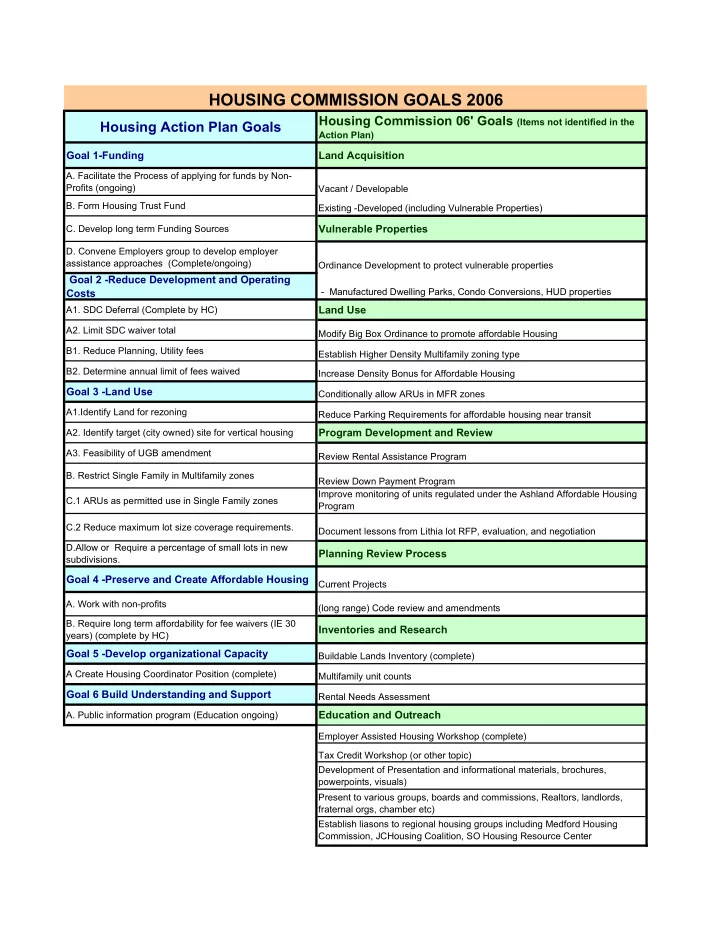

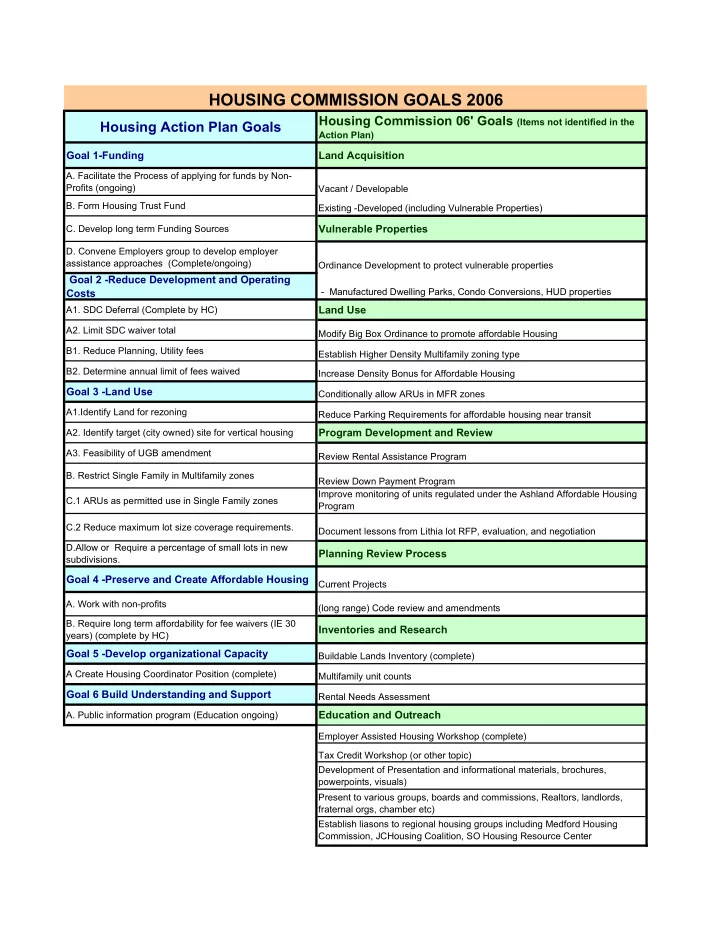

HOUSING COMMISSION GOALS 2006 Housing Commission 06' Goals (Items not identified in the Housing Action Plan Goals Action Plan) Goal 1-Funding Land Acquisition A. Facilitate the Process of applying for funds by Non- Profits (ongoing) Vacant / Developable B. Form Housing Trust Fund Existing -Developed (including Vulnerable Properties) C. Develop long term Funding Sources Vulnerable Properties D. Convene Employers group to develop employer assistance approaches (Complete/ongoing) Ordinance Development to protect vulnerable properties Goal 2 -Reduce Development and Operating - Manufactured Dwelling Parks, Condo Conversions, HUD properties Costs A1. SDC Deferral (Complete by HC) Land Use A2. Limit SDC waiver total Modify Big Box Ordinance to promote affordable Housing B1. Reduce Planning, Utility fees Establish Higher Density Multifamily zoning type B2. Determine annual limit of fees waived Increase Density Bonus for Affordable Housing Goal 3 -Land Use Conditionally allow ARUs in MFR zones A1.Identify Land for rezoning Reduce Parking Requirements for affordable housing near transit Program Development and Review A2. Identify target (city owned) site for vertical housing A3. Feasibility of UGB amendment Review Rental Assistance Program B. Restrict Single Family in Multifamily zones Review Down Payment Program Improve monitoring of units regulated under the Ashland Affordable Housing C.1 ARUs as permitted use in Single Family zones Program C.2 Reduce maximum lot size coverage requirements. Document lessons from Lithia lot RFP, evaluation, and negotiation D.Allow or Require a percentage of small lots in new Planning Review Process subdivisions. Goal 4 -Preserve and Create Affordable Housing Current Projects A. Work with non-profits (long range) Code review and amendments B. Require long term affordability for fee waivers (IE 30 Inventories and Research years) (complete by HC) Goal 5 -Develop organizational Capacity Buildable Lands Inventory (complete) A Create Housing Coordinator Position (complete) Multifamily unit counts Goal 6 Build Understanding and Support Rental Needs Assessment Education and Outreach A. Public information program (Education ongoing) Employer Assisted Housing Workshop (complete) Tax Credit Workshop (or other topic) Development of Presentation and informational materials, brochures, powerpoints, visuals) Present to various groups, boards and commissions, Realtors, landlords, fraternal orgs, chamber etc) Establish liasons to regional housing groups including Medford Housing Commission, JCHousing Coalition, SO Housing Resource Center

