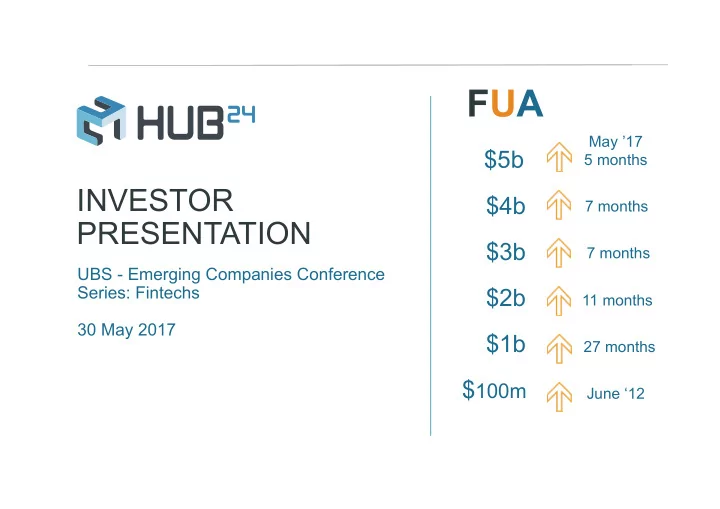

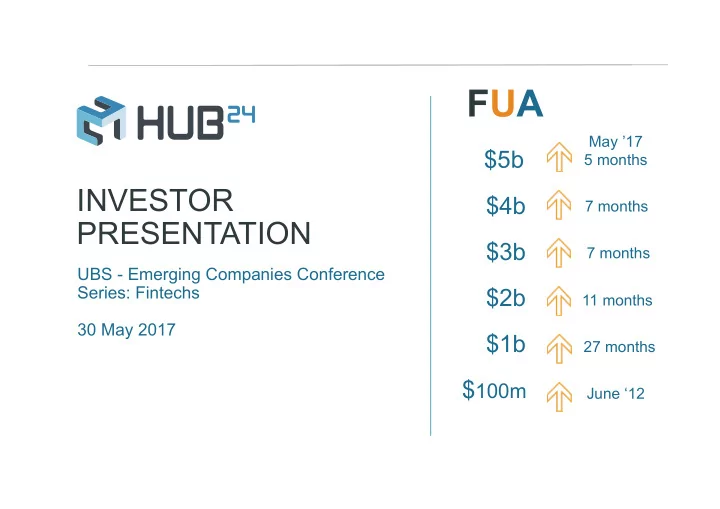

FUA May ’17 $5b 5 months INVESTOR $4b 7 months PRESENTATION $3b 7 months UBS - Emerging Companies Conference Series: Fintechs $2b 11 months 30 May 2017 $1b 27 months $ 100m June ‘12

2 Overview 4 7 13 19 20 1HFY17 Opportunities Financial results Outlook Appendix A – highlights for growth Corporate

3 HUB24 - a leader in wealth management The fastest growing wrap platform 1 capitalising on HUB24 IS A LEADER IN WEALTH significant disruption in the wealth management MANAGEMENT PLATFORMS industry UNDERPINNED BY MARKET LEADING TECHNOLOGY Now profitable and Funds Under Administration (FUA) of $5.05b (as at 26 May 2017) PLATFORM REVENUE AND RETAIL FUA Margin expansion occurring at increasing scale Includes Paragem (Licensee with a national FUA Revenue adviser network) which advises on client funds of $M $M over $3.25 billion 4,500 14 4,000 12 Acquisition of Agility Applications (specialist 4 Yr CAGR of FUA 101% 3,500 4 Yr CAGR of Revenue 134% 10 provider of technology and application products to 3,000 8 the financial services industry) 2,500 2,000 6 1,500 4 1,000 2 500 Fastest growing Best managed ‐ ‐ platform 1 1HFY13 2HFY13 1HFY14 2HFY14 1HFY15 2HFY15 1HFY16 2HFY16 1HFY17 accounts platform 2 Revenue FUA 1. Source: Plan For Life. Analysis of Wrap, Platform and Master Trust Managed Funds at December 2016. HUB24 is the fastest growing wrap platform relative to its size in percentage terms, 7th fastest in dollar terms of net inflows. 2. Results from Investment Trends December 2016 Platform Competitive Analysis and Benchmarking Report based on extensive analyst reviews of 19 platforms across 526 functional points.

