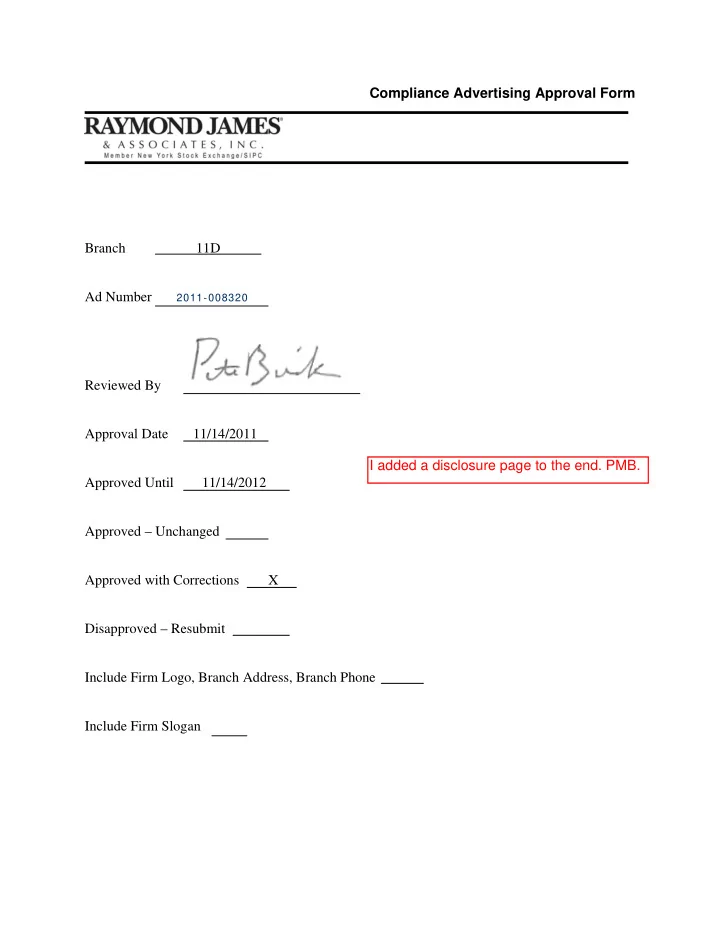

Compliance Advertising Approval Form Branch 11D Ad Number 2011-008320 Reviewed By Approval Date 11/14/2011 I added a disclosure page to the end. PMB. Approved Until 11/14/2012 Approved – Unchanged Approved with Corrections X Disapproved – Resubmit Include Firm Logo, Branch Address, Branch Phone Include Firm Slogan

Economic Outlook Scott J. Brown, Ph.D. Chief Economist November 16, 2011

This Recession/Recovery Is Different This Recession/Recovery Is Different • Recessions caused by financial crises tend to be: Recessions caused by financial crises tend to be: – more severe – longer ‐ lasting – longer ‐ lasting – with gradual economic recoveries – And more often than not, monetary/fiscal stimulus is removed too soon y/ This is not your father’s recession…

Addressing The Crisis Addressing The Crisis Three Policy Prescriptions: Three Policy Prescriptions: Federal Reserve Policy (liquidity, monetary stimulus) The Bank Rescue The Bank Rescue (stabilization of the banking system) Fi Fiscal Stimulus l Sti l (limiting the downside)

Federal stimulus ramping down Federal stimulus ramping down American Recovery and Reinvestment Act of 2009 , $bln 400 400 350 350 300 300 Tax Cuts Added Spending Added Spending 250 250 200 200 note: infrastructure 150 150 spending is about 1/5, aid to the states is about 1/3 100 100 50 50 50 50 0 0 source: Congressional Budget Office -50 -50 2009 2010 2011 2012 2013 2014 2015-19