City of Ashland, City Council Presentation 1-17-2006 Ashland’ ’s s Ashland Housing Housing Needs Needs Providing for the housing needs of Ashland’ ’s Workforce s Workforce Providing for the housing needs of Ashland Presentation Prepared by: Dept. of Community Development 1/2006

“What does “Affordable” mean? The terms “workforce”, “affordable”, “family”, “subsidized” and “low-income” housing are often used interchangeably. Although there is considerable overlap between the terms, each is intended to identify a distinct type of housing. 2

“Workforce” Housing Workforce Housing Work-force housing commonly refers to housing intended to bridge the gap facing those gainfully employed residents that may earn too much to qualify for affordable housing subsidies, but not enough to afford a home for purchase, or an apartment within their means. Such “workforce” housing can be targeted to low, medium or moderate income households including as nurses, teachers, police and others depending on the community needs. 3

“ Affordable” Housing Affordable Housing: This term refers to a households’ ability to find housing within their financial means. Households that spend more than 30% of their income on housing and certain utilities are considered to experience cost burden. This term applies to all income levels. 4

“Family” Housing Family Housing: Although families come in various configurations, the term “family housing” typically is used to refer to housing occupied by households with children. As families have various incomes this type of housing also targets households of all income ranges. 5

Subsidized housing Subsidized housing This type of housing is made affordable by the addition of Federal, State, local or private funds . This “subsidy” buys down the cost of the home for the occupant. Subsidized housing is typically targeted to low-income households, however in some expensive markets subsidies have been used for moderate income households as well. 6

