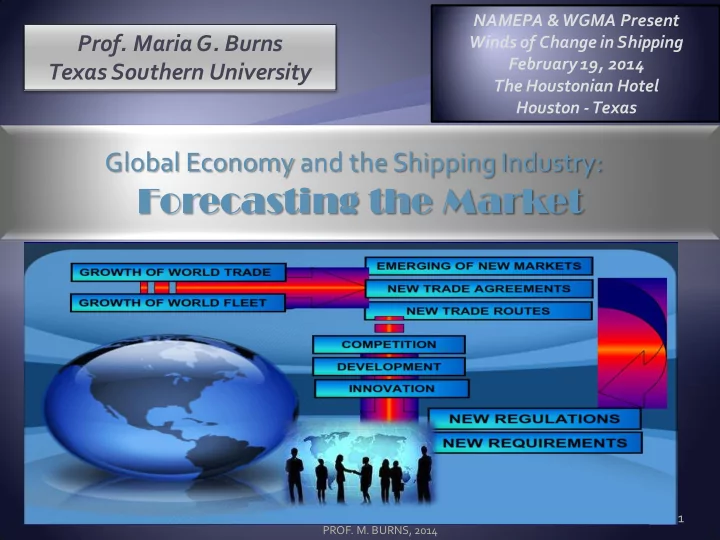

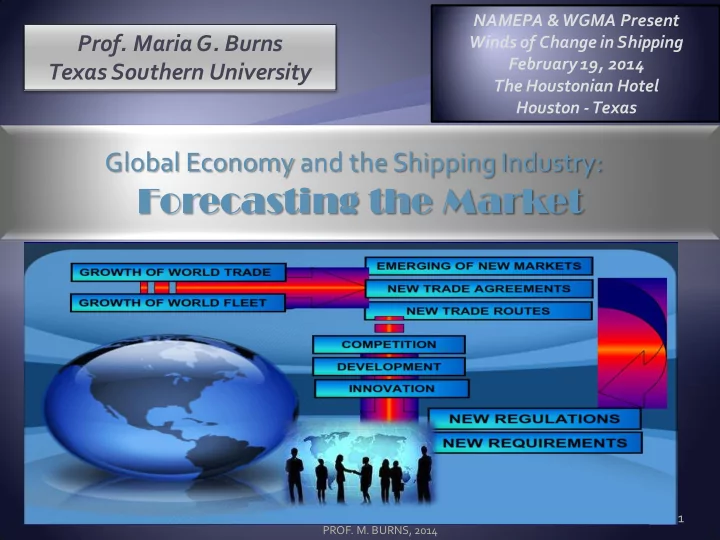

NAMEPA & WGMA Present Prof. Maria G. Burns Winds of Change in Shipping February 19, 2014 Texas Southern University The Houstonian Hotel Houston - Texas Global Economy and the Shipping Industry: Forecasting the Market 1 PROF. M. BURNS, 2014

2014 FORECAST! • 80% +of global trade is carried by water . • 100,000+ (oceangoing & coastal vessels) . • 32 million ton-miles / annum. SHIPS • 9 billion tons of cargo traded worldwide ***. • 9,400 ports 2,000 major ports globally • Thousands of terminals PORTS 2 MGB 2014

THE MANY FACES OF THE TRIPLE-E Concept 3 MGB 2014

Global Economy and the Shipping Industry: Forecasting the Market Governments & THE SHIPPING INDUSTRY: New Ship Designs Policy Makers New Environmental Regulations Classification Focus on the Triple-E Concept Societies LNG as Fuel Port Authorities Oil Price Fluctuations Shipbuilding Subsidies Ship Builders AT A GLOBAL LEVEL: Trade Deficit Shipowners Inflation, Currency Manipulation Cargo Escalating Geopolitical Tensions Owners Financing & Investment 4 PROF. M. BURNS, 2014

2014 FORECAS AST ! THE KEY DRIVERS OF THE MARITIME INDUSTRY ECONOMIES OF SCALE INNOVATION ENERGY SUPPLY & DEMAND 5 SOURCE: M. BURNS - PORT MANAGEMENT AND OPERATIONS.*. CRC , 2014. MGB 2014

FORECASTING THE SHIPPING MARKET Source: M.BURNS - PORT MANAGEMENT AND OPERATIONS.*. CRC 6 Press, Taylor & Francis Group

Forecasting the Market GDP (PPP) TRADE BALANCE OF TRANSPORT COMMODITY AGREEMENTS per Capita TRADE MARKETS 7 MGB 2014

