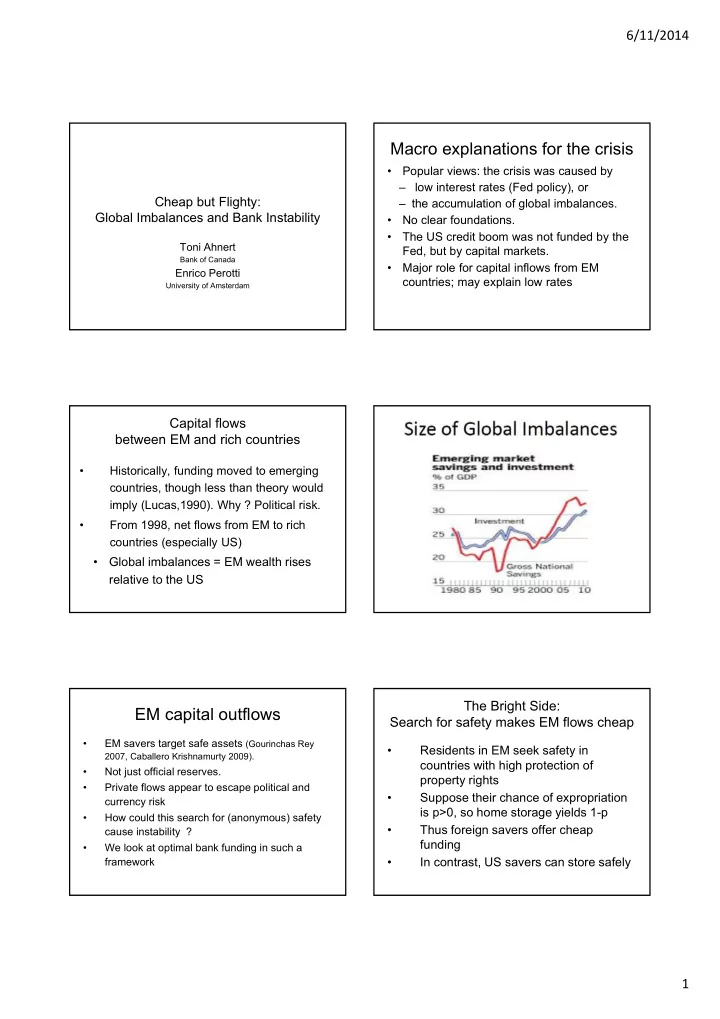

6/11/2014 Macro explanations for the crisis • Popular views: the crisis was caused by – low interest rates (Fed policy), or Cheap but Flighty: – the accumulation of global imbalances. Global Imbalances and Bank Instability • No clear foundations. • The US credit boom was not funded by the Toni Ahnert Fed, but by capital markets. Bank of Canada • Major role for capital inflows from EM Enrico Perotti countries; may explain low rates University of Amsterdam Capital flows between EM and rich countries • Historically, funding moved to emerging countries, though less than theory would imply (Lucas,1990). Why ? Political risk. • From 1998, net flows from EM to rich countries (especially US) • Global imbalances = EM wealth rises relative to the US The Bright Side: EM capital outflows Search for safety makes EM flows cheap • EM savers target safe assets (Gourinchas Rey • Residents in EM seek safety in 2007, Caballero Krishnamurty 2009). countries with high protection of • Not just official reserves. property rights • Private flows appear to escape political and • Suppose their chance of expropriation currency risk is p>0, so home storage yields 1-p • How could this search for (anonymous) safety • Thus foreign savers offer cheap cause instability ? funding • We look at optimal bank funding in such a • In contrast, US savers can store safely framework 1