Low income housing Low-income housing This term refers to housing reserved for “low-income” households. HUD considers a household low-income if it earns 80% or less of median family income. In short, low-income housing is targeted at households that earn 80% or less of median family income. In Ashland a family of four earning less than $41,700 qualifies as low income. Income Limits by Family Size : $/year *For the Medford-Ashland Statistical Area as determined by the Department of Housing and Urban Development 2005-2006 Income Level Number of Persons in Family Category 1 2 3 4 5 6 7 8+ Extremely Low Income (30%) 10950 12500 14050 15650 16900 18150 19400 20650 Very Low Income (50%) 18250 20850 23450 26050 28150 30200 32300 34400 Income at 60% of Median 21900 25020 28140 31260 33780 36240 38760 41280 Low Income (80%) 29,200 33350 37500 41700 45000 48350 51700 55000 Median Income (100%) 36500 41700 46900 52100 56300 60400 64600 68800 Income at 120% of Median 43800 50040 56280 62520 67560 72480 77520 82560 Income at 130% of Median 47450 54210 60970 67730 73190 78520 83980 89440 7

Who needs Affordable Housing? Hourly Annual Income Level Wage Wage Sample Occupations Minimum $6.50 $13,559 Service station attendant, Wage temporary work, convenience store clerk, dishwasher 30% of MFI $5.81 $12,120 Fast food cooks, dining room attendants, service station attendants 50% of MFI $9.68 $20,200 Retail clerks, home health aides, electronic assemblers, carpenters 80% of MFI $15.49 $32,320 Electronic engineering tech, real estate sales/broker, accountants 120% of MFI $23.24 $48,480 Physician, Attorneys, Dentists, Professors, Engineers 2001 Ashland Housing Needs Analysis Given Ashland’s high cost of housing, the median home purchase ($439,000) would require a household income of over $127,787 per year, assuming no debt and a $20,000 down-payment. With a down payment of $120,000 (equity transfer) that household would have to earn just over $100,000 annually to qualify for a conventional loan of $319,000. 8

$400,000 $450,000 $300,000 $350,000 $200,000 $250,000 $150,000 $100,000 Median Income (family of 4) $50,000 $0 1 9 9 6 $34,600 1 9 $117,208 9 7 $162,094 $36,200 1 9 $123,573 9 Housing Costs 1996-2005 8 $176,551 $38,000 Housing Cost and Income Comparison 1 $128,120 9 9 9 $191,028 $38,800 YEAR $131,239 2 0 0 0 Median Purchasing Power $203,791 $38,800 $131,239 2 0 0 1 $241,162 $40,400 $137,117 2 0 0 2 $281,029 $41,900 $141,615 2 0 0 $297,479 3 $49,500 $164,407 2 0 0 $323,422 4 $52,100 $172,204 2 0 0 $378,403 5 Median Home Price $52,100 $172,204 $439,900 9

Hourly Wages of Ashland Residents 12% earn $7.50 per hour (minimum wage) or less 13% earn between minimum wage 50% earn more and $9.70 than $19.42 per hour (the "median" income) 17% earn between $9.70 and $15.50 per hour 8% earn between 15.50 and $19.42 per hour 10

Regional Housing Cost Surpass Ashland’s 2000 Average Average Sales Price on Resale Properties $500,000 $450,000 $400,000 $350,000 $300,000 $250,000 $200,000 $150,000 $100,000 2000 2001 2002 2003 2004 2005 Ashland Central Point East Medford Jacksonville Phoenix Talent 11

Recent Developments (2004-2005) Projects completed since January 2004 • 6 rental units (perpetually affordable) completed by ACLT • 3 ownership units (20yr) Park and Siskiyou –Parkplace Condominiums • 2 rental units (20yr) 232 & 234 Grant Street –Hillview Condominiums • 1 ownership units (20yr) 315 Beach Street • 2 rental units (perpetually affordable) acquired by ACLT with CDBG funds • 3 ownership units 2 @20 year, 1 perpetually affordable) 290 Patterson, 321 Hersey, and 311 Hersey -completed by RVCDC, one purchased through ACLT A total 17 affordable units were created and occupied by low-income households in 2004-2005 12

Pending Developments New Units expected in 2006 Includes only those units currently approved or in process and required to be affordable due to land use requirements (zone-change, annexation and condominium conversions) or financing (Community Development Block Grants, USDA Self-Help). � 6 units : Clay Street annexation (Old Buds Dairy) -project approved � 2 ownership units : Fordyce Co-Housing - project approved � 2 ownership units : Condominium conversion – Siskiyou and Glendale - project approved � 8 rental units : Ashland St. and Clay - project approved � 4 rental units : Ashland Street (Lower Pines site) project approved � 17 units : Clay Street annexation (10 acre) - pending annexation approval � 15 ownership units: RVCDC Siskiyou Self Help Project – Project funded and has received planning approval for 9 of the 15 units. Total Pending = 54 new affordable units 13

Recommend

More recommend