GLOBAL GROWTH RATES GDP – real growth rate: GDP (purchasing power parity), in trillion dollars (2010, 2011, 6.00% 2012): 5.00% $84.00 4.00% $83.00 $82.00 3.00% $81.00 2.00% $80.00 $79.00 1.00% $78.00 0.00% $77.00 2010 2011 2012 1 2010 2011 2012 2 3 0 0.5 1 1.5 2 2.5 3 3.5 GDP per capita (PPP) $12,600 $12,500 $12,400 Agriculture $12,300 Industry $12,200 $12,100 Services $12,000 $11,900 $11,800 $11,700 8 MGB 2014 1 2 3 2010 2011 2012

GDP (PPP) GLOBAL GROWTH per Capita ADVANCED VS. DEVELOPING COUNTRIES 9 MGB 2014

GDP (PPP) Figure : Real GDP, USA and China. 1980-2012 Real GDP, Trillions of USD (PPP) 15 10 5 0 USA CHINA SOURCE: M. BURNS - PORT MANAGEMENT AND OPERATIONS.*. CRC Press, Taylor & Francis Group based on data from US Bureau Of Economic Analysis. 1980-2013,and China NBS, 2013. 10

200000 400000 200000 400000 600000 100000 300000 500000 100000 300000 500000 700000 0 0 ASIA Shanghai, China Figure : World’s leading Ports by Hemisphere, 2003 -2013 : AUSTRALASIA VS. THE AMERICAS, EUROPE & AFRICA Hong Kong, China Dalian, China Shenzhen, China MGB 2014 Ningbo, China Guangzhou, China Quingdao, China QuinHUANdao,… Tianjin, China Rizhao, China Yingkou, China Nantong, China Xiamen, China Tokyo, Japan Yokohama, Japan Chiba, Japan Nagoya, Japan Kwangyang, S.… Busan, S. Korea Ulsan, S. Korea Inchon, S. Korea Port Kelang,… Kaohsiung, Taiwan OCEANIA Newcastle,… Port Hedland,… Dampier, Australia 2011 2008 2007 2003 2011 2008 2007 2003 11

Figure 2.3 World’s Leading Ports: 2003 -2013 700,000 Shanghai, China Singapore, Singapore 600,000 Tianjin, China Rotterdam, Netherlands Guangzhou, China 500,000 Quingdao, China Ningbo, China 400,000 QuinHUANdao, China Busan, S. Korea Hong Kong, China 300,000 Port Hedland, Australia South Louisiana, LA, USA 200,000 Houston, USA Dalian, China Shenzhen, China 100,000 Port Kelang, Malaysia Antwerp, Belgium Nagoya, Japan 0 0 1 2 3 4 5 Source: the Author based on data from World Shipping Council (2013), IMF (2013), Agência Nacional de Transportes Aquaviários - ANTAQ(Brazil), Institute of Shipping Economics & Logistics, Containerisation International Yearbook 2012; U.S. ArmCommerce Statistics Center, Secretariat of Communications and Transport (Mexico), Waterborne Transport Institute (China); AAPA Surveys ; and 12 MGB 2014 various port internet sites (2003-2013).

World’s leading Ports 13 MGB 2014

Global sources of pollution. POLLUTION FROM Millions OIL SPILLS (2012) of Gallons Used Oil from Land, Municipal & Industrial Waste 363 Ships' Planned Maintenance 137 Air Pollution from Industry & Vehicles 92 Natural Seeps- hydrocarbons released 62 Spills from Maritime Accidents 37 Offshore Drilling 15 Deepwater Horizon 210 Total pollution level in Mil. Gallons: 916 14 MB, NAMEPA 2014

World’s leading Ports World’s marine pollution World’s leading Economies World’s natural seeps 15 MGB 2014

ECONOMY Vs. ECOLOGY While the sources of anthropogenic (man-made) pollution receive considerable publicity, little is known of the naturally spilled oil and gas that the seas have been receiving and absorbing for 400 million years. G raph : N.AMERICA SEA POLLUTION FROM OIL SPILLS Non- Anthropogenic Pollution: Energy Consumption Anthropogenic 34% Pollution: Natural Seeps 60% Anthropogenic Pollution: Transportation, Refining, Anthropogenic Pollution: Distribution Extraction 4% 2% Source: compiled by M. Burns, based on data from Bureau of Ocean Energy Management, 2009 ww.boem.gov ) and National Research Council, “Oil in the Sea” 2003 ( w (w ww.nap.gov) 16 MB, NAMEPA 2014

2007 2013 17 MB, NAMEPA 2014

COMPLIANCE TO ENVIRONMENTAL REGULATIONS REFINERIES, PRODUCTION TRANSPORTATION PIPELINES, (OFFSHORE, ONSHORE) STORAGE 18 MB, DOT 2013

Forecasting the Market Global Areas of Growth POLITICAL, MILITARY, PRODUCTION : DISTRIBUTION I.T. TRANSPORTATION industrial zone, CENTERS, Mass ECONOMIC refineries. Storage Areas. CENTERS 19 GDP, T echnology, Population MGB 2014