4 4 1HFY17 highlights Netflows of Acquisition of Launch 1st $ 694m Agility of direct investing in in categories for Managed FUA Increase of 25% since international shares Accounts, User Interface Applications 30 June 2016, now $5.05b across 15 exchanges and Smartphone/Tablet Access 3 First reporting period of profitability EBITDA 4 of Underlying NPAT 5 of Increase in Positive operating Operating EBITDA of cashflows of $ 1.7m $ 0.9m 240 % $ 1.5m 3. Results from Investment Trends December 2016 Platform Competitive Analysis and Benchmarking Report based on extensive analyst reviews of 19 platforms across 526 functional points. 4. EBITDA represents earnings before interest, tax, depreciation, amortisation and other significant items. 5. Represents Net Profit After Tax excluding non-recurring items

5 1HFY17 financial results GROUP PLATFORM FINANCIAL 1HFY17 1HFY16 % 1HFY17 1HFY16 % FINANCIAL RESULTS $m $m CHANGE RESULTS $m $m CHANGE Group revenue 26.6 20.0 33% Retail FUA (now $5.05b) $4,149 $2,368 75% Direct costs (18.4) (15.2) 21% Revenue 11.8 6.9 70% Gross profit 8.3 4.8 73% Direct costs (4.8) (3.3) 48% Operating expenses (4.2) (3.6) 16% Gross profit 7.0 3.7 89% Operating EBITDA 4.1 1.2 240% Operating expenses (2.8) (2.4) 19% Growth resources expensed 6 (2.4) (2.1) 12% Operating EBITDA 4.2 1.3 215% EBITDA 7 before other significant items 1.7 (0.9) - Growth resources expensed 6 (2.3) (2.1) 12% EBITDA 1.5 (1.7) - EBITDA 7 before other significant items 1.9 (0.7) - NPAT 1.3 (1.8) - EBITDA 1.9 (0.6) - Underlying NPAT 8 0.9 (1.6) - NPAT 1.6 (0.8) - Other significant items reported in NPAT include interest, share based payments, non-recurring corporate costs, amortisation and tax expense. (refer Appendix B) 6. Growth resources expensed are costs for platform development, strategic development and to accelerate additional FUA onto the platform 7. EBITDA represents earnings before interest, tax, depreciation, amortisation and other significant items 8. Represents Net Profit After Tax excluding non-recurring items.

6 Platform segment results MARGIN EXPANSION ACROSS ALL PLATFORM REVENUE AND PROFIT LINES AT INCREASING EXPENSES SCALE 1HFY17 Vs 1HFY16 PLATFORM – REVENUE, GROSS PROFIT, 14 OPERATING EBITDA 9 AND EBITDA 10 TRENDS Revenue increase – 70% 12 Direct & operating expense increase – 36% 10 $‘M Revenue Gross Profit Operating EBITDA EBITDA 8 14 6 12 4 10 2 8 ‐ 6 1HFY15 2HFY15 1HFY16 2HFY16 1HFY17 4 Revenue Direct & operating expenses 2 0 PROFIT MARGINS AS A % OF REVENUE PLATFORM (2) PROFIT LINES 1HFY15 2HFY15 1HFY16 2HFY16 1HFY17 (4) Gross profit 1HFY15 2HFY15 1HFY16 2HFY16 1HFY17 32.3% 43.8% 53.1% 57.7% 59.2% Operating EBITDA (17.3%) 7.5% 19.1% 29.4% 35.4% EBITDA (73.5%) (35.0%) (10.6%) 1.9% 15.8% 9. Operating EBITDA represents earnings before interest, tax, depreciation, amortisation, growth resources expensed and other significant items 10. EBITDA represents earnings before interest, tax, depreciation, amortisation and other significant items

