Financial Information Effectively Jody Pigg Associate Vice - PowerPoint PPT Presentation

Board Presentations: Tips & Tools for Presenting Financial Information Effectively Jody Pigg Associate Vice President Finance Practice 1 Day Before Board Meeting 2 Board Meeting Day 3 Presentation Objectives Clear , Concise and

Board Presentations: Tips & Tools for Presenting Financial Information Effectively Jody Pigg Associate Vice President Finance Practice 1

Day Before Board Meeting 2

Board Meeting Day 3

Presentation Objectives Clear , Concise and Consistent Communication that… Creates a common impression of the following: Urgency Opportunity Performance Priority It’s more about what they hear than what you say ! 4

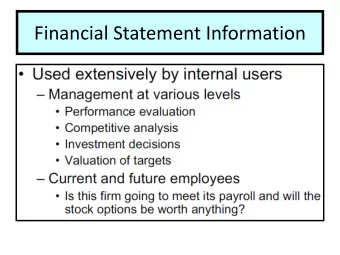

Presentation “Tools” Provides Provides Provides Focused Accountability Interpretation Attention Requires a States the Visually highlights working knowledge managerial action significant trends of Accounting/ plans addressing Allocate 50% of Finance significant trends your Presentation Allocate 20% of Allocate 30% of time to this Tool your Presentation your Presentation time to this Tool time to this tool Graphs, Financial Bullet Charts Statements Statements and Metrics 5

Presentation “Tips” Design Presentation for 10-20 minutes Give Administrative team members opportunity to comment. Don’t Bluff or speculate…develop a list of follow up items for next meeting. Remember…most of your audience are not accountants!

Presentation “Focus” EBITDA I tell you what 'ibi dah ‘ is. Tank you veddy much! 7

EBITDA The Accountant’s Understanding Earnings Before Interest, Taxes, Depreciation and A mortization… 8

EBITDA The Board Trustee Understanding Excess Earnings created from day to day operations available for the following: Fund Make Debt Build Cash Building, Service Reserves Equipment Payments and related Infrastructure needs 9

Financial Stability Metrics It’s all about the BASE, ‘bout the BASE… Stressed Stable Strong < 50 50-150 > 150 Cash Days days Days > 12 8-12 < 8 Average Age of Plant years years years Long Term Debt as a % 25%- Total Assets > 50% < 25% 50% 50%- Net Revenues >75% < 50% 75% < 1.5 1.5-3 > 3 Debt Service Coverage times times times EBITDA <5% 5% - 15% >15% 10

Financial Stability Metrics Five Year Average Stressed Stable Strong Cash 88 10.2 Average Age of Plant years Long Term Debt as a % Total Assets 20% Net Revenues 48% 2.4 Debt Service Coverage times EBITDA 8.6% 11

Financial Stability Metrics Current Fiscal Year Stressed Stable Strong Cash 55 12.1 Average Age of Plant years Long Term Debt as a % Total Assets 32% Net Revenues 60% Debt Service Coverage 1.25 EBITDA 2% 12

EBITDA Build up the BASE! EBITDA For Month 11/30/2014 Date: 12/15/2014 Hospital: Our Hospital RVP: John DOE Location: USA AVP: Ricky ROE RFA: Heidie HOE Target Annual EBITDA $2,000,000 Last Twelve Months EBITDA: $150,000 Last Twelve Months EBITDA as of FYE: $190,000 Most significant Initiatives to Improve EBITDA: % of Amount Initiative Annual Financial Achieved to Achieved Impact Current Month's Status update for Initiative date to date Description of Initiative Target start date of July 1, 2015 $0 1 Geropsych $1,000,000 0% Target start date of March 31, 2015 $0 2 100% Participation in Hospitalist Program $1,000,000 0% Total of Initiatives $2,000,000 $0 0% When is expected date for Facility to target EBITDA 12/31/15 What is frequency of oversight meetings/calls with this client Monthly 13

The Desired Effect… Not to “ENCAGE” the Board 14

The Desired Effect… Not to “ENRAGE” the Board 15

But to “ENGAGE” the Board The Desired Effect… 16

Questions Jody Pigg Associate Vice President Finance Practice (615)371-4591 Jody_Pigg@qhr.com 17

Intended for internal guidance only, and not as recommendations for specific situations. Readers should consult a qualified attorney for specific legal guidance. 18

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.

![Obtaining Relevant Juror Information Effectively Judge-Lawyer Collaboration [E]nsurethe](https://c.sambuz.com/1078838/obtaining-relevant-juror-information-effectively-s.webp)