Forecasting the Market National Areas of Growth PRODUCTION DISTRIBUTION POLITICAL, industrial zone, TRANSPORTATION MILITARY, CENTERS, Mass I.T. refineries. ECONOMIC Storage Areas. CENTERS 20 MGB 2014

21 MB, DOT 2013

Table : World seaborne trade in 2006 – 2012, by type of cargo. (Millions of tons) 10,000.00 9,000.00 Total LDG 8,000.00 Total DSG 7,000.00 6,000.00 2006 2007 2008 2009 2010 2011 2012 1 2 3 4 5 6 7 Table: World seaborne trade in 2006-2012 LOADED UNLOADED Petroleum Petroleum Total products Dry cargo Total Year Crude Crude products Dry cargo and gas and gas 2006 7,700.30 1,783.40 914.8 5,002.10 7,878.30 1,931.20 893.7 5,053.40 2007 8,034.10 1,813.40 933.5 5,287.10 8,140.20 1,995.70 903.8 5,240.80 2008 8,229.50 1,785.20 957 5,487.20 8,286.30 1,942.30 934.9 5,409.20 2009 7,858.00 1,710.50 931.1 5,216.40 7,832.00 1,874.10 921.3 5,036.60 2010 8,408.90 1,787.70 983.8 5,637.50 8,443.80 1,933.20 979.2 5,531.40 2011 8,747.70 1,762.40 1,033.50 5,951.90 8,769.30 1,907.00 1,038.60 5,823.70 2012 9,165.00 1,785.40 1,050.90 6,329.00 9,183.70 1,928.70 1,054.90 6,200.10 Sources: UNCTAD, Review of Maritime Transport, 2012, based on data supplied by reporting countries and as published on the relevant government, port industry websites and other specialist websites and sources. 22 MGB 2014

Table : World seaborne trade in 2006 – 2012, by type of cargo. (Millions of tons) 10,000.00 9,000.00 Total LDG 8,000.00 Total DSG 7,000.00 6,000.00 2006 2007 2008 2009 2010 2011 2012 1 2 3 4 5 6 7 CARGO LOADED CARGO UNLOADED 8,000.00 8,000.00 Crude Crude 6,000.00 6,000.00 4,000.00 4,000.00 Petroleum Petroleum products and products and 2,000.00 2,000.00 gas gas 0.00 0.00 Dry cargo Dry cargo 06 07 08 09 10 11 12 1 2 3 4 5 6 7 1 2 3 4 5 6 7 06 07 08 09 10 11 12 SOURCE: M. BURNS - PORT MANAGEMENT AND OPERATIONS.*. CRC Press, Taylor & Francis Group 23 based on data from UNCTAD Statistics, 1980 - 2013 MGB 2014

Table : World seaborne trade in 2006 – 2012, by type of cargo. (Millions of tons) 10,000.00 9,000.00 Total LDG 8,000.00 Total DSG 7,000.00 6,000.00 2006 2007 2008 2009 2010 2011 2012 1 2 3 4 5 6 7 GLOBAL FLEET CARGO UNLOADED 2000000 Total fleet 1500000 Oil tankers Bulk carriers 1000000 General cargo 500000 Container ships 0 Other types of ships 0 10 20 30 40 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 06 07 08 09 10 11 12 SOURCE: M. BURNS - PORT MANAGEMENT AND OPERATIONS.*. CRC Press, Taylor & Francis Group based on data from UNCTAD Statistics, 1980 - 2013 24 MGB 2014

World Commodities carried by sea, Fleet by key ship types (millions of DWT) 10000 8000 Oil & Gas 6000 5 major bulks 4000 Other dry cargo 2000 Container 0 1980 1985 1990 1995 2000 2005 2008 2009 2010 2011 2012 1980 1985 1990 1995 2000 2005 2008 2009 2010 2011 2012 Oil & Gas 1,871 1,459 1,755 2,050 2,163 2,422 2,742 2,642 2,772 2,796 3,033 5 major bulks * 608 900 988 1,105 1,295 1,709 2,065 2,085 2,335 2,477 2,547 Other dry cargo 1,123 819 1,031 1,125 1,928 2,009 2,173 2,004 2,027 2,090 2,219 Container 102 152 234 371 598 909 1,249 1,127 1,275 1,385 1,498 Source: Compiled by UNCTAD, 1980 – 2013 UNCTAD review of maritime transport 1980 – 2013 * coal, alumina-bauxite, grain and oilseeds, iron ore, phosphate PORT MANAGEMENT AND OPERATIONS.* M. BURNS . CRC Press, Taylor & Francis Group 25

Recommend

More recommend