6/11/2014 The dark side: Negative Rates of Return on Safe Assets Less informed • Cattle common as investment in rural India • Foreigners less able to assess local asset risk • Indian households earn negative average (Rajan-Petersen; Stein; Cao Brennan) returns of -64% on holdings of cows. • They may run even in the good state, causing • losses If own labor priced at zero , average return is -6% • Trade off: cheaper but less stable funding • Indian explanation: we invest in them for safety, banks are unreliable • Potential endogenous risk: when there is too • Negative returns as evidence of high much unstable foreign funding, it leads also demand for safety informed agents to run in the good state Optimal funding choice Basic Model • Domestic savers (mass 1-W) and foreign savers • Optimal contracting, no deposit insurance: bankers pay for all risk • Intermediaries seek to invest in a LT project • But bankers have limited liability • Return at time 2 is R with prob γ , else zero. • At 1, future return known to banker & local • May trade off stability against funding costs investors; foreigners less informed • Result: private choice not socially optimal • Asset may be liquidated at 1 ( α <1) • A key issue: what happens as foreign • Optimal to do so when return is low wealth keeps increasing ? Information structure Social optimum in basic model • Three possible states at 1: • The first best allocation is G: Return R, confirmed by public signal (prob δ ) – – Full investment at 0 (I=1), attracting both – M: Return R, no public signal domestic and foreign funding – L: Zero return, no public signal – Liquidation only in state L • Intermediary should issue long term debt • If no signal occur at 1, F expect state L with increased probability (1- γ )/(1- γδ ) > 1- γ . • Drawbacks: • Banker cannot discriminate foreigners to extract • We rule out silly runs, when all savers know the safety rents state is good • LT debt claims are risky (since α <1) 2

6/11/2014 Main model: Safe Asset Bias Safe asset share in US wealth • Evidence of preferences for absolute safety (Krishnamurty Vissing-Jorgensen 2013; Gorton, Lewellen, Metrick 2014) • Evidence: a stable safe asset ratio in US • When Treasury supply falls, private creation of “safe assets” (deposits/AAA claims) • A new banking model needed ? • Agents seek a minimum value in all states (Caballero Farhi, 2013; Gennaioli Shleifer Vishny, 2013) • Contrast safety preferences with contingent liquidity preferences (Diamond-Dybvig 1990) Seeking safety Savers protect minimum wealth value • While all savers have storage, foreign savers may be expropriated, domestic savers never. » Foreigners must satisfy their absolute safety demand S with an intermediary in a safe country. • Let S = S F be the foreigners’ absolute safety demand, while S D =0. Extreme version: savers value only the safe amount (Gennaioli Shleifer Vishny 2013) Short term debt for foreigners Main result • Foreigners want S with probability 1, so they • If foreign funding is cheap but not too will not accept LT debt if α < S. abundant, optimal contract is (expensive) long term debt for domestic savers and cheap • New optimal funding: demandable debt for foreign savers. • Else the banker targets domestic funding by • Bank offers both LT and demandable debt. offering only LT claims (mutual fund). • Foreigners never take LT debt, domestic • This forces a smaller investment scale and a savers take it if adequately rewarded higher funding cost. • In equilibrium, LT stable but more expensive than ST debt. 3

6/11/2014 LT to domestic, ST to foreigners Payoff to informed savers • Losses on foreign funding in M state, as it runs too often • Domestic savers insure foreigners, demand higher return as R realized less Notice that the required payment to long often term debt D 2 rises as w rises, as larger • Cost of informed funding increases in runs force to liquidate more in state M foreign funding w Payoffs What if w rises further • At some point, it becomes impossible to reward domestic savers for run losses • Can bankers only target F ? (at cost of smller scale) • No! Because F does not invest in a bank where only F invest ! • The banker must seek to secure enough domestic savers (=stable funding) to attract the cheap foreign funding. Upper bound on w Would bankers exclude cheap, unstable funding ? • When excess liquidation costs in state G is larger than NPV of more funding + extracted safety rent • If violated, return in the good state is not • Not the same as social optimum enough to offer adequate compensation to domestic savers. • Liquidation costs increasing in S and • But without LT savers, foreigners do not decreasing in the precision of the signal δ . invest either ! (since S> α ) 4

6/11/2014 Self interested choice of bank capital Conclusions • Without deposit insurance, bankers • Global imbalances imply more foreign wealth need to secure enough LT funding to cushion the bad state • EM outflows into developed countries seek • Voluntary capital ratios safety, but are less able to asses local risk • Paradoxically, partial deposit insurance may reduce stability of funding • Cheap but unstable • Shin’s proposal: tax non-core funding Size of Global Imbalances Text 5

Recommend

More recommend