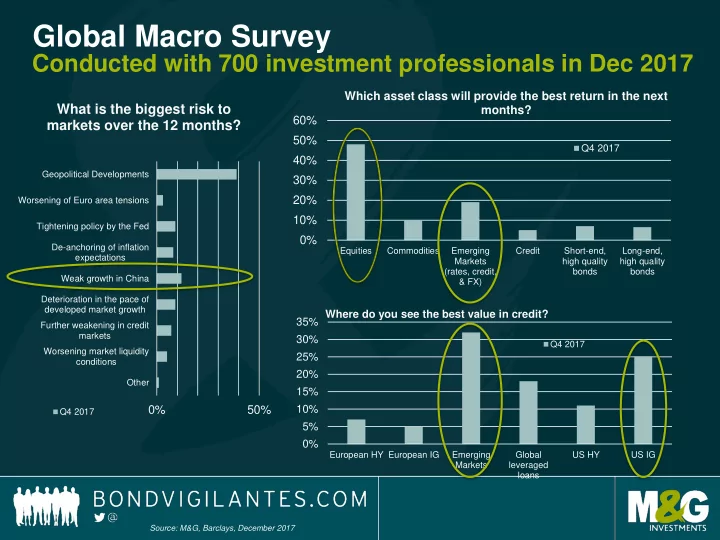

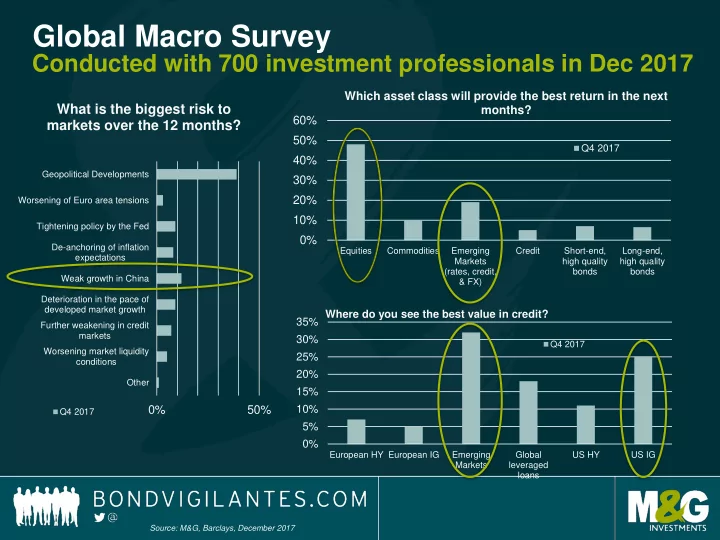

Global Macro Survey Conducted with 700 investment professionals in Dec 2017 Which asset class will provide the best return in the next What is the biggest risk to months? 60% markets over the 12 months? 50% Q4 2017 40% Geopolitical Developments 30% 20% Worsening of Euro area tensions 10% Tightening policy by the Fed 0% De-anchoring of inflation Equities Commodities Emerging Credit Short-end, Long-end, expectations Markets high quality high quality (rates, credit, bonds bonds Weak growth in China & FX) Deterioration in the pace of developed market growth Where do you see the best value in credit? 35% Further weakening in credit markets 30% Q4 2017 Worsening market liquidity 25% conditions 20% Other 15% 0% 50% 10% Q4 2017 5% 0% European HY European IG Emerging Global US HY US IG Markets leveraged loans Source: M&G, Barclays, December 2017

YTD 2018 Performance 5% Government Corporate bonds EMs Currencies Equities bonds 0% -5% -10% Source: M&G, Bloomberg, Bank of America Merrill Lynch, JP Morgan, June 2018

YTD Performance of major bond markets Total returns in local currency unless otherwise stated Emerging Government High Yield Corporate bonds Markets bonds 2 0.48 0 Total Return % -0.3 -0.16 -0.27 -0.39 -0.32 -2 -1.05 -0.85 -1.48 -2.23 -4 -2.79 -3.33 -6 -5.07 -8 -7.31 Return from duration effect Return from spread effect Total return Source: Bloomberg, June 2018. BAML indices for developed credit and government bonds; JPM indices for emerging markets BONDVIGILANTES

Recommend

More recommend