back to IGG on the debt 946 flag trends for 2014. CER 04/03/2015 14/01/2015 LTNA Suppliers to review LTNA reports received from ESBN and provide feedback to ESBN on any actual/potential initiatives or action taken in relation to 947 them. Suppliers 04/03/2015 14/01/2015 Data Protection - ESBN to report back on how the COLE process currently records the moving out of an occupant to identify whether the moved out customer details are retained in the ESBN system. If details are retained data 948 protection concerns need to be investigated ESBN 04/03/2015 14/01/2015 949 CER to adjudicate on Supplier's position on the Revenue Code of Practice. CER 04/03/2015 14/01/2015 950 Multi-site MPRNs. ESBN to send list of MPRNs with Multi-sites to SSE Airtricity ESBN 04/03/2015 14/01/2015 Retail Market Design Service

CER Update Industry Governance Group 4 th March 2015

Work Item End date More details PAYG Policy Q3/Q4 Industry processes for PAYG lifestyle choice suppliers – looking at, inter alia , assurance needs, customer engagement, need for a working practice Cooling off period Q2 Review of CoS process in terms of how the cooling off period should be managed Debt Management Waiting for Awaiting responses to determine next steps to the consultation paper published and responses workshop held in 2014 Price Comparison websites Q3/Q4 Annual audits Potential review of accreditation framework Consumer Survey Q2 Domestic and SME – additional questions re customers who have never switched Compliance and Enforcement Framework Q2 Develop a formalised framework for compliance and enforcement issues – eg a supplier complaining to CER Annual Supplier Audit Q2/Q3 Content to be determined Market Monitoring Q2- Q4 Supplier meeting. Finalise implementation and commence/continue monitoring. Deemed Contracts Q2/Q3 Progress SI underpinning recent CER decision Green Products Q1/Q2 Decision paper Fuel Mix Q3 Decision paper SoLR Q4 Review current processes and publish information note on same Supplier Handbook Q4 Review billing, marketing and sign up provisions as well as looking at general changes driven by the energy efficiency directive

Retail Market Assurance Services for the Irish Electricity Market Lizzie Montgomerie Neil Grennan-Heaven IGG 4 th March 2015 Belfast

Assured Parties – Feb 2015 Number and type of live parties assured by Gemserv since 2005 NB this is not a reflection of the live market position. Gemserv 10

Assurance Processes: Feb 2015 Parties in assurance by process 3 2 1 0 Gemserv 11

Assurance Services: Mar 2014 - Feb15 Re- Market Design New Segments Defects New Entrants qualification Releases One Small Supplier One Supplier Small MCR1137 to Large (Two Complete 13100 (complete) One Supplier (complete) (Complete) One On Hold) One Supplier – One Large Supplier MCR1037 additional segment 13058 (complete) (complete) (One Complete) (Complete) Four DSU MCR1033 13078 (complete) (Complete) (Complete) Post Implementation Two Self-Suppliers Review (Complete) Gemserv 12

Assurance Services: Forward Work Plan February/March 2015 Later 2015 IPT • 1 Large Supplier IPT • 1 Small Supplier Re-qualifcation • 1 Small Supplier Gemserv 13

Post Implementation Review Outcome Respondents cover 90% volume of Metering Points: 7 Suppliers 1. To what extent are you aware of the changes that took place in 2014? Fully aware Unaware Manual processes – changes not required & therefore not verified 2. To what extent do you implement the changes? Not Implemented Fully Implemented 3. To what extent did you verify the changes had been implemented successfully? Fully Verified Not verified 14 Gemserv

Post Implementation Review Lessons Learned 4. How would you rate your experience of the assurance processes for these changes? More than Satisfactory Not-satisfactory 5. Do you have any recommendations for improvement? Send questionnaire Ask Suppliers to fill out after each change and the questionnaire not at the end of the immediately after the year change so its fresh in the mind Gemserv 15

Thank You Lizzie Montgomerie Head of Assurance T: +44 (0) 20 7090 7750 E: Elizabeth.montgomerie:@Gemserv.com W: www.gemserv.com

MRSO Update Gerry Halligan 04 March 2015

Market Message 010 40,000 2013 2014 2015 35,000 30,000 25,000 20,000 15,000 10,000 5,000 0 Septembe January February March April May June July August October November December r 2013 22,930 24,475 26,327 28,580 29,120 26,426 32,371 29,258 26,997 27,646 25,232 19,063 2014 24,339 27,531 28,279 33,915 30,387 28,754 33,560 31,262 33,495 36,321 35,743 24,768 2015 29,927 32,316 18 esbnetworks.ie

Market Message 105L 40,000 2013 2014 2015 35,000 30,000 25,000 20,000 15,000 10,000 5,000 0 Septemb Novembe Decembe January February March April May June July August October er r r 2013 18,434 19,665 23,585 23,382 25,581 22,922 26,192 25,831 22,357 22,640 22,600 18,078 2014 18,159 22,308 24,568 28,254 30,517 22,914 28,014 26,735 28,590 28,553 33,776 24,219 2015 22,833 28,140 19 esbnetworks.ie

COS in-progress 2nd March 2015 – 8,752 • Reviewed Monthly • Suppliers notified of individual Oct 2014 1 switches outstanding and reason • Switch outstanding for Energisation Nov 2014 5 or Token Meter Removal, will not time-out • Contact Customer or submit Dec 2014 9 cancellation • 22 Switches held due to an existing Jan 2015 17 Open Service Order 20 esbnetworks.ie

Recommend

More recommend