Large budget deficits in the near term Large budget deficits in the near term CBO Budget Projections ($bln, % of GDP) 400 2 200 200 0 0 -200 -2 2 -400 -4 -600 assumes assumes -800 -6 Bush tax cuts expire -1000 $ billion -8 % of GDP -1200 1200 August 2011 -10 -1400 projections source: Congressional Budget Office -1600 -12 80 80 85 85 90 90 95 95 00 00 05 05 10 10 15 15 20 20

Super committee to the rescue? Super committee to the rescue? • Deadline approaching: $1.5 trillion in defict reduction (10 yrs) package due by November 23 (pass by December 23) Nowhere near completion • No incentive to compromise Republican goal: no tax increases Republican goal: no tax increases Democratic goal: no major cuts in entitlements Do nothing: both sides achieve main goal Bottom line: trigger will lead to automatic cuts to defense and other B li i ill l d i d f d h discretionary spending • Bush tax cuts, debt ceiling pushed past Nov. 2012 A lot of uncertainty in the fiscal outlook • Another downgrade? Who cares? Who cares?

Outlook: Muddling Along Outlook: Muddling Along Federal Reserve Officials' Projections of Real GDP growth (4Q/4Q, %) 5 5 November 2, 2011 4 4 4 4 3 3 2 2 1 1 0 0 -1 -1 -2 -2 central tendency -3 -3 range of forecasts history y/y history y/y -4 4 -4 4 -5 -5 source: Federal Reserve -6 -6 05 05 06 06 07 07 08 08 09 09 10 10 11 11 12 12 13 13 14 14

Outlook: Muddling Along Outlook: Muddling Along Federal Reserve Officials' Projections of the Unemployment Rate (4Q) November 2, 2011 10 10 central tendency range of forecasts 9 9 history 8 8 7 7 6 6 5 5 source: Federal Reserve 4 4 05 05 06 06 07 07 08 08 09 09 10 10 11 11 12 12 13 13 14 14

Job gains by size of firm Job gains by size of firm ADP: Private-Sector Payrolls , monthly change, th. 300 300 200 200 100 100 0 0 -100 -100 -200 -200 -300 -300 -400 400 -400 400 ADP: Small (1-49 employees) -500 -500 ADP: Medium (50-499) ADP: Large (>499) -600 -600 BLS -700 700 -700 700 -800 -800 source: ADP, BLS -900 -900 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12

Headwinds Headwinds • Lingering problems in housing Many mortgage holders under water, prices bottoming Many mortgage holders under water, prices bottoming • Higher prices of food & gasoline Inflation reduced purchasing power considerably in 1H11 p g p y • Contractionary policies in state & local gov’t ‐ 25,000 jobs per month , j p • Federal fiscal stimulus is ramping down Will subtract from GDP growth in 2012 and 2013 • Europe Slower global growth, financial market risks

Housing: still weak Housing: still weak Single-family Starts, Permits, and New Home Sales , mln. 1.8 1.8 1.6 1.6 1.4 1.4 1.2 1.2 1.0 1.0 0.8 0 8 0 8 0.8 Housing Starts 0.6 0.6 Building Permits New Home Sales 0.4 0.4 0.2 0.2 source: Census Bureau 0.0 0.0 99 99 00 00 01 01 02 02 03 03 04 04 05 05 06 06 07 07 08 08 09 09 10 10 11 11 12 12

Home prices are still a concern Home prices are still a concern S&P/Case-Shiller Home Price Indices (Jan-00 = 100) 280 280 Washington Los Angeles New York San Diego g 260 260 Boston Miami Portland Seattle 240 240 San Francisco Tampa Denver Minneapolis 220 220 Chicago g Dallas Charlotte Phoenix 200 200 Atlanta Cleveland Las Vegas Detroit 180 180 160 160 140 140 120 120 100 100 100 100 80 80 source: Standard & Poor's 60 60 00 00 01 01 02 02 03 03 04 04 05 05 06 06 07 07 08 08 09 09 10 10 11 11 12 12