7 HUB24 is well positioned for further growth INDUSTRY GROWTH FORECASTS Wrap platforms: fourfold increase next 15 years Sector Predicting By Year CAGR the fastest growing personal Superannuation assets $9.5 tn 2035 8.1% investment sector 11 Deloitte Dynamics of Superannuation Report 2015 Managed portfolios Wrap Platforms $315 bn 2030 10.4% in which HUB24 is a market Rice Warner’s Personal Investment Market Projections Report 2015. leader, could account for 75% of Managed portfolio (SMAs) $60 bn 2020 32% platform net inflows 12 Morgan Stanley Research Asia Insight June 22, 2016. Disruptors: Australia Financials Abundant room for growth HUB24 has 0.57% market MORGAN STANLEY RESEARCH HAS REVEALED THAT: share 13 with fastest FUA growth rate at CAGR of 101% over the • Incumbent business models face • Business models are realigning around the disruption from managed accounts/SMAs customer, managed portfolios are altering past 4 years the traditional value chain • Managed portfolios are an innovative solution delivering higher flows and market • Impetus for managed portfolios is from Award winning share to modern industry players. financial planners seeking to grow revenue and ranked ahead of all and the value of their practices and incumbent institutional investors seeking greater transparency, platforms in terms of platform professional management and tax efficiency. functionality 11. Rice Warner’s Personal Investment Market Projections Report 2015. 12. Morgan Stanley Research Asia Insight June 22, 2016. Disruptors: Australia Financials 13. Source: Plan For Life. Analysis of Wrap, Platform and Master Trust Managed Funds at December 2016

8 HUB24 is well positioned for further growth MARKET SHARE BY NETFLOWS – TOP 10 PLATFORMS 14 FUA AND NUMBER OF ADVISERS HUB24 has 0.57% share of Wrap, Platform & Master Trusts at 31 Dec ‘16 with 11.57% share of netflows 27 new licensees signed in 1HFY17 Non-institutional platforms (disruptors) account for 2.9% of FUA Ongoing growth in adviser numbers and 30% of netflows Increasing platform usage by advisers Highest growth rate in % terms, 7 th in $ terms Further increases expected given currently low share of the typical adviser’s average FUA Platforms ranked by market share of netflows # Advisers $M HUB24 achieves 20% 900 7.00 11.57% of market 18% 800 flows with a 6.00 Netflow 16% 700 current market mkt share 5.00 14% share of 0.57% 600 12% 4.00 500 10% 400 3.00 8% 300 2.00 6% 200 4% 1.00 100 2% 0 0.00 0% Sep‐13 Dec‐13 Mar‐14 Jun‐14 Sep‐14 Dec‐14 Mar‐15 Jun‐15 Sep‐15 Dec‐15 Mar‐16 Jun‐16 Sep‐16 Dec‐16 Mar‐17 1 2 3 4 5 6 HUB24 8 9 10 Platform ranking by netflows # of Advisers Average FUA per adviser FUA Annual net flows 14. Source: Plan For Life. Analysis of Wrap, Platform and Master Trust Managed Funds at December 2016. HUB24 is the fastest growing wrap platform relative to its size in percentage terms, 7 th fastest in dollar terms of net inflows.

9 HUB24 continues to win awards

10 Acquisition of Agility Applications Agility Applications (‘Agility’) is a successful specialist technology services provider to the financial services industry, particularly stock brokers Licensing over 2,300 users from within 165 firms, BANKS reporting on over $200 billion of client assets A strategic acquisition supporting the convergence of EXECUTION & MARGIN traditional stockbroking and financial planning sectors CLEARING SERVICE LENDERS PROVIDERS into holistic wealth management providers HUB24 together with Agility aims to be the leading provider of wealth management platform and financial technology services in Australia AGILITY BACK‐OFFICE TRADING CONNECT SETTLEMENT PARTICIPANTS SYSTEMS (BROKERS) CHI‐X PLATFORMS & VENDORS ASX

Recommend

More recommend