State & local government contracting State & local government contracting Public-Sector Payrolls , change since December 2008, th. 100 100 0 0 -100 -100 -200 -200 -300 -300 -400 -400 Federal ex-census State & Local Gov't -500 -500 -600 -600 source: BLS -700 -700 Jan 09 Jan-09 Jan-10 Jan 10 Jan-11 Jan 11 Jan 12 Jan-12

Gasoline prices down but not by much Gasoline prices down, but not by much Energy Prices , $ 4.00 125 3.75 115 3.50 105 3.25 95 3.00 85 2.75 75 Avg. Gasoline Price (right) Crude Oil Futures, Brent (left) West Texas Intermediate (left) source: Raymond James 65 2.50 Jan-10 Jan-11 Jan-12

Reduced purchasing power Reduced purchasing power Real Personal Income and Spending , trln $2005, annual rate 10.6 10.6 Disposable Income 10.4 10.4 Consumer Spending 10.2 10.2 10.0 10 0 10 0 10.0 9.8 9.8 9.6 9 6 9 6 9.6 9.4 9.4 9.2 9.2 9.0 9.0 source: Bureau of Economic Analysis 8.8 8.8 06 06 07 07 08 08 09 09 10 10 11 11 12 12

Real consumer spending rebounded in 2Q10 Real consumer spending rebounded in 2Q10 Real Consumer Spending , 2005 dollars, annual rate 9500 9500 9450 9450 9400 9400 quarter month 9350 9350 9300 9300 9250 9250 9200 9200 9150 9150 9150 9150 9100 9100 source: Bureau of Economic Analysis 9050 9050 9050 9050 2010 2011 2012

Federal Reserve Policy Federal Reserve Policy • Sept. 22 and Nov. 2: “there are significant downside risks to the economic outlook, including strains in global financial markets” • Sh Short ‐ term interest rates to stay at an exceptionally low level “at least i i ll l l l “ l through mid ‐ 2013” conditional on: 1) low rates of resource utilization 2) a subdued outlook for inflation over the medium run ) a subdued outlook for inflation over the medium run • Maturity Extension Program (“Operation Twist”): by the end of June 2012, 1) purchase $400 bln in Treasuries maturing in 6 ‐ 30 year 1) purchase $400 bln in Treasuries maturing in 6 ‐ 30 year 2) sell $400 bln in Treasuries maturing in 3 years or less • MBS Reinvestment: reinvest maturing MBS and agency debt into MBS • R Result: lower long ‐ term interest rates l l l i • More to come: QE3 (mortgage ‐ backed securities) and possible changes to the Fed’s communication strategies

Inflation What, Me Worry? Inflation – What Me Worry? • Higher food & energy prices – only minor relief so far • Core inflation trending higher than in 2010, but moderate • Where would inflation come from? 1) Commodity prices? Not so much 2) Labor market? No way 3) Production constraints, bottlenecks? Nope 3) P d i i b l k ? N 4) Import prices, weaker dollar? Some • Inflation expectations: p well ‐ anchored • Currently in sweet spot Not higher inflation not deflation Not higher inflation, not deflation Until this outlook changes, Fed on hold

Europe Europe • October agreement was short on details – Just enough to prevent a catastrophe • Greece may be the least of out worries – Italy a much greater concern • Little help from the ECB 1) not the lender of last resort 2) not there to address financial instability 3) new president may need to prove “toughness” on inflation • Faced with a major financial crisis, the authorities should hit back hard and early – European leaders have lagged, doing barely just enough • ECB must step in more forcefully. Get used to disappointment…

Summing Up Summing Up • The recovery is expected to continue, but there’s a lot to worry about y • A number of economic headwinds (housing, s&l gov’t, fading fiscal stimulus) • Lackluster ‐ to ‐ moderate growth near term, not a double dip, but some downside risks • Keys to the outlook: – gasoline prices – fiscal policy – Europe

Things could be worse Things could be worse

Recommend